When you're just starting out, learning how to invest can be overwhelming, daunting, and at times just plain scary.

After all, this is your real, hard-earned cash you're messing with, not to mention your financial future. That's a lot of weight to carry.

But learning how to invest doesn't have to be hard – and it definitely doesn't have to be scary.

This guide will take you through everything you need to know about learning how to invest in Canada – from the basics to the nitty gritty details. When you're done, you'll feel like you understand where your money is going a whole lot more – which can take a lot of the fear away.

And as your investments, goals, and risk levels change, you'll be able to adapt your strategy along with them, because you actually understand what's going on below the surface of trading fees and net return.

Let's get started on your investing journey.

- Main options for investing in Canada

- Types of investments

- 30 investment terms you should know

- What to consider when investing

- What fees to look out for when investing in Canada

- Understanding your own risk level

- How to rebalance your portfolio

- How taxes affect your investments

- How to start investing

- 5 tips for new investors

- FAQ

Your 3 main options for investing in Canada

While investing in general can seem like a nebulous task that you know you should do but aren't quite sure how to even start…it's actually one of many things that has been made much, much easier (and cheaper) by the advent of technology.

But even if you don't consider yourself one of technology's biggest fans, there are still more traditional options available to you through your bank or 3rd party services.

If you want to break it down for the sake of simplicity, Canadians have 3 major options when it comes to deciding how to invest their money:

- speak with a financial advisor,

- get down and dirty with an online broker, or

- automate the whole thing with a robo advisor.

Like most things, each method has its own pros and cons. And there's nothing stopping you from doing a combination of the 3 different types either.

So let's go over each option so you can get a better feel for what may work best for you.

1. Talking with a financial advisor in Canada

Let's start with the most traditional of the 3 options – meeting with a real-life person to plan out your finances together.

Financial advisors are still offered by the big banks in Canada, and you can also find financial advisors in your area who aren't affiliated with a specific bank if you'd like a broader reach or alternative opinion.

Financial advisors usually have access to certain tools, funds, and investments. They'll meet up with you to go over things like your income, goals, and risk tolerance levels, then recommend products and services based on your responses.

Together, you and your advisor will build a financial plan and you'll transfer over your money for them to delegate as necessary. After that, you'll meet up at regular intervals to see how things have shifted and recalculate as needed.

If you would prefer to have someone walk you through investing in a much more personalized environment, this will be your best bet. A real person will be able to understand your wants and needs much better than a computer – and an expert can likely understand the path to reaching your goals better than you can.

Pros of investing with a financial advisor

Investing with a financial advisor in Canada has a unique advantage over other investment options.

- Get personalized and detailed feedback and advice from a qualified professional that has done a thorough analysis of your goals and financial situation.

- Fee-only financial advisors keep their charges crystal clear, instead of hiding them in commissions, so you know the products they're recommending are good for you (not just for their own pockets).

- Little to no dependence on technology on your end.

- Setting up regular meetings can ensure you stay on top of your money better than much looser self-made plans for DIY options.

- More personable and understandable than working with bots online.

Cons of investing with a financial advisor

But traditional options do come with some downsides to keep in mind as well.

- Some financial advisors work on commission, which can encourage them to steer you towards investments that will make them more money (rather than grow your investments in a way that makes sense for your financial goals and circumstances).

- They may hide their fees, which can make it difficult to see the true return on your money.

- May be some delay in buy times, especially if you need to move money around first.

- Might not have the most sophisticated or convenient way for you to check in on your money by yourself. For example, sometimes you're left waiting for a quarterly letter in the mail to see how your investments are doing.

2. Using an online brokerage

If you like the idea of being so up close and personal with your investments, but would rather handle the decision making, buying, and selling on your own – then using an online brokerage may be right up your alley.

Online brokers are offered by all the major banks in Canada, but you also have plenty of independent options (which generally have much cheaper fees). These platforms give you the tools to buy and sell investments as you wish, usually with a flat fee per trade.

The best online brokers will have a wide assortment of investment vehicles at your fingertips, from equities and bonds, to mutual funds and precious metals. All you do is transfer money into your account or buy your investments directly, and you can see everything laid out for you in your dashboard.

Since this is the DIY option, it obviously requires a lot more know-how and experience. Many brokers do offer investment education tools, practice accounts, and sometimes even personalized advice if you set up a meeting.

You can also open multiple accounts with an online broker, allowing you to keep different types of investments within your different account types (registered vs. unregistered, for example).

Pros of investing with an online broker

So why would you choose the DIY option over more laid back choices?

- Enjoy much more intimate control over your money, so you never have to wonder where your money is going – you know exactly where you put it.

- Allows you to buy and sell whenever you want, if you're interested in trying to capitalize on fast trades on the market.

- Gives you invaluable first-hand experience with investments that can help bring you a greater understanding of what your money can do for you.

Cons of investing with an online broker

And what should you look out for if you think it's time to become a DIY investor?

- Requires a significant amount of knowledge to do it well with a huge learning curve to start out.

- More expensive online brokers can charge you almost $10 per trade, which can easily pile up into high expenses.

- Encourages more active investing, which can be more susceptible to stress, anxiety, and emotional or impulsive trades.

3. Investing with robo advisors in Canada

One of the more recent options to grace the world of investing is using a robo advisor. This method is one of the most hands-off approaches you can get, which makes it tempting for people who know they should invest but aren't confident enough in their abilities to make the right decisions.

Robo advisors generally invest your money in an ETF portfolio that's managed by an algorithm. This means there's very little human interaction with your investments, which sounds scary but actually removes a lot of the emotional and impulsive bias that could create mistakes. The algorithm knows to wait out temporary financial storms – your heart does not.

How it works is you create an account online and answer a few questions to determine your risk tolerance. The results of this test will pair you up with a portfolio that most closely matches your goals. Usually the options are between the following levels of risk:

- conservative,

- balanced, and

- growth.

Many options also include risk tolerance levels that exist between the above tiers, like moderate-conservative, for example.

Once you've chosen the portfolio that works best for you, the next step is to fund the account. You can also usually set up automatic deposits at this time. Once that's done, there's nothing left for you to do but sign in every once in a while and see how things are going.

Pros of investing with a robo advisor

This type of investing can be very enticing for a variety of people – whether you're just starting out, too busy to give your online broker account the attention it needs, or just prefer to trust technology with logical decisions.

- A hands-off approach to investing that takes much less time to create and maintain.

- Because there's usually no human actively managing the account, the fees tend to be lower than your alternatives.

- ETF investing means you're likely getting a fairly diversified investment pool.

- Doesn't require much knowledge but can still get good returns on your investments.

- Because an algorithm is managing your investments, it helps remove the emotional part of investing, which can often lead to mistakes.

- Immediate access to reports and information about how your investments are doing.

- The algorithms are getting better and the best may be yet to come.

Cons of investing with a robo advisor

Of course, there are some downsides to investing with a robo advisor as well.

- Since you won't be interacting with a human advisor much (if at all), the advice and direction of a robo advisor won't be very personalized. You'll be matched up based on risk tolerance, but that's mostly it.

- You won't have a lot of options in terms of investment vehicles – most robo advisors deal strictly with ETF portfolios.

- You can't decide exactly where your money is going, apart from limited socially-responsible options.

- If you prefer to talk with someone face-to-face about your investments, this won't be a good option for you.

Types of investments

Once you've decided on how you want to start investing, the next step is to get a good handle on what you'll be investing in (unless you choose the robo advisor route, in which case, you'll be dealing with ETFs pretty exclusively).

There are many different types of investments (also called investment vehicles), each of which offer unique advantages and disadvantages.

We'll go over each of the main types here, including a brief description of how you can start investing in them if you're excited to get started right away.

Stocks

One of the most popular investment vehicles is a stock, also often referred to as equity.

When you buy a stock (often called "buying shares"), you're essentially buying a portion of a business, entitling you to a part of the corporation's profit and assets (proportional to the amount of shares you own). Companies sell stocks to raise funds for their business, so you're essentially giving them money in the hopes that they use it to grow their valuations.

If the company does well, they can choose to share the profits with their shareholders through dividends. That way, you'll earn a profit while still holding on to your share. You can also choose to make money through capital gains by holding onto shares then selling them once they appreciate in value.

Generally speaking, stocks have been shown to outperform other investment vehicles over a longer period of time. But there isn't much in terms of guaranteed returns with a stock, which makes it a pretty risky investment. If the company you're invested in suddenly falls out of favour, the value of your shares could plummet.

How to invest in stocks in Canada

You can buy and sell stocks on the aptly named stock market, which follows strict regulations.

If you want to have full control over the stocks you're buying, then going with an online broker will allow you to buy and sell as you want, as long as the stock markets are open. You may also be able to ask your financial advisor to invest in stocks on your behalf as well.

If you choose to buy some stocks yourself through an online broker, all you have to do is fund your trading account and select the stock you want to invest in. Then you can submit one of the following types of orders:

- Market order: Buy it ASAP at best available price (may change from the time you submit to the time the order goes through).

- Limit order: Buy it only at a specific price (or lower).

- Stop order: Buy the stock as a market order once it reaches a specific price.

- Stop-limit order: Buy the stock as a limit order once it reaches a specific price.

When placing orders, don't forget to consider the costs of your online broker as well. Many brokers charge a flat fee per order, which can be as high as $10. Make sure you're getting the most out of each order in order to maximize the cost of this fee as best you can.

Once the order is placed and goes through, you'll be able to see and track your shares on your personal dashboard. This is also where you'll be able to sell the stocks as you like, which will also result in fees.

ETFs

The term ETF stands for Exchange-Traded Fund, which means a pool of investments that's traded on an exchange like a stock (unlike a mutual fund, which is a pool of investments that's only traded once a day). That means it's open to be bought and sold while the markets are open, so the price is constantly fluctuating during the day.

Any type of investment can be included within an ETF, including stocks and bonds. You'll often find ETFs that are designed to track a certain index or investment strategies. For example, you could invest in a stock that tracks the S&P 500 Index (which includes the top 500 companies on the public market by market cap).

Because they're a collection of investments, ETFs are naturally well diversified – which is key to a healthy portfolio. There are even some "all in one" ETFs that claim to have everything you need in just one investment. The wide reach and low cost are some of the most attractive features of ETF investing.

That said, if you go with an ETF that has a limited reach (like one that's focused on a single industry, for example), you could still find yourself with relatively low diversification. And if you opt for actively managed ETFs, they may incur higher fees as well.

How to invest in ETFs

One of the most popular ways to invest in ETFs is to buy them through your online broker account. This works exactly like a stock: you fund your account and place your order. ETFs are bought and sold on the stock market, so they're available to buy while the markets are open.

Just like stocks, online brokers will often charge a flat rate when you buy and sell ETFs. This can be up to $10 again, but you may be able to find some cheaper options.

For example, Questrade allows you to buy ETFs for free. Just be aware that you do have to pay to sell the ETFs, but it's a low cost of 1 cent each (minimum $4.95, maximum $9.95).

It's a pretty amazing price structure, so if you're interested, you can find out more info about Questrade right here:

Questrade is one of Canada's top online investment platforms. With very low fees, including no-fee ETF trading, commission-free stock trades, and plenty of investment types, Questrade just about covers it all.

- Total transparency with fees

- Surprisingly low fees

- Lots of investment accounts and product choices

- Options for Socially Responsible Investing (SRI)

- Plenty of convenient methods for support

- Limited amount of time to report fraud for full reimbursement

- Trading research is limited

- Excellent array of investing and trading tools

- Trade ETFs for $0

- Commission-free stock trades

- TFSA

- RRSP

- Spousal RRSP

- LIRA

- Locked-In RRSP

- RIF

- LIF

- RESP

- Family RESP

- Corporate

- Investment Club

- Partnership

- Sole Proprietorship

- Individual Informal Trust

- Joint Informal Trust

- Formal Trust

- Individual Margin

- Joint Margin

- Individual Forex & CFDs

- Joint Forex & CFDs

- FHSA

- Stocks

- ETFs

- Options

- FX

- IPOs

- CFDs

- Mutual Funds

- Bonds

- GICs

- International Equities

- Precious Metals

Another popular option to invest in ETFs is through a robo advisor, since the vast majority of them use your money to invest in ETF portfolios – which is essentially a collection of ETFs. All you do is fund your account and choose your risk tolerance, and your money will be used to buy specific ETFs according to the algorithm.

Bonds

Bonds are a lower return investment typically issued by government or corporations to raise funds. They're often called fixed-income instruments since they traditionally paid out fixed income rates, but it is possible to find variable interest rate bonds as well.

When you buy a bond, you're letting the issuer borrow your money with the agreement that they'll pay it back plus interest at a set maturity date. That means you'll likely know exactly when and how much of a return you'll get back on your return.

Of course, that means you can't expect to receive stock-level returns on a bond – it'll be a much more modest return since there's less risk. If you opt for a variable rate bond, you may see a higher return (and a bit more risk).

That said, the company behind a bond could default on the loan, leaving you with nothing. So bonds aren't entirely risk free, despite their usually low return.

Another way to make money off a bond is to sell it on the market, since you don't need to hold the bond through to its maturity date.

Bonds are a good option for investors looking to get some low-risk investment vehicles into their fund pool – but they can't be relied on for impressive returns.

How to invest in bonds

The easiest way to invest in bonds is by buying them through your online broker. Like stocks, you'll have to pay attention to the buy/sell fees on bonds, but they tend to be a bit less expensive, depending on where you're buying them from.

Of course, you can also express interest in buying bonds to your financial advisor, and they should be able to make that happen for you.

Mutual funds

A mutual fund is a pool of investments you buy into with other investors, which usually has an active manager. The pool itself can hold all types of securities, including stocks, bonds, and more.

The main draw of mutual funds is that smaller investors can pool their money together to invest in larger and professionally managed portfolios that they wouldn't be able to afford on their own. Your losses and gains are proportional to the amount of money you have invested in the fund.

But keep in mind that mutual funds have nearly notoriously high fees, which are expressed as an annual fee (or management expense ratio, MER) as well as commissions. These fees obviously eat into your bottom line and should be monitored.

How to invest in mutual funds

You can buy mutual funds through your online broker or by speaking with your financial advisor. The fees for buying them yourself are the same as stocks and ETFs at most places, so you can expect to pay upwards of $10 per trade.

Precious metals

Precious metals are exactly what you think they are: real-life metals like gold and silver. Traditionally, these metals were used as the actual basis for money. You can also invest in metals used for industrial purposes, the most common of which is iridium.

Nowadays, investing in metals is moreso used as a way to hedge against inflation and diversify portfolios. They have the unique advantage of being a tangible asset, rather than investing in the more abstract idea of a company doing well in the future, like stocks.

This usually means they're a relatively safe investment, because chances are gold, silver, and other metals will have real-life use in the future.

You can invest in precious metals in a variety of ways, but if you choose to physically buy some gold, for example, you'll have to spend money on storage and insurance costs. Those are extra fees on top of the initial buy fee to consider.

Another downside of precious metals is you don't really earn interest or dividends in them. They're more of a store of value.

How to invest in gold and precious metals

There are a number of ways to invest in gold and precious metals in Canada.

First, you can physically buy minted coins or bars and store them in a safety deposit box. Of course, you'll need to consider the extra, continual costs of this method.

But there are less straightforward ways to invest in gold and precious metals as well. For instance, you could buy shares in a company that's directly involved in the production of precious metals. This way, you can cash in on actual interest and dividends at the same time.

You can also buy ETFs or mutual funds that focus on precious metals, which is an easy way to diversify your reach. These can be bought and sold just like any other ETF – through your online broker or financial advisor.

Options

Options are a derivative investment vehicle that gets its value from another security. Options are sold because the investor believes the stock it's based on will rise (a "call" option) or fall (a "put" option) in value.

The value of an option depends on the actual value of the stock, bond, or other type of security it's based on. Options generally have short timelines of 30, 60, or 90 days, though it can go up to a full year in some cases. This time value is included in the overall value of the option as well.

The main benefit of buying options is that you can take advantage of a security's change in value for a lower price than actually buying the stock itself. This can help you generate income for your portfolio.

Of course, there's lots of risk involved here, since it's all based on a future opinion of the security. You also have to pay upfront premiums to the person who wrote the option.

How to invest in options

Like most other investment vehicles, you can buy options from most online brokers in Canada. They generally cost the same price as stocks and ETFs, so you're looking at upwards of $10 per trade.

Of course, you can also chat with your financial advisor and ask if they could put some of your money in some options as well.

FX

FX stands for foreign exchange, and is exactly the same thing you do when you exchange your money to another country's currency when you go on a trip.

The main difference is that FX investors buy and sell currencies in the hopes that it will rise or fall in value. As you may have noticed when comparing USD and CAD, the exchange rate of currencies changes often, so FX investors hope to be one step ahead of those changes and cash in on the profit.

How to invest in FX

Unlike the other types of investments here, FX trading has a number of different avenues available, since exchanging currency is a commonplace thing people need to do everyday. All you need to do is buy a country's currency with another currency.

Just pay close attention that you're not paying a bunch of extra exchange fees with the FX service you're using.

GICs

A GIC, which stands for Guaranteed Investment Certificate, is a low risk investment option that allows investors to deposit money for a predefined length of time for a predetermined interest rate. In this way, you know exactly what to expect when it comes to when you'll get your money back and how much profit you'll have accumulated.

The principal of GICs are also guaranteed, which means you'll always get back what you put in. This makes it incredibly low risk, but they also don't offer very high rates of return. That said, they often have higher rates than the savings accounts at the same bank.

The main drawback of GICs is that, generally speaking, your money is tied up for the entire length of time. If you withdraw early, you'll likely face penalties. There are certain GICs that allow you to withdraw at any time (called cashable), but these often come with lower rates than their non-cashable counterparts.

You can also buy GICs that are connected to the stock market, which have the potential to earn a lot more return (usually capped). Usually only the principal is guaranteed with these types, so it's hard to say how much interest you'll actually earn once all is said and done.

How to invest in GICs

Unlike the other investment options here, you can buy GICs directly from your bank without needing a direct investing account or any other investment account. In this way, investing in GICs is very similar to parking your money in a savings account.

Cryptocurrency

A hot topic in recent years, cryptocurrency is a digital currency that is often decentralized, which means it exists outside government and central bank authority. Based on blockchain technology, cryptocurrency uses digital encryption, which makes it nearly impossible to counterfeit.

Crypto markets are always open and crypto coins can be bought and sold on a variety of crypto exchanges. Each crypto coin will have its own set of rules, such as how it's created, how much of it is in circulation at any given time, if there's an upper limit to that circulation, and other,

In general, cryptocurrency is extremely unstable and has seen huge crashes and shocking rises throughout its history. Bitcoin is the most popular example, and it's also the first cryptocurrency to be created. Nowadays, other popular crypto options include Ethereum, Cardano, and Litecoin, and more.

How to invest in cryptocurrency in Canada

If you want to invest in cryptocurrency in Canada, you'll likely need to sign up for a crypto exchange. There are plenty of popular options to choose from, ranging from all-encompassing (and probably overwhelming) to very simple exchanges that only offer a handful of coins.

If you want to dip your toes in crypto but don't really want to buy coins outright, you can combine more traditional investing with this new venture by buying a crypto ETF. As you may imagine, these ETFs are completely normal, except what they're tracking is cryptocurrency.

NFTs

NFTs, or Non Fungible Tokens, are basically a digital certificate that certifies that the asset it's connected to is unique. These certificates can be attached to anything, like artwork, recordings, recipes, and more. The token itself carries a unique, unalterable digital signature which also tracks the hands it's passed through.

These tokens use blockchain technology, which is the same technology that cryptocurrency is based on.

There's a lot of hype around NFTs since they're new technology and can foresseably be used in interesting ways in the ever growing online world. Some people have made a lot of money on NFTs, which of course adds to the hype, but most people have not seen much return.

How to invest in NFTs in Canada

If you want to invest in NFTs in Canada, you'll first have to purchase some Ethereum, as this cryptocurrency is what most NFTs are based on.

With some ETH coins in your wallet, you can then browse various NFT collections and make your purchase.

30 basic investment terms you should know

But it's one thing to sign up for an investment account and move some money over – it's another to be able to read and understand all the investment jargon that goes on.

Whether you're trying to navigate your investing software or trying to read a Reddit post for advice, you're likely going to run into words you don't understand if you're just starting out.

Here's a list of some of the most common investment terms you should know.

| Investment term | Definition |

|---|---|

| Annualized | Recalculating short term numbers so they're extended over a period of a full year. Often used to estimate the yearly return of an investment. |

| Appreciation | The amount an investment asset has increased in value. |

| Asset allocation | Dividing your investments among different risk levels in order to balance risk and reward. |

| Asset class | Types of investments, like stocks, bonds, and cash. |

| Bear market | A period of time where stock market prices are falling (usually a decline of at least 20%). |

| Benchmark | A standard to compare performance of an investment against. |

| Bull market | Opposite of a bear market – a period of time where stock market prices are generally on the rise. |

| Bullish | Believing an asset or market is going to rise in value. |

| Capital | The money you used to purchase an investment asset. |

| Capital gain | The profit you made from an investment. It's the difference between what you paid for it and what you sold it for. |

| Custodian | The financial institution that holds the assets within a fund. It usually does the "custodial" tasks of settling the trades and collecting important data. |

| Dividend | The portion of a company's profit that's paid out to its shareholders. |

| Fixed income fund or security | A type of investment that pays a set interest rate on a regular basis. |

| Index | Tracks and measures the performance of investments in a particular category. For example, the S&P 500 tracks the top 500 large company stocks in the US. |

| Interest rate | The percentage of the investment you can expect to be paid, such as the interest rate for a savings account. |

| Liquidity | How accessible the money is. For example, can you just take the money out or will you need to sell stocks in order to access the funds? |

| Market capitalization (Market cap) | The value of a company, determined by multiplying the number of shares by the price per share. |

| Net Asset Value (NAV) | The dollar value of a mutual fund share. |

| Portfolio | A collection of investments which is usually managed together. |

| Premium | The amount a stock sells over its original purchase price. |

| Price-to-earnings ratio (P/E) | Stock price divided by earnings per share. This is used to calculate how much the company's earning power is going for. |

| Risk tolerance | How much risk you can handle in your investments. Generally speaking, longer term investments usually have higher risk tolerances, and vice versa. |

| Securities | A common alternate term for investments, usually stocks and bonds. |

| Share | A single unit of an investment. For example, you can buy shares of a stock. |

| Stock market | A collection of exchanges where buying and selling of stocks take place. |

| Ticker symbol | A short series of letters used to identify a stock on a stock exchange. |

| Valuation | The estimated value of a company that's assigned to an individual stock. |

| Volatility | How often the investment fluctuates in value. |

| YTD | Stands for year-to-date and generally refers to an investment's return so far this year. |

| Yield | The dividend, return, or interest paid by an investment, expressed as a percentage rate. |

What to consider when investing

Now that you have some of the most important terms under your belt and you have an idea of the options in front of you, there are still some things you'll need to consider before diving head first into investing.

These topics can help you mould your investment plan into the method that works best for you. It's important to understand how they reflect your current situation and your plans for the future.

Risk tolerance and risk management

You'll often see people talking about risk tolerance when it comes to investment portfolios. Analyzing this is often the goal of those short questionnaires you take when opening a new investment account or meeting with an advisor.

But first, let's talk about risk.

Defining risk in investing

In simple terms, risk is how far off the goal an investment is likely to go. A low risk investment would deviate only slightly and a high risk investment has potential to land much further away from the goal.

Though this sounds negative, it's important to remember that the investment could deviate much farther above the goal as well as below.

That means a high risk investment has the potential to see much greater gains (as well as losses) than a low risk equivalent. If you want to see high returns, you'll have to take on more risk.

So what is risk tolerance and risk management?

Risk tolerance seeks to define how conservative or growth-oriented your investment portfolio should be, based on your goals and your tendency to get anxious over losses in the value of your investments.

Generally speaking, someone with a long-term goal could handle a bit more risk than someone with shorter goals, since your investments have a longer horizon to grow over.

This is based on the general conception that higher risk means higher returns over time. But higher risk also means greater volatility – so there will be lows as well as highs. If you need your money out in a couple years, you don't want to be stuck liquidating your assets when they're at a net loss.

But even people saving for retirement in 30 years could be overly worried about their investments, causing them to withdraw early if they see massive dips. That person would probably do better with a lower risk portfolio.

The concept of risk management starts with analyzing your risk tolerance, then applying that knowledge to your investment portfolio. If you believe you have high risk tolerance, you can go for higher risk investments, and vice versa.

We discuss how to determine your own risk level further below.

Portfolio diversification

Portfolio diversification is a common investment tactic that seeks to reduce your overall risk. You've probably heard the phrase "don't keep all your eggs in one basket" – which is exactly what's going on here.

Basically, you want to invest in multiple sectors, companies, industries, countries, market caps, and vehicles. That way, if one sector crashes, for example, you'll have the rest of your investments to buffer you.

As an example, if you have 100% of your investments in the Tesla stock, for example, and the company goes under tomorrow because of some unforeseen circumstance, that's 100% of your investments that tanked.

But if you only had 1% in Tesla, and the rest of the 99% was spread out across other tech, energy, and healthcare stocks, you wouldn't feel the crash nearly as much. It would be an inconvenient blip in your radar rather than a full-blown catastrophe.

This concept is integral to risk management. Spreading out your investments across different risk levels can help stabilize your overall risk over time.

Here's a list of some common investment sectors to diversify your portfolio across:

- energy,

- materials,

- industrials,

- utilities,

- healthcare,

- financials,

- consumer discretionary,

- consumer staples,

- information technology,

- communication services, and

- real estate.

Spreading your investments across these sectors can help you keep your portfolio properly diversified.

Stock markets

As you've started to explore investing in Canada, you may have come across discussion of the stock market. This is how people refer to the multiple exchanges on which you can buy and sell stocks of publicly traded companies.

Typically, each country has multiple exchanges or indices. For example, here's a list of Canadian stock exchanges:

- Toronto Stock Exchange (TSX),

- TSX Venture Exchange,

- Canadian Securities Exchange,

- Montreal Exchange,

- NASDAQ Canada, and

- Aequitas Neo Exchange.

If you've heard of the S&P 500, this is another example of a stock index, but this time from the United States. It follows the top 500 companies in the country.

Within each of these stock markets is a series of investments that you can buy or sell. Overall, they're referred to as the stock market. Prices of the stocks on these markets rise and fall with demand. The idea is to buy stocks at a good price that will rise in the future, or sell your stocks before you lose money on them.

Want to learn more about the stock market? Check out your beginner's guide to the Canadians stock market.

Monitoring portfolio performance

Monitoring your portfolio is the act of checking in on your investments to see how they're doing in terms of performance. Most investment software has an easy way to do this, usually giving your overall return as a simple number.

Monitoring portfolio performance is a way to see if things are working out as you think they should be. If you see issues cropping up, being ahead of the game and readjusting your portfolio accordingly could catch the problem before it wreaks havoc on your finances.

There's also a ton of 3rd party software out there that can track performance and other factors and make suggestions for you. Most robo advisors will do this on their own based on their algorithm, so you won't have to adjust anything.

The main thing to keep in mind when monitoring your portfolio performance is that a little bit of loss every once in a while is completely normal. It's not always the best idea to immediately remove money from stocks or investments that are falling, since you're locking in that loss. If you had just left it, chances are it may have recovered in a few months or years, and you would've had an overall net gain.

Think about the way you handle financial stress in everyday life. Do you think you'd have trouble accepting loss, especially when it's likely temporary? If so, you may want to have some distance from your portfolio and not monitor it so intensely.

For example, you could set up a time every quarter to check in. That way you can still see where things are going, but won't be tempted to make rash decisions every other week.

Rebalancing portfolio

After monitoring your investment portfolio, if you choose to take action in some way (like buying some stocks and selling some bonds), that's called rebalancing your portfolio.

The goal with portfolio rebalancing is usually to bring your investments back to a certain risk level while also keeping your goals for return in mind.

For example, if you're looking for a bit more return from your portfolio, you could sell some bonds and use that money to buy some more stocks. That way, you've introduced more return potential to the overall portfolio (while also taking on a bit more risk). Hopefully, this adjustment still meets your predetermined risk tolerance.

If you don't want to do it yourself (it can get pretty complicated), you may want to consider hiring an investment advisor to go through your options with you. Many robo advisors also take care of this themselves, so that may be another option if you'd rather be as laid back as possible.

We'll discuss how to rebalance your portfolio further below.

Dividend reinvestments

A dividend is the cash that a company pays out to its shareholders. Since this is your return, you can do anything you want with the money – spend it, save it, or invest it.

If you choose to use that cash to buy more shares, then you're performing dividend reinvestment. Not as complicated as it sounds, eh?

To make things even more simple, DRIP (or Dividend Reinvestment Plan) is a common program offered by many investment software companies. This will automatically reinvest your dividends for you, so you don't even need to think about it.

Just note that not all stocks pay dividends – you'll need to specifically invest in dividend stocks to take advantage of this investment strategy.

Socially responsible investing

As the name suggests, socially responsible investing (SRI) is investments that have a particular focus on socially responsible companies and funds. These work the same as normal investments in terms of risk and return, but you can rest easy knowing that you're not funding a company that may be going against your beliefs, for example.

A common term you'll see when discussing SRI investments is ESG, which stands for environmental, social, and government. These terms are often used interchangeably.

Of course, being extra picky about the companies you invest with can add a layer of difficulty to your investments. Thankfully, there are many robo advisors that offer SRI portfolios – so you still get the laid back treatment, but with a little extra peace of mind.

Wealthsimple is one of the biggest examples of this in Canada. They decide their investments by eliminating the top 25% carbon emitters in each industry and making sure the board of directors for each included company has at least 25% women on their board of directors (or at least 3). They also avoid investments in industries like tobacco, firearms, and big oil.

Want to learn more about Wealthsimple investments? Check out the full review here:

Wealthsimple managed investing is a robo advising investment platform from one of Canada's favourite online brokerages, Wealthsimple. It offers a hands-off investment experience with no paperwork and no account minimums – a huge draw for anyone who's new to the world of investing or simply trying to make smart choices with minimal funds.

- Easy to understand fees

- The set-and-forget-it simplicity

- A good array of account types that can grow with you

- Extraordinary security for your money and accounts

- Grow into Wealthsimple Premium

- Socially responsible and Halal investment options available

- New user offer

- Higher account management fees

- Limited tools

- Talking to a human can be tricky

- Provides socially responsible and Halal investment options

- Can connect your account to Mint for easy budgeting

- Get a dedicated team of advisors if you have more than $500,000 in assets

- RRSP

- TFSA

- Personal

- RESP

- RRIF

- LIRA

- Joint

- Business

- FHSA

What fees to look out for when investing in Canada

One of the most important things to keep in mind when investing is what kind of fees you're paying. Though this seems like it should be pretty easy, there are multiple kinds of fees to look out for – so it can get complicated fast.

For example, you could be paying a different amount depending on whether you're buying or selling the stock, even with the same company. Plus you could be paying management fees for an ETF or mutual fund that's included in the return, so you may not even realize you're paying a fee at all.

And if you want to switch investment companies, you may find yourself paying some pretty hefty fees to move your money and close your account.

All of these fees cut into your bottom line, which is the last thing you want to get out of control as an investor.

Let's go over some of the main fees to keep in mind.

Buying fees

Buying fees are how much you pay when you purchase an investment, whether that be a stock, a bond, an ETF, and more. These are on top of the purchase price of the investment.

How much this fee costs you depends on your investment software of choice and also the specific investment you're buying.

For stocks, bonds, options, and ETFs, the Big 5 Banks will usually charge you up to $10 per trade. You can expect to pay about half that if you're an active trader (usually around 150 trades per quarter).

That said, CIBC Investor's Edge actually only charges $6.95 per trade, which is by far the cheapest from the Big 5 Banks. If you're interested in more from CIBC, check them out here:

This online investment brokerage is owned and run by CIBC, and is targeted towards people who are interested in managing their own investments, learning about how to manage their own investments, and people who do investment management for a living. With relatively low fees for trades, and discounts for students and active traders, this is a service worth looking into.

- Get 100 free online equity trades with code EDGE2526

- No minimum investment required

- Lower than average fees per trade

- Discount on trade fees for students and young adults

- Discount on trade fees for active traders

- Seems to be designed for regular people, not just the ultra rich

- Per transaction fees can add up quickly

- Ages 18 - 24 trade for free

- Free investment research tools

- Extended trading hours

- TFSA

- RRSP

- RESP

- RRIF

- LRSP

- PRIF

- LIRA

- LRIF

- Cash

- Margin

- Corporate

- Partnership

- Formal trust

- Investment club

- Estate

- FHSA

- Stocks

- ETFs

- Options

- Mutual Funds

- GICs

- Fixed Income

- Precious Metals

- Structured Notes

- IPOs

- CDRs

Buying fees are usually very transparent, so it's an easy (and important) thing to keep track of next time you're buying investments.

Selling fees

On the other end of the trade is the selling fee, which is what incurs when you sell your investment with an online broker.

Most of the time, the fee here is exactly the same as the buying fees, especially if you're working with a Big 5 Bank.

But there are some online brokers that will charge you a different amount depending on if you're buying or selling. The biggest example in Canada would be Questrade.

When you're buying ETFs through Questrade, they're actually completely free. But when you go to sell them, they cost 1 cent per share. While that's an amazing price (and the free buying fee is even better), just note that it does have a minimum fee of $4.95 and a max of $9.95.

But that means that as long as you're buying less than 495 shares at a time, you'll be paying less than half of the standard Big 5 Bank fees. Stocks also have the same minimum and maximum, but this time it applies both when you're buying and when you're selling.

Want to learn more about Questrade and their impressively low fees? Read more here:

Questrade is one of Canada's top online investment platforms. With very low fees, including no-fee ETF trading, commission-free stock trades, and plenty of investment types, Questrade just about covers it all.

- Total transparency with fees

- Surprisingly low fees

- Lots of investment accounts and product choices

- Options for Socially Responsible Investing (SRI)

- Plenty of convenient methods for support

- Limited amount of time to report fraud for full reimbursement

- Trading research is limited

- Excellent array of investing and trading tools

- Trade ETFs for $0

- Commission-free stock trades

- TFSA

- RRSP

- Spousal RRSP

- LIRA

- Locked-In RRSP

- RIF

- LIF

- RESP

- Family RESP

- Corporate

- Investment Club

- Partnership

- Sole Proprietorship

- Individual Informal Trust

- Joint Informal Trust

- Formal Trust

- Individual Margin

- Joint Margin

- Individual Forex & CFDs

- Joint Forex & CFDs

- FHSA

- Stocks

- ETFs

- Options

- FX

- IPOs

- CFDs

- Mutual Funds

- Bonds

- GICs

- International Equities

- Precious Metals

Again, selling fees are generally very transparent, so it should be easy to keep an eye on how much you're spending here. Just make sure to take it into account when you're budgeting how many shares you're buying.

Management fees and MERs

If you're investing in funds – like mutual funds or ETFs – you can expect to be paying a management fee.

This money compensates the investment manager for the time they spend analyzing the fund and choosing the proper investments to go in it. This fee will also cover other administrative costs.

These fees are usually structured based on a percentage of the investments within the fund. This is called "assets under management" (or AUM) and generally ranges between 0.1% and 2.5%.

You also have the MER to consider, which includes the actual cost of buying and selling securities within a mutual fund. In simple terms, then, the MER is the management fee PLUS the operation costs. It's a broader way to define how expensive the fund is for the investor.

Paying attention to this fee is important because it can be easy to forget about it. After all, you're paying this relatively small percentage over time, so it won't seem like much all at once (unlike the buy and sell fees of an online broker).

Account fees

A more indirect fee you may want to keep in mind is any account fees you may face.

Here's a list of some account fees you may want to keep in mind. We've grabbed the current price from a big bank as well as an independent online broker as a small comparison.

| Fee type | Scotiabank iTrade | Questrade |

|---|---|---|

| Paper account statements | $3 | N/A |

| Inactivity fee | $25 | $0 |

| Annual account fee | $100 | $0 |

| Deregistration fees | $125 | $25 - $100 |

| Wire transfer out | $25 | $20 ($30 if USD) |

| Transfer account out | $150 | $150 |

As you can see, some of these fees are pretty high, so it's not recommended to be moving your investments between accounts often. The good news is a lot of investment software offers to cover the transfer fees.

Understanding your own investment risk level

Figuring out your own personal risk level is important, especially when you're planning on taking on investing by yourself, armed only with an online broker account and Google.

This means you have a firm understanding of how much risk you're comfortable with while investing.

While all investments come with a certain level of risk, some are definitely riskier than others. Not only that, but return is always connected to risk. The higher risk, the higher potential return. So figuring out your risk tolerance is finding the right balance between return and a healthy amount of risk that you can live with.

When talking about risk tolerance, most investors will break it down into the following levels:

- Conservative

- Moderately conservative

- Moderately aggressive

- Aggressive

- Very aggressive

How to determine your own investment risk level

The first thing to keep in mind when you're trying to understand your risk tolerance level is that it's a dynamic thing. Your risk tolerance today may differ from what it was last year and, depending on circumstances, may even differ from what it will be next week.

All that means is you should check in on your risk tolerance every once in a while. If you set up quarterly sessions to sit down with your investments, bring risk tolerance evaluation into the agenda.

While you can take various quizzes online to determine your risk tolerance level (like this one from the University Of Missouri), it's important to understand the thought process behind the quizzes as well.

At a basic level, there are 3 main factors that go into assessing your risk tolerance level.

1. Investment time horizon

First, how long are you looking to invest for? For example, are you saving up for your retirement in 30 years or for a new house in 5?

The length of time between now and when you want to withdraw your investments is a major part of your risk tolerance level. This is because riskier investments (like stocks) are shown to perform better over longer periods of time than less risky alternatives (like bonds).

That means if you have 30 years before you're planning on using the money, you may want to up the risk level a bit to ensure you get some delicious rates of return by the time it's all said and done. This will introduce more volatility into your investments, but with so much time between now and your end goal, you can weather the storms with a healthy level of trust.

But if your investment horizon is much closer down the road, like within a few years, you don't want to find yourself suddenly needing to withdraw when the markets are down. If the end goal is close, it may be better to aim for modest returns in exchange for more stability.

2. Your personality

The personality aspect of risk tolerance depends on how you react to changes in the market.

For example, if the markets are down, do you tend to panic and withdraw your funds? Or do you pour more money into your investments with the hope that things will eventually recover (which they usually do)?

If you find yourself making hasty decisions when it comes to your investments, or even if you just feel uncomfortable with the thought of high volatility levels, then you may want to consider yourself to have a lower risk tolerance.

But if you see downturned markets as an opportunity and have near superhuman ability to keep calm under stress, then you may consider yourself to have higher risk tolerance.

3. How much you're willing to lose

This factor of risk tolerance seeks to determine how much you're willing to lose when investing. Or in other words, what's your net worth and income?

The higher it is, the more money you can put into investing without risking total ruin if the markets crash tomorrow. If you have less money coming in every month, then you probably have less wiggle room to invest.

How to match your investments to your risk level

So now that you have an idea for your risk tolerance, it's time to match the investments you're buying to what you can handle in terms of risk.

Just keep in mind that you should consider diversification in your investment portfolio, even if you consider yourself 100% conservative or aggressive. It's good to get different types of investments in your portfolio so it has a better overall performance.

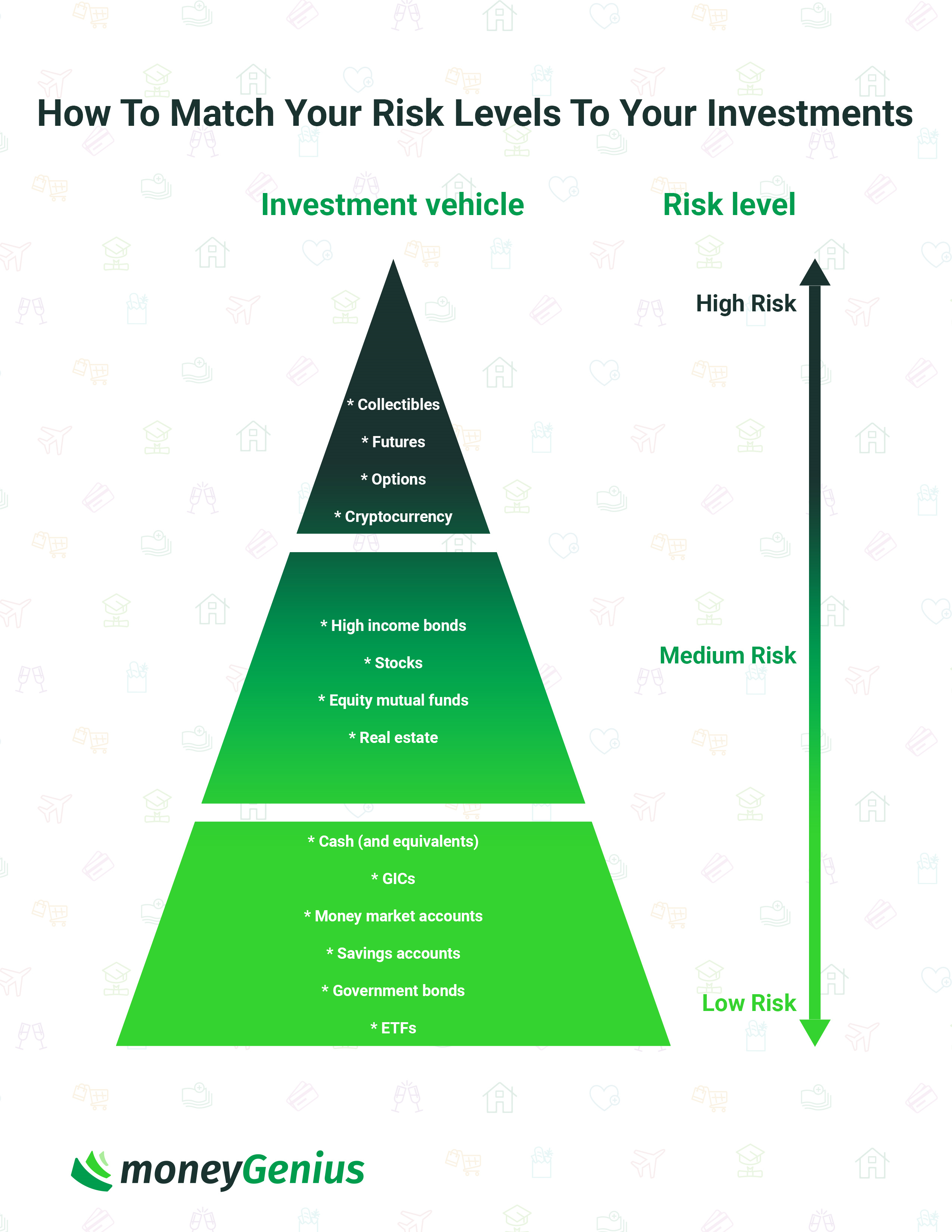

Here's your basic list for matching investment vehicles to risk levels:

How to rebalance your portfolio

Nothing stays the same for very long, especially when it comes to investments. So it's almost a no-brainer that leaving your investments to sit stagnant may not be your best option.

Rebalancing your portfolio is a pretty simple concept. When you first start your investment portfolio, you and/or your advisor likely built it with a certain asset allocation or risk level in mind. Then every once in a while you'll check back in to make sure things are still within those original constraints.

For example, say you began your portfolio with a 70% stocks and 30% bonds allocation. That year, your stocks performed really well so your asset allocation has shifted to about 80% stocks. Since that introduces an increased level of risk to your portfolio, you may consider selling off some of your stocks and/or buying additional bonds in order to return to the original 70/30 split.

When should you rebalance your portfolio?

When and how often you rebalance your investment portfolio is largely up to you.

There are 2 main strategies that investors use to decide when they'll sit down and rebalance their portfolio: after a certain amount of time or after a certain amount of change.

Rebalancing your portfolio by time

One of the most common ways to schedule your portfolio rebalancing sessions is by time. This involves setting a quarterly or monthly date where you'll sit down and see how you're doing. You can also do it:

- yearly,

- weekly,

- bimonthly, or

- any other length of time.

Generally, most investors recommend the monthly or quarterly method. This is kind of a sweet spot, since a weekly rebalance would likely incur a lot of trading expenses, and yearly may be a bit too long to catch significant drifts in your asset allocation.

Rebalancing your portfolio by targets

The other main strategy is to monitor your target allocation and rebalance whenever it drifts over a certain threshold.

Returning to the earlier 70/30 example, you could decide to rebalance whenever your allocation sways 5% in either direction.

This is a good way to make sure your portfolio is always as close to your targets as possible, but it could also prove to be extremely expensive depending on how volatile the markets are at that time.

Analyze your investment portfolio

Once you've decided to sit down and rebalance your portfolio, you'll be looking for a number of things. Of course, the asset allocation is one of the main things to look for – but it's not the only thing.

You'll also want to keep an eye out for:

- Risk: Are you comfortable with the amount of volatility currently present in your portfolio?

- Returns: Is your portfolio currently meeting your goals for returns? How do your funds compare against benchmarks – are they meeting the mark?

- Fees: How much have you paid in fees? Do they meet your budget? Are there ways you can cut them down?

- Market changes: Are there new things in the investment world that have come up since the last time you checked? New opportunities to invest in?

Keeping the above in mind can help you understand what your goals are and how you can achieve them.

How taxes affect your investments

Just like your other sources of income, investment income is also taxed. This is important to keep in mind, since it does eat into your bottom line. All investment income will need to be reported on your tax return at the end of each tax year.

There are 3 main sources of taxable income while investing.

1. Dividends

Some company stocks choose to distribute dividends to their shareholders, often on a monthly or quarterly basis.

These dividends are essentially shares of the profit and are a nice way to earn money from your stock holdings without having to sell them.

They come as 2 types: eligible and other than eligible. These will need to be reported on your federal tax return.

2. Interest

If you have a high interest savings account or GIC, you're likely earning interest on the money you have invested there. Though this is often not very much of a return, you'll still need to report it on your tax return.

This also goes for other similar types of investments, like:

- Canada savings bonds,

- treasury bills,

- life insurance policy earnings, and

- foreign interest and dividends.

3. Capital gains tax

The last main type of taxable investment income is capital gains tax.

Briefly, a capital gain is when you sell an investment for more than you paid for it. This is of course one of the main goals of stock investing, so it hopefully happens fairly often for you.

But the amount you gained will be taxed at your income tax bracket, so try to keep that in mind when calculating your total returns.

Want to learn the ins and outs of this type of taxable investment income? Check out the full guide to capital gains tax in Canada.

How to pay less tax while investing in Canada

So now you know where you'll likely be taxed while investing in Canada – but what about knowing how to cut down on those expensive taxes as much as possible?

Luckily, there are a couple very useful accounts offered by the Canadian government which offer tax sheltering benefits. Let's take a brief look at how they both work.

Investing in your Registered Retirement Savings Plan (RRSP)

The special thing about your RRSP is any contributions you make are actually tax deductible on your income tax for that year. That means you can save money on taxes by essentially reducing your taxable income.

Plus once the money is in there, any income you generate is allowed to grow tax free – so you don't have to worry about what we mentioned above as much.

But there are a couple very important things to note.

First, you'll face tax penalties if you withdraw from your RRSP before retirement, though there are special exceptions for first time home buyers and lifelong learning.

Second, when you retire, your withdrawals are treated as income, which means you'll need to pay income tax on what you take out. The idea is that your income tax bracket is much lower during retirement than when you were contributing to your RRSP, so it should be cheaper than it would have been.

Investing in your Tax-Free Savings Account (TFSA)

Investing in your TFSA is a lot less complicated. All income generated within the account will be sheltered from taxes completely.

That said, your contributions aren't tax deductible, so you'll still need to pay income tax on that money and won't get a tax break for that year.

Both types of registered accounts have limitations for how much you can contribute each year, so most people try to max out their RRSP contributions first, then move on to maxing out their TFSAs, then put the rest in non-registered (and thus more accessible) investment accounts.

How to start investing

So now that you've learned all the basics of investing, how can you get started?

Here are the 4 steps you can take to get the ball moving with your investment journey.

1. Define your safety net

The concept of your safety net is the amount of money you think you'll need to remain financially secure in the future, no matter what happens.

Essentially an emergency fund, your safety net should be kept fairly liquid – like in a savings account where you can easily transfer it back to your chequing account when needed. This will also mean it's very low risk, since you don't want your emergency funds to disappear overnight in a market crash.

To determine your safety net, tallying up your estimated expenses for a few months is the general strategy. This includes all your needs, like rent, food, and bills for 3 - 6 months. Your goal should then be to keep that amount in a separate account just in case you need it.

This will help you take on a bit more risk with your savings that you're putting towards your longer-term (and higher risk) investments – since even if something goes terribly wrong there, you have yourself covered.

2. Determine investable assets and funds

Once your safety net is defined, you also need to cut out a certain amount of money that you can comfortably put aside for the rest of your investments.

This also means you need to define your investment goals – like a new house, a big trip, your kid's education, or retirement.

At this step, you can either plan a certain amount of money you can put aside every month towards your investments, or cut out a lump sum from an existing savings account that goes over your emergency fund definition you created in the first step.

3. Find the right investment account for you

Armed with a plan, it's time to find out which method of investing works best for you.

As we discussed above, you have 3 main options when it comes to investing in Canada:

- Robo advisor: A laid back, low fee option that doesn't need much prior knowledge.

- Online broker: A hands-on approach that lets you decide where your money goes.

- Financial advisor: A personalized approach that lets you talk with a real person.

That said, there's absolutely nothing stopping you from using any combination of the above. In fact, that might be the best way to spread out your investment strategy even further.

4. Open your investment account

Once you've chosen from the above, you'll need to decide on your preferred account type (or types) and open the account.

Most of the time, you'll need some basic personal information to open an account, like your name, address, and SIN. Most options will walk you through the account opening process in a very simple way and it should only take a few minutes.

Once you have the account open, you'll need to fund it by transferring money into it. This process will vary depending on the company you're working with, but Interac e-Transfers and wires will usually work just fine.

Want to share these 4 steps of investing with everyone you know?Download your free, printable version right here .

5 tips for new investors

If you're a brand new investor, this whole starting process can feel overwhelming even at the best of times.

So what are they key takeaways you need to hear before you start your investing journey?

1. Start as soon as possible

Chances are you have a lot of time left before you retire, or maybe even a few more years until you want to buy a house. That doesn't mean you should put off starting to save for these life-changing events any longer than absolutely necessary.

One of the most important ingredients in investing is time. Nothing can mitigate risk and drudge up return much like having a 30 year horizon ahead of you.

So if you haven't started saving yet, do it as soon as you can. Even if you don't know what you're doing, putting some money away in a high interest savings account is the first step that can bring you down the path towards having $1 million waiting for you at retirement.

2. Don't get caught up in the hype (or fear) too much

If you listen to finance news, you'll constantly be barraged with talk about what's the next investment that's gonna shoot up 100% – or worse, what investment should you pull out of immediately.

While there's definitely value in this type of discussion, if you have a portfolio with moderate risk, it's best to avoid getting too caught up in the ups and downs of the market. Over a long enough timeline, your returns will probably turn out okay despite bumps in the road.

The main thing you want to steer clear of is making impulsive decisions based on rumours you've heard about the future. Buying and selling too often can cost you a lot of money, and may be the split decision that loses you out on long term growth.

Keep an eye out for the important stuff, but try to keep your cool.

3. Don't be afraid to start easy and build yourself up

It can be way too easy to get overwhelmed when you're just starting your investment journey. With everything going on and so many choices ahead of you, sometimes the better choice may feel like giving up.

But even putting aside a small amount of money a month into a simple low cost robo advisor can be all you need to get started. When your situation changes, you can re-evaluate as needed.

But starting early and starting small is the best way to get started at all.

4. Set goals and timelines

Figuring out what your short term and long term goals are will help you calculate your timelines properly, which can set the groundwork for what kind of investment tools are best for you (and what your risk tolerance is).

Some of the most common goals people like to save for are:

- buying a house,

- having kids,

- sending kids to university,

- completing a big home project,

- going on a trip, and

- retirement.

Once you decide what your goals are, the timeline will come naturally. Then you can calculate how aggressive you'll need to be in order to make your timelines.

Everything will be based on your goals.

5. Automate as much as you can

Finally, once you've decided on your goals, one of the best tools in investing is automating everything.

That way you're saving without even thinking about it. You hardly even see the money you're putting away before it goes into your investment account, so that means you adapt to living without it.

Then one day you'll go check your investments and hopefully be pleasantly surprised at how much accumulated there.

What does investing in Canada look like for you?

Now that you've travelled through the investing journey with us, what do you think your next step is?

How did you find your first few years of investing went? Do you have any regrets or things you would've done differently?

And best of all, do you have tips of your own?

Let us know in the comments below!

FAQ

How to start investing in Canada?

The first step to starting investing in Canada is deciding what your goals are and how much of your monthly take-home pay can you comfortably spare. Once that's settled, choosing the investment account that properly fits your needs is important. See the 4 steps to start investing here.

What are investments?

In a nutshell, investments are assets that you put money towards with the hope that they'll grow in value over time. There are many different types of investments available and each has different prices, risk levels, and rules involved. Here are 10 types of investments to get you started.

How can I invest in cryptocurrency?

There are multiple ways to invest in cryptocurrency in Canada. The most direct way is by opening an account with a cryptocurrency exchange and trading crypto there. But you can also buy crypto-based ETFs and other funds.

Where to invest money in Canada?

You have a large number of investment choices, opportunities, and software to choose from in Canada. If you're just getting started, investing in ETFs can be an easy way to diversify your portfolio with just one purchase.

How to invest in gold?

If you want to invest in gold in Canada, you can either buy it from an online broker, buy actual physical gold and keep it in a safe place, or invest in ETFs or other funds that are based on the price of gold.