A notice of assessment (NOA) is an acknowledgement from the CRA that they've received and reviewed your tax return. You can access your NOA through your CRA My Account or by phone.

You’ll receive your NOA shortly after filing your tax return. It'll confirm how much you owe – or are owed – and contains other useful information, like when your tax payment is due, your RRSP deduction limit, and more.

Your NOA will also indicate if you’re required to undergo an audit, and it will outline the process of how to contact the CRA if you want to make an objection.

Key Takeaways

- A notice of assessment is provided to you by the CRA after you file your taxes.

- It includes how much you owe or will be refunded, and when.

- You can access your NOA through your CRA My Account or over the phone.

- It's common for the CRA to make changes to your NOA, but you can contact them with any disputes or concerns you may have.

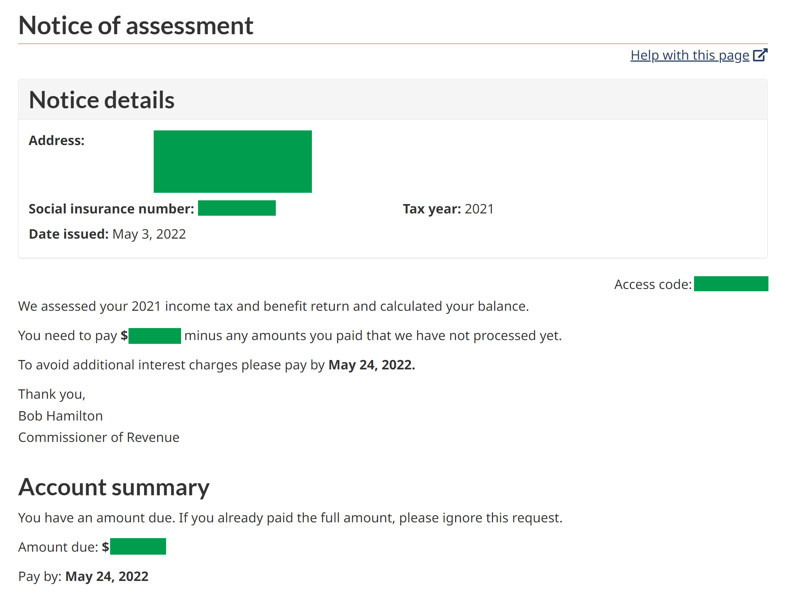

What's on a notice of assessment?

Your notice of assessment is a summary of your tax return. It includes how much you can expect to receive as a tax refund or what you owe in taxes.

It also contains other details, such as the following information:

- NETFILE access code (you’ll need this for your tax return software)

- Payment date deadline to avoid interest charges

- Tax assessment summary, including income, credits, and deductions

- Any changes or corrections that the CRA made on your return

- RRSP deduction limit statement

- Home Buyer's Plan statement

- Lifelong Learning Plan statement

How to get your notice of assessment

The easiest way to find your notice of assessment is by signing in to your CRA My Account on the CRA’s website or mobile app.

To sign in, use one of these options:

- Sign in through a partner: This includes many major Canadian banks, so you can usually sign in via your existing online bank account.

- Sign in through a CRA user ID: If you don’t have one, you can create it.

- Sign in through your province: This may not be available in all areas.

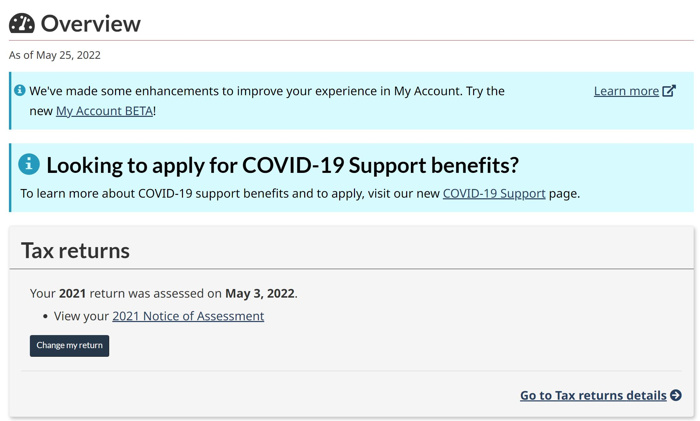

Once signed in, you'll be taken to the overview of your account, which includes many helpful links and information (like your TFSA and RRSP contribution room).

At the top of your account overview, you’ll see a grey box titled "Tax returns" (you can also find it in the left side menu). In this box, you’ll see links to your current NOA, along with your NOAs from the previous 3 years. Select the desired NOA to see the full notice details.

If you use the CRA mobile app, you can access any NOAs and reassessments you received after February 9, 2015.

Getting an Express NOA

If you have a CRA MyAccount and you file your taxes using NETFILE-certified software, you can view your Express NOA as soon as your tax return has been processed by the CRA.

Getting your notice of assessment through the mail

If you don't have electronic delivery of your NOA set up, the CRA will likely send your notice of assessment to your physical mailing address.

Getting your notice of assessment via phone

Another option is to get a copy of your NOA by phone. To do so, call the number relevant to your situation between 8 am and 8 pm Eastern during the week (9 am to 5 pm on Saturdays):

- Most cases: 1-800-959-8281

- In the territories: 1-866-426-1527

- Outside of Canada and the US: 613-940-8495

Before you call, make sure you have the following information on hand so it goes smoothly:

- Social insurance number

- Full name and birth date

- Mailing address

- Previously assessed return or NOA, if you have one

What to do if you notice errors on your NOA

If you find an error on your NOA, contact the CRA within 90 days of receiving it. The CRA is required to make the necessary changes and update your NOA accordingly.

It’s fairly common for the CRA to make changes to your NOA. For instance, they may update your income amount or any credit or deduction amounts you claimed. These updates are usually made to ensure the information on your tax return is correct, but you can file a dispute if you believe their changes aren't accurate.

You can find the contact information for the proper CRA department here: Contact the Canada Revenue Agency. You'll likely have to provide supporting documentation regarding your dispute, so be sure to have that on hand when you reach out to them.

FAQ

What does notice of assessment mean?

Your NOA is a financial summary the CRA sends after reviewing and evaluating your tax return. It includes details like the amount you owe/are owed, payment dates, and a final tax assessment breakdown of your income, credits, and deductions.

How do I get a notice of assessment?

You can access your notice of assessment by signing into your CRA My Account or by requesting a copy over the phone. Once logged in, it should be the first thing you see on your overview page.

How long after receiving a notice of assessment do you get a refund?

Typically, you’ll receive your refund at about the same time that you get your NOA. The CRA aims to have your refund processed within 2 weeks of filing your taxes online, or within 8 weeks for paper returns.

What is the NETFILE access code?

On your notice of assessment, you’ll find an 8-character NETFILE access code that can be entered when you NETFILE your return using tax software (but isn't mandatory). It allows the CRA to confirm your identity using information from your return.

Can I make changes to my return?

Yes, you can request changes to your return, but only after you’ve received your notice of assessment. After you’ve submitted your adjustment request and the CRA has reviewed it, you may receive another NOA, if applicable.

Leave a comment

Comments