While it may seem simple, there are some little quirks to consider to truly understand Canadian cheques. This article explains how to read a cheque in detail.

Discover how to identify key cheque details, interpret bank codes and personal information, and safeguard your cheques from fraud.

Key Takeaways

- A Canadian cheque features the issuer’s name, address, and banking information.

- Canadian cheques cannot be cashed before the date indicated on the cheque.

- The amount a cheque is issued for is noted in both written and numeric form to avoid confusion.

- A cheque’s most important security feature is your signature.

How to read the main parts of a cheque

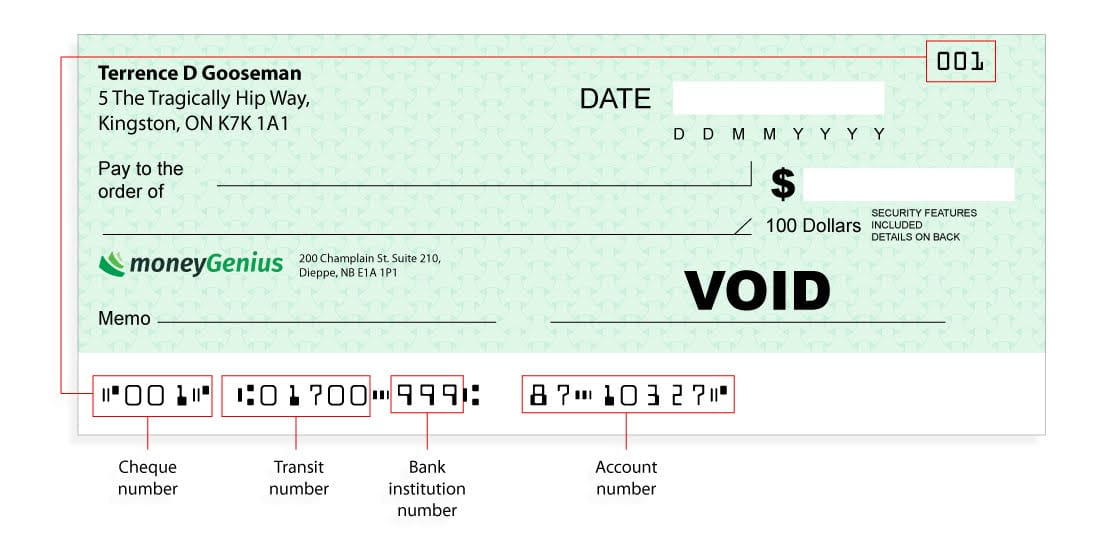

A Canadian cheque is made up of two main sections – the personal information and date section and the banking information section.

The personal and date section is located in the cheque’s top portion and includes the following information:

- The issuer’s full legal name and address

- The legal names of all account holders if from a joint account

- The date (in the top right-hand corner)

- Phone numbers and/or email addresses can be added

The banking section sits in the center of the cheque and extends towards the bottom. It includes the following:

- Amount line

- Amount box

- The sender's bank name and address

- Signature line

- Memo line

- Cheque number

- Bank transit number

- Institution number

- Bank account number

How to read bank information on a cheque

A typical Canadian cheque includes the following:

- Cheque number

- Transit number

- Institution number

- Account number

- Routing number

Cheque number

When you receive a book of cheques from your bank, they will be numbered sequentially, starting with “001.” This number appears in the bottom left corner of the cheque (and sometimes at the top right).

When you receive a new chequebook, you should flip through to ensure the cheques are numbered correctly.

If using temporary or starter cheques, you'll need to write in the cheque number and all other information yourself.

Transit number

The transit number is a five-digit number immediately following the cheque number. It's used to identify the bank branch where you opened the account.

No matter which branch you bank at, the transit number will not change.

Bank institution number

The bank institution number is the three-digit number immediately following the transit number. It refers to the bank that issued the cheque.

Just like the transit number, this number will not change.

Each banking institution in Canada has an institution number or code. Here are some of the most common codes in Canada:

| Banking institution | Institution number |

|---|---|

| BMO | 001 |

| Scotiabank | 002 |

| RBC | 003 |

| TD Bank | 004 |

| National Bank | 006 |

| CIBC | 010 |

| Canadian Western Bank | 030 |

| EQ Bank | 623 |

| Vancity | 809 |

| Meridian | 837 |

Account number

Your account number is between 7 to 12 digits long and identifies the specific bank account the cheque draws funds from. The account number is listed to the right of the institution number.

Routing number

Your cheque’s routing number consists of 8 digits – your cheque’s transit number and institution number combined.

The routing number is used to identify the institution and branch the funds are coming from or going to, such as for automatic payments or direct deposit.

How to read personal information on a cheque

You'll find personal information and the cheque’s date at the top of the cheque.

Name

The cheque issuer’s full legal name sits in the top left-hand corner of the cheque. If the cheque is issued from a joint chequing account, all the account holders’ names will be listed on the cheque.

If desired, the account holder's phone number and email address can be included here as well.

Address

The issuer’s full address is located under the issuer’s legal name in the top left-hand corner of the cheque.

Date

A cheque’s date is located at the top right of the cheque – a cheque cannot be cashed or deposited before this date.

You can post-date a cheque or a series of cheques, which means indicating a future date for when the cheque can be cashed.

For example, your landlord might require post-dated cheques for a year’s worth of rent. If the cheque is dated the first of each month, your landlord cannot deposit those cheques until the date indicated on the cheque.

A stale-dated cheque is one that still hasn't been cashed six months after the indicated date. If you don't cash a cheque before the six-month mark, you'll likely have to ask the issuer to write another one.

A certified cheque, or a cheque issued by the Government of Canada, are the exceptions to the 6-month rule – they can still be cashed after the 6-month mark.

Other information to consider when reading a cheque

A cheque is issued to a payee, or the person receiving the cheque, with the amount the cheque is worth written in two spots in the center of the cheque – the amount box and the amount line.

The signature line, at the bottom right of a cheque, is a cheque’s most important security feature. The memo line can note the cheque’s purpose, but it is not mandatory to fill it out.

- Payee: The recipient’s full name goes on this line. If the payee line is left blank or made out to "cash" and the cheque is signed, the cheque can be cashed by anyone.

- Amount box: Written in numeric form, this box indicates the amount of money to be transferred from the payer’s bank account to the recipient. The cheque’s total amount should include a dollar sign, followed by the numerical amount, and a decimal point with the amount of cents. If the cheque is for an even amount (e.g. $100), add a decimal point and “00” to ensure no one can add more zeros to the cheque’s value.

- Amount line: This confirms the amount listed in the amount box, but in written form. Spell out the dollar amount, followed by the number of cents over 100. Add a dash to the end of the amount line to prevent more zeros from being added to the original amount.

- Memo: The memo line is optional and can indicate the cheque’s purpose. For example, “January rent.”

- Signature: Your signature authorizes the recipient to deposit the cheque and transfer the specified funds into their account. Make sure your signature is consistent, written in cursive and not printed, to avoid forgery. You cannot deposit a cheque that doesn't include the payee's signature.

How to read the back of a cheque

You'll find an endorsement line on the back of each cheque. If you receive a cheque and you want to give it to a third party, sign the back to endorse it before handing it over.

If there isn't a specified endorsement line, simply write “pay to the order of” on the back of the cheque and include the new recipient’s legal name. Then sign the back of the cheque.

Cheque safety tips

Follow these steps to keep your cheques (and your bank account) safe, including writing out cheques in ink, using all the space allotted to you on a cheque, and keeping track of cheques you issue.

- Permanent ink: Write your cheques in permanent ink, not pencil. A recipient could erase or change the amount the cheque is made out for if it is not written in permanent ink.

- Use the entire amount box and line: Fill in the entire amount box with the numeral amount of the cheque, followed by a dash extending to the edge of the amount box. This will prevent anyone from altering the numerical value of the cheque. Do the same with the amount line – spell out the amount the cheque is valued at before drawing a line to the edge of the amount line.

- Balance your chequebook: Keep track of all cheques you issue by recording their value in your chequebook, including the payee, date, and amount issued for each one. Ask your bank for a chequebook that includes carbon copies to ensure you have a physical record of each cheque issued.

- Void unused cheques: If you have cheques you know won’t be used, write “VOID” in large letters across the front of the cheque. This will ensure the cheque cannot be used improperly or forged.

- Keep your signature unique: Do not print your signature. Write it out in cursive and make sure it's unique and difficult to forge.

- Sign a cheque only when ready: Signing a cheque authorizes the recipient to withdraw the specified amount from your bank account, so only sign a cheque when you are ready for those funds to be drawn.

FAQ

How do you read a cheque in Canada?

Look for these key details on a Canadian cheque: the date (top right), the payee name after "pay to the order of," the amount written twice (in numbers and words—verify they match), and the account holder's signature at the bottom right.

The numbers at the bottom of a cheque identify key banking information. Read them left to right: the first three digits show the cheque number, the next five show the transit/branch number, the following three show the institution number, and the final 7-12 digits show the account number.

Are there special features on Canadian cheques?

Canadian and American cheques differ in a few ways. Canadian cheques always list bottom numbers in this order: cheque number, transit/branch number, institution number, then account number. American cheques vary by bank. Canadian cheque numbers use three digits (American use four). Canada also honors post-dated cheques—recipients must wait until the specified date to cash them. American banks may process them immediately.

How do you read a TD cheque?

TD cheques are similar to other Canadian cheques, but they have one major difference. At the bottom of the cheque, the first three digits you’ll find are the cheque number. The next five digits are the transit/branch number. The following three digits are the financial institution number. Rather than going straight to the account number, the next four digits are the designation number. Finally, the last 7 to 12 digits are the account number.

What do cheque numbers mean?

The numbers at the bottom of a cheque all identify important information. The first three digits, the cheque number itself, are used to identify the specific cheque. The next five digits, the branch/transit number, are used to determine the specific branch. The following three digits, the institution number, are used to identify the institution through which the cheque is being issued. Finally, the last set of digits, which can be between 7 to 12 digits long, is the account number, used to determine the account through which the cheque is being issued.

How do I fill in a cheque in Canada?

First, write the earliest date you wish the cheque to be cashed in the top right corner. On the line next to where it says “pay to the order of”, you should write the name of the person or institution to whom you are giving the cheque. Next, you need to fill out the cheque amount twice: once in numbers and again in words. Make sure these amounts match. Finally, you need to sign your name on the line at the bottom right of the cheque.

Does the cheque number matter?

While a cheque number is not crucial for processing a cheque, it still matters. Because each cheque number is unique, it helps you track your payments. This can help confirm that the correct amount was cashed. It can also be useful when dealing with issues like fraud or double payments.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments