When looking at the best dividend stocks in Canada, you’ll see a list of options that provide consistent performance, growth potential, and unwavering commitment to shareholder profits.

Exploring various sectors, including finance, energy, and telecommunications, we uncover hidden gems that can bolster any dividend portfolio. These stocks have the potential to become cornerstones of your investment portfolio as they reward your hard-earned investment dollars with stability and growth.

Of course, we can’t choose the best dividend stocks for you. But the information we share here can provide a place to start as you look around for the perfect fit.

Key Takeaways

- The best dividend stocks in Canada are from a range of sectors, including finance, energy, and telecommunications.

- When choosing the right dividend stock for your portfolio, you should thoroughly research your options and ensure they yield consistent payouts.

- Make sure your chosen dividend stocks add diversification to your portfolio and support your ethical and moral views.

The 10 best dividend stocks in Canada

We scoured the internet and compiled a list of the top 10 dividend stocks that financial experts recommended, taking into consideration the dividend yield, price-to-earnings ratio, and more. However, it’s important that you do your own research to make sure these stocks fit within your portfolio and investment goals. Treat this as a helpful jumping off point.

| Stock | Ticker | Dividend Yield | Market Cap | P/E | Next Payout |

|---|---|---|---|---|---|

| Bank of Nova Scotia | BNS | 6.57% | $76.963 billion | 9.63 | July 3, 2023 |

| CIBC | CM | 6.01% | $51.937 billion | 10.9 | June 26, 2023 |

| Enbridge | ENB | 7.3% | $98.44 billion | 41.2 | August 15, 2023 |

| BCE Inc. | BCE | 6.52% | $54.118 billion | 21.11 | August 2, 2023 |

| Canadian Natural Resources Limited | CNQ | 5% | $79.368 billion | 8.5 | July 04, 2023 |

| Canadian Utilities | CU | 5.13% | $9.411 billion | 15.2 | September 9, 2023 |

| Great-West Lifeco Inc. | GWO | 5.49% | $35.303 billion | 11.61 | June 29, 2023 |

| Imperial Oil LTD. | IMO | 3.04% | $38.391 billion | 5.53 | June 30, 2023 |

| Telus Corp | T | 5.71% | $36.64 billion | 24.8 | July 4, 2023 |

| Toronto-Dominion Bank | TD | 4.73% | $145.855 billion | 10.08 | Jul 6, 2023 |

Please note: Due to the volatile nature of the stock market, the numbers above are likely to change from day-to-day. These are accurate as of June 22, 2023, but please check your investment tools for the most up-to-date information.

Want an easy way to buy and sell dividend stocks?

Check out our reviews of Canada’s top online brokers:

1. Bank of Nova Scotia (BNS)

- Industry: Major banks

- Market cap: $76.963 billion

- PE Ratio: 9.63

- Dividend Yield: 6.57%

BNS is the ticker for the Bank of Nova Scotia stock on the Toronto Stock Exchange. One of the Big 5 banks in Canada, the Bank of Nova Scotia – or, as it’s better known, Scotiabank – provides banking services to Canadians, as well as internationally. It employs over 101,000 people with headquarters in Toronto, Ontario.

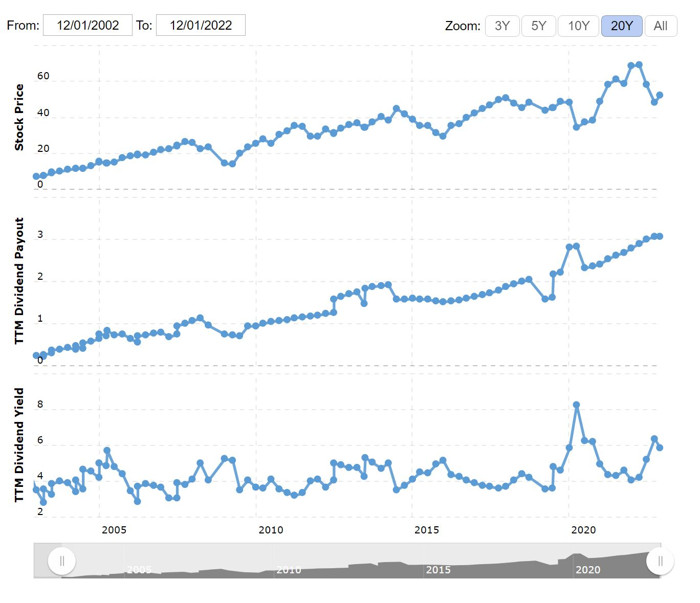

Below is the stock’s dividend history.

For more information, see Bank Of Nova Scotia – 20 Year Dividend History.

2. Canadian Imperial Bank of Commerce (CM)

- Industry: Major banks

- Market cap: $51.937 billion

- PE Ratio: 10.9

- Dividend Yield: 6.01%

The CIBC stock, another Big 5 bank, deals with financial products in both the personal and business sectors. They offer everything from savings and chequing accounts, to mortgages and credit cards. They currently employ about 45,000 people, with their headquarters in Toronto, Ontario.

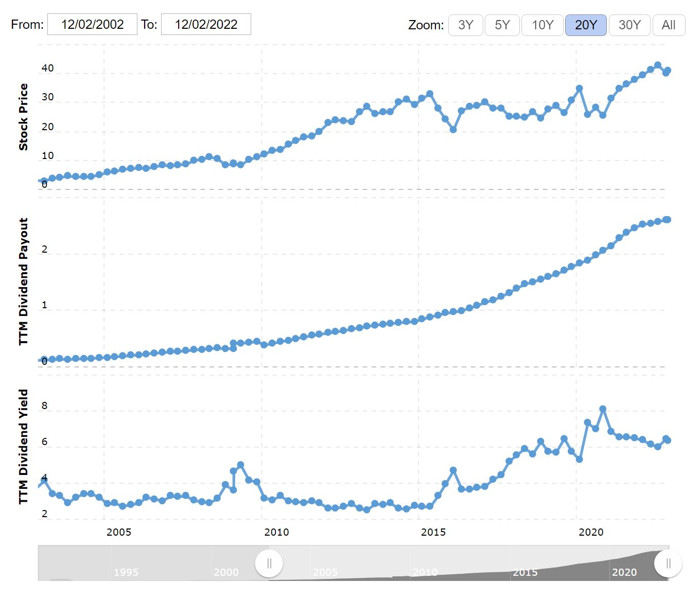

You can see their dividend history below:

To learn more, see Canadian Imperial Bank Of Commerce – 25 Year Dividend History.

3. Enbridge (ENB)

- Industry: Oil & Gas Pipelines

- Market cap: $98.44 billion

- PE Ratio: 41.2

- Dividend Yield: 7.3%

Operating in the industrial services sector, Enbridge is a gas and oil company based in Calgary, Alberta. With over 11,000 employees, the energy company mostly serves Canada and the United States.

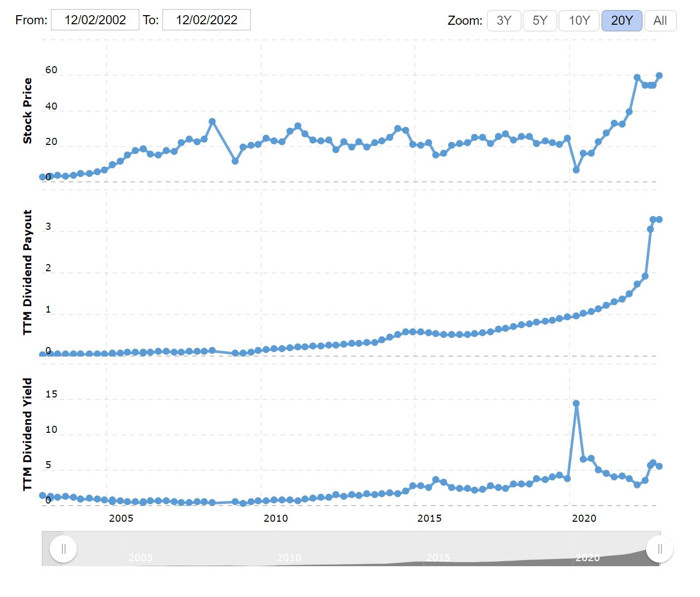

They’ve had a pretty steady dividend payout growth over the last 10 years, as you can see in the chart below.

To see more, check out Enbridge Inc – 32 Year Dividend History.

4. BCE Inc. (BCE)

- Industry: Major telecommunications

- Market cap: $54.118 billion

- PE Ratio: 21.11

- Dividend Yield: 6.52%

BCE Inc. is a telecommunications company perhaps better known by its former name – Bell Canada Enterprises. With subsidiaries like Bell Canada and The Source, you’ve probably heard of the company before. They provide phone and internet services to Canadians, among other things.

They had an interesting peak around the turn of the century, but have remained relatively flat since.

To learn more, see BCE – 35 Year Dividend History.

5. Canadian Natural Resources Limited (CNQ)

- Industry: Oil & Gas Production

- Market cap: $79.368 billion

- PE Ratio: 8.5

- Dividend Yield: 5%

Headquartered in Calgary, Canadian Natural Resources is another energy company, focusing on petroleum and natural gas. With over 10,000 employees, they also explore and develop crude oil, mostly in western Canada as well as a few more international locations.

Their dividend payouts have been rising relatively steadily throughout their 17 year history, with a recent rise and fall reflective of the unsteady market.

To learn more, see Canadian Natural Resources – 21 Year Dividend History.

6. Canadian Utilities (CU)

- Industry: Electric utilities

- Market cap: $9.411 billion

- PE Ratio: 15.2

- Dividend Yield: 5.13%

Part of the utilities sector, Canadian Utilities focuses on electricity and natural gas, both globally and in Canada.

Unfortunately, MacroTrends does not track the CU stock, so we were unable to find an interactive graph showing their dividend history.

For more information, see CU Stock Price And Chart.

7. Great-West Lifeco (GWO)

- Industry: Life/Health insurance

- Market cap: $35.303 billion

- PE Ratio: 11.61

- Dividend Yield: 5.49%

The first (and only) insurance stock on our list, Great-West Lifeco offers life and health insurance to Canadians (as well as Americans, Europeans, and to people in Asia). Despite their global reach, they’re headquartered here at home, in Winnipeg.

Like Canadian Utilities, GWO was not listed on MacroTrends, so we couldn’t find an interactive graph for their dividend history. For more information, you can check out GWO Stock Price and More.

Want an easy approach to investing? Check out the best robo advisors in Canada.

8. Imperial Oil Ltd. (IMO)

- Industry: Integrated oil

- Market cap: $38.391 billion

- PE Ratio: 5.53

- Dividend Yield: 3.04%

Imperial Oil is an oil company owned by ExxonMobil and headquartered in Calgary, Alberta.

Below you can see their dividend history:

Learn more here: Imperial Oil – 35 Year Dividend History.

9. Telus Corp (T)

- Industry: Major telecommunications

- Market cap: $36.64 billion

- PE Ratio: 24.8

- Dividend Yield: 5.71%

Telus is a telecommunications company that goes under the ticker T on the Toronto Stock Exchange (not to be confused with the TU stock). Its subsidiaries include AT&T Mobility and they’re headquartered in Vancouver, British Columbia.

MacroTrends did not have dividend history data, but you can find more information here: T Stock Price and Chart.

10. Toronto-Dominion Bank (TD)

- Industry: Major banks

- Market cap: $145.855 billion

- PE Ratio: 10.08

- Dividend Yield: 4.73%

The 3rd Canadian big bank to make our list, the TD stock has a good dividend history and a huge market cap to back it up. Operating in the banking sector, they have a foothold in both Canada and the United States.

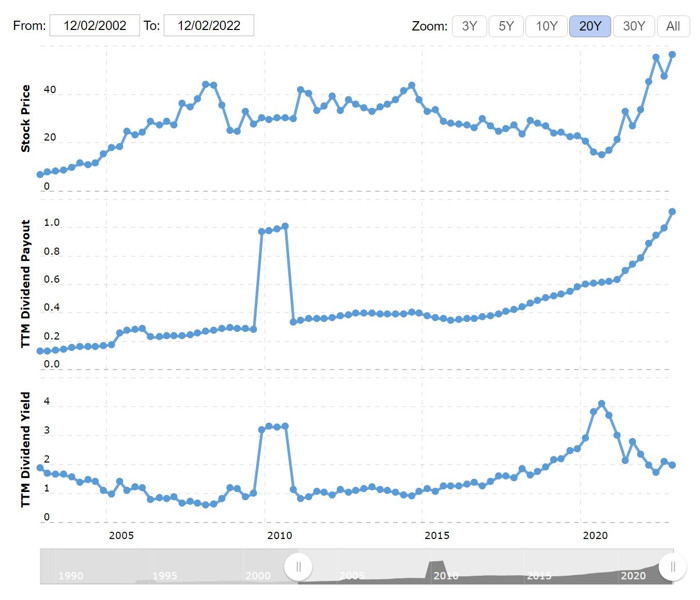

Check out the TD stock dividend history, snapshotted in the screenshot below.

See more here: Toronto Dominion Bank – 26 Year Dividend History.

How to choose the best dividend stocks in Canada

Really, when choosing the right dividend stocks for you, the most important thing is to do your research before making an investment decision. Know what’s out there, know what you need in your portfolio, and go with the one that suits you best.

There are some key factors to keep in mind before making any investment decisions. Make sure the stocks you choose add diversity to your portfolio, support your ethical considerations, and provide consistent yields.

Let’s look at these concerns in a bit more detail.

1. The best dividend stocks in Canada should be consistent

Though the dividend yield and payout are certainly attractive features of a dividend stock, the main thing you should be looking for is consistency.

Like all investing, picking stocks comes with some degree of risk. No matter how promising a company is, there’s no guarantee they won’t go out of business tomorrow, or cut their dividends for that matter.

So looking at the history of a company is a great place to start when picking stocks. Generally you’ll want to aim for a company that has consistently been increasing their payout, without making major cuts, or having too much volatility.

The longer your investment horizon, the better it is to focus on consistency and potential for growth over current yield.

Wondering what happens to your investments if a company goes under? Click here to learn about your CIPF coverage.

2. They should help diversify your portfolio

Making sure your investment portfolio covers a lot of ground may be a basic tip, but it’s still something to keep in mind.

It’s a good idea to buy stocks in several different sectors and industries in order to spread your money around, decreasing your overall risk.

For example, if for some reason the majority of your stocks were in the energy sector, your overall return would be in for a serious shock if the overall value of energy investments were to dip. But if you had your investments in a number of different sectors, this event would be like a blip on your radar (rather than feel like a near catastrophe).

3. Dividend stocks can support your ethical considerations

If you care a lot about where your money is going, looking into the company you’re thinking of buying a stock for is a good idea. After all, if you don’t support pipelines, you may not want to invest in a company that produces those pipelines.

This is also true for people who want halal investment opportunities or other socially responsible investments, like green energy stocks.

How to invest in dividend stocks

Once you have an idea of which dividend stocks you’d like to start with, the next question is how you should actually buy them. Assuming that you prefer to choose individual stocks (hence why you’re reading this article), going with a financial advisor or a DIY online broker may be your best bet.

When it comes to online brokers, your best option in Canada is CIBC Investor's Edge. Not only is it backed by a name you can trust (one of the biggest banks in Canada), it also has some of the best commission rates.

Learn more here:

This online investment brokerage is owned and run by CIBC, and is targeted towards people who are interested in managing their own investments, learning about how to manage their own investments, and people who do investment management for a living. With relatively low fees for trades, and discounts for students and active traders, this is a service worth looking into.

- Get 100 free online equity trades with code EDGE2526

- No minimum investment required

- Lower than average fees per trade

- Discount on trade fees for students and young adults

- Discount on trade fees for active traders

- Seems to be designed for regular people, not just the ultra rich

- Per transaction fees can add up quickly

- Ages 18 - 24 trade for free

- Free investment research tools

- Extended trading hours

- TFSA

- RRSP

- RESP

- RRIF

- LRSP

- PRIF

- LIRA

- LRIF

- Cash

- Margin

- Corporate

- Partnership

- Formal trust

- Investment club

- Estate

- FHSA

- Stocks

- ETFs

- Options

- Mutual Funds

- GICs

- Fixed Income

- Precious Metals

- Structured Notes

- IPOs

- CDRs

If you’re okay with trading the household name for a little more savings, then Qtrade is your next best option. You can buy and sell over 100 ETFs for no commission fees, plus the rest of your trades are at a lower price than average.

Learn more here:

Looking to take your investments into your own hands? Qtrade Direct InvestingTM is a discount online broker that offers top-of-the-line portfolio analytics tools and a robust trading platform designed for new and experienced DIY investors. All Stocks, ETFs, and Mutual Funds are now commission-free.

- $0 commission on ETFs, mutual funds and more

- Fund your new account and get a $80 GeniusCash bonus

- No quarterly administration fee

- Earn up to $5,000 in cashback

- Excellent mobile app

- Educational tools

- Options Lab

- Get up to $5,000 cash when you open new accounts

- Some activities still carry fees

$80 GeniusCash + Up to $5,000 in cashback + $0 trade commissions for all clients

$80 GeniusCash + Up to $5,000 in cashback + $0 trade commissions for all clients

- $0 commission trades on mutual funds, equities, ETFs and more

- Trial account available

- Second-to-none portfolio analytics tools (including scoring against key ESG components)

- Pre-market and after-hours trading available for US markets

- $0 quarterly administration fee

- Cash

- TFSA

- RRSP

- Spousal RRSP

- LIRA

- RIF

- LIF

- RESP

- Margin

- FHSA

- LRSP

- Corporate

- Formal Trust

- Informal Trust

- Investment Club

- Estate

- Stocks

- ETFs

- Mutual Funds

- Bonds

- New Issues

- GICs

- Options

FAQ

What are dividend stocks?

Dividends are a payment made by a company to its shareholders. If you hold a dividend stock, you’ll be paid a portion of the company’s earnings every time they distribute, which is usually once per quarter.

What Canadian stocks pay the best dividends?

The best dividend stock depends on what you’re looking for in an investment. Though you could just go for high dividend stocks, the amount a stock yields isn’t the only detail to consider. You should consider yield consistency as well.

How do I know which dividend stock is best for me?

There are 3 main questions to ask yourself when choosing a dividend stock. Does it have a consistent history of dividend payout growth? Does it introduce diversification into my portfolio? Does the company align with my ethical and moral views?

How do I buy dividend stocks in Canada?

Dividend stocks can be bought the same way as any type of stock – with help from your financial advisor or through an online broker. Most robo advisors use ETF portfolios which could include dividend stocks – and the best part is products like Wealthsimple can reinvest your dividends automatically.

Is there an ETF to make dividend investing easier?

Using a dividend-paying ETF can be a convenient and valuable way to earn more cash and diversify your investments. It’s easy to purchase ETF shares and there are several high-yielding dividend ETFs available, like the Vanguard S&P 500.

Can you tell me how to make $1,000 a month in dividends?

It can take some work, but if you choose 30 stocks that each uses a max of 3.33% of your portfolio, it should work. As long as each stock generates $400 per year, you’ll meet your goal.

Leave a comment

Comments