Interac e-Transfers have become one of the most popular ways to send and receive money in Canada—whether you’re splitting a bill, paying rent, or sending funds to friends and family. But while Interac e-Transfers are fast and convenient, they also come with limits that vary depending on your bank and account type. Most banks cap transactions at $3,000 each, with weekly and monthly limits typically set at $10,000 and $20,000, respectively.

In this guide, we break down the specific Interac e-Transfer limits for major Canadian banks, explain how to send and receive e-Transfers, and offer alternative money transfer options when you need more flexibility.

Key Takeaways

- The standard Interac e-Transfer limit is $3,000 per transaction.

- You may also be subject to daily, weekly, and monthly transaction limits.

- Interac e-Transfer limits are determined by your bank and can sometimes vary between accounts at the same bank.

- Some bank accounts may charge fees for Interac e-Transfer even if you're within the limit.

Maximum Interac e-Transfer limits by bank

Here are the current Interac e-Transfer limits for some of the major banks in Canada. Because these limits could also vary based on bank account, it’s best to double-check limits with your bank.

| Bank | Per-transfer limit | 24-hour limit | 7-day limit | 30-day limit |

|---|---|---|---|---|

| Alterna Bank | $3,000 | $3,000 | $10,000 | $20,000 |

| ATB | $5,000 | $5,000 | $35,000 | $150,000 |

| BMO | $3,000 | $3,000 | $10,000 | $29,800 |

| CIBC | $3,000 | $3,000 | $10,000 | $30,000 |

| Desjardins | $5,000 | $5,000 | N/A | N/A |

| EQ Bank | $5,000 | $5,000 | $20,000 | $50,000 |

| Innovation Credit Union | $10,000 | $20,000 | $50,000 | $100,000 |

| Koho | $3,000 | $3,000 | N/A | N/A |

| Laurentian Bank | $3,000 | $3,000 | $10,000 | $20,000 |

| Manulife | $3,000 | $3,000 | $10,000 | $20,000 |

| Motive Financial | $3,000 | $3,000 | $10,000 | $20,000 |

| National Bank | $4,000 | $4,000 | N/A | N/A |

| Neo Financial | $3,000 | $10,000 | $10,000 | $20,000 |

| RBC | N/A | Depends on client card's daily access limit | N/A | N/A |

| Scotiabank | Depends on the account | Depends on the account | Depends on the account | Depends on the account |

| Simplii Financial | $3,000 | $3,000 | $10,000 | $30,000 |

| Tangerine | $3,000 | $3,000 | $10,000 | $20,000 |

| TD | $3,000 | $3,000 | $10,000 | $20,000 |

| Vancity | $3,000 | $10,000 | $10,000 | $20,000 |

| Wealthsimple | $5,000 | $5,000 (though eligible accounts can get higher limits) | $10,000 | $30,000 |

Alterna Bank Interac e-Transfer limits

Alterna Bank provides fee-free access to your money, but they do enforce the standard limits when it comes to sending money via e-Transfer. Clients are subjected to the standard $3,000 per day/transaction, $10,000 per week, and $20,000 per month limits. You can only receive up to $25,000 per transaction.

There's also a $25,000 per-transaction limit for receiving Interac e-Transfers, but no daily, weekly, or monthly restrictions.

ATB Interac e-Transfer limits

ATB bank accounts have fairly high limits compared to the standard. Each one can be up to $5,000, with rolling limits of $5,000 per day, $35,000 per week, and an impressive $150,000 per month – the highest limit on this list. The maximum you can receive per transaction is still $25,000.

If you're someone who sends a lot of Interac e-Transfers and/or particularly sizable e-Transfers, an ATB account may be ideal for you.

BMO Interac e-Transfer limits

If you're a BMO customer, you'll likely have a daily e-Transfer limit of $3,000, a weekly limit of $10,000, and a monthly limit of $20,000.

However, these amounts can vary alongside the withdrawal limit on your debit card – so if you've requested an increase in the amount you can withdraw with your card per day, your Interac e-Transfer limit will change too.

CIBC Interac e-Transfer limits

CIBC has standard maximum limits of $3,000 per day, $10,000 per week, and $30,000 per month. Though they don't specify a per-transfer limit, it's safe to assume it would be the same as the daily limit.

If your account doesn't have free Interac e-Transfers, they'll cost you $1.50 to send and $3.50 to stop.

Desjardins Interac e-Transfer limits

Desjardins mentions a $5,000 limit per day and per transfer, but doesn't list any weekly or monthly limits. You should also take into account the $25,000 per transfer limit when receiving a transfer.

To verify any weekly or monthly transfer limits, you may want to reach out to a bank representative.

EQ Bank Interac e-Transfer limits

Clients with EQ Bank enjoy a slightly higher-than-average per-transaction and daily Interac e-Transfer limit of $5,000. The weekly limit is set at $10,000 per week, and the monthly cap is $20,000.

Don't forget the limit for receiving e-Transfers either – EQ sets this limit at $25,000.

Innovation Credit Union Interac e-Transfer limits

Innovation Credit Union's clients can send a max of $10,000 per e-Transfer transaction, but up to $20,000 per day and $50,000 per week. The monthly cap is a very high $100,000. Incoming transfers are limited to $25,000 each, but there's no daily, weekly, or monthly cap.

The Innovation site has a note to warn clients that transfer limits are based on the date and time of the most recent Interac e-Transfer. This means that if you send an e-Transfer at 10AM today, your limit resets at 9:59AM tomorrow.

KOHO Interac e-Transfer limits

There aren't many limits for KOHO clients sending Interac e-Transfers – the per-transaction limit is the same as the daily limit, $3,000. There's no weekly or monthly limit listed.

However, there are several limits for receiving e-Transfers. The per-transaction and daily cap is $10,000, and the monthly limit is $40,000. Clients can receive a max of 20 Interac e-Transfers per day and 120 per month.

Laurentian Interac e-Transfer limits

Laurentian Bank is on par with many other financial institutions, setting its per-transaction and daily Interac e-Transfer limits at $3,000. The weekly limit is the usual $10,000, and the monthly cap is $20,000.

With a few valuable account options that include free e-Transfer transactions – like the Laurentian Bank Unlimited Account.

Manulife Interac e-Transfer limits

Manulife offers some interesting online bank accounts, including a US Dollar Advantage Account. They have normal maximum limits of $3,000 per transaction, $3,000 per day, $10,000 per week, and $20,000 per month for e-Transfers.

However, keep in mind that Manulife has a minimum Interac e-Transfer of $10. This is higher than most accounts, which are $1.

Motive Financial Interac e-Transfer limits

Motive Financial e-Transfer limits are a maximum of $3,000 per day, $10,000 per week, and $20,000 per month for outgoing transactions.

When it comes to the minimum amount you can send, it's about as low as you can go – any amount above $0.

National Bank Interac e-Transfer limits

If you bank with National Bank, you have to adhere to a $4,000 per day limit, which also means you can only send $4,000 per transaction.

They don't have a weekly or monthly limit listed, but you can reach out to your account representative for details.

Neo Interac e-Transfer limits

The Neo Financial per-use limit is $3,000 while the daily and weekly limits are both $10,000. This is one of the few cases where the daily limit for Interac e-Transfers is higher than its per-use limit. It's also unusual that the daily and weekly limits are identical.

RBC Interac e-Transfer limits

RBC customers have a daily access limit that includes all withdrawals in a day, such as ATM withdrawals, e-Transfers, and debit purchases. The access limit can be viewed and changed online or by contacting the bank.

There are no specific weekly or monthly limits on Interac e-Transfers.

Scotiabank Interac e-Transfer limits

The details for Scotiabank Interac e-Transfer limits are different for each account they offer. For example, the Scotiabank Basic Bank Account comes with a $3,000 daily limit and $10,000 weekly limit for Interac e-Transfers.

You can find your own limit by following these steps:

- Sign into the mobile app

- Click "More" on the bottom ribbon

- Click on "Profile and Settings"

- Scroll down to "View Transaction Limits"

Simplii Financial Interac e-Transfer limits

Simplii Financial offers a slightly higher than average $30,000 monthly limit on Interac e-Transfers, but their weekly and daily caps are both a standard $10,000 and $3,000, respectively.

Simplii bank accounts offer free Interac e-Transfers, so you don’t have to worry about surprise fees.

TD Interac e-Transfer limits

With TD, there's a sending and request limit of $3,000 per e-Transfer, but there's no mention of a limit on the amount of deposits.

The 24-hour, 7-day and 30-day limits are rolling limits based on the time the last e-Transfer was sent. For example, if you send a $3,000 e-Transfer at 10 am on Monday, the next one must be after 10AM on Tuesday.

There's a note for TD customers that some account holders may have different limits. If you’re unsure of your own limits, it’s best to contact your bank directly.

Tangerine Interac e-Transfer limits

Tangerine accounts come with the standard $3,000 per day, $10,000 per week, and $20,000 per month limit.

These limits look slightly different when you're on the receiving end:

- Daily: $10,000

- Weekly: $70,000

- Monthly: $300,000

Vancity Interac e-Transfer limits

If you have a bank account with Vancity, you will be subject to the standard Interac e-Transfer limits, but with a higher daily limit than usual. You're looking at a maximum of $3,000 per transaction, $10,000 per day and $20,000 per month for outgoing transactions.

You'll also have a standard limit of $25,000 per received transaction for your account.

Wealthsimple Interac e-Transfer limits

Canadians with Wealthsimple Chequing accounts* are subject to default Interac e-Transfer sending limits of $5,000 per day, $10,000 per week, and $30,000 per month, but certain accounts are eligible for higher limits. There aren't any caps on e-Transfers received, or at least, none are listed online.

* Legal disclaimer

Keep in mind that Wealthsimple also has its own peer-to-peer payment feature, so you can send money to other Wealthsimple account holders. It's free and has the same sending limits as Interac e-Transfers.

How to send Interac e-Transfers to friends and family

You can pay for items and services using Interac e-Transfer through online banking, either by accessing it with a web browser or a mobile app.

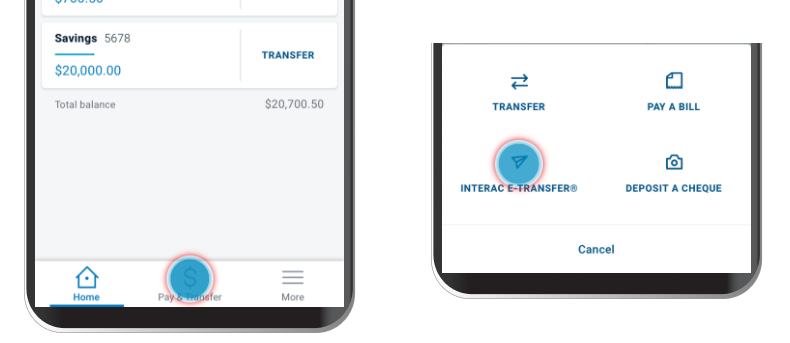

Here’s an example from BMO. Though this might not be exactly how it works for you, chances are it’s pretty similar.

Step 1: Go into the e-Transfer option. In this case, it’s under "Pay & Transfer" then “Interac e-Transfer.”

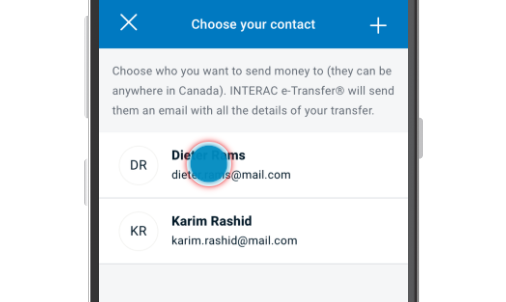

Step 2: Select the recipient for the transfer.

If the person you want isn’t already in your contacts list, you can add them. You’ll need to know their name and either their mobile phone number or their email address.

It will ask if you want to send or request money. Choose the "Send" option.

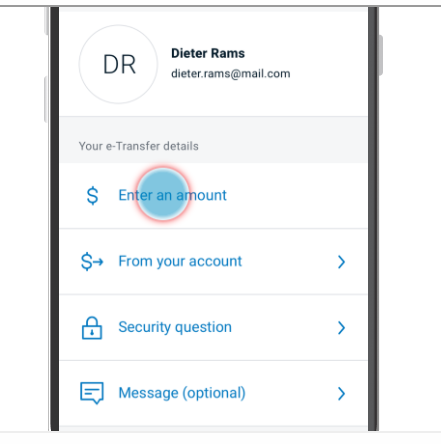

Step 3: Select your bank account, enter the amount you want to transfer, then select a security question and answer, and (optionally) write a message to the sender.

The security question and answer should be something the recipient will know but is not obvious to others.

Some recipients may have an Autodeposit feature already set up, so you won’t need to bother with a security question.

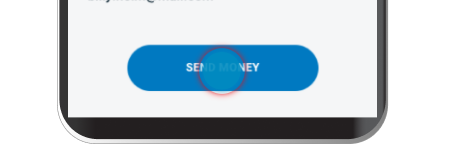

Step 4: Confirm the transfer, in this case by selecting "Send Money."

How to receive an Interac e-Transfer

When an Interac e-Transfer arrives, you’ll get a text message or an email (depending on which method the sender used) to notify you of the receipt. Simply click on the link and follow the prompts to deposit the amount sent.

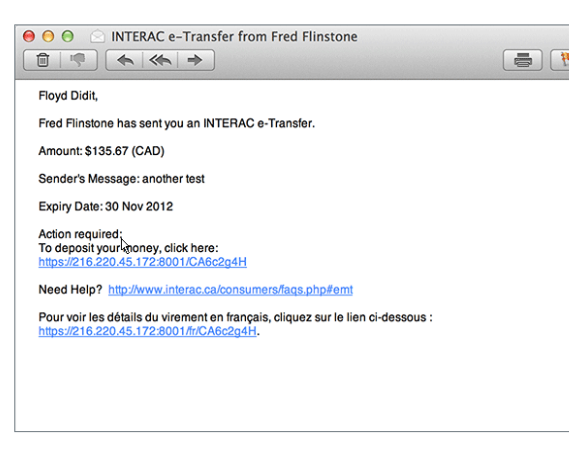

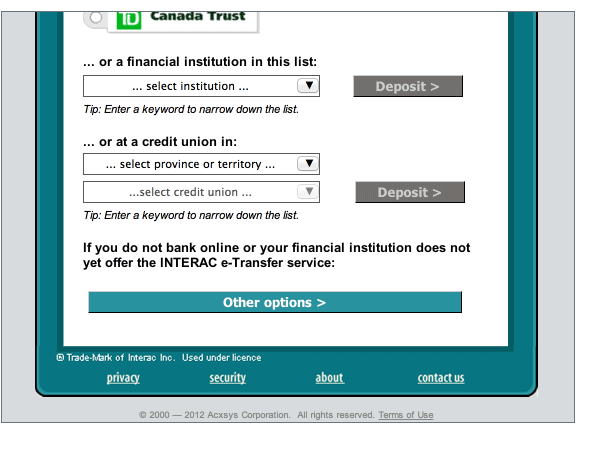

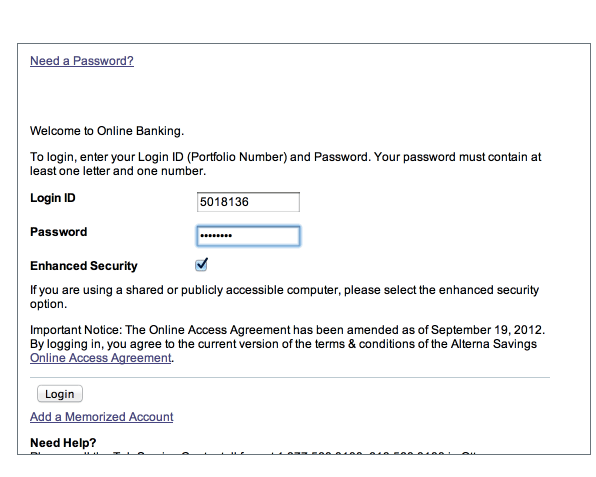

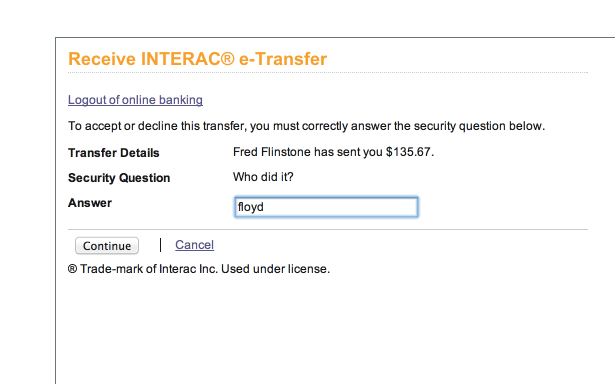

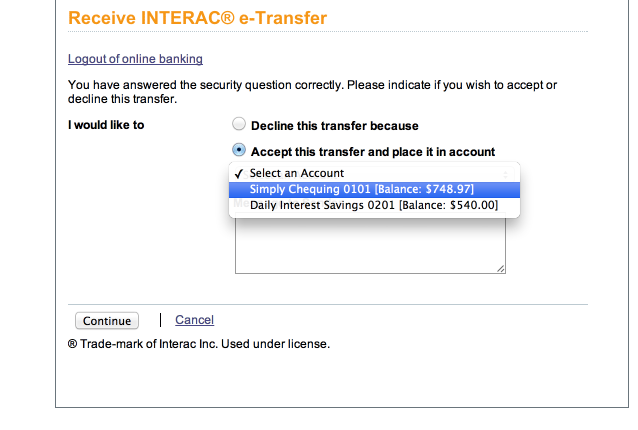

Here’s an example from Alterna Bank.

Step 1: Click on the link in the email or text message.

Step 2: Select your financial institution from the list.

Step 3: Sign into online banking the way you usually do.

Step 4: Answer the security question.

Step 5: Choose which of your bank accounts the money should go into and accept the transfer.

If you've set this email address or phone number to auto-deposit, then you don’t need to do anything. The money will be automatically deposited into the financial institution and the account you've specified. You’ll simply receive an email or text telling you that money has been deposited.

Alternative money transfer options

Interac e-Transfer is good for many situations, but here are a few specific types of money transfers and alternatives you might consider:

| Money transfer option | Good for |

|---|---|

| PayPal | Paying small online businesses |

| Wise | Sending money internationally |

| Money order | Purchases under $999.99 |

| Certified cheque | Large purchases |

| Bank draft | Large, secure payments |

1. Send money to small online businesses

Many small online businesses request payment through PayPal. For the vendor, the advantages are that they can accept credit cards and get paid without having to set up a special merchant account with the bank.

Payments can be made in any currency and are automatically converted. And many platforms used by small online businesses (like Etsy and Constant Contact) have a PayPal interface already built in.

For the customer, PayPal provides a secure way to pay with a credit card, and you can still earn reward points on your cards. PayPal offers its own payment protection program too, just like credit cards, so those who choose not to pay with credit can still shop with confidence.

A PayPal account is required to make purchases directly, but if a business or individual sends you an invoice or money request, you don’t need an account to respond and pay.

2. Send money internationally

If you need to send money internationally, like when you want to send money to friends or family abroad or pay in advance for vacation accommodations, transaction and conversion fees can really add up.

Credit cards and banks (and Interac e-Transfer) typically charge conversion fees of between 1% and 3%, in addition to any up-front fees. The worst part is you often don't even see the fee, since they often build it right into the currency exchange fee.

In contrast, Wise has a transparent fee structure and no exchange rate markup. And with the ability to send, spend, and withdraw funds in 40 different currencies, Wise's convenience is hard to beat.

3. Payment options for large transactions

If you need to make a purchase that puts you over your daily e-Transfer limit, you may be able to go with a physical form of payment instead, such as a bank draft, certified cheque, or money order. These are all secure and guaranteed payment options, provided you have access to the recipient.

Typically, there’s no limit to how much you get a bank draft or certified cheque made out for (as long as you have the funds to cover it), but with a money order, you’re limited to purchases under $999.99.

FAQ

What are the maximum e-Transfer limits?

Interac e-Transfer limits are usually $3,000 per transaction, $3,000 per day, $10,000 per week, and $20,000 per month. That said, each bank has its own rules, and these rules sometimes vary between bank accounts.

How can I increase my Interac e-Transfer limit?

You can only increase your Interac e-Transfer limit by contacting your bank online, via a mobile app, by visiting a branch, or through telephone banking. It may not be possible to raise the limit, but it's worth inquiring about.

How can I transfer money between banks?

Interac itself is a network of over 300 Canadian banks and financial institutions, and its e-Transfer service is a convenient and very popular method of sending money. Bank-to-bank transfers are also an option for moving funds electronically.

What’s the best way to make an international money transfer?

When making international transfers, you’ll want to choose a transfer method without hidden fees or currency surcharges. One of the best options is Wise as it has a transparent fee structure and no exchange rate markup.

How do I send money from Canada to the U.S.?

The best method for sending money to the U.S. is transferring via Wise as it's both convenient and fast. It's also quite inexpensive, which is a big help if you have to send such transfers regularly.

Leave a comment

Comments