Banks use routing numbers to identify individual bank branches. A routing number is a combination of a 5-digit transit number (or branch number) that identifies your bank and a 3-digit financial institution number that identifies the branch where you opened your bank account.

A bank routing number is used by financial institutions like banks, credit unions, and trust companies in Canada to facilitate transactions, including cheque and electronic transfers, direct deposits, digital cheques, and recurring loan and bill payments.

Key Takeaways

- A bank routing number is the combination of a transit number and institution number used to identify your banking institution.

- These numbers are used during transactions when money is moved, such as authorizing automatic bill payments and setting up direct deposits.

- You can find your bank routing number on a personal cheque, a bank statement, or via your online banking account.

- An ACH or ABA number in Canada is the same as a bank routing number – these terms are more commonly used in the U.S.

What is a bank routing number in Canada?

In Canada, routing numbers are managed by the Canadian Payments Association (CPA), an organization that oversees the country’s banking industry. These routing numbers are used to identify the financial institution and bank branch where an account is held. They include two parts:

- Branch number (transit number): 5-digit number that identifies the branch where an account was opened

- Financial institution number: 3-digit number that identifies the bank

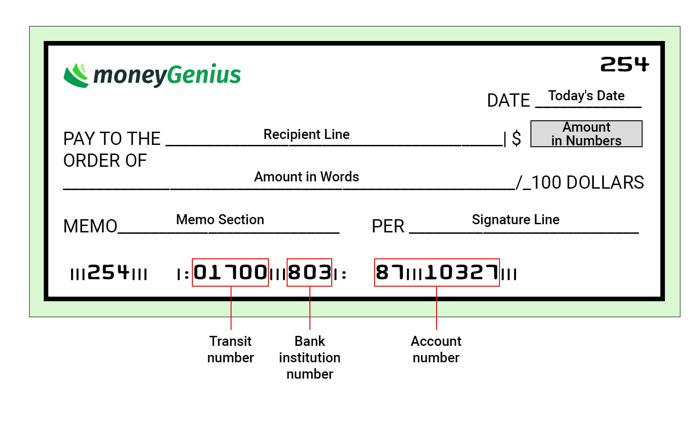

Where to find your bank routing on a cheque

The routing number is the combination of the 5-digit transit number and the 3-digit institution number on the bottom of your cheque, as shown here:

How to find your bank routing number without a cheque

You can find your bank routing number via your online banking portal or on a paper statement from your bank. Here’s what to look for:

- Online banking: Log in to your account, navigate to the "Account Information" or "Account Summary" section, and look for details related to your checking or savings account. The routing number is typically listed along with your account number and other account details.

- Bank statement: You can typically find your routing number on a paper copy of your bank statement listed along with other identifying information.

Despite popular belief, your routing number isn’t listed on your debit card.

Example routing numbers in Canada

| Routing Number | Bank | Branch | Address |

|---|---|---|---|

| 01824-003 | RBC | Liberty Village Branch | 51 Hanna Ave Toronto, ON M6K 3N7 |

| 06720-003 | RBC | Hornby & Nelson Branch | 1010 Hornby St Vancouver, BC V6Z 1V6 |

| 47941-004 | TD | 2001 Robert-Bourassa | 2001 Boul Robert-Bourassa, Montreal, QC H3A 2A6 |

| 02099-004 | TD | Edmonton Capilano Mall | 5615 101 Ave NW Edmonton, AB T6A 3Z7 |

| 27556-001 | BMO | Britannia Plaza | 1495-100 Richmond Rd Ottawa, ON K2B 6R9 |

| 60293-002 | Scotiabank | Quinpool Centre | 6169 Quinpool Road Halifax, NS B3L 4P8 |

| 00373-010 | CIBC | Stavanger Banking Centre | 65 Stavanger Dr St. John’s, NL A1A 5E8 |

| 00937-010 | CIBC | Crossroads Banking Centre | 1586 Regent Ave. W Winnipeg, MB R3H 3B4 |

| 14051-006 | National Bank of Canada | Branch 14051 | 301 6e Avenue S O Calgary, AB T2P 4M9 |

Financial institution numbers of major banks

Because bank routing numbers are different for each branch, it can be tough to know your exact number. However, you can easily fill in the blanks if you have your bank institution number.

Here are the institution numbers for Canada's big 5 banks and a few others:

| Bank | Institution number |

|---|---|

| BMO | 001 |

| Scotiabank | 002 |

| RBC | 003 |

| TD | 004 |

| National Bank of Canada | 006 |

| CIBC | 010 |

| Canadian Western Bank | 030 |

| Laurentian Bank of Canada | 039 |

| Bank of Canada | 177 |

| First Nations Bank of Canada | 310 |

| Manulife Bank of Canada | 540 |

To find your bank’s routing number, look up the transit number for your main branch, then add the institution number.

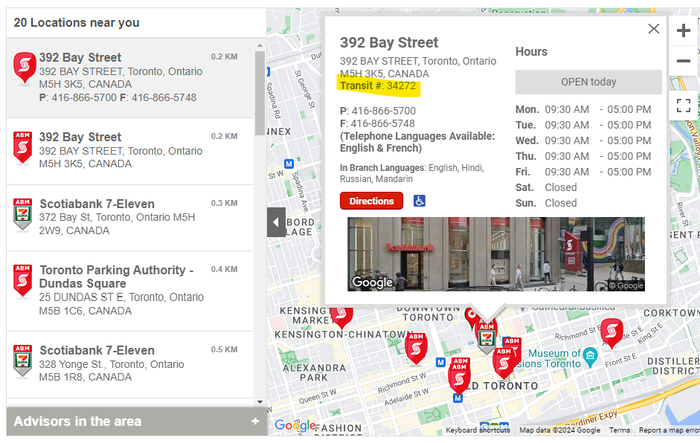

For example, if your main branch is the Scotiabank on Bay Street in Toronto, you can use the Scotiabank branch map to locate your transit number and add it to the institution number above. In this case, your routing number would be 000234272 for electronic transfers and 34272-002 for paper ones.

What is a routing number used for?

A bank routing number is used to identify the specific bank and branch that your account is associated with. It's used to help process various transactions and is required for the following:

- Setting up a digital wallet

- Setting up direct deposits

- Arranging pre-authorized debits

- Making transfers between bank accounts

- Sending wire transfers

- Authorizing bill payments

The format of a bank routing number

A bank's routing number will always contain the transit and institution numbers. However, the number may be ordered differently on a paper transaction vs. an electronic one.

Here’s how the numbers will appear:

- Paper transaction routing number: YYYYY-XXX

- Electronic transfer routing number: 0XXXYYYYY

XXX represents the institution number and YYYYY represents the transit number.

Bank routing number vs. transit number vs. account number

Routing, transit, and account numbers all have separate jobs in identifying and facilitating the flow of your money.

Here’s a breakdown of these three types of banking numbers:

| Number | Use | Number of digits |

|---|---|---|

| Institution number | * Identifies your bank | 3 digits |

| Account number | * Identifies your specific account | 7 - 12 digits (varies based on bank) |

| Transit number | * Identifies the branch where your account was initially opened * Used alongside your account number to distinguish or determine your specific account | 5 digits |

| Routing number | * Combines institution and transit number to identify your account to set up transactions | 8 - 9 digits (varies based on type of transaction) |

FAQ

What is a bank routing number?

A bank routing number is an 8- or 9-digit numeric code created by combining your bank's 5-digit transit number and 3-digit institution number. This information is used to identify your banking institution during certain types of financial transactions.

What is a routing number in Canada TD?

TD routing numbers combine the account owner’s home branch (aka transit) number and TD’s institution number, which is 004. Your 5-digit branch number is specific to the location where you first opened your account.

What is the RBC routing number?

The RBC routing number is a combination of RBC’s institution number (003) and a 5-digit branch number. US customers of RBC may need RBC’s transit routing number, which is 063216608.

How do I find my routing number on my debit card?

Your ATM debit card does not contain any routing number information. Check your bank statements, cheques, or online portal to find your routing number.

Do routing numbers ever change?

It's rare for a bank to change its routing number, but you'll be notified ahead of time if it does. You'll need to update your direct deposits with the new number, and you may need to order more cheques.

Can I get my routing number from my local bank?

Yes, if you speak to a bank representative in person or over the phone, they'll give you the routing number. You can also log into your online banking account and find this number along with other related information.

Can you tell me how to find a routing number without a cheque?

If you don't have a cheque handy, you can log into your online banking platform to find this information. It can be found along with other account identification information as well as on forms used to set up direct deposits.

Do direct deposits need your routing number?

Yes, the direct deposit process uses your routing number and you'll find this number on any direct deposit forms. The number's format is distinct, appearing as 0YYYXXXX, where X is the transit number and Y is the institution number.

What is an ABA number in Canada?

In Canada, an ABA number is called a bank routing number. In the United States, bank routing numbers are also referred to as American Bankers' Association (ABA) numbers or Automatic Clearing House (ACH) numbers.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments