A HELOC is a type of secured credit that uses your house as collateral. It taps into the existing equity in your home to give you access to a low-interest line of credit.

HELOC rates in Canada are not displayed until you apply for them, since they’re highly individualized. Instead, we’re comparing different banks that offer HELOCs and their key features.

Keep in mind that while you can receive up to 65% of the total value of your home in a HELOC, it requires financial stability and cash flow to ensure you can responsibly borrow and pay back your loan without risk.

Methodology

To evaluate HELOCs, we analyze over 10 data points to generate a trustworthy Genius Rating. We consider all aspects of a HELOC, including availability, access to different payment types, perks, customer satisfaction, and protections, to assess its overall value. Then, the HELOC’s features are rated based on how they stack up against other available options.

Best HELOC in Canada 2026 winner – TD Home Equity FlexLine

While few opt for a home equity line of credit instead of getting a traditional mortgage when they have relatively little equity in their home, this option can be attractive to those who owe less on their home. With the ability to split your TD Home Equity FlexLine into a revolving portion and a term portion, you can take advantage of interest rates when they're low and flexible prepayment options at the same time. You could use the term portion to pay off your house, for example, and the revolving portion to pay down existing debt or do some renovating.

- Good credit and adequate income

- At least 20% equity in your home

Our pick for the best home equity line of credit for 2026 is the TD Home Equity FlexLine. With the ability to split your TD Home Equity FlexLine into a revolving portion and a term portion, you can take advantage of interest rates when they're low and flexible prepayment options at the same time. You could use the term portion to pay off your house, for example, and the revolving portion to pay down existing debt or do some renovating.

RBC Homeline Plan

The RBC Homeline Plan is a surprising product from RBC that combines a traditional mortgage with a home equity line of credit. With this loan, homeowners have access to a revolving credit line that increases as what you owe on your mortgage decreases. It's an interesting, popular hybrid product that offers significant flexibility.

- Interest-related Perks

- Apply once, borrow repeatedly

- Super convenient access to funds

- Maximum borrowing limit

- Puts your home at risk

- At least 20% equity in your home

- HomeProtector Mortgage Insurance

The RBC Homeline Plan is a top-rated HELOC in Canada for 2026 with a prime rate of 4.45%. You can access your funds online, via cheques, or at a branch or ATM. You can start the application online, and there’s a helpful example to explain how much you can save.

Why we picked it:

- Multiple, convenient ways to access your money

- Start your pre-approval online

- RBC HomeProtector Mortgage Insurance option

TD Home Equity FlexLine

While few opt for a home equity line of credit instead of getting a traditional mortgage when they have relatively little equity in their home, this option can be attractive to those who owe less on their home. With the ability to split your TD Home Equity FlexLine into a revolving portion and a term portion, you can take advantage of interest rates when they're low and flexible prepayment options at the same time. You could use the term portion to pay off your house, for example, and the revolving portion to pay down existing debt or do some renovating.

- Good credit and adequate income

- At least 20% equity in your home

The TD Home Equity FlexLine works much the same as other big banks – giving you a revolving line of credit along with your TD mortgage at a prime rate of 5.45%. Like Scotiabank and CIBC, you can choose either a fixed or variable rate for the mortgage portion, and it can be either open or closed.

Why we picked it:

- Fixed and variable rate options, open or closed

- Access your money via cheques, online banking, or access card

- 2nd position HELOC

BMO Homeowner ReadiLine

The BMO home equity line of credit, called BMO Homeowner ReadiLine, is like having a mortgage and line of credit all in one. It’s best understood as one loan with 2 parts: the mortgage portion, which has regular payments, and the line of credit portion, which you pay back only as you need to use the funds.

- Line of credit portion can be used for anything

- Split up your mortgage payments

- Line of credit stays open as long as you own your home

- Lower interest rates because it’s secured against your home

- Can only borrow up to 65% of your home’s value for the line of credit portion

- Your mortgage must be at BMO

- At least 20% equity in your home

- Smart Fixed rates available

- Lock in a rate with 130-day guarantee

- Balance protection

- Payment protection

The BMO Homeowner ReadiLine is a standard home equity line of credit combined with a mortgage. The prime rate is 4.45%, and there are two types of helpful insurance on the credit portion. You do have to book an appointment to set up your account, and a government-issued photo ID and proof of employment are required.

Why we picked it:

- Balance protection insurance

- Payment protection insurance

- Access your money via cheques, online banking, and at a branch

CIBC home equity line of credit

For more information, see the CIBC Home Power Plan page.

If you bank with CIBC and would like to stick with them for your mortgage and HELOC needs, they offer the CIBC Home Power Plan. This is a combined mortgage and line of credit bundle, like BMO’s. The prime rate is 4.45% and the minimum amount is $10,000.

Why we picked it:

- Variable rate mortgage available

- Online access to your funds

- No monthly services fees

What is a home equity line of credit (HELOC)?

A home equity line of credit (HELOC) is a secured type of credit that uses your home as collateral. It often comes combined with your mortgage.

Borrowing limit: Your credit limit is based on your equity, up to 65% of your home's total value.

Revolving credit: Revolving credit means you can take money out, pay it back, and then borrow more, up to a predefined limit. The bank is essentially lending back the portion of your mortgage that you've already paid off.

Interest rates: You’ll enjoy lower interest rates than with personal, unsecured loans.

Collateral risk: You're at risk of losing your home if you can't pay back what you borrow, since a HELOC is secured against the value of your home.

Types of HELOCs

There are two main types of HELOCs: combined HELOC and mortgage and standalone HELOC.

Combined home equity line of credit and mortgage

When you combine a home equity line of credit with a mortgage, it acts as two products in one. This is the type of home equity line of credit that most big Canadian banks offer.

Limit: There's a 65% value maximum credit limit. This means at least 35% of your home's value must be paid off or exist as a mortgage. You may be able to finance a home purchase with a combined HELOC.

Example: You buy a $500,000 home with a 20% down payment ($100,000), leaving $400,000 to be paid off. You can only take out 65% of the home's total value, which is $325,000. In this case, you’re still left with $75,000 that needs to be financed with a fixed-term mortgage.

Payments: You'll likely have a standard amortization schedule for the mortgage portion, but you'll only have to pay back the part of the line of credit you take out.

Standalone home equity line of credit

You can get a home equity line of credit on its own. It will still be connected to the equity you have in your home, but it won't have anything to do with your mortgage.

You can use a standalone HELOC to finance your home. In this case, you're not required to pay off the mortgage on a fixed payment schedule. However, you'll need to pay off 35% as a down payment (since your line of credit can't be worth more than 65% of your home's value).

HELOC rates

None of the banks state their rates online (since they vary so much on a case-by-case basis).

Contact a bank for more information if you're interested in comparing more closely.

How much money can you get from a HELOC?

Most banks allow you to borrow up to 80% of your home’s equity, but only 65% in a HELOC. Rules vary by bank and by property type.

Here are some examples:

$500,000 home value, 20% paid off: You owe 80% on your home and your equity is 20%. You are not eligible for a HELOC due to insufficient equity.

$750,000 home value, 50% paid off: You owe 50% on your home, and your equity is 50%. The potential HELOC is 80% of the home value ($600,000) but we have to subtract the amount you still owe ($600,000). You may be eligible for a HELOC of $225,000.

$1 million home value, 40% paid off: You owe $60% on your home, and your equity is 40%. The potential HELOC is 80% of the home value ($800,000) but we have to subtract the amount you still owe ($800,000). You may be eligible for a HELOC of $200,000.

What are home equity line of credit fees?

Most banks don't charge a monthly maintenance fee, but you might have to pay set-up and application fees.

Remember to consider interest rates, too. They’re not technically fees, but they do affect your payment amounts.

HELOC setup or application fee

- $0 to a few hundred dollars

This is a one-time fee charged by some lenders to process your application and set up the HELOC.

HELOC discharge fee

- $100 to $300

This is a one-time fee charged by some lenders if you decide to pay off your HELOC and close the account.

HELOC early payment fees

- TBD

Most big banks don't charge for this, but some lenders will charge a fee if you pay off your HELOC before a specified period.

HELOC fees related to home buying

- $1,000 to $3,000

From appraisals to legal fees and title search fees, these are common fees during the home-buying process.

How to increase your HELOC limit

The amount of money available to you via your line of credit is equal to how much of your mortgage you've paid off.

If you want more funds in your HELOC, you'll have to pay off more of your mortgage's principal.

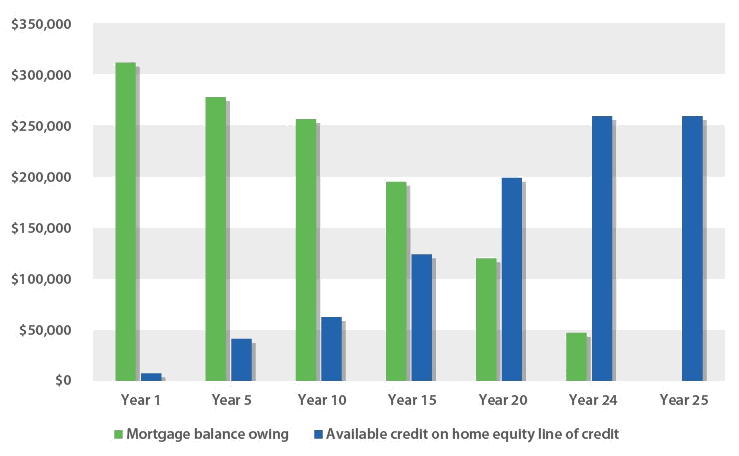

Here's a chart from Canada.ca that illustrates the relationship between paying off your mortgage and the equity you have in your home:

Source: Getting a home equity line of credit

Note that you can only access up to 65% of your home's value with a HELOC.

If you have a $400,000 home, your maximum credit limit is $260,000. In the chart above, that's why the available equity didn't change between the 24th and 25th year.

2026 mortgage market update: How does it impact HELOCs?

Demand for HELOCs may increase in 2026 thanks to recent rate cuts, changes in federal mortgage regulations, and rising property values.

The Bank of Canada cut the overnight rate multiple times this year, most recently on October 29, 2025, to 2.25%. As a result, HELOCs and variable-rate mortgages will see drops in interest rates to align with the prime rate of 4.45%.

It’s possible that higher demand could mean that HELOC rates will adjust in response to market conditions.

The Canadian Real Estate Association is already reporting a 6.9% increase in home sales for 2024, with the increase holding steady throughout 2025. Experts are predicting this increase in home-buying activity will hold into 2026. Many Canadians have been waiting for lower rates, and this most recent cut could lead to more home purchases.

The national average home price increased 2.1% year-over-year. This impacts HELOCs because, as property values increase, so does the borrowing limit for HELOCs.

Prospective first-time homebuyers should also be aware of two helpful new changes to federal regulations on mortgages. As of December 15, 2024, 30-year amortizations are available to all first-time buyers with or without an insured mortgage. The maximum insured mortgage purchase price is also increasing to $1.5 million.

Is it a good time to get a home equity line of credit?

Now could be a good time to get a HELOC, thanks to recent rate cuts, the availability of bigger properties, and rising home prices.

Before you commit to a HELOC in Canada, speak with a mortgage broker and/or shop around with different lenders and lay out how you plan to use (and repay) the money.

Remember that, although HELOC interest rates are likely to be lower than unsecured loans, these can change at any time because they're variable interest rates based on the bank's prime rate.

The prime rate can change at any point during your lending time, so consider your financial situation carefully.

Is a HELOC right for me?

HELOCs may be a good solution for you if you fit these criteria:

- Homeowner with significant equity in your home

- Need flexible, low-interest revolving credit (not a lump sum)

- Considering home renovations or debt consolidation

HELOCs do carry risks, like variable interest rates, which could trigger increased monthly payments. Since your home is the collateral that secures your loan, you could face foreclosure if you miss payments. Plus, revolving credit access can tempt you to overspend if you’re undisciplined about budgeting.

Here’s a closer look at more benefits and disadvantages of HELOCs in Canada:

| Pros | Cons |

|---|---|

|

|

It's best to go over all the fees, rates, and expectations of your home equity line of credit with your potential lender before committing.

You can even talk to a mortgage broker if you want advice from a third party (i.e. not your lender). For instance, many parents are interested in using a HELOC to help their adult children make a down payment on a home. You could speak to a broker about your options.

How to compare HELOCs

The main features to consider are the bank's prime rate and how you’ll access the funds, but here’s a full list of the HELOC features you should compare:

- Prime rate: Most major Canadian banks align their prime rate, though individual margins may vary.

- Access: Some may offer ATM withdrawals, cheques, and/or online access to your funds.

- Amount: BMO and Scotiabank have no minimum HELOC amount, whereas other big banks require you to borrow at least $5,000 or $10,000, up to 65% of the loan-to-value of your home.

- Tiered vs. revolving: HELOCs have a revolving balance, but some banks also offer a tiered structure where different portions of your balance can have varying terms or limits.

- Convert to fixed: Not all banks allow you to convert some or all of your HELOC funds to a fixed rate. This can help lock in stable rates.

- Subdivision: Some banks allow you to divide your HELOC funds into multiple accounts. This can have tax benefits in some cases.

- Second position: This is when your mortgage and HELOC are held with 2 different banks. "Second position" is the loan’s claim position. It usually means higher interest rates but it can work for some borrowers.

- Fees: There may be credit insurance fees or cancellation fees associated with your HELOC, as well as fees typically associated with home-buying like legal fees and home appraisal fees.

Home equity lines of credit alternatives

There are 3 main alternatives to a HELOC: a mortgage, a home equity loan, and a reverse mortgage.

Home equity line of credit vs. mortgage

Similarities: Both are secured against your home.

Differences: A mortgage is a large loan that you pay back according to your amortization schedule, whereas a HELOC is money you borrow from the money you’ve already paid off on your home.

You may be able to buy your entire home with a mortgage, but most lenders will want a 20% down payment or else you'll have to buy mortgage insurance.

It can be advantageous to use a HELOC to buy a secondary recreational property or investment property as well – but only if you have the cash flow to cover the additional payments comfortably, i.e. the cash flow to cover your expenses to lessen the risk of default.

Home equity loan vs. line of credit

Similarities: Both are secured against your home.

Differences: A home equity loan comes as one lump sum payment instead of as a revolving line of credit. With a home equity loan, the amount you can borrow is up to 80% of your home's value – compared to the line of credit's max of 65%.

You'll have to repay the loan according to a schedule that you agree upon with the lender. You'll pay interest on the entire amount of the loan, unlike with a line of credit.

A HELOC can be preferable to a regular LOC because it’s a secured loan. This means you’re likely to receive a better interest rate than you would with a personal line of credit.

Home equity line of credit vs. reverse mortgage

Similarities: Both mean you take out money that's secured against the equity in your home.

Differences: You only qualify for a reverse mortgage if you’re 55+ and you own your own home. You can also borrow up to 55% of your home's equity with a reverse mortgage (compared to 65% with a HELOC).

A reverse mortgage is a loan, not a line of credit. You do not need to pay off your payments after a certain amount of time. Instead, you only need to repay the reverse mortgage loan once you sell your home, move, pass away, or default on your loan.

You cannot have a HELOC open on a home that has a reverse mortgage. If you qualify for both, you need to decide between the two.

If you already own your home and are free of mortgage payments, a reverse mortgage might be a better option than a home equity line of credit. It could be the right option for those planning to age in place or to downsize in the near future.

Editorial Disclaimer: The content here reflects the author's opinion alone, and is not endorsed or sponsored by a bank, credit card issuer, rewards program or other entity. For complete and updated product information please visit the product issuer's website.

FAQ

What is a home equity line of credit?

A home equity line of credit is a secured type of credit that uses your home as collateral. You'll have lower interest rates with this revolving credit, but you're at risk of losing your home if you can't make payments.

Is a home equity loan or a line of credit better?

A HELOC offers considerably more flexibility since it's a type of revolving credit. A home equity loan means a lump sum payment, and you’ll have to pay interest on the entire amount on a set schedule. Whether a home equity line of credit is better for you will depend on your cash flow, personal goals, and exactly what you’re using your LOC for.

How can I increase my home equity line of credit limit?

Your HELOC limit is based on the equity you have in your home, which is the portion that you've paid off. It’s possible to increase your home equity line of credit, though. If you’re hoping to increase in the future, you'll need to pay off more of your mortgage's principal to increase your credit limit.

What's the difference between a home equity line of credit and mortgage?

Both options are secured against the value of your home. A mortgage is a lump sum loan that you repay according to an amortization schedule. A line of credit is revolving credit that only requires repaying the funds you use. Your mortgage is a fixed loan, whereas your home equity line of credit can be used for renovations or other expenses that require a larger lump sum.

How do home equity lines of credit interest rates work?

First, it's important to note that HELOCs usually have variable interest rates. These are typically expressed as prime plus a percentage, and the prime rate varies. For example, since the current prime rate is 4.45%, a "Prime + 3%" HELOC means your effective interest rate is 7.45%. It's possible for a HELOC to offer a fixed interest rate, but it's rare.

Can I get a home equity line of credit with bad credit?

Yes, it's possible to get a HELOC even with poor credit. Of course, it will likely be tricky, but it may still be easier than getting other unsecured types of credit. With a HELOC, your home serves as collateral, and your bank has something to fall back on should you default on your payments. Unsecured credit options offer no fallback for the bank and, therefore, aren't an attractive option for a client with poor credit.

What are the downsides of a home equity line of credit?

The major downside of a HELOC is that it’s secured against your home, so missed payments could lead to foreclosure. Plus, it delays fully paying off your mortgage since you’re re-borrowing funds you’ve already repaid.

What are the best HELOC rates in Canada?

Banks don’t usually display HELOC rates publicly, but these rates are generally lower than other forms of borrowing. They’re usually variable, too, so they move with the prime rate. It's a good idea to start by requesting quotes from multiple banks or lenders to compare rates. You can also consult with a mortgage broker for personalized guidance.

How do HELOC payments work?

You'll usually only have to make interest-only payments while drawing money. After this period, your payments will include both principal and interest, as specified in your agreement. Keep in mind that regular payments can fluctuate along with the changes in the interest rate. This means you won’t want to overspend on your HELOC unless you have the cash flow to pay it back, even with variable rates.

Should I get a HELOC?

If you have a stable financial situation and enough equity in your home, a HELOC could be a valuable solution to access flexible funds for home improvements, debt consolidation, emergencies, or helping an adult child fund a down payment. Keep in mind that HELOC amounts tend to be much higher than personal lines of credit or credit cards. This means it will require a careful payback schedule and plan to avoid defaulting.

How much of a HELOC can I get?

In Canada, you can receive up to 65% of the total value of your home in a home equity line of credit. It is vital to ensure you have a stable financial situation and sufficient cash flow to continue paying back your HELOC, as it's secured by your home.

Find more mortgage products

Looking for more mortgage product options? Check out these top offers: