The best First Home Savings Account (FHSA) in Canada right now is the Qtrade FHSA. An FHSA is a registered savings account that helps first-time home buyers save, and Qtrade's FHSA has excellent features, low fees, and an impressive interest rate.

To choose an FHSA, compare the interest rates, fees, and investment options offered by different financial institutions to ensure the account suits your savings goals. Consider factors like account accessibility, withdrawal flexibility, and customer support to find the best FHSA for you.

Here, you'll find reviews of the top FHSA products available for Canadians.

Comparing the best FHSAs in Canada

Here’s a summary of the best FHSAs in Canada:

How we picked the best FHSAs

To evaluate FHSAs, we analyze over 20 data points to generate a trustworthy Genius Rating. We consider all aspects of an FHSA, including different investment options, fees, perks, average MER, customer satisfaction, and promotions, to assess its overall value. Then, the FHSA’s features are rated based on how they stack up against other available options.

Best FHSA in Canada 2026 winner: Qtrade FHSA

Trading platform Qtrade now offers their own version of an FHSA, and from the get go, it’s clearly aimed at investors who prefer to keep a close eye on their money. It allows you to keep stocks, bonds, and other investment products in your FHSA, as well as cash.

- Robust self-directed trading and investing platform

- Keep a wide variety of investments in your FHSA account

- Available everywhere in Canada

- No interest rate gain

- Mainly aimed at self-directed investors

- First-time home buyer

- Canadian resident

- 18 years or older

- Fees: N/A

- Minimum balance to start investing: N/A

Our pick for the best first home savings account of 2026 is the Qtrade FHSA. Qtrade now offers their own version of an FHSA, and from the get go, it’s clearly aimed at investors who prefer to keep a close eye on their money. It allows you to keep stocks, bonds, and other investment products in your FHSA, as well as cash.

Best for providing choice: RBC

- Fees: 0.5% (RBC InvestEase) or $6.95 - $9.95 (RBC Direct Investing) trading fees

- Minimum balance to start investing: $0

There are several options for holding an FHSA with RBC. You can open one through their robo advisor service, RBC InvestEase, or through their online brokerage, RBC Direct Investing.

When opening an account via RBC's website, users are prompted to answer whether they'd prefer an "FHSA built & managed for me" or an "FHSA I can trade in." Essentially, it's asking whether you'd prefer a robo advisor or an online brokerage – InvestEase or Direct Investing.

RBC Direct Investing doesn't charge any FHSA maintenance fees, but there are commission fees for trading (RBC InvestEase also charges commission fees). A significant perk here is that you have the option of using your Avion points to cover these commission fees. Or you can choose to turn those points into cash contributions and add to your savings.

However you decide to go about it, an RBC FHSA allows you to hold stocks, options, bonds, ETFs, GICs, and/or mutual funds.

Best for step-by-step guidance: National Bank

- Fees: $0

- Minimum balance to start investing: N/A

National Bank of Canada was the very first of the big banks in Canada to offer the FHSA, on April 17, 2023, which is a fact that really sets it apart.

If you're already a National Bank client, you can login online and fill out a form to open an FHSA. But if you're new to National Bank, you'll have to set up an appointment with a bank representative and they'll guide you through the process of setting up the new account. This can be particularly helpful if you have questions or concerns about how the FHSA works.

National Bank now has an FHSA brokerage account available too, adding another option for clients looking to open an account.

There aren't many investment options available with an FHSA from National Bank, though. Your only choices right now are GICs, mutual funds, and cash. Their website says that clients will soon also have access to stocks as well as government and corporate bonds.

Best for earning interest: Meridian Credit Union

- Fees: $6.95 - $8.75 trading fees (100+ free ETFs)

- Minimum balance to start investing: N/A

Meridian Credit Union is one of the top credit unions in Canada and offers an excellent menu of high-quality financial products and services, not the least of which is its FHSA.

You have two options with Meridian: Open your FHSA as an investment account or a savings account. The high interest account offers a decent 0.85% interest rate and free, unlimited transactions. If you go with the investment account option, you can hold GICs, stocks, bonds, ETFs, and mutual funds within it.

Meridian has a partnership with Qtrade, which means you could hold an FHSA there instead. This offers a multitude of benefits, including the convenience of online investing and the blended support options provided by this investment platform and a customer-focused credit union.

Best for ETFs: Questrade

The Questrade FHSA was the very first First Home Savings Account (FHSA) to be available to Canadians. And for those that are already active investors, this FHSA was a welcomed addition to the Questrade investment platform portfolio. But for hopeful homebuyers that want to save for their down payment, is this their best FHSA option? Or is this FHSA better left to more robust investors?

- Robust self-directed trading platform

- Professionally managed portfolio available

- Free to buy ETFs

- Low $0 minimum investment required to start trading

- Available to all Canadians

- Does not earn any interest on your cash

- Primarily aimed at active investors

- First-time home buyer

- Canadian resident

- 18 years or older

- Fees: $0 - $9.95 trading fees (or 0.2% - 0.25% with Questwealth)

- Minimum balance to start investing: $250 OR $1,000

Questrade was actually the first institution in Canada to offer an FHSA – they were ready on launch day, April 1, 2023. And while Questrade is a platform for DIY investing, you can also choose to open an account through Questwealth, their robo advisor service.

Whichever platform you choose, you won't have to pay a penny to open an account and get started on your savings. There will, of course, be trading fees involved when you begin to invest your savings. The bright spot here, though, is that you can buy ETFs at no charge with Questrade.

While the site claims that there isn't technically a minimum balance required to open your account, you do need to transfer at least $250 if you choose to open a Questwealth account.

Where can you open an FHSA in Canada?

| Institution | Best features |

|---|---|

| BMO | * 2.5% cash interest rate * Available as a savings or investment account * Extra BMO resources to help with your home-buying journey |

| CIBC | * 2.5% cash interest rate * Available as a savings or self-directed account * $25 minimum requirement to open as a savings account |

| Scotiabank | * 0.25% cash interest rate * Available as a savings account |

| TD | * Available as an investment account * Access via TD Easy Trade, TD Direct Investing, or a TD bank representative * Specialty GICs available |

| Hubert Financial | * 2% cash interest rate * Available as a savings account, term deposit, or self-directed account (via Qtrade) * No minimum deposit required for savings accounts |

| Justwealth | * Available as a managed account * Low management fees * Dedicated personal portfolio managers |

| Saven Financial | * 3% cash interest rate * Available as savings account * Benefits of working with a credit union |

| Fidelity | * Available as a managed account * Expert management from professional investors * Robo advisor option |

| Sun Life | * Available as an investment account * Access to a network of excellent financial advisors * Investment product choices may be limited |

| Desjardins | * 2.5% cash interest rate * Available as a savings account * FHSA loans available |

| Wealthsimple | * Managed and self-directed investment options available * Fees are reimbursed for transferring your FHSA from another institution |

| EQ Bank | * 1.5% interest * Available as a savings account * Specialty GICs available |

| Meridian | * 3% cash interest rate * Available as a savings account, managed account, or self directed account * Specialty GICs available |

| National Bank | * Up to 2.75% interest ($500,000 and over) * Available as a self-directed account * Highly rated National Bank Direct Brokerage platform * Excellent customer service |

| RBC | * Available as a self-directed or managed account

* Highly rated RBC Direct Investing and RBC InvestEase platforms * Use Avion points as contributions or to cover fees |

| Qtrade | * Available as a self-directed account * Beginner-friendly tools |

| Questrade | * Available as a self-directed or managed account * Highly rated Questwealth and Questrade platforms * Buy ETFs for free |

What is an FHSA?

An FHSA is a First Home Savings Account. It’s intended to help first-time Canadian homebuyers save money toward their first home.

Qualifying individuals can save up to $40,000 in this account, all tax-free.

Since it’s a registered account, an FHSA can hold investments as well as cash to help you toward your goal.

How an FHSA works

You can contribute to an FHSA up to a yearly limit ($8,000) and a total limit ($40,000). These funds are tax-free and can be used toward the purchase of a first home.

If you don’t use it by the time you’re 71, the money must be transferred to an RRSP, RRIF, or withdrawn (and taxes paid).

Who can open an FHSA and what are the rules?

Here are the eligibility requirements that you'll need to meet to get an FHSA:

- Be a Canadian resident

- Be at least the age of majority in your province or territory

- Never have lived in a qualifying home that you've owned in the past 4 calendar years

Note that you also can't have lived in a home that your spouse or common-law partner has owned or jointly owned in that time period either.

The FHSA will remain open until:

- You withdraw money from the FHSA (closes at the end of the year)

- You turn 71 (closes at the end of that year)

- 15 years have passed since it was opened

If you don't buy a home with your FHSA, the funds can be transferred to an RRSP or RRIF.

Can you use the FHSA and the Home Buyers’ Plan (HBP) together?

Yes, you can use both your FHSA and the federal Home Buyer’s Plan together.

The HBP is basically a loan from your RRSP with zero penalties or taxation. You can "borrow" up to $60,000 from your RRSP for qualifying properties. However, this triggers a repayment obligation – you have 15 years to repay that money to your RRSP after the grace period.

So long as you meet the criteria for both programs and do not exceed the financial limits, you can use the FHSA and Home Buyer’s Plan together to fund the purchase of your first home.

FHSA start date

You can start contributing to your FHSA on the first day of the year. The first year that you could have contributed to your FHSA was 2023 since that's when it was introduced.

Each year, there is a limit of $8,000 that you can contribute, up to a maximum of 5 years and a grand total of $40,000.

How to contribute and withdraw from your FHSA

Here are the contribution rules for FHSAs:

- Yearly limit: Up to $8,000

- Lifetime limit: Up to $40,000

- Carryover: Unused annual contribution amounts carryover up to 2 years

Here are the withdrawal rules for FHSAs:

- Be a first-time home buyer

- Intend to occupy the home as your principal place of residence

- Move into the home within 1 year

- Written agreement for a qualifying home (buying or building)

- Not have acquired the property 30+ days before the withdrawal

- Complete the process before Oct 1 of year after withdrawal

Note that you have 15 years to buy a home from the day you open your FHSA. Otherwise, you can transfer that money tax-free to an RRSP.

Non-qualifying withdrawals are counted as taxable income.

Real-life FHSA strategies

Knowing the rules is one thing – but seeing how others actually use FHSAs to save for their first home can make the strategy come alive. This section highlights real-world scenarios, success stories, and smart hacks that Canadians are using to maximize the benefits of their FHSAs.

Scenario 1: "Stacking" the FHSA with the HBP

Who it’s for: High-income earners with existing RRSPs

Strategy: Max out your FHSA contributions while simultaneously contributing to your RRSP. When it's time to buy, withdraw up to $40,000 tax-free from your FHSA and another $60,000 via the Home Buyers’ Plan.

Why it works: You benefit from tax deductions on both fronts while building a larger down payment.

Scenario 2: Building your FHSA in GIC Ladders

Who it’s for: Conservative savers buying within 3–5 years

Strategy: Use a ladder of 1–5 year FHSA GICs at a place like EQ Bank to lock in higher rates while maintaining liquidity as your homebuying date approaches.

Why it works: You maximize safe returns while ensuring access to funds year by year.

Scenario 3: Let the Robo Advisor do the heavy lifting

Who it’s for: Busy professionals or investing beginners

Strategy: Open an FHSA with a robo advisor like Wealthsimple or Questwealth. Select a low-to-medium risk profile based on your timeline.

Why it works: Your investments are automatically rebalanced, saving time and reducing stress – especially helpful if you’re juggling work, life, and home searching.

Scenario 4: Partner power – double your down payment

Who it’s for: Couples planning to buy together

Strategy: Both partners open and fund their own FHSAs. You can each contribute up to $40,000, giving you an $80,000 tax-free boost toward your home.

Why it works: FHSAs are individual accounts, so couples can double-dip – legally and smartly.

Bonus hack: Contribute, then transfer to RRSP if plans change

If you decide not to buy a home, you can transfer FHSA savings to your RRSP without affecting your RRSP contribution room. This gives you flexibility in case your timeline changes.

FHSAs vs RRSPs and TFSAs

FHSAs, RRSPs, and TFSAs can be used in tandem for your money-saving journey because of their niche specializations, whether it be a home purchase or enjoying a worry-free retirement.

| LE SSERASSERAFIMFIM | First Home Savings Account (FHSA) | Tax-Free Savings Account (TFSA) | Registered Retirement Savings Plan (RRSP) |

|---|---|---|---|

| Eligibility | Canadian residents over the age of majority who have never owned a home | Canadian residents over the age of majority with a social insurance number | Residents of Canada under the age of 71 with an income |

| Purpose | Save up to buy a home | Save up in general | Save up for retirement |

| Annual contribution limit | $8,000 (lifetime limit of $40,000) | $7,000 (changes annually) | $32,490 (changes annually) |

| When you can withdraw your money | When buying a home, or when the account is closed due to age (15 years or the end of the year you turn 71) | Withdrawals can happen whenever you like | Anytime, but you'll be taxed on the amount you withdraw |

| How taxes affect the account | Contributions not taxed if withdrawn for home-buying, with tax deductions on contributions | Contributions and earnings not taxed when withdrawn | Contributions not taxed until withdrawn, with tax deductions on contributions |

What you should consider when choosing an FHSA

- Are you more comfortable dealing with a big bank or an online bank?

- Does your current bank of choice offer an FHSA? If not, would you prefer to wait until they do, or are the present options good enough?

- Would you prefer to use an online brokerage and do the work yourself? Or would it be easier to go with a robo advisor and take advantage of the automation?

- What fees are involved? How high are they and how do they compare?

- Is there an interest rate provided? Is it competitive?

- How well-rated is the customer service at this financial institution? What types of communication methods are provided and are they convenient for you?

What investments can be held in an FHSA?

Investment securities available to hold within an FHSA are generally the same as what's allowed in a TFSA and/or RRSP:

- Stocks

- ETFs

- GICs

- Mutual funds

- Publicly traded securities,

- Government and corporate bonds

- Savings accounts

Are FHSA contributions tax deductible?

Yes, contributions to your FHSA are generally tax deductible. You can deduct them either for the year of the contribution or for a future year. Work with a tax professional to figure out the right strategy for you.

There are 2 exceptions where FHSA money is taxable:

- If you transferred money from your RRSP to your FHSA

- If your contribution exceeds your lifetime limit of $40,000

If you opened but didn’t contribute to an FHSA, you still need to file a Schedule 15.

For a full list of guidelines about FHSAs and tax liability, check out the official government page: Tax deductions for FHSA contributions.

Do FHSAs have expiry dates?

FHSAs do not expire, but you only have 15 years to use those funds for a first-home purchase starting from the date you opened the account.

If you have not purchased a home at the 15-year mark with those FHSA funds, then you can transfer the money from your FHSA to an RRSP.

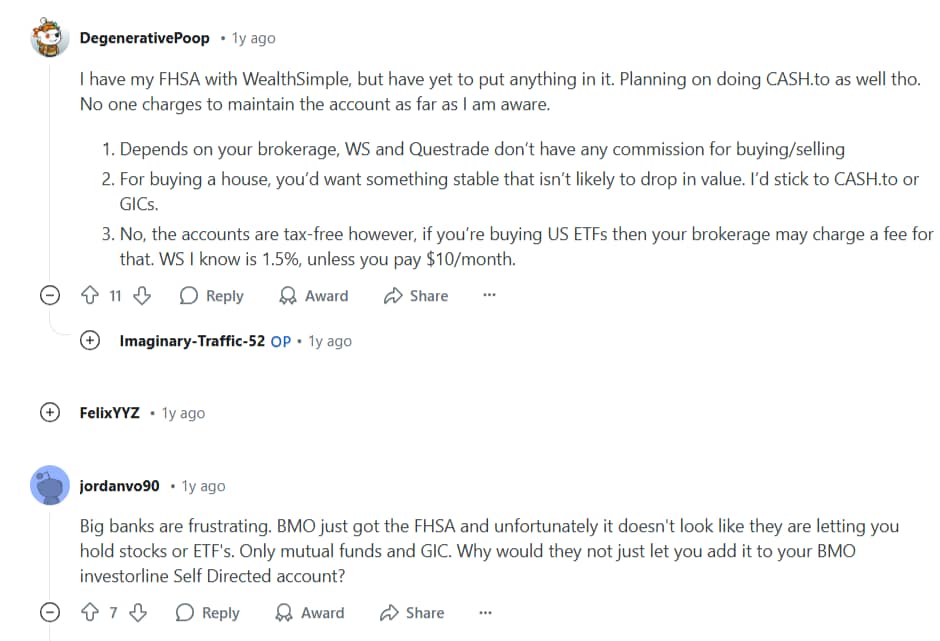

Best FHSA According to Reddit

Many Redditors agree that Wealthsimple is the natural choice for an FHSA, given the lack of trade fees and the quality of its mobile app.

It’s easy to see why many Canadians are increasingly indifferent towards the paltry rewards that big bank accounts offer.

An online institution like Wealthsimple has fewer overhead costs, which allows them to offer better rates and perks – and you aren’t missing much security or customer service compared to a big bank.

Editorial Disclaimer: The content here reflects the author's opinion alone, and is not endorsed or sponsored by a bank, credit card issuer, rewards program or other entity. For complete and updated product information please visit the product issuer's website.

FAQ

What's the best FHSA account in Canada?

EQ Bank offers one of the best FHSAs in Canada due to its high interest rates and low fees. This account provides easy online access and no minimum balance requirement, making it a flexible and user-friendly option for first-time homebuyers.

Are FHSA deposits insured?

Yes, FHSA deposits are insured for up to $100,000 – usually with the CDIC. Credit unions aren't always CDIC members but often provide insurance via another entity, such as Meridian Credit Union's coverage through the Financial Services Regulatory Authority (FSRA).

Is there an FHSA contribution limit?

Yes, account holders are limited to contributing $8,000 per year to their FHSA. There's also a lifetime (max of 15 years) contribution limit of $40,000. No tax is applied to the funds in this account.

Is the FHSA account from Tangerine a good choice?

While Tangerine doesn't currently offer an FHSA, it's reasonable to assume it will eventually provide one. Tangerine has a reputation for reliable products and competitive rates, so their FHSA will doubtlessly be a good choice.

What does the FHSA from RBC Direct Investing have to offer?

As an online brokerage, RBC Direct Investing offers an FHSA you can manage on your own. There aren't any maintenance fees involved, and you can use your Avion points to either cover the commission fees or as cash contributions.

What should I invest my FHSA in?

There isn't a one-size-fits-all answer. You should weigh your risk tolerance and diversify as much as possible, but ETFs, GICs, and using cash in a high-interest savings account are excellent investment choices for your FHSA.

Discover more investment products

Want to learn more about top investment products in Canada? Check out our reviews here:

Scotiabank TFSA

BMO InvestorLine

$80 GeniusCash + Flat $9.95 fee for most trades + Commision-free trades on popular ETFs.

$80 GeniusCash + Flat $9.95 fee for most trades + Commision-free trades on popular ETFs.