To write a cheque, fill in the date, write the payee's name, write out the amount of the cheque numerically and in words, sign it, and fill out the memo section, if needed.

If it's been a while since you've filled out a cheque or if you've never used one, we’ll walk you through the necessary steps. You’ll also find some safety tips for paying with cheques, and a list of chequing accounts where you can get a free chequebook.

Key Takeaways

- A cheque has several fields to fill out: date, recipient, amount (in numbers and words), signature, and memo.

- Always write your cheques in pen using capital letters.

- Sign your cheques with the signature that your bank has on file.

- Cheques provide proof of payment but can take a while to process.

- Several chequing accounts include free cheques as a perk.

What is a cheque?

A cheque is a written, dated, and signed order to a financial institution to pay a specific amount to a designated recipient.

You’ll need a chequebook to write a cheque. Some chequing accounts will provide cheques for free, but some banks require you to order and pay for them ahead of time.

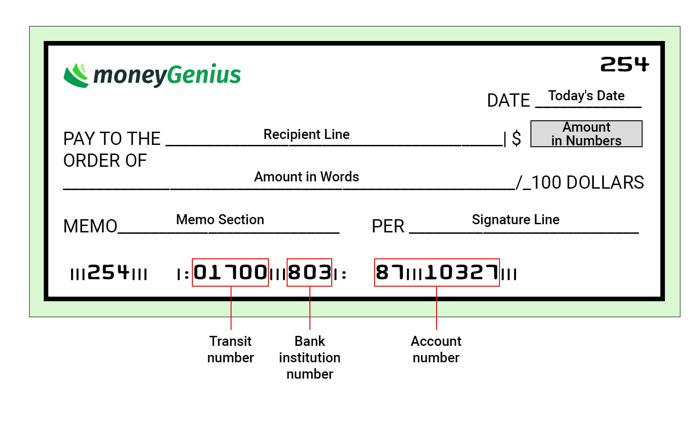

Before you start to fill in a cheque, make sure you know all the different parts of a cheque.

The image shows what a cheque typically looks like – each field is labelled according to its purpose.

- Today’s date: Write the current date (any format works)

- Recipient line: Write the full legal name of the recipient (person or company)

- Amount in words: Write out the full amount, like "One hundred twenty-two and 57/100"

- Amount in dollars: Write the amount in numerals, like 122.57

- Signature line: Sign your name

- Memo section: This section is optional, but you can use it to describe the transaction (to help remember in the future)

- Transit number: This number identifies your specific bank branch

- Bank institution number: This number identifies your general bank

- Account number: This number identifies your chequing account

At the top of the cheque is the name associated with your chequing account (yours!). Some cheques include your full address here, but it's not always included.

At the top right (and bottom left) of the cheque is the cheque number. Cheques are issued sequentially in a chequebook, so no two cheques have the same number.

How to write a cheque in Canada

The six steps involved in writing a cheque begin with filling in the date and end with entering info into the "notes" section.

Once you have your own chequebook in hand, you can follow these steps when filling one out:

Step 1: Fill in the current date on the cheque

The date tells the bank when the cheque can be cashed, so usually you'll fill it in with the current date.

Cheques can be cashed up to six months after the written date.

- For current date cheques: Use today’s date.

- For post-dated cheques: Use a future date. You might use a post-dated cheque to give a landlord 12 months of rent in advance, avoiding the hassle of monthly payments.

Step 2: Write the payee's name on their cheque

Neatly print the full legal name of the person or company on the "Pay to the order of" line.

Use the full name, with no acronyms or nicknames.

- My landlord

- Mr. Leonard

- Correct: Tony Leonard

If you’re writing a cheque to a company, use the full company name:

- BTS Rentals

- BTS Rental Management Company

Step 3: Write out the amount of the cheque in numbers

In the box with the dollar sign, write the amount in numbers:

- Use two decimal places (e.g., 1250.50)

- You can use a comma, but it's not necessary (1,250.50 or 1250.50)

- Don’t add an extra dollar sign (since the cheque already has one)

Step 4: Write out the amount in words

Write the amount in words on the line below the payee’s name.

- Start at the far left – don't leave gaps

- Use fractions for cents (e.g., 50/100)

- Draw a dash/line after you’ve written it all, to fill any space left over

Example:

If you're paying your rent of $1,250.50, you can write that in two ways, both are acceptable:

One thousand, two hundred and fifty dollars and 50/100

or

Twelve hundred and fifty dollars and 50/100

If the words and numbers don’t match, it's the written words that are legally binding.

Step 5: Sign the cheque with your personal signature

Use your official signature:

- Make it as legible as possible

- It must match the bank’s records

A cheque without a signature is invalid and can’t be processed.

Step 6: Fill in the memo section on the cheque (optional)

This section is handy for noting the purpose of the cheque, like:

- Rent payment for May

- Invoice #1234

While it isn't required that you fill in this section, the memo can help you and the payee keep records.

Example of writing a cheque

Imagine you’re paying a utility bill for BC Hydro, a company that accepts cheques by mail.

Amount owed: $102.42 by August 5th.

Here’s how you’d fill out the cheque:

- Today’s date: Write the current date

- Recipient line: Write "BC Hydro"

- Amount in words: Write "One hundred and two and 42/100"

- Amount in dollars: Write the number in the box, 102.42

- Signature line: Sign your name

- Memo section: Write your BC Hydro account number on the memo line, as requested by the company

Now, put your signed cheque into an envelope and mail it to the company.

Types of cheques

Choose the correct type of cheque for the situation:

| Type of cheque | Details |

|---|---|

| Personal cheque | * From your own chequebook, a book issued to you by your bank * Used to pay rent, give money as a gift, make purchases, etc. |

| Certified cheque | * From your own chequebook but written at the bank * Bank teller verifies the funds and certifies the cheque * Often required for high-dollar transactions * Used to pay contractors, make real estate down payments, etc. |

| Void cheque | * From your own chequebook * Write VOID in large letters across the front (without covering the numbers at the bottom) * Used to electronically link your bank account for direct deposits or bill payments |

| Cashier’s cheque | * Issued by your bank * Requires visiting a bank to obtain one * Bank holds the amount until the cheque is cashed * Often required for high-dollar transactions * Used for real estate down payments, purchasing a car, etc. |

How to write a void cheque

A void cheque is an official document that includes your account information but doesn't have value in and of itself.

Why you’d do it:

- To set up direct deposits from employers or other sources

- To set up automatic payment withdrawals for things like mortgage or loan payments

How to do it:

- Get a blank cheque

- Write the word VOID across the page so it’s unmistakably clear

How to write a cheque to cash

You don't always have to fill in the recipient line with an actual name. Instead, you can write "Cash" on that line, providing yourself or someone else with a simple method for withdrawing cash.

It can sometimes be faster or cheaper than digitally transferring funds.

Why you’d do it:

- You don't know the name or title of the payee

- You need access to cash, but don't have a debit card

How to do it:

- Get a blank cheque

- Write "cash" on the recipient line

- Fill out the rest as usual

This method does come with significant risks. If such a cheque is lost or stolen, someone else has easy access to your funds and your banking information.

It's highly recommended that you do not write cheques payable to cash.

How to write a post-dated cheque

A post-dated cheque is one written with a future date. Instead of using the date on which you're writing the cheque, you write the specific date when you want the cheque to be cashed, and the recipient isn't able to access funds until that day.

Why you’d do it:

- Make payments in advance (such as rent or other ongoing payments)

- The money isn't in your account yet, but will be shortly

How to do it:

- Write in the date you'd like the cheque to be cashed

- Fill out the rest as usual

If, somehow, someone manages to cash a post-dated cheque early, you can ask your bank or financial institution for help. As long as you request the help before the date written on the cheque, the bank can return the money to your account.

Or, if NSF fees were incurred, you can file a complaint with the bank and ask to be reimbursed.

Common errors when writing a cheque and how to fix them

If you make a big mistake when writing a cheque, you should void and shred it – don't use any type of correction fluid. Otherwise, take these steps to correct errors:

- Using a pencil or the wrong type of ink: This requires shredding the cheque and writing a new one. You can try erasing any pencil marks and rewriting, but this can get messy.

- Writing the incorrect date: Draw a neat line through the incorrect date, write the correct date, and add your initials to signify you authorized this change.

- Writing the wrong numerical amount: Draw a neat line through the numbers, write the correct amount, and add your initials to signify you authorized this change.

- Writing the wrong amount in words: You can cross it out, write the proper amount, and initial the change, but it's likely best to shred the cheque and start again.

8 tips for how to write a cheque safely and securely

Security is critical, whether you’re using a cheque, cash, credit card, or something else.

When using cheques, consider these tips to keep yourself and your money safe:

- 1. Always use a pen: Black or blue pen ink is preferable because they are the easiest to read. Ink cannot be erased or altered like pencil marks can, and unusual colours may trigger your bank's fraud protocols.

- 2. Write in all caps: Use capital letters for everything except your signature. Capital letters are more legible and more difficult to alter if a fraudster or thief gets hold of your cheque.

- 3. Don’t ever give out a blank cheque: Don’t give someone a blank cheque if you don’t know the name or proper spelling to use. A blank cheque gives unlimited access to your chequing account and provides an easy opportunity for criminals to rip you off. Only sign a cheque once you've identified and filled in the recipient's name and correct amount.

- 4. Use a consistent, legible signature: Consistent and legible signatures increase security since they help the bank validate your identity. Your signature should match what the bank has on file, so don’t create a new signature for your cheques.

- 5. Avoid blank spaces: Blank spaces on cheques provide opportunities for fraudsters to alter the document by adding numbers or adding a name to the recipient line. Be sure to write from one edge of the dollar amount box to the other edge, use dashes after writing the amount on the line, and/or simply draw horizontal lines on any line or in any box where you see blank space.

- 6. Record it in your register: Add the details of each cheque in your chequebook register to help you keep track. Note the cheque number, the date, the amount, and the payee. This can help you reconcile with bank statements if necessary.

- 7. Secure your chequebook: Store your chequebook in a safe place that can be locked and that is within your eyesight frequently. Only tell your most trusted people where it is kept. Do not leave it unattended, especially not in a vehicle.

- 8. Regularly review your account balance: While this isn't part of writing a cheque, it's important to know your balance in order to tell whether funds have been fraudulently withdrawn from your account.

Count the number of cheques left in the book regularly, and report any lost or stolen cheques as soon as possible to your bank.

How to order cheques

You can order cheques from your bank or from other third-party merchants.

How to order cheques by bank

For all of the big 6 banks, you can order cheques online or by phone.

Fees will vary depending on the design features you select, and some account types offer a certain number of free cheques.

| Bank | Cost for cheques | Where to order |

|---|---|---|

| TD | $0 - $50 | Order cheques |

| Scotiabank | $0 - $45.95 for 50 cheques | Order cheques |

| BMO | $0 - $60 for 50 cheques (varies by style) | Order cheques |

| RBC | $0 for the first book, then varies by style | Order cheques |

| National Bank | Varies by style | Order cheques |

| CIBC | $0 - $56 for 50 cheques | Order cheques |

| Tangerine | $0 for the first book, then $50 | Order cheques |

| Simplii | $0 | Order cheques |

| EQ Bank | Does not offer cheques | N/A |

Here’s how to do it through your online banking platform:

- Log into your online account via mobile device or desktop

- Look for something like "My Accounts," “Account Services,” or “Manage My Accounts”

- Find the "Order Cheques" option

- Select your options, like design and number of cheques

- Pay the fee

You can also order by phone if you call your bank’s helpline. The bank may need to verify your identity before you can order, especially if it’s your first time ordering a chequebook.

How to endorse a cheque

Endorsing a cheque, or signing it, is what you do when you receive a cheque from someone else. You have to endorse a cheque before you deposit it.

Here's how to do this:

- Flip the cheque over: On the back of the cheque, locate the area that says "Endorse here"

- Sign your name: Writing only in the endorsement area, sign your name in signature form

Make sure you don't make any marks in the section labelled, "Do not write, stamp, or sign below this line." This is where the bank will add its own stamps.

With a multiple-payee cheque written out to 2 people, you may need the other person to endorse it. If there is an "and" between the names (like “Jessy and Diego Bennett”), both people need to endorse it. If there is an “or” between the names (like “Jessy or Diego Bennett”), either party can endorse it and cash it solo.

That’s it! Now you can deposit the endorsed cheque at an ATM or via mobile deposit.

Extra security option: For extra security, you can do a secure endorsement by writing "For Deposit Only to Account Number XXXXXXXX" on the back.

Third-party endorsement: You can endorse a cheque to someone else, which means they can immediately turn around and cash it. To do this, endorse it on the back by writing "Pay to the order of [Name]" and sign it.

How to deposit a cheque

You can deposit cheques in person, at an ATM, via mail, or via mobile deposit with your smartphone.

- In person: Bring your endorsed cheque and your bank card to a branch

- At an ATM: Bring your endorsed cheque and your bank card to an ATM belonging to your bank

- Via mail: Endorse your cheque and write "For Deposit Only" on the back along with your account number, then mail it in a sealed envelope to your bank’s official address

- Mobile deposit: Open the app and log into your account, find the "Deposit Cheque" option, and follow the instructions regarding how to take photos of the front and back of the endorsed cheque

How to get free cheques in Canada

There are several bank accounts in Canada that provide a free chequebook or another means of accessing unlimited free cheques.

Here's a look at some of your best options:

| Bank account | Monthly fee | Free cheques option | Learn more |

|---|---|---|---|

| Simplii No Fee Chequing Account | $0 | All cheques are free | Learn more |

| Scotiabank Ultimate Package | $30.95 or $0 with minimum balance | 100 per year for free | Learn more |

| Tangerine Chequing Account | $0 | First book of 50 is free | Learn more |

FAQ

What is the most common mistake with writing a cheque?

The most common mistake is mismatching the written and numerical amounts. If the two don’t match, the written amount is legally binding. Other frequent errors include leaving blank spaces, forgetting the date, or using an incorrect payee name.

Who signs the back of a cheque?

The person or business receiving the cheque, called the payee, signs the back when depositing or cashing it. This signature, known as an endorsement, authorizes the bank to process the cheque and deposit the funds into their account.

What's the largest amount you can write a cheque for?

In Canada, there’s technically no legal limit to the amount you can write a cheque for. However, Payments Canada can't process a single cheque that's more than $25 million. Banks have per-cheque deposit limits too, so watch for those.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments