Bonds vs. stocks – what are the important differences you should know if you’re thinking about investing in either of these?

Both stocks (also known as equities) and bonds are thought of as a very foundational type of investment in Canada. They’re a common option that you’ll see included in a large majority of investment portfolios.

Looking for a cheap way to invest in bonds and stocks in Canada? Check out CIBC Investor’s Edge – the cheapest online broker from a big bank.

In a nutshell, stocks are a bit more volatile (and thus often give higher return over the long term) while bonds are often used as a fixed income investment.

Here’s everything you need to know – including the pros and cons of both options.

Bonds vs. stocks: An overview

But before you can get into the differences between bonds vs. stocks, you’ll first have to understand what these types of investments are like on their own.

What is a bond?

A bond is a fixed income financial instrument that provides a percentage of interest as a return. That return is “fixed” for a period of time, which is called a maturity date.

When the maturity date arrives, the investment returns the principal as well as a specific amount of interest.

If you simplify it further, it’s best thought of as a loan between a lender (investors) and a borrower (typically the government or a corporation). The idea is that instead of going to a bank for a loan, the corporation seeks out investors to lend them the cash to grow their business.

Differences between bonds

But not all bonds are made equal.

The 2 most common ways bonds in Canada vary are:

- length of terms, typically categorized by short, medium, and long terms, and

- interest rates, with different returns as well as fixed or variable options.

Bonds also have different credit ratings assigned to them with some being riskier than others, based on who the issuer is. These ratings are given by independent rating companies (like Standard & Poor’s and Moody) and are expressed with a series of letters ranging from AAA (best) to D (worst).

The rating companies calculate the ratings based on how likely the issuer is to be able to pay back the principal and interest on time.

Be mindful of something called “junk bonds” which offer high returns but are the riskiest for investors.

The bond market

The bond market is the general term for the place to buy bonds.

Bonds are issued either by a corporation or the government, including Federal, Provincial, as well as Municipal bonds. The bond market is where both types are put up for sale.

There are 2 markets at play here when it comes to purchasing bonds:

- The first is the primary market where transactions take place between the bond issuers and the bond buyers. The only thing offered and sold here are new bonds not previously offered to the public.

- The other market is the secondary market which features bonds that have been previously sold and offered up by a reseller, such as a bond broker.

Bonds typically have a minimum buy-in. For example, the online broker Questrade allows you to purchase them commission-free with a minimum $5,000 investment.

If that high minimum deters you, it’s also possible to buy them with a much lower buy-in through ETFs and mutual funds.

What is a stock?

A stock is a financial instrument that offers partial ownership of a company. Companies issue stocks in order to raise money (similar to bonds) and they list them on a stock exchange.

So when you buy a stock, you’re basically buying a piece of that company’s pie that has been cut up into many, many slices. Along with your slice of ownership, you have basic rights – including voting rights.

Stocks can be held for the life of the company and sold at any time you choose. They’re also subject to dividends, which can be paid annually, bi-annually, quarterly, or even monthly at the company’s discretion.

Because a stock can be bought and sold at any time, the price of stocks can fluctuate sharply due to the rising or falling of demand.

The stock market

The stock market is a term for a collection of markets and exchanges where the buying, selling, and issuing of company shares takes place for publicly traded companies.

People can buy and sell pieces of companies, known as stocks or shares, through an institutional exchange. Each country typically has multiple stock exchanges or indices with publicly traded companies listed who do business within their borders.

At its core, these markets are about supply and demand of any given stock.

Want to know more about the stock market? Here’s everything new Canadian investors should know.

Bonds vs. stocks – what’s the difference?

There are notable differences between bonds and stocks, but the big similarity they share is that they’re issued in order for a company to raise capital.

Here’s how they differ…

Ownership stake vs. debt

A stock is equity in the company – which is why they’re referred to as “equities” – while a bond is a contract that is essentially an “I Owe You” to the investor.

Bonds don’t come with voting rights and aren’t as liquid, since they have a set maturity date. On the flip side, when you buy a stock in a company, you do get voting rights and can sell that stock at any time of your choosing.

Capital gain vs. fixed income

If you purchased your stock, the idea is always to sell it for more than what you paid for it. That way, you create a profit – or capital gain – for yourself.

A bond, on the other hand, generates a fixed income that the issuer agreed to pay you at the time of purchase. As noted above, you have to “hold” the bond for a fixed amount of time until it matures with the lender and the borrower fulfilling an agreement.

Risk levels

When it comes to risk, both types of investments have risk associated with them.

For stocks, it’s the price volatility that the market dictates on a day-to-day basis that makes them appear to be riskier.

But it’s important to keep in mind that bonds also have risk associated with them. Typically, the higher the bond yield, the more risk that bond carries.

In particular, there’s something called “junk bonds” which investors should be aware of. These are bonds that carry very high yields but also extreme risk. Be wary of the high interest on these. If it seems too good to be true, it likely is.

Stocks returns vs. bond yields

Now an interesting thing happens when you look at stock returns vs. bond yields over a long period of time.

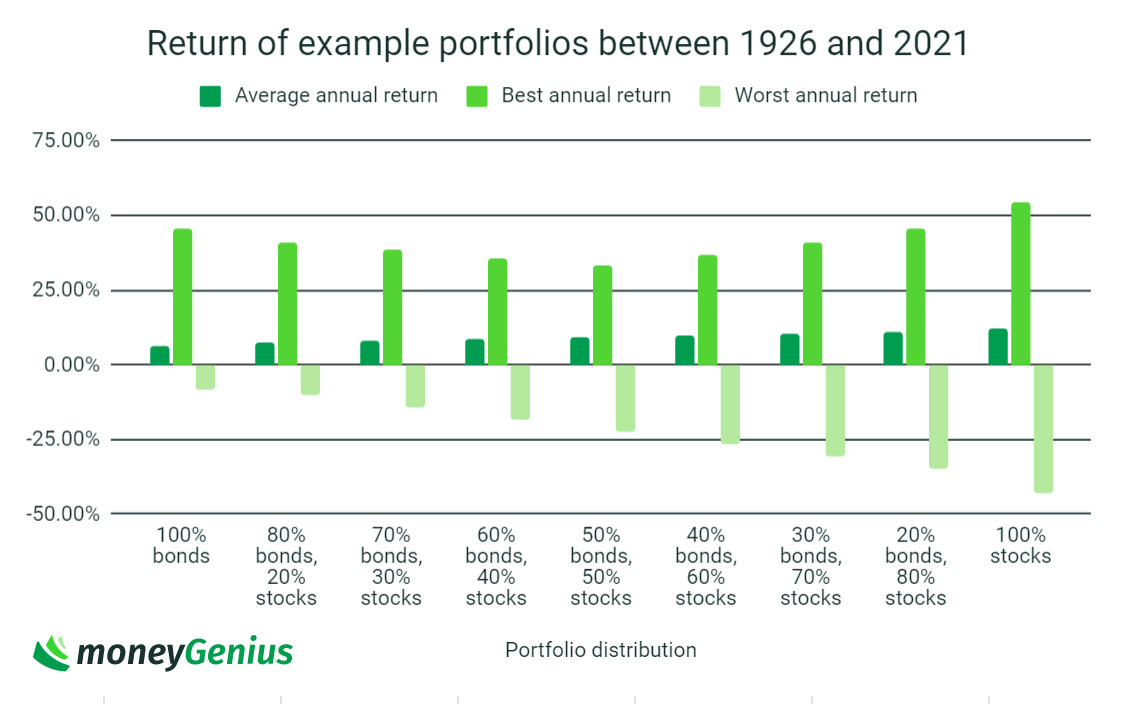

In this interesting study, Vanguard looks at the potential return of different portfolios if they were held between 1926 and 2021.

Here’s the average annual yield graphed together, plus a look at each portfolio’s best and worst annual returns were:

If you focus on the best annual returns, you can see a slight decline when there’s a more even distribution. The 2 edges of the spectrum – 100% bonds or 100% stocks – are actually pretty similar.

The biggest thing to note is that the worst annual returns get worse every time you add a higher percentage of stocks. This is a testament to the increased volatility in stocks.

Yet, if you were to just look at the average annual yield, you can also see how stocks seemed to gradually increase the return:

So while bonds weren’t a devastating blow to the return of the portfolio, stocks showed an inarguable advantage when it came to the average yield performance.

Per-share vs. built-in fees

Both types of investments have fees associated with them.

In the case of stocks, those fees are paid whenever shares of a company are purchased through your broker or online trading account. But when it comes to bonds, there are typically built-in fees on purchasing.

One thing to keep in mind with bonds is that there are often minimum purchase price points. For example, a bond can have a face value of $5,000, $25,000, or even $500,000. These higher price points are a barrier for most individual investors.

That said, you can buy bonds (and stocks) through a mutual fund or ETF, which can help you overcome the minimum purchase amount.

The pros and cons of bonds vs. stocks

The key is both types of investments have their benefits and drawbacks. It’s important to know the strength of each of these financial tools that go into a balanced and diversified portfolio.

Here’s a summary of the pros and cons:

| Bonds | Stocks | |

|---|---|---|

| Pros | * Tend to have less risk associated with them * Have a known value on maturity date * Higher claim on assets owned * Value remains as long as the company is in business | * Historically higher return on investment * Voting shares in the company * Potential dividends generating quarterly income * Can be held indefinitely as long as the company is in business * You own part of a company |

| Cons | * Historically lower return * Can be just as risky as stocks in certain situations * A maturity date means your money is locked in, not as liquid of an asset * No ownership rights * Fixed interest payment | * More risky, higher volatility * Higher volatility can lead to emotional decisions which can lose you money * Value in flux |

The pros of bonds

Let’s take a closer look at the upsides of investing in bonds.

1. Tend to be less risky

Since bonds have a set interest rate, you know exactly what you’re getting when the term matures.

Just note that this is for bonds with higher credit ratings, so look into what rating the bond has before investing. Some have very high return but extreme risk associated with them, making this pro null.

2. Maturity date and fixed interest rate

Having a fixed rate means no surprises when it comes to the interest made on your investment. This makes it easy to plan for the future value of your investments.

The pros of stocks

Now let’s take a closer look at stocks.

1. Higher rate of return

When it comes to stocks, the return on your investment tends to be higher overtime.

Choosing individual stocks or “stock picking” is a difficult task with much research needed in order to find a fair price to buy at.

That’s why ETFs and index funds can be so effective in adding stocks to your investment portfolio. They take the guesswork out of your purchase, letting you buy a variety of stocks under the banner of an ETF.

2. High liquidity

Stocks can be bought and sold freely in the market. You don’t need to hold them until a specific maturity date.

3. Stocks represent ownership

I love the idea of having ownership in some of the world’s largest and most successful companies.

In a way, having ownership and a vote within it helps you have a say (no matter how small) on the future of the economy. It’s a great place to create change when needed.

4. Some stocks pay out dividends

Though this isn’t a given for any stock you may buy, there are a lot of dividend stocks out there that can pay you some profit at set intervals.

This is a way to make money while still holding on to a stock, so you don’t constantly have to be buying and selling to see any sort of return.

The cons of bonds

Now let’s look at the flipside, starting with bonds.

1. Bonds can take many years to mature

The fact there’s a maturity date on a bond means it’s not easy to get your money out of the investment. Instead, you have to wait until the agreed upon terms of the capital loan.

This can be a bad situation if you find yourself needing money but it’s all wrapped up in a bond.

2. Bonds historically have smaller returns

When you invest your hard earned cash, you’re expecting decent returns.

But since they have less risk associated with them, they also have historically smaller returns.

The cons of stocks

There are a few fairly major downsides to investing in stocks.

1. Highly volatile

If your blood pressure is tied to the volatility of the stock market, then perhaps bonds are more your speed.

People tend to get emotional with their investments when they see negative returns, and this causes some people to buy high and sell low. Not a good scenario.

Since stocks are so liquid, the stock market fluctuates a lot. If you can’t handle waking up to a 20% loss one day without immediately panic selling…then maybe stocks aren’t your thing.

2. No guaranteed return

Unlike bonds, there is no guaranteed return when you’re investing in stocks. You buy it for a certain price, and that price can fluctuate throughout the day as long as the stock market is open. There’s no maturity date with a set amount of interest attached.

That means there’s a lot more research that should go into stocks at all parts of the process, whether you’re buying, holding, or selling them. Knowing when the best time to buy or sell is paramount to maximizing your profits, and it depends on a lot of complicated factors that some people dedicate their lives to analyzing.

How to buy bonds and stocks

There are multiple ways to buy bonds and stocks in Canada, including:

- through an online broker,

- indirectly through various ETFs and mutual funds, and

- through your financial advisor.

The best way to purchase stocks and bonds in Canada, in my opinion, is through an online broker. They typically offer the lowest fees when purchasing, plus you have the option to buy ETFs which hold a variety of bonds and stocks.

Generally speaking, there are 2 types of online brokers to choose from in Canada, so let’s look at your best options for each.

Best online broker from a big bank

The online brokers you’ve most likely already heard about are the ones offered by the various big banks in Canada. These are usually a bit expensive, but do offer a large suite of investment tools and resources – all backed by a big name that you trust.

The best of these big bank online brokers is CIBC Investor’s Edge, which offers the cheapest rates from the bunch. You’ll be able to buy stocks for $6.95 per trade (as opposed to the typical $9.99 price tag).

When it comes to bonds, the fee is included in the price or yield.

Learn more about this online broker here:

This online investment brokerage is owned and run by CIBC, and is targeted towards people who are interested in managing their own investments, learning about how to manage their own investments, and people who do investment management for a living. With relatively low fees for trades, and discounts for students and active traders, this is a service worth looking into.

- Get 100 free online equity trades with code EDGE2526

- No minimum investment required

- Lower than average fees per trade

- Discount on trade fees for students and young adults

- Discount on trade fees for active traders

- Seems to be designed for regular people, not just the ultra rich

- Per transaction fees can add up quickly

- Ages 18 - 24 trade for free

- Free investment research tools

- Extended trading hours

- TFSA

- RRSP

- RESP

- RRIF

- LRSP

- PRIF

- LIRA

- LRIF

- Cash

- Margin

- Corporate

- Partnership

- Formal trust

- Investment club

- Estate

- FHSA

- Stocks

- ETFs

- Options

- Mutual Funds

- GICs

- Fixed Income

- Precious Metals

- Structured Notes

- IPOs

- CDRs

Best discount online broker

But if you’d rather save the most amount of money possible, going with an independent online broker can usually net you some pretty impressive fees.

Questrade is one of your best options for this (they even let you buy ETFs for free). When it comes to stocks, you’ll be able to buy at a cost of 1 cent per share (with a minimum of $4.95 and maximum of $9.95).

As for bonds, they don’t list a price but do stipulate that they have a minimum of $5,000 per purchase.

You can learn more here:

Questrade is one of Canada's top online investment platforms. With very low fees, including no-fee ETF trading, commission-free stock trades, and plenty of investment types, Questrade just about covers it all.

- Total transparency with fees

- Surprisingly low fees

- Lots of investment accounts and product choices

- Options for Socially Responsible Investing (SRI)

- Plenty of convenient methods for support

- Limited amount of time to report fraud for full reimbursement

- Trading research is limited

- Excellent array of investing and trading tools

- Trade ETFs for $0

- Commission-free stock trades

- TFSA

- RRSP

- Spousal RRSP

- LIRA

- Locked-In RRSP

- RIF

- LIF

- RESP

- Family RESP

- Corporate

- Investment Club

- Partnership

- Sole Proprietorship

- Individual Informal Trust

- Joint Informal Trust

- Formal Trust

- Individual Margin

- Joint Margin

- Individual Forex & CFDs

- Joint Forex & CFDs

- FHSA

- Stocks

- ETFs

- Options

- FX

- IPOs

- CFDs

- Mutual Funds

- Bonds

- GICs

- International Equities

- Precious Metals

Want to see more online brokers? See our major comparison article here.

What do you think of the bonds vs. stocks debate?

Are you thinking of purchasing bonds or stocks in the near future?

What kind of balance of stocks and bonds do you find most rewarding to have?

How often are you rebalancing your portfolio to meet your goals?

Let us know in the comments below.

FAQ

What’s a bond?

A bond is a loan between a lender (investors) and a borrower (typically the government or a corporation). They have a specific set interest rate and maturity date when both the investment and interest are due to the investor. This is when you’ll receive your return. Learn more about bonds here.

What’s a stock?

A stock offers partial ownership of a company that can be sold at any time you choose. Learn more about stocks here.

What are the key differences between bonds and stocks?

Bonds are typically less risky and offer little volatility and a promised maturity date. On the other hand, stocks are highly liquid and subject to moments of volatility. Learn more about the differences here.

Should I invest in stocks or bonds?

This is a personal question, one worth the research, but for most people both stocks and bonds are worth owning in a well-balanced diversified financial portfolio.

How do I invest in stocks or bonds?

You can buy stocks and bonds through an online broker (either an independent one or through your bank), your financial advisor, or indirectly through funds like ETFs or mutual funds. Using an online broker gives you the most control over what you’re buying, and you can see your 2 best options here.

Leave a comment

Comments