Interac e-Transfer scams occur when someone tricks an individual into giving them access to a bank account or when someone diverts an e-Transfer not meant for them into their own bank account.

You may be able to avoid this type of scam by not clicking on links in texts and/or emails from unfamiliar senders. If an offer you receive in a text or email seems too good to be true, it probably is, so be cautious.

Below, you'll find information about how these scams work, how to recognize them, and how to protect yourself while still enjoying the benefits of online banking.

Key Takeaways

- e-Transfer scams often appear legitimate and can involve fake buyers, phishing links, or intercepted payments.

- Always double-check sender details and never click links in unexpected emails or texts.

- Fraudsters may impersonate banks or businesses to trick people into entering passwords or accepting fake transfers.

- Auto-deposit settings can help prevent intercepted transfers.

- If you’ve been scammed, report it immediately to your bank and the Canadian Anti-Fraud Centre.

Can I get scammed through e-Transfer?

Unfortunately, Interac e-Transfer scams are real and increasingly common.

These scams can happen in a few different ways – fraudsters might send you a fake payment confirmation, intercept a legitimate transfer before it reaches your recipient, or impersonate someone you know.

The most common trick involves phishing emails or texts. These messages look like they’re from Interac or your bank and ask you to "accept" or "decline" a transfer. Clicking the link, however, redirects you to a fake login page designed to steal your banking information.

To avoid this, never click links contained in unexpected messages, even if they look official.

Instead, log into your bank account directly through the app or website to verify any transactions. You should also enable auto-deposit on your account whenever possible – it removes the need to answer a security question and prevents others from intercepting the funds.

Common e-Transfer scams in Canada 2025

Here are some of the most common e-Transfer scams reported in Canada right now:

- Fake buyer scams: A person buys an item you're trying to sell online and sends you payment via e-Transfer. When you open the e-Transfer, you're redirected to a fraudulent site that saves your banking username and password for the fraudster to use.

- Overpayment scams: You’re selling something online, and the "buyer" overpays via e-Transfer, and then asks for the extra to be refunded. The original e-Transfer is actually fake or is later reversed, so you don't receive any money at all.

- Phishing scams: You receive an email or text that looks like it's from your bank or another trusted institution, prompting you to click a link to deposit a payment. Clicking it leads to a spoofed website that steals your banking info.

- Intercepted transfers: If auto-deposit isn't enabled, fraudsters may guess or obtain the answer to your security question and claim the funds before the intended recipient does.

- Fake refunds or CRA scams: Scammers impersonate government agencies or businesses and send fake refunds or tax payments, prompting victims to enter personal and financial info.

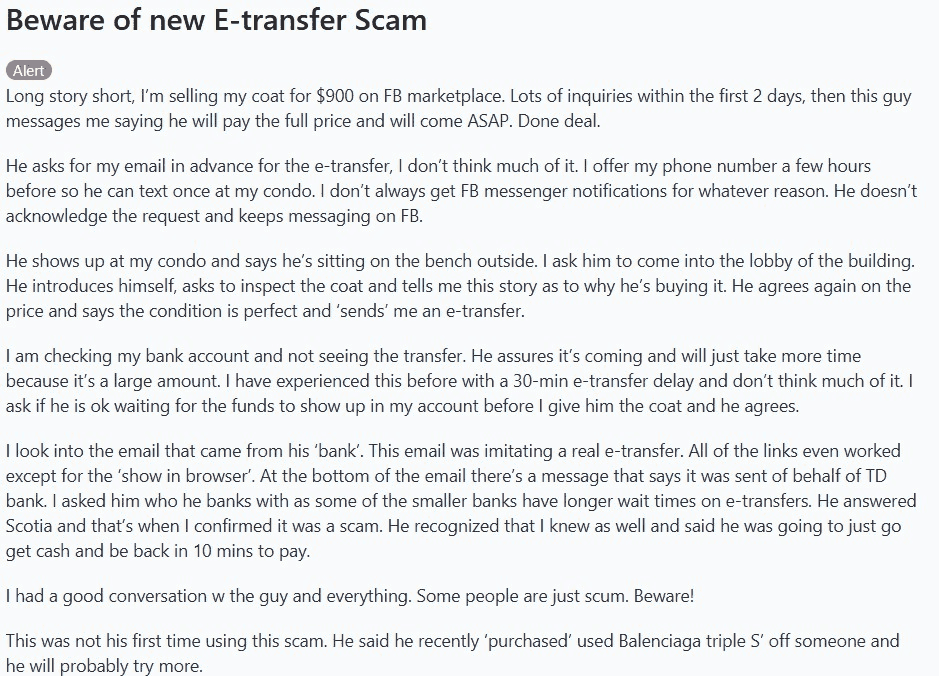

In a Reddit post on r/toronto titled "Beware of new e-Transfer Scam," a user recounted an attempted scam involving the sale of a $900 coat on Facebook Marketplace.

Similar to this Redditor's experience, the Edmonton Police Service (EPS) has issued warnings about e-Transfer scams related to online buy-and-sell platforms. The EPS received multiple reports of purchasers receiving emails resembling legitimate e-Transfers.

When these victims clicked the link to deposit the funds, they were directed to fraudulent websites that mimicked their bank's login page. Upon entering their credentials, scammers gained access to their online banking accounts.

At the time of writing, more than $6,700 has been lost to this scam.

How to spot an e-Transfer scam checklist

To ensure that you're not falling victim to an e-Transfer scam, ask yourself the following questions and take the required steps:

Is the message unexpected or too good to be true?

If someone you don’t know sends you an unexpected payment or says you’ve won a prize, it’s likely a scam. Always verify the source by contacting the sender via a trusted method, such as a phone call or a different email address.

Be extra cautious with e-Transfers that appear out of the blue, especially if they come with a sense of urgency or a request for a refund. Scammers often rely on catching people off guard.

Does the email address or phone number match?

Fraudulent e-Transfers are often sent from suspicious-looking email addresses or phone numbers that aren't what you’d expect from a bank or business.

To check this, hover over any links (without clicking) to see the URL, which should be your bank’s official website. If it still looks odd or doesn’t match the domain of the institution it claims to be from, don’t click it.

Are you being asked to click a link to accept money?

Scammers use fake Interac emails or texts to prompt victims to click phishing links. These often lead to inauthentic banking login pages designed to steal your credentials.

You should only access your bank account directly through the bank's app or secure website. And remember that if you have auto-deposit enabled, you should never have to click a link to accept funds.

Is the sender pressuring you to act fast?

Urgency is a red flag in any scam. If the sender is rushing you to refund money, complete a sale, or provide personal info quickly, it’s likely a scam.

Legitimate buyers, businesses, and banks won’t rush you into immediate action without explanation. Take your time and verify everything first.

Has payment shown up in your account?

Scammers may send fake confirmation screenshots or doctored emails to make it look like a transfer has happened.

If someone claims they’ve sent you an e-Transfer but nothing shows up in your bank account, don’t assume it’s just a delay. Log into online banking – through the bank's app or site, not through any email links – to check for pending transfers.

Did you receive a request for personal information?

Legitimate organizations won't ever ask for sensitive information via email or text. This includes social insurance numbers, passwords, credit card numbers, etc.

It's best not to share personal details through unsecured channels, no matter who asks. It leaves you vulnerable to identity theft and more.

Do banks and credit card companies refund money lost to scams?

Banks may or may not refund money lost in an e-Transfer scam, depending on the circumstances.

If you clicked a phishing link and entered your banking info, you may be considered responsible, especially if it wasn't a technical failure on the bank’s side. However, if a scam involves a compromise on the bank’s end, you may be eligible for reimbursement.

To improve your chances, report the fraud immediately. Contact your bank’s fraud department and explain the situation clearly. Most banks will investigate and may freeze your account temporarily.

If a credit card was used, you may have more protection under their fraud policies. Visit your bank's website to find their fraud reporting info, and also contact the Canadian Anti-Fraud Centre to file a report.

How to report e-Transfer scams in Canada

If you suspect you’ve been scammed through an e-Transfer, act fast to cancel any pending transfers and immediately report the incident to your bank or credit union right away. They can help secure your account and possibly prevent additional losses.

If the scam involved a business or happened through a classified ad site, you can report it to the platform (like Facebook Marketplace or Kijiji). You can also file a complaint with your local police department, especially if you lost a significant amount of money.

You may also need to contact these departments:

- Canadian Anti-Fraud Centre: Report scams online at www.antifraudcentre-centreantifraude.ca or call 1-888-495-8501.

- Local police: File a report with your local law enforcement agency.

- Your financial institution: Notify your bank or credit card company about the scam.

- Credit bureaus: Consider contacting Equifax and/or TransUnion to place fraud alerts on your credit reports.

Canadians are losing money to e-Transfer scams every year

As of March 31, 2025, the Canadian Anti-Fraud Center reports 9,092 victims of fraud so far this year, for a total loss of $165 million. In 2024, they reported 36,199 victims losing $648 million.

The Ombudsman for Banking Services and Investments (OBSI) says that the number of Canadians impacted by e-Transfer fraud in the post-pandemic years is completely unprecedented. In 2024, 68% of banking fraud cases the OBSI dealt with were related to e-Transfers and global money transfers.

Keep in mind that many scams go unreported, so the total number of Canadians affected may be even higher than these numbers imply.

FAQ

What are common e-Transfer scams?

The most common e-Transfer scams include fake buyers, phishing links, and intercepted transfers. Scammers use email and text to send even fake payment confirmations and other fraudulent messages to trick people into sending money or sharing personal banking information.

Can I get scammed through an e-Transfer auto deposit?

Interac Autodeposit does reduce the risk of getting scammed, but doesn't eliminate it. If a fraudster convinces you to refund money before the original transfer clears, you can still lose money, even with autodeposit enabled.

Can you get an e-Transfer back if scammed?

Once an e-Transfer is accepted, it’s usually irreversible, but refunds from your bank may be possible, depending on the individual circumstances. That’s why it’s important to act fast and report the fraud to your bank and the Canadian Anti-Fraud Centre.

What should I do if I receive a suspicious e-Transfer?

Most importantly, don’t click any links. Instead, log into your bank directly and check if there’s a pending transfer. If nothing shows up, it’s likely a scam, so you should report the message to your bank and delete it.

Do banks always reimburse fraud victims?

It's not common but does sometimes happen. Reimbursement depends on how the fraud occurred and whether you followed security best practices. You should always contact your bank’s fraud department right away to start an investigation.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments