A bank draft is one of the most secure payment methods offered by a bank. You typically get a bank draft when you want to transfer a large amount of money to someone, like when you’re purchasing real estate or a vehicle.

With a bank draft, the financial institution withdraws the funds from your account and holds it until your recipient comes to the bank with the form and ID, then they receive the funds. We’ll walk you through the details and show you how much you can expect to pay the next time you need a bank draft.

Key Takeaways

- A bank draft is a guaranteed form of payment by an issuing financial institution, typically used for particularly large purchases.

- It usually takes 24 hours for a bank draft to clear, but could take up to 4 days.

- Once the payment has been deposited, the bank draft can’t be cancelled or reversed.

- Alternatives to bank drafts include certified cheques, money orders, and Interac e-Transfers.

How a bank draft works in Canada

A bank draft is a secure form of payment guaranteed by a financial institution. It looks and feels similar to a cheque or money order.

Here is how a bank draft works:

- Request a bank draft from your bank (usually for a fee)

- Your bank transfers the funds from your account to its own reserve account

- You'll receive a physical bank draft slip

- It's your responsibility to give the draft to the intended recipient

- Only the intended recipient can cash the bank draft

Bank drafts are used mostly for large purchases or to guarantee payment between buyer and seller.

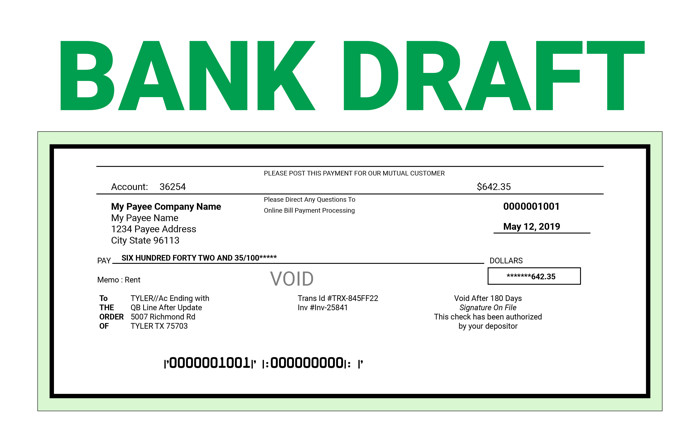

Each bank has its unique design for its bank drafts – here is an example of what your bank draft may look like:

How much does a bank draft cost?

Generally, a bank draft in Canada costs an average of $9.21 per draft. Prices vary by bank, ranging from roughly $7 to $10.

Some premium bank accounts include bank drafts for free or at a discounted rate – like the RBC VIP Banking and BMO Premium Chequing Account.

Bank draft fee by bank

Each bank has its own set price for bank drafts, starting at $7.50 and going as high as $10.

These are the fees from some popular Canadian banks:

| Bank | Draft fee |

|---|---|

| BMO | $7.50 |

| CIBC | $9.95 |

| Desjardins | $9.50 |

| Laurentian Bank | $8.50 |

| Meridian Credit Union | $10 |

| National Bank | $9.00 |

| RBC | $9.95 |

| Scotiabank | $9.50 |

| TD | $9.95 |

| Simplii | $7.50 |

| Tangerine | $10 |

These institutions don't provide bank drafts (or only provide drafts in foreign currencies):

- Alterna Savings

- Coast Capital Savings

- EQ Bank

- Innovation Credit Union

- KOHO

- Manulife

- Neo Financial

- Vancity

When to use a bank draft

Bank drafts are usually required when you're making a particularly large payment and the recipient requires assurance that you have sufficient funds to cover the transaction. There are several other reasons why you might need to use a bank draft as opposed to another form of payment.

Here are a few example situations that could require using a bank draft:

- Buying a car

- Purchasing real estate (making the down payment)

- Paying the security deposit on an apartment or rental property

- Making tuition payments

- Paying a legal settlement

- Making big purchases from overseas (boats, jewelry, etc.)

How to get a bank draft

Requesting and acquiring a bank draft is usually pretty simple – you head to your local bank branch and request one.

Here's a rundown of this process:

1. You visit your bank and request a bank draft for a specified amount and recipient.

2. The bank representative checks to make sure you have sufficient funds to cover the draft. The funds are then moved into a reserve account and held there until the bank draft is cashed.

3. The representative issues you the paper slip that is the bank draft and charges you any applicable bank fees, which you pay.

4. You take the bank draft and present it to the intended recipient.

5. The recipient deposits the bank draft into their account, either at a bank machine, with a teller, or via online banking.

6. After a period of one to four business days, the bank draft clears and the funds are available for the recipient to do with as they wish.

While most of us are used to completing much of our financial transactions online, this is one that often must be done in person, presumably because a bank representative needs to verify your identity. And, of course, this is much more safely and easily done if you're right there on the premises.

Exceptions are sometimes made for businesses, though. Email or fax requests for bank drafts from businesses are fulfilled at some banking institutions. You'll also be able to get one from an online bank by using your banking portal, though it'll need to be couriered to you (some allow you to transfer the funds to a bank of your choosing to get it faster).

How long does it take a bank draft to clear?

A bank draft from a Canadian bank or financial institution will usually clear in 24 hours. In some cases, it could take up to 4 business days.

An international bank draft may take up to 30 days to clear.

How to cancel a bank draft

It's nearly impossible to cancel a bank draft. The funds have already been withdrawn from your account and transferred to a reserve account, so technically, the transaction has already happened.

There may be some leeway if the recipient hasn't cashed the draft yet. In this case, the bank can cancel it and refund the amount to your account.

You can replace a bank draft, but this could require a Bond of Indemnity – a written statement declaring that one party will reimburse the other for a loss that occurred due to a specific event.

Once a bank draft has been cashed, it's too late to cancel it.

Bank draft pros and cons

As with pretty much all financial products and tools, there are pros and cons to using a bank draft. It isn't always the solution you're looking for, but there are certainly some interesting benefits.

Here's an overview of the main benefits and drawbacks of bank drafts:

| Pros | Cons |

|---|---|

|

|

Paying by bank draft can be annoying, and the inability to cancel can be nerve-wracking. But the convenience of using multiple currencies and not having a dollar limit at all? These factors can make it worth the risk, depending on the situation.

Bank draft alternatives

Sometimes a bank draft's cons can outweigh the benefits and you'll need an alternative payment method – cheques are the most obvious choice, but not always the best.

Consider this table of other money transfer options and see how they stack up when compared to a bank draft:

| Alternative | Similarities | Differences | Usage examples |

|---|---|---|---|

| Certified cheque | * Guaranteed by the bank * Available in large amounts * A fee is charged * Can move large sums of money * Payment can't be stopped | * Issued by the payer, not the bank * Funds are put on hold, not withdrawn * Can take a bit longer to obtain | * Buying a used car * Making payments to collections agencies |

| Money order | * Guaranteed by the issuing institution * A fee is charged * Can move large sums of money * Risk of fraud | * Available from Canada Post as well as financial institutions * Only available up to $999.99 * Usually paid for in cash, so doesn't require a bank account * Can be refunded if uncashed * Usually available in limited currencies | * Sending a payment through the mail * You don't have a bank account |

| Interac e-Transfer | * A fee is charged * Can move large and small sums of money | * Sends funds instantly * No need to go to the bank * Amount is restricted to a daily and weekly limit | * Splitting a bill with other people * Sending money as a gift |

| Wire transfer | * Very secure * A fee is charged * Can move large sums of money * Must be done at a bank branch* Can't be reversed | * Transfers funds from one account to another (which makes it more secure) * You need to provide the recipient's banking info* Much higher fees | * Sending money to someone in another country * Sending large sums of money quickly |

| Cash | * No fees involved * No wait times * Anonymity * Inclusive and accessible for underbanked individuals | * Security risks * No proof of payment * Complicated and impractical for large sums * Risk of receiving counterfeits | * Avoiding credit card use and overspending * Keeping the transaction anonymous |

FAQ

What is a bank draft?

A bank draft is a payment method that’s guaranteed by the bank. They’re also called banker’s drafts or teller’s cheques, and they’re typically made out to a third party that must show ID in order to cash them.

How does a bank draft work?

Head to your bank and complete a bank draft form with the amount you’d like to transfer and the recipient’s details. The bank pulls the funds and you give the bank draft to the recipient. They go to the bank and show ID to receive the funds.

Is a bank draft the same as a cashier's cheque?

They’re very similar, but a cashier’s cheque shows the bank or financial institution as the payer, so your personal information is not on the cheque at all (as it is with a bank draft). Both are used for large purchase transactions.

What is the difference between a cheque and a bank draft?

With a bank draft, the funds are immediately transferred from your bank account to a holding account until the recipient withdraws them, unlike with a cheque, when funds are only withdrawn when the cheque is cashed.

What are the disadvantages of a bank draft?

Bank drafts can only be cashed by the person who is named on the draft, so you can’t have your spouse cash it for you. Plus, you’ll have to provide ID in order to receive the funds.

How safe is a bank draft in Canada?

If you want one of the most secure payment methods, a bank draft is for you, as the funds are directly debited from your bank account. Recipients will appreciate the fact that the funds are guaranteed.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments