A small business loan could be exactly what you need to get your business off the ground. And in unprecedented times like these, your business may need it more than ever.

The Canada Small Business Financing Program (CSBFP) provided by the government of Canada is available for most startups and existing small businesses. This money can be used towards a number of your major costs, though there are some restrictions to be aware of.

Here’s what you can expect before applying for this program.

- What is the Canada Small Business Financing Program?

- How to apply for a small business loan in Canada

- Small business loan fees

- Small business loans vs. small business grants

- The pros and cons of small business loans

- FAQ

What is the Canada Small Business Financing Program?

The Canada Small Business Financing Program is in place to make it easier for small Canadian businesses to get a loan because the government shares a risk with the lender. In fact, 85% of the loan is guaranteed by the federal government.

On a basic level, you still get your loan from a participating financial institution (which is responsible for processing and approving your application), but the government provides support on the back end.

Small bonus loan eligibility

Of course, not every Canadian-owned business qualifies for a “small business” loan.

Let’s go over the eligible businesses – as well as the types of expenses that can be covered by the loan.

Types of businesses that are eligible to apply

The eligibility requirements for the CSBFP isn’t too tight, though there are a few restrictions to keep in mind.

Most start-ups and existing businesses can apply, but they have to be for-profit and have gross revenues of $10 million or less.

The one major exception are farming businesses, since they’re covered by a separate program called the Canadian Agricultural Loans Act program.

Types of expenses the loan can cover

So if you’re eligible, what kind of expenses can you use this money for?

Here are some examples of what can be covered by the CSBFP:

- Business registration fees.

- Purchase or improvement of land for commercial use.

- Purchase or improvement of buildings for commercial use.

- Purchase or improvement of new or used equipment.

- Purchase of leasehold improvements, whether they’re new or existing.

You may also purchase the above assets from an existing business, though it’s recommended that you contact your financial institution to make sure requirements are met.

Another thing to note is that your loan can cover purchases made up before your loan was approved. The length of time varies by lender, but RBC covers up to 6 months, and BMO only covers up to 180 days before loan approval.

So what are some things that can’t be covered by your small business loan?

Here are some examples:

- Franchise fees.

- Goodwill.

- Working capital.

- Inventories.

There are a lot of exceptions to these rules, so your best bet is to ask the financial institution you want to work with exactly what you can and can’t use your loan for.

Maximum small business loan amounts

Though these small business loans are backed by the government, the actual loan agreement is between you and the lender. That means you and the financial institution will work together to come up with an appropriate loan amount based on your situation. Up to 90% of your eligible costs will be considered.

There is, however, a maximum loan amount of $1 million that you can access.

Another point to note is that only $350,000 of your loan can be used towards equipment or purchase of leasehold improvements.

How to apply for a small business loan in Canada

Though the Canada Small Business Financing Program is backed by the government, you’ll still need to apply for it through a financial institution, just as you would a regular loan.

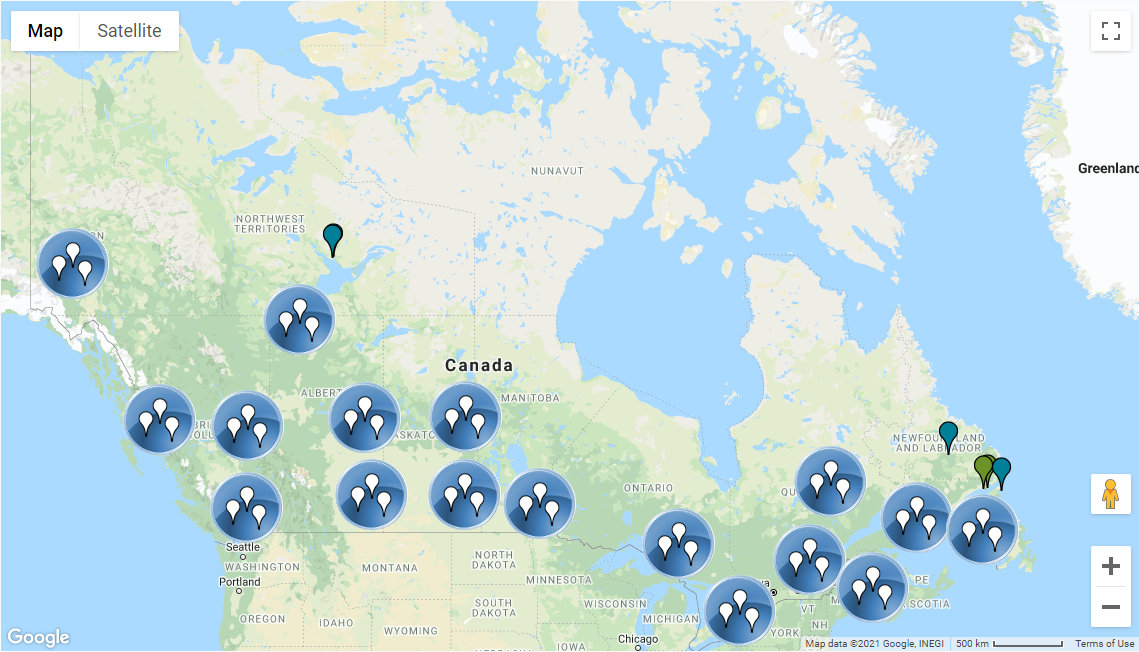

There are participating banks, credit unions, caisses populaires, and other institutions across the country that are authorized to participate in the CSBFP.

Click here to see the interactive map.

It’s important to note that the lender itself is responsible for processing and approving your application – not the government.

A comparison of the big 5 banks small business loans

If you want to stick with a big Canadian bank… what do they have to offer you?

| Bank | RBC | TD | Scotiabank | BMO | CIBC |

|---|---|---|---|---|---|

| Interest rates available | * Variable (plus or including interest) * Fixed (plus or including interest) | * Variable * Fixed | Not listed | * Variable * Fixed | * Variable: Prime + 3% |

| Retroactive payment coverage | Up to 6 months | Not stated | Up to 180 days | Up to 180 days | Not stated |

| Terms available | * Equipment loans: up to 10 years * Leasehold improvements: up to 7 years * Property loans: up to 15 years | * Terms up to 10 years * Amortization up to 20 years | * Leaseholds and equipment: 10 years * Property loans: 20 years | * Up to 10 years | Not stated |

| Fees listed | * Documentation preparation fee: $175 * Application fee: $100 * 1.25% administration fee (included as part of interest rate) | Not stated | Not stated | Not stated | Not stated |

| Special features | * Don’t pay principal payments for 11 months | * Up to 6 months interest in the first year | |||

| Interested? | Learn more | Learn more | Learn more | Learn more | Learn more |

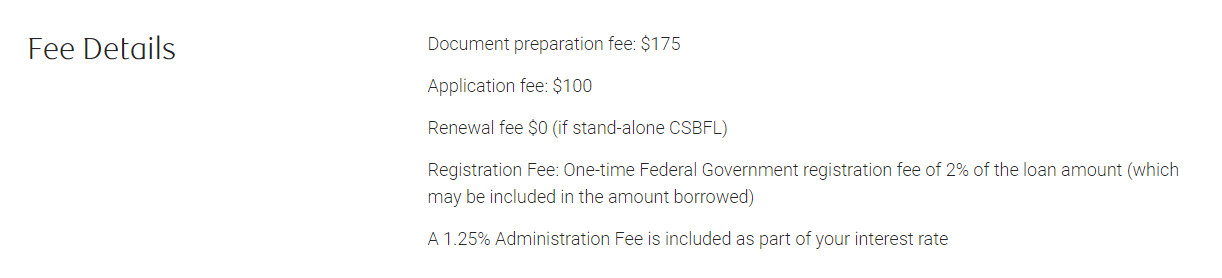

Not every bank is forthright with their fees, unfortunately, but you can get a pretty good idea of them thanks to RBC.

For more information on what isn’t listed on their websites, a quick call to your local branch can help to clear things up.

Documents you may need when applying for a small business loan

When you’re ready to apply for a loan, it’s best to call your financial institution of choice and ask what exactly they’ll need you to provide when you meet to discuss your small business loan.

In most cases, these are the general documents you should have prepared:

- A business plan: This will indicate why you need a loan, what you’ll use it on if you’re approved, and how much you need.

- Financial documents: Including bank statements, tax returns, balance sheets, and income statements.

You’ll also need to bring general information like your bank account and business details.

Small business loan fees

So what can you expect to pay if you pick up one of these small business loans?

There are 2 sets of fees to be aware of: what’s charged by the government, and what’s charged by the lender.

Government fees

The government does charge a registration fee that costs 2% of the loan amount. Depending on how much you’re borrowing, this could really add up. For example, a $500,000 loan would have a $10,000 registration fee.

The good news is you can add the registration fee to the amount borrowed, so you pay it back with the rest of the money.

Lender fees

Of course, the lender will have a set of fees as well – mostly interest.

These fees will of course vary from bank to bank, but all of the options we looked at had both fixed and variable rates available.

Let’s take a look at RBC for example. Here’s the fees they have listed on their website:

On top of that, they offer the following interest options:

- variable or fixed rate principal plus interest, or

- variable or fixed rate principal including interest (blended payment.

Small business loans vs. small business grants

Of course, there are some small business grants available for Canadians as well.

The big pro about grants is that they don’t have to be paid back. But they’re also usually harder to get and worth a lot less money.

For that reason, grants are usually best as a supplement to your main loan rather than a full replacement.

There are many different types of benefits you can get, like:

- tax credits,

- wage subsidies, and

- other financial assistance.

You can see what you qualify for using the Government of Canada’s Business Benefits Finder.

The pros and cons of small business loans

So what are the general benefits and downsides of getting a loan to help fund your small business startup?

3 reasons to consider a small business loan

Is a loan the investment your business needs right now?

1. Helps get your feet off the ground

You know this, but…starting a business can be expensive.

Sometimes you just need that extra capital to get your feet off the ground and take your business to the next level.

2. You can claim the interest you pay on loans as a business expense

Though you can’t claim the principal of the loan on your taxes, you are able to claim the interest – helping you out on your tax returns.

3. The CSBFP guarantees 85% of your loan

Choosing to go with a CSBFP loan from a qualified lender means you’ll likely have an easier time getting approved, and may even get a lower interest rate than usual.

Other options may be available, but they don’t have the government-backing of the CSBFP.

2 downsides to getting a small business loan

And here are a couple things to watch out for when considering a small business loan.

1. Hard to get if you haven’t earned much income

If you’re really just starting out, it’ll be hard to pitch your business to the lender.

Think of it as an episode of Shark Tank or Dragon’s Den. If you’ve watched those shows, you know how much the investor’s eyes light up when they hear about a good profit history – and how quickly their cheque books close when they hear they haven’t made money yet.

Lenders will look at it in a similar way – profit is proof of business – but at least a CSBFP loan has the federal government to back it up.

2. Can be a lot of money if your business doesn’t go well

This is the worst case scenario, but what if you take out $100,000s on a business that just doesn’t work out?

You’ll be left with huge debt – higher than most other personal loans.

It’s good to only get exactly what you need, and not a penny more.

Will you apply for a small business loan?

Have you started a business that you think is ready to take things to the next level?

Let us know what bank you’re thinking of going with in the comments below – and how your business is doing.

FAQ

What is a small business loan?

A small business loan is a personal loan you can take out to cover expenses of opening and operating your small business.

What is the Small Business Financing Program?

The Canada Small Business Financing Program is a program designed to make it easier for Canadian small businesses to get a loan. The government works with financial lenders to guarantee 85% of your loan. Learn more about CSBFP here.

Should I get a small business loan?

If your Canadian small business is showing lots of promise, getting a small business loan can be the boost you need to get things to the next level. Read the pros and cons here.

What are small business grants?

Small business grants are sums of money that don’t need to be repaid.

How do I apply for a small business loan?

You can apply for a small business loan at hundreds of financial institutions across the country.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments