A Guaranteed Investment Certificate (GIC) is a low-risk investment where you deposit money and earn interest at a fixed or variable rate. It’s similar to the American CD, or Certificate of Deposit.

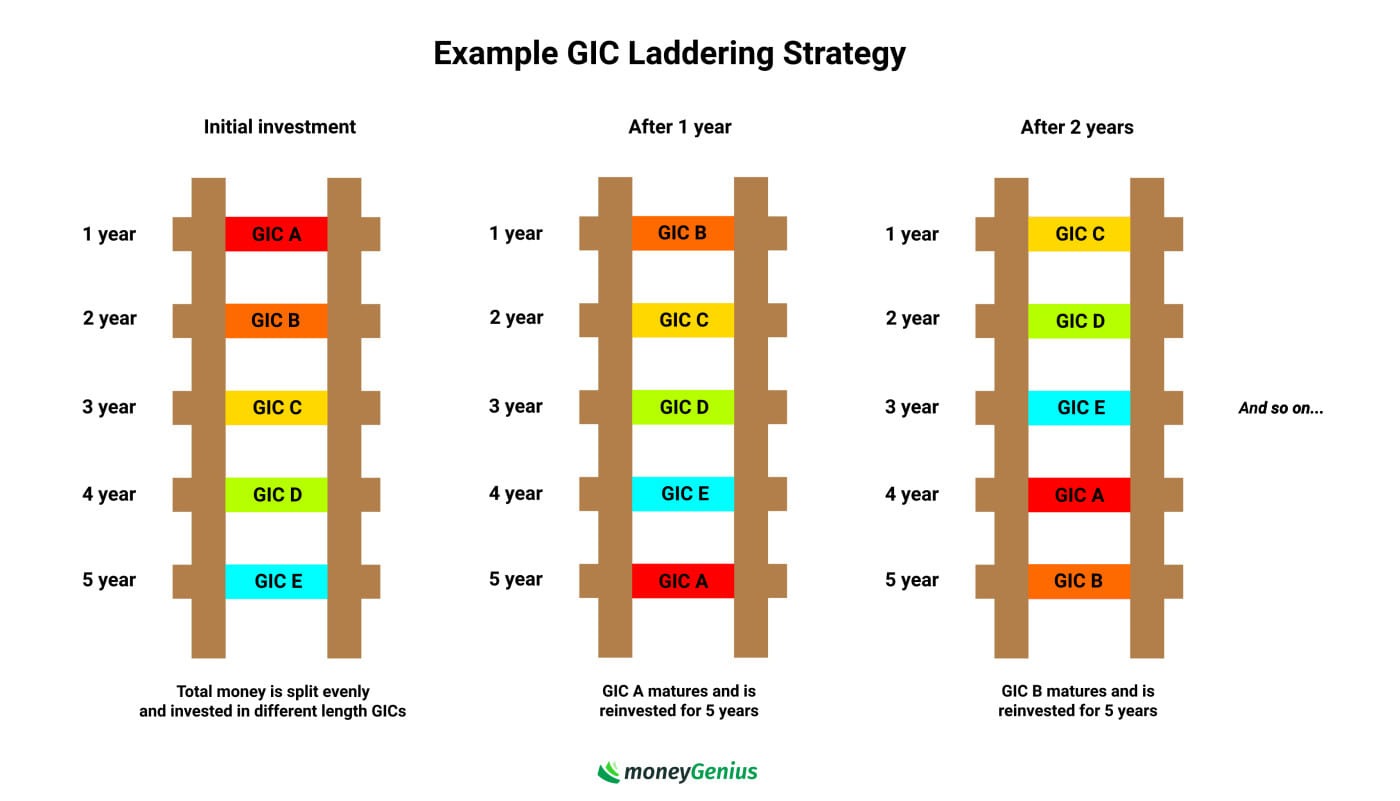

What is a GIC ladder? A GIC ladder is an easy investment strategy where you invest in multiple GICS with varying term lengths, stepping up from 1-year to 5-year GICs. You then reinvest your yields as each GIC expires.

GIC laddering allows you to earn the highest possible return on investment while avoiding the biggest downside of a single GIC or multiple long-term GICs: not being able to access your money for a set period.

Let's take a look at how you can set up your own GIC ladder, along with the pros and cons of doing so.

Key Takeaways

- A GIC ladder is an investment strategy that involves purchasing multiple GICs with different term lengths, then reinvesting the returns when each one reaches maturity.

- GIC laddering is guaranteed to provide growth while still offering a good level of liquidity and flexibility – however, downsides include the low rate of return and the inability to access your money.

- Set up your own GIC ladder in 3 steps: split your investment funds into equal parts, invest them in equally-spaced GICs, then reinvest each one once they mature.

- It's not a strategy suited for every investor, but GIC laddering may be a good fit for people who are first entering the market or who are risk averse.

3 steps to create your GIC ladder in Canada

There are three easy steps to create a GIC ladder in Canada as an investment method: invest your chosen amount into GICs with spaced out maturation dates, wait for your GICs to mature, and then continue to reinvest as each one matures.

Here’s how to create a GIC ladder:

1. Determine your total amount and purchase GICs

Make a budget and decide how much money you can invest. GICs should only make up a portion of your total investment portfolio since they’re low reward/low risk.

Let’s say you want to invest $20,000. Split this total amount into separate (but equal) amounts for purchasing several GICs.

With $20,000 for a GIC ladder, you can do 5 separate investment amounts of $4,000 each.

Term lengths: Common GIC ladders use 1, 2, 3, 4, and 5-year term lengths. The term lengths don’t really matter, except that they need to be different lengths and equally spaced.

2. Wait for the first GIC to mature, then reinvest

When your shortest-term GIC reaches maturity, you take that money and re-invest it into a long-term GIC.

Example: GIC A is the 1-year GIC in the ladder. You’re investing $4,000 with a 4% return.

- Initial investment: $4,000

- After one year: $4,160

- GIC laddering: Invest $4,160 into a 5-year GIC

With GIC laddering, the money you earn after your one-year GIC matures is the money you then use to buy another 5-year GIC – because your original 5-year GIC now has 4 years left on its term.

This reinvestment strategy allows you to continually grow your cash and benefit from the higher returns on longer-term GICs.

3. Repeat

With a staggered GIC ladder, you’ll have one GIC that reaches maturity each year and becomes cash. You can then repeat this process by buying and reinvesting as many times as you want, adding new rungs to your GIC ladder as others expire.

GIC ladders grow your money slowly but steadily every year. Although GIC laddering isn't meant to be a long-term investment strategy, the longer you keep up the cycle of reinvestment the higher your returns will be.

GIC ladder example

Let’s say that Nikki has $20,000 in funds and plans to buy 1, 2, 3, 4, and 5-year GICs. She invests $4,000 into each GIC.

See how Nikki’s money grows with GIC laddering – and pay attention to the GIC rates:

| GIC | Immediately | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 |

|---|---|---|---|---|---|---|---|

| A | * Purchase 1-year GIC * 3.25% interest | * Reaches maturity with balance of $4,130 * Reinvest funds in a 5-year GIC with 3.75% interest | * Reaches maturity with balance of $4,965 * Reinvest in a 5-year GIC | ||||

| B | * Purchase 2-year GIC * 3.5% interest | * Reaches maturity with balance of $4,284.90 * Reinvest funds in a 5-year GIC | |||||

| C | * Purchase 3-year GIC * 3.6% interest | * Reaches maturity with balance of $4,447.74 * Reinvest funds in a 5-year GIC | |||||

| D | * Purchase 4-year GIC * 3.6% interest | * Reaches maturity with balance of $4,607.86 * Reinvest funds in a 5-year GIC | |||||

| E | * Purchase 5-year GIC * 3.75% interest | * Final GIC reaches maturity with balance of $4,808.40 * Reinvest funds in a 5-year GIC |

After 5 years, all of Nikki’s original 5 GICs have matured – plus interest.

Here’s Nikki’s return:

- Original investment: $20,000

- Interest earned: $2,278.90

Nikki now has $22,278.90 to invest.

If Nikki continues with this approach for 5 additional years, GIC laddering will earn her an additional $4,503 (assuming a continued rate of 3.75%) for a total of $6,782 in 10 years.

To do your own calculations, try RBC’s GIC Laddering Tool.

The pros and cons of GIC laddering

| Pros | Cons |

|---|---|

|

|

You can always consult with a financial advisor or other financial professional to determine if GIC laddering aligns with your overall investment strategy.

Who should try GIC laddering?

Beginner investors and/or cautious investors benefit from GIC laddering because it’s simple to set up, with surefire returns and flexibility.

People who may want to try GIC laddering include:

- Those who are new to the world of investing

- Those who want a near-immediate return on their investment

- Those who are particularly nervous and/or conservative

- Those who want to add diversification to their portfolio

- Those who are looking for more of a short-term reward

- Those who are looking for a bit more than the average liquidity level

- Those who are hoping to balance things out with fixed-income investments

- Those who want a higher interest rate than what a savings account offers

On the other hand, there are also specific types of investors who likely won't appreciate the laddering strategy at all:

- Those who are primarily focused on growth

- Those with long-term investment horizons (saving for retirement, etc.)

- Those concerned with inflation affecting their purchasing power

- Those with a high risk tolerance

How to pick the right financial institution for a GIC ladder

You can purchase GICs from any major bank or broker, as well as some credit unions and financial cooperatives.

There are 2 factors to keep in mind:

- Rates: Some institutions offer better rates than others.

- Ease: Buying GICs at your existing bank can be easier

Remember, your GICs can be held at different institutions. For instance, your 1-year GIC could be from a credit union and your 5-year GIC could be from EQ Bank.

Tangerine offers a good GIC for beginner investors

For a low-risk option, try Tangerine GICs as the first rung on your GIC ladder.

Here are 2 key perks of Tangerine GICs:

- No minimum deposit

- Consistently competitive rates

You can learn more about Tangerine GICs here:

Tangerine GICs provide consistently competitive rates. When coupled with the fact that they have no minimum investment amount, this makes this a legitimate investment option for small budgets or nervous investors.

- No minimum investment requirement

FAQ

What is a GIC ladder?

A GIC ladder is an investment approach that involves using equal amounts of money to purchase GICs of different term lengths, and then reinvesting the returns in more GICs. It's a simple, low-risk strategy for the right type of investor.

What is a GIC ladder for retirement?

This is a strategy that includes buying GICs with staggered maturation dates. After each one expires, you reinvest that money into a new GIC. GICs are a beneficial component of a retirement plan because they’re low-risk – but they’re also low-reward.

Is GIC laddering worth it?

There are plenty of benefits to this strategy, and it can certainly be worth the time, money, and effort. However, in the rare case when shorter-term GICs have higher rates than the long-term options, it can diminish your return.

What is the downside of a GIC?

When you buy a GIC, your cash is locked up and unavailable for the term of the investment. Another downside of GICs is that your return will be relatively low compared to other high-risk investment options like stocks.

What's the best way to ladder GICs?

This requires 3 steps. First, determine the amount you can invest, divvy it up into equal parts, and invest in GICs with different, equally spaced terms. At maturity, you reinvest each return in the same manner.

Is a laddered GIC a good investment choice?

A laddered GIC can definitely be a good choice and provides a range of benefits. One big perk is that your investments are more liquid with a GIC ladder than with other strategies thanks to the staggered term lengths.

What kind of investors choose a laddered GIC approach?

A wide range of investors find this approach to be convenient and valuable. New investors find that it's easy to implement, and nervous investors enjoy both the guaranteed returns and the extra liquidity the ladder offers.

Leave a comment

Comments

You're absolutely right, this strategy is based on the fact that longer term GICs usually have higher rates. When this isn't the case, GIC laddering may not be the ideal approach, as you could put all your money in a shorter term GIC and get a better overall return and higher liquidity.

An alternative option is to put more money into your shorter term GICs instead of splitting them evenly. Then you can also include the 1.5 year GIC since it has some good rates at the moment. This approach will be slightly more lucrative in terms of interest compared to the standard GIC laddering strategy.

Hope this helps!

It is true that right now shorter term GICs have higher rates, which isn't usually the case. In today's situation, GIC laddering may not be the ideal approach, as you could put all your money in a shorter term GIC and get a better overall return and higher liquidity.

Out of curiosity, I plugged in the numbers you proposed to see the difference. Here is the total interest earned in 5 years with each scenario:

- Equal split for 1 - 5 year terms: $2,545

- Equal split for 1, 1.5, 3, 4, 5 year terms: $2,536

- Two units of $5,500 + three units of $3,000 for 1 - 5 year terms: $2,256

- Two units of $5,500 + three units of $3,000 for 1, 1.5, 3, 4, 5 year terms: $2,244

So your scenario actually ends up being the most lucrative, but only by $11 over the the standard GIC laddering strategy.

Hope this helps!

That's a very good question! Though it's true that longer term GICs usually do have higher rates, it's not always the case (like right now, as you pointed out). In these cases, GIC laddering may not be the ideal approach, as you could put all your money in a shorter term GIC and get a better overall return and higher liquidity.

That said, an alternative option is to put more money into your shorter term GICs instead of splitting them evenly. Then you can also include the 1.5 year GIC since it has some good rates at the moment. This approach will be slightly more lucrative in terms of interest, but not by much.

Hope this helps!