There are plenty of details to consider when looking at mutual fund investments, but what about the management fee vs. MER? What’s the difference and why does it matter?

Management fees and the management expense ratio (MER) are 2 significant fees that investment companies charge and must disclose to their clients. However, it’s up to the client to factor them into their investment decisions.

Some investors assume that the management fee and the MER are the same, but this isn’t actually true. The MER includes the management fee, but it’s only one – albeit the most significant – of the expenses included within.

Considering the impact of these fees is an important step to take when looking at adding mutual funds to your portfolio. Let’s take a deeper look at what these fees entail.

Defining management fee vs. MER

Mutual funds as investments are a solid choice. After all, what could be better than an investment that doesn’t require a lot of cash, is diversified, and is managed for you?

But you’ve got to consider the fees when determining whether a specific mutual fund is truly a good investment choice for you. And to consider these properly, you have to know what they are and what they’re for.

What is a management fee?

Investment professionals manage mutual funds. Each fund will have a management style, such as an actively managed fund that tries to beat the market returns or a dividend fund that focuses on investing in dividend-paying companies.

A mutual fund’s management fee pays for the services of the mutual fund’s manager or managers and any other expenses that may need to be paid due to managing the investment, such as:

- the hiring of fund managers,

- portfolio management services, and

- hiring other companies for assistance with investment decisions.

Depending on the fund’s management style, a fund generally will charge between 1% – 3% of its assets under management (AUM) as a management fee. A more actively managed fund will have charges leaning towards the high end, while a passively managed fund – like an index fund – will charge less.

What’s an MER and how is it different?

The MER is different from the management fee because it includes associated operating costs for the mutual fund, including the management fee. The MER covers expenses like:

- management fees,

- accounting costs,

- administrative costs,

- marketing fees,

- legal costs,

- audit fees, and

- taxes.

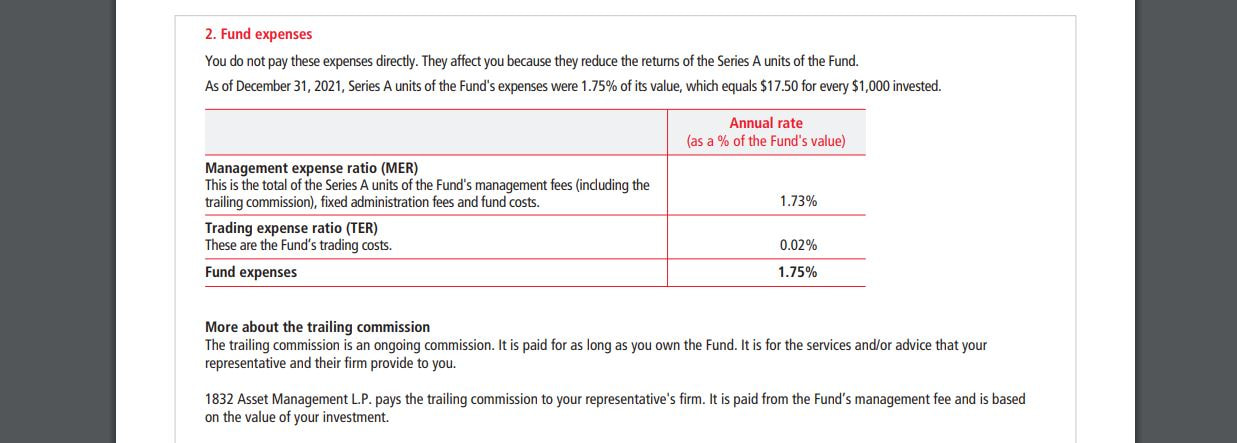

Example MER

As an example, let’s look at the MER for the Scotia Canadian Dividend Class A fund.

This fund has an MER of 1.73% and added to the MER is an additional charge of 0.02% for the fund’s trading expense ratio (TER). Therefore, the cost of this fund to the investor is 1.75%.

So, if you have $10,000 invested, you’ll pay an MER plus TER of $175.00.

The MER for the Scotia Canadian Dividend Fund breaks down like this:

- Trailing commission: 0% – 1.1%

- Fixed administration fee: 0.06%

- Management fee: 1.5%

The fund may or may not pay trailing commissions (which pays the advisor for their advice and services to you, the investor), which is why the trailing commission can range from 0% – 1.1%. This is paid out of the management fees, and the trading expense ratio is the fund’s trading costs.

As an investor, you pay the MER – which includes the management fee – annually for as long as you own the investment, whether or not you make money from the investment.

How management fees vs. MER affect your return

Typically, the management fee makes up the lion’s share of the MER. The higher the management fee, the higher the MER.

However, a high management fee isn’t necessarily a bad thing. Management fees are higher with actively managed funds since your portfolio managers will be actively managing your fund to accomplish one or more goals specific to your fund.

For example, your fund may be actively managed to:

- beat the market returns,

- balance a portfolio, or

- follow particular investment parameters such as ethical investing.

If your fund manager’s goal is to beat average market returns, they will need to perform a lot of research and analysis to accomplish this objective. The intention is that higher returns offset the higher MER.

Research has shown, however, that most actively managed funds don’t actually beat the market. Once you factor in the MER, you may find your actively managed fund has lagged behind the market in performance.

On the other hand, passively managed funds are designed to match the returns of an index. The manager will structure the fund to have the same investments in the same weightings as the index in question. Active management isn’t needed, so the management fee and MER are typically low.

The downside of these investments is that your performance will be the same as the index, which can be pretty volatile.

How much do MER and management fees REALLY cost you?

It’s not always easy to see how much you spend on mutual fund fees. Companies are required to disclose them, but they often bury them in your statements.

So while investors often look to see how much their investment has grown (or declined) and the rate of return, if they don’t go through their entire statement, they may miss how much they’ve paid.

A few examples

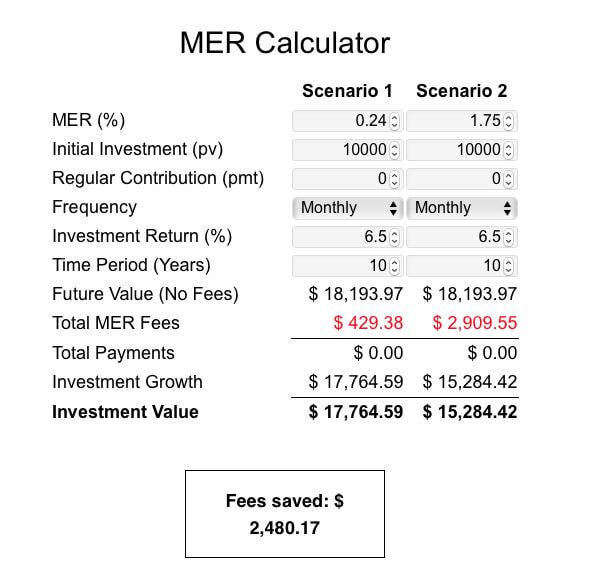

Here, we compare 2 funds. Both have initial investments of $10,000 with no additional contributions and an identical 6.5% rate of return. The time frame is 10 years.

The only difference between these is that the fund in the first scenario is an ETF with an MER of 0.24%, and the fund in the second scenario is a mutual fund with an MER of 1.75%.

Both funds earned the same return, but the one with the higher MER left the investor with $2,480.17 less than the one with the lower MER.

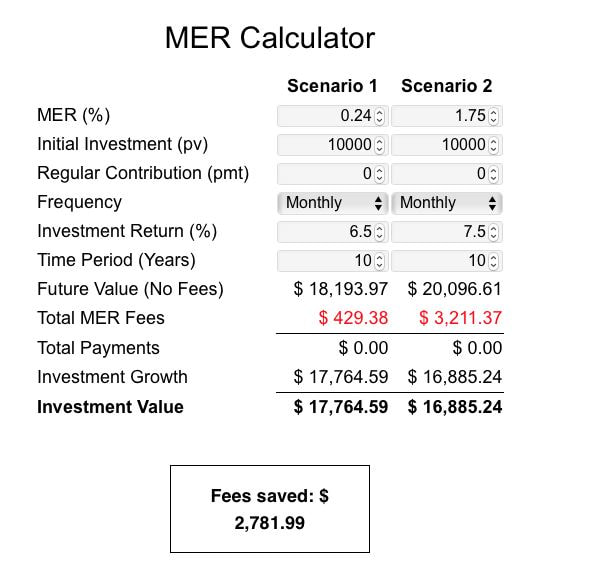

In our next scenario, the fund with the higher MER generated a return of 1% more than the fund with the lower MER.

But despite this fact, the investor who paid the higher MER still had less money in the end.

You can also see that the investment with the higher return paid significantly more in fees than the other. This is because the MER is charged on the value of the investment, so the higher the amount of the investment, the higher the fee.

Average management fee vs. MER

First of all, it’s important to remember that a fund’s MER includes the management fee. If you pay an MER, you’re paying a management fee – it’s just not billed separately.

Investors might be surprised to know that Canada has some of the world’s highest fees for mutual funds. Average management fees in Canada typically range from 1% to 3%.

In 2018, the median MER for an equity fund in Canada was 1.98%, while the median MER for a bond fund in Canada was 0.99%, and asset allocation funds had a median MER of 1.94%.

As we’ve seen, these fees take a huge bite out of your returns, leaving you with less while the mutual fund companies make higher profits. Adding insult to injury, you pay the fees regardless of whether your investment makes or loses money.

But you can end up with 30% more in your investment accounts simply by lowering your costs.

It makes sense to keep your fees as low as possible. If you’re researching new investment opportunities or reviewing your investments, pay attention to the MER.

Here’s what you should aim for:

- Mutual funds: MER below 1%

- ETF: MER below 0.75%

2 ways you can lower MER and management fees

As we all know, even the smallest, most pesky fees can really add up. Big banks tend to have higher MERs on the mutual funds they offer, and Canadians pay some of the highest investment fees in the world.

But the point of investing is to grow your nest egg, not to pay fees continually, right?

So, how do you avoid them? There are 2 handy methods for avoiding fees: use a discount broker or a robo advisor. These solutions allow you to purchase mutual funds and ETFs without trailer commissions.

Trailer commissions are included in the management fee – and they make up a large chunk of it too.

The Scotia Dividend Fund example we used has a trailing commission fee of up to 1.1%. Naturally, eliminating this fee would mean more money in your pocket.

Use a discount broker for lower fees

A discount or online broker is an online trading platform that allows you to choose and buy your investments directly, with no salesperson involved. Overall, discount brokers usually charge lower management fees and commissions, plus they provide access to various research tools.

You can use a discount broker to research investments that don’t have trailer commissions, and then can purchase mutual funds, ETFs, etc., without worrying about these fees.

You can open just about any type of investment account with a discount broker, including these popular choices:

- RRSPs,

- RESPs,

- TFSAs,

- LIRAs,

- LIFs, and

- RIFs.

One popular Canadian online broker is Questrade. They boast some of the lowest fees in the business and are completely upfront and transparent about everything they charge for.

Questrade is one of Canada's top online investment platforms. With very low fees, including no-fee ETF trading, commission-free stock trades, and plenty of investment types, Questrade just about covers it all.

- Total transparency with fees

- Surprisingly low fees

- Lots of investment accounts and product choices

- Options for Socially Responsible Investing (SRI)

- Plenty of convenient methods for support

- Limited amount of time to report fraud for full reimbursement

- Trading research is limited

- Excellent array of investing and trading tools

- Trade ETFs for $0

- Commission-free stock trades

- TFSA

- RRSP

- Spousal RRSP

- LIRA

- Locked-In RRSP

- RIF

- LIF

- RESP

- Family RESP

- Corporate

- Investment Club

- Partnership

- Sole Proprietorship

- Individual Informal Trust

- Joint Informal Trust

- Formal Trust

- Individual Margin

- Joint Margin

- Individual Forex & CFDs

- Joint Forex & CFDs

- FHSA

- Stocks

- ETFs

- Options

- FX

- IPOs

- CFDs

- Mutual Funds

- Bonds

- GICs

- International Equities

- Precious Metals

Use a robo advisor

If you’d like to save even more investment fees, another option is to use a robo advisor – digital platforms that automate your investments through sophisticated algorithms.

You’ll answer a few questions regarding your risk tolerance, and once you fund your investment account, the robo advisor will invest your money in suitable investments.

There’s a long list of benefits to robo advisors, including these:

- The algorithm selects your investments and rebalances your portfolio, so it’s completely hands-off investing for you.

- The fees are much lower, in part because there aren’t any brick-and-mortar branches nor as many physical employees to pay for.

- Since most investments are in ETFs and passively managed funds, MERs are low.

- Your investment portfolio is designed with your risk tolerance, financial goals, and interests in mind.

Investors looking for a robo advisor will find a platform like Wealthsimple Invest a simple and convenient option for a low-fee, low-maintenance investment strategy. No minimum balance is required to get started, and there are no commissions for trading.

Wealthsimple managed investing is a robo advising investment platform from one of Canada's favourite online brokerages, Wealthsimple. It offers a hands-off investment experience with no paperwork and no account minimums – a huge draw for anyone who's new to the world of investing or simply trying to make smart choices with minimal funds.

- Easy to understand fees

- The set-and-forget-it simplicity

- A good array of account types that can grow with you

- Extraordinary security for your money and accounts

- Grow into Wealthsimple Premium

- Socially responsible and Halal investment options available

- New user offer

- Higher account management fees

- Limited tools

- Talking to a human can be tricky

- Provides socially responsible and Halal investment options

- Can connect your account to Mint for easy budgeting

- Get a dedicated team of advisors if you have more than $500,000 in assets

- RRSP

- TFSA

- Personal

- RESP

- RRIF

- LIRA

- Joint

- Business

- FHSA

So why does the difference between a management fee vs. MER matter?

Fees are money and investors want to know where every one of their dollars goes. Understanding the difference between these 2 fee structures will help you grasp the impact of these fees on your returns.

Do you know what the MERs on your investments are? Is the management fee something you consider before choosing a particular investment?

We enjoy reading our readers’ thoughts and suggestions, so feel free to leave us a note in the comment section below.

FAQ

What’s a management expense ratio?

A management expense ratio (MER) is an ongoing cost charged to manage the fund. The MER includes the management fee, operating expenses, trailing commissions, and sometimes taxes as well. In addition to the MER, a trading expense ratio (TER) may be added to compensate for fees incurred when trades are made.

What is an MER fee?

The MER fee is the management expense ratio, which is, essentially, the cost the investor pays for owning the fund. It is an ongoing annual fee that the investor pays whether the fund makes money or loses money. You’ll find more information here on how these fees affect your returns.

What is the difference between a management fee vs. MER?

A management fee is one part of the MER that covers costs related to managing the fund. This can include hiring portfolio managers, hiring other companies to assist in managing the fund, and paying trailing commissions to advisors who sell the fund. The MER incorporates the management fee and additional costs such as administration, legal expenses, accounting, and taxes. Read here for information on the average amount these fees can run.

Are investment management fees tax deductible in Canada?

MERs are not tax deductible in Canada if they are included with your mutual funds or ETFs. This is because, as an investor, you’re not paying the fees directly but are instead paying a fee to the fund as an MER. However, if you have an advisor taking care of your investments and you pay them a fee directly, this can be deducted as carrying charges.

What’s a good management fee and MER in Canada?

A good management fee and MER depends on your investment type. A good MER for a mutual fund would be below 1% and a good MER for an ETF is anything below 0.75%. Keep in mind, though, that a higher MER can sometimes be worth it if you want a more actively managed investment.

Leave a comment

Comments