The main difference between RSP vs. RRSP accounts is that a Retirement Savings Plan (RSP) is a catch-all term for accounts you use to save for retirement, whereas a Registered Retirement Savings Plan (RRSP) is a specific example of those accounts, which is registered with the government and has specific tax benefits and contribution limits.

But some people also use the RSP acronym interchangeably between Registered Savings Plans and Retirement Savings Plans – blurring the difference a bit more.

Here’s everything you need to know so you can clear your understanding of the difference between RSPs and RRSPs.

The difference between RSP vs. RRSP

The difference between an RSP and RRSP is as follows:

- A Retirement Savings Plan (RSP) can be any account or plan you put in place to save for retirement, which can include an RRSP or just a normal savings account.

- A Registered Savings Plan (RSP) refers to any account that is registered with the government for tax purposes, including a TFSA or RRSP.

- A Registered Retirement Savings Plan (RRSP) is a specific government account that allows you to defer taxes until later and take advantage of tax deductions now.

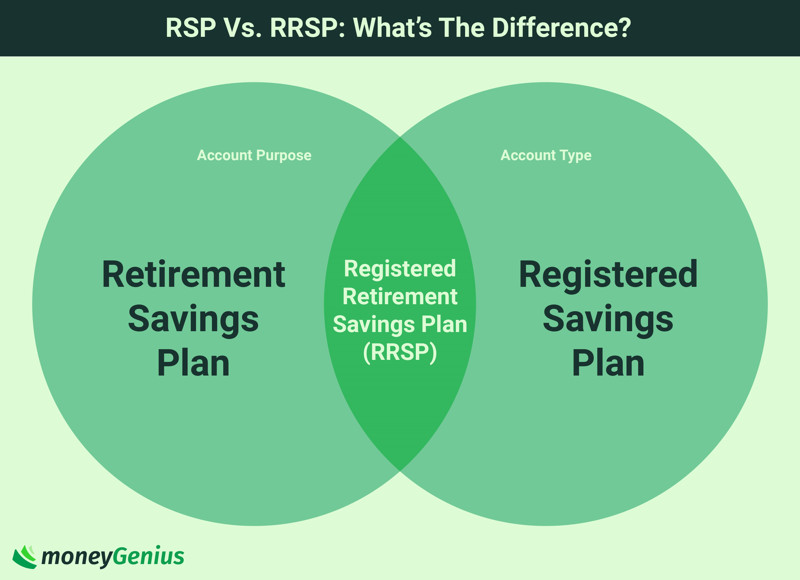

These definitions are so similar that it can be easy to get them confused, so try to visualize the differences in a venn diagram:

With these meanings in mind, it can be easier to see that an RSP can refer to a number of different account types that have retirement savings as their main goal.

An RRSP is an example of one of those types, but it’s far from the only one. In short, all RRSPs are an RSP, but not all RSPs are an RRSP.

What is a Retirement Savings Plan (RSP)?

A Retirement Savings Plan is an umbrella term that refers to an account or set of accounts that you use to save for retirement. It can involve a collection of different types of investment accounts. For example, you could have:

- an RRSP to take advantage of tax deductions,

- a TFSA to have tax sheltered growth, and

- a non-registered account for easier liquidity and for contributions over your limits.

Within each of these account types can be a number of investment vehicles, like stocks, ETFs, mutual funds, index funds, and more. Since you’re planning for your retirement, you want to cover a lot of ground by choosing long-term, well diversified investments.

What is a Registered Savings Plan (RSP)?

A Registered Savings Plan refers to a set of specific accounts that are registered with the Canada Revenue Agency (CRA) for tax purposes. These don’t have to be specific to retirement, but many of them are.

Here’s an overview of the main types of accounts:

| Plan | Special features | Contributions tax deductible? | Contribution limits (2022 tax year) |

|---|---|---|---|

| Registered Retirement Savings Plan (RRSP) | * Contributions are tax deductible * Your money grows tax free until withdrawal | Yes | Up to 18% of your income or $29,210 |

| Tax Free Savings Account (TFSA) | * Contributions grow tax free * No early withdrawal penalty | No | $6,000 |

| Registered Pension Plan (RPP) | * Set up by your employer | Yes | Cuts into RRSP limits |

| Registered Retirement Income Fund (RRIF) | * Used to receive payments from your RRSP during retirement years | N/A | N/A |

| Registered Education Savings Plan (RESP) | * Lets you save for your child’s education, including government-matched contributions | No | $50,000 lifetime limit per person |

| Registered Disability Savings Plan (RDSP) | * Lets you save money for someone with a disability * Eligible for government grants | No | $200,000 lifetime limit per person |

You can learn more about different plans on the government’s Registered savings plans page.

What is a Registered Retirement Savings Plan (RRSP)?

An RRSP is a type of retirement savings plan that’s registered with the government. You have to work within yearly contribution limits, but your contributions are tax deductible and grow tax-sheltered within the account.

When you do withdraw the funds during your retirement, they’ll be taxed as income. But it’ll most likely be less since you’re now in a lower tax bracket than during your working years.

Here’s a bit more detail about RRSPs that you should know.

RRSP tax benefits

There are a few tax benefits involved with having an RRSP.

First, your RRSP contributions are also tax deductions, letting you reduce how much income tax you have to pay for every year you contribute. Every year, you’ll get a contribution receipt from the financial institution you have your RRSP set up with, and you’ll have to claim that amount on your tax return.

Second, anything you make on your savings and investments in an RRSP is tax-sheltered, meaning you won’t pay taxes on them until they’re withdrawn.

Sound pretty good? If you want to get started on some tax savings, opening an RRSP account with Wealthsimple makes it pretty much as easy as it can get (plus you could get 25). Learn more here:

Wealthsimple managed investing is a robo advising investment platform from one of Canada's favourite online brokerages, Wealthsimple. It offers a hands-off investment experience with no paperwork and no account minimums – a huge draw for anyone who's new to the world of investing or simply trying to make smart choices with minimal funds.

- Easy to understand fees

- The set-and-forget-it simplicity

- A good array of account types that can grow with you

- Extraordinary security for your money and accounts

- Grow into Wealthsimple Premium

- Socially responsible and Halal investment options available

- New user offer

- Higher account management fees

- Limited tools

- Talking to a human can be tricky

- Provides socially responsible and Halal investment options

- Can connect your account to Mint for easy budgeting

- Get a dedicated team of advisors if you have more than $500,000 in assets

- RRSP

- TFSA

- Personal

- RESP

- RRIF

- LIRA

- Joint

- Business

- FHSA

RRSP contribution limits

Of course, there are limits to how much you can contribute each year, but the good news is they carry over if you don’t use them up.

RRSP contribution limits are based on 2 possible values. The one that applies for you is whichever is less:

- 18% of your total pre-tax income, or

- the CRA limit ($29,210 for 2022).

In other words, unless your income is over $162,277, your contribution room is 18% of what you make. The easiest place to find these limits is on last year’s notice of assessment.

Also, take note that these amounts get reduced if you have a pension plan through your employer, as a way to level the playing field.

But be wary of overcontributing, as any contributions you make over this limit will be met with a 1% fee per month until they’re withdrawn. See Excess Contributions for more information.

Withdrawing from your RRSP

All of the above sounds pretty good, but there are some downsides once it comes time to withdraw funds.

First of all, since your RRSP is meant to be used to save up for retirement, you’ll be hit with withholding taxes if you withdraw early. This is why some people aren’t as keen to contribute, especially earlier in life – retirement seems so far away, but potential financial disasters don’t.

Exceptions for the RRSP withdrawal rules are only made for 2 reasons, and these are when you take advantage of one of these programs:

- First Time Home Buyers Plan: For those purchasing their first home.

- Lifelong Learning Plan: For pursuing continued education.

But once you hit retirement, your withdrawals must be declared as part of your income – which means you might end up paying more in income taxes for those years. It’s one of those “feels good now but bad later” situations.

One more thing to keep in mind – your RRSP has to be converted to an RRIF once you turn 71 and you’ll be forced to make withdrawals.

Want to learn more about the withdrawal rules? Check out our article on the particulars of withdrawing from your RRSP here.

So is an RSP or RRSP best for you right now?

Although it’s usually recommended to begin with an RRSP and take advantage of the tax deductions, only you can decide which retirement savings option is best for your needs and goals.

Contribution limits can make it tricky to stick to just one account, too, so it’s possible you’ll make use of all the ones we’ve mentioned at one point or another.

So what about you? Do you already have a retirement account or 2 set up? Which ones are you using?

If you don’t already have some type of RSP, has the information here helped clarify which type of account you’d like to open for the future?

Let us know in the comments below.

FAQ

What is an RSP?

An RSP can be either a Retirement Savings Plan or Registered Savings Plan. The latter refers more generally to accounts that you use to save for retirement, whereas the former refers to specific accounts that are registered with the government and/or CRA for tax purposes and other benefits.

How do RRSPs work?

A Registered Retirement Savings Plan (RRSP) is a specialized savings account that’s typically used to save for retirement. Account holders aren’t required to pay taxes on the funds in this account until it’s time to withdraw. For these and other tax-related reasons, it’s a popular choice for retirement planning.

What’s the difference between an RRSP and an RSP?

An RSP is a more general term that includes any type of savings with retirement as its main goal. An RRSP is one of the most common types of accounts included in an RSP, since it has some pretty helpful tax benefits. You can see these accounts compared here.

What are the contribution limits for RRSPs and TFSAs?

For RRSPs, the limit is either up to 18% of your income or $29,210 for 2022 (whichever number is lower). And for TFSAs, the limit is $6,000 for 2022.

How does tax affect my RRSP contributions?

RRSPs work on a deferred-tax structure. This means you take your contributions as tax deductions every year, so you don’t pay taxes on what was contributed that year. When it comes time to withdraw from your RRSP, you must declare your payments as income – so you’ll have to pay income taxes on them that year. Because your tax bracket is likely to be lower in retirement than during your working years, this should still save you money. All earnings made with your RRSP are tax-sheltered until you withdraw them.

How does tax affect my TFSA contributions?

TFSAs contributions are made with after-tax dollars. This is because you can’t use them as deductions on your tax return, unlike your RRSP contributions. The up-side is you won’t have to pay taxes on your contributions when it comes time to withdraw, since you already paid taxes on the year you made the contributions. All earnings within your TFSA are tax-sheltered, but become taxable if you were to withdraw them from your TFSA and re-invest elsewhere.

Leave a comment

Comments