The term “risk tolerance” refers to how comfortable an individual is with the risks associated with investing. There’s always a potential for loss when investing and your risk tolerance goes hand-in-hand with your ability to stomach market volatility and unpredictability.

Basically, if you’re someone who tends to panic when your investments aren’t doing well, you have a low risk tolerance. If you’re more patient and willing to take a chance on losing money when the reward is big, you have a high risk tolerance. Unfortunately, you may not fully understand your own level of risk tolerance until you’re faced with a potential loss.

Understanding your own level of risk tolerance and how it affects your decisions is a big step in learning how to invest in the first place. We created this guide to help you navigate through these waters, whether you’re a DIY investor or you leave it all up to an investment advisor.

Understanding risk tolerance

Taking time to understand your personal risk tolerance is important for any investor, but especially for those who are or will be relying on their investments as a retirement income source. Unfortunately, we’re often our own worst enemies when it comes to our investment portfolios.

There are 3 main classifications of risk tolerance: aggressive, moderate, and conservative. The table below provides an overview of the characteristics common to each type of tolerance level.

| Tolerance level | Characteristics |

|---|---|

| Aggressive risk tolerance | * Willing to risk losing money in favour of a high reward * Used to seeing their portfolio take dramatic swings in either direction * Value capital appreciation over generating income or preserving the principal * Tend to be wealthy individuals, experienced investors, or both * Tend to have a broader portfolio than others |

| Moderate (balanced) risk tolerance | * Will accept some risk * Carefully weighs opportunities against risk * Often set a loss limit for themselves * Earn less than aggressive investors but not as susceptible to market falls |

| Conservative risk tolerance | * Not at all comfortable with volatility within their portfolio * Prefers guaranteed, liquid investments * Will prioritize avoiding loss over making gains * Retirees or those nearing retirement often fall into this category |

By understanding your own risk tolerance and choosing a portfolio allocation that suits this, you can reduce your stress as well as your likelihood of doing something rash when markets experience large swings.

If you’re still not sure where your tolerance lies, consider the following example.

An example scenario

If you chose to put 100% of your portfolio in stocks and there was a 40% crash like in March 2020, would you have panicked and sold at the bottom? Or would you have continued your regular contributions?

Just 5 months after that crash, the market was already back to pre-crash levels. In September, it surpassed February’s highs.

If you panicked and sold your stocks, you likely won’t be surprised to hear that you have a low risk tolerance. In this situation, you would have been financially hurt in 2 ways: by selling low and by not participating in the upswing.

On the other hand, if you decided to invest more in order to take advantage of the market sell-off, you have a high risk tolerance. The stock market reached record highs in 2021, which means the situation above would have been a big win for you.

All of this being said, it’s also important to remember that even if you’re willing to tolerate a certain amount of risk, you may not be able to tolerate that amount of risk in reality. Plus, your risk tolerance is not static – it will change over the years as your circumstances change and you gain more investing experience.

The 4 main factors of risk tolerance

Your risk tolerance is dynamic and is influenced by several factors, and it may help you to determine your own tolerance level if you understand these better. Alternatively, you can use Vanguard’s Investor Questionnaire to help you narrow it down.

1. Your age

Your age is a major factor that affects your risk tolerance. That’s because a 30-year-old has more working years ahead of them than a 60-year-old, which means they have more human capital. Plus, younger people are better able to weather any short-term volatility in the stock market because their investing horizon is decades away.

While the stock market always goes up over the long term (say, 10 years), it takes a rollercoaster path on its way there.

Someone who plans on retiring in a year likely shouldn’t have 100% of their portfolio investments in stocks, as a stock market crash just before or after their retirement could have a catastrophic effect on their retirement plans. This type of risk is referred to as a “sequence of returns risk” and it’s worth understanding as you get closer to retirement.

Meanwhile, someone who is still working can see a market drop as a buying opportunity, using money they’ve just earned to invest in the market when everything’s “on sale.”

2. Your income, net worth, and goals

It likely won’t come as a surprise since these are factors that affect many different areas of your life, but your income, net worth, personal goals, and your financial goals all play significant roles in your level of risk tolerance.

Someone with a higher income or net worth will be able to take more risks with their money than someone of more modest means. Similarly, someone with a good pension from a stable company or the government can be riskier with their investment portfolio because their entire retirement doesn’t depend on just one source of income.

3. Your personality

Are you more of a risk-taker or more risk-averse? Because your personality is another big factor that affects your risk tolerance. Either is fine, but you need to know yourself well so you can choose a portfolio allocation that suits you.

This is an especially important factor for investment managers and financial advisors to consider when making decisions on behalf of their clients, since it’s not something that can be determined by looking at numbers or facts on a page. Asking questions about the client’s life experiences, career paths, and even their character traits can go a long way to understanding how their personality affects their risk tolerance and, therefore, how you the advisor should proceed.

4. Your investment horizon

Investors will naturally feel that they can take more risk if they have more time to work with. Someone who requires a certain sum of money within a specific timeframe will be more dedicated and take appropriate precautions to make sure they achieve their goals. If that timeframe is 20 years, you’ll be more likely to embrace riskier investment than if you’re looking at a 5 year goal.

For example, you may be saving for a down payment on a house, in which case you would want to have that portion of your portfolio in safer, fixed-income assets – or not on the stock market at all, depending on your anticipated time frame.

The relationship between risk and reward

When it comes to risk, over the long term, assets that are riskier have greater returns than assets that are safer.

For example, stocks historically have a higher average return than bonds – but they’re also much more volatile, so you’ll need to weather the downturns while still being able to sleep at night.

While we typically understand risk as it relates to stocks and dramatic drops in their value, there’s a more sneaky, dangerous type of risk that plays out over much longer time frames: inflationary risk. It’s important to balance both types of risk so that you can meet your financial goals.

An example return based on 3 different risk types

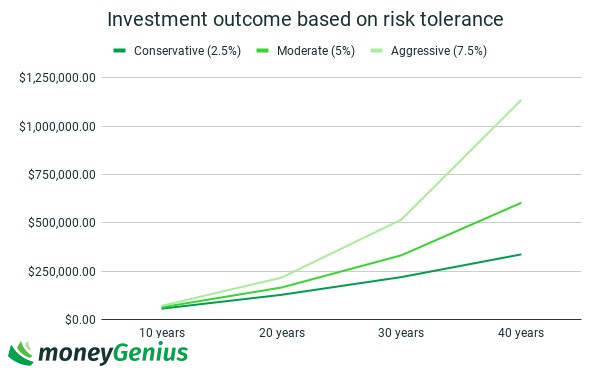

The graph below shows 3 possible outcomes after investing $5,000 each year in your investment portfolio for 40 years.

With a conservative portfolio (using an assumed 2.5% annual return), you would come out far behind someone who pursued an aggressive investment strategy (an assumed 7.5% annual return), while the moderate portfolio is in the middle (5%).

While more aggressive allocations offer the possibility of higher returns over longer periods, there is no one-size-fits-all portfolio allocation and there is nothing inherently wrong in choosing a conservative strategy.

Ultimately, it’s up to you to determine your financial goals and how you will reach them.

Stay aligned with your risk tolerance with Passiv

Once you’ve figured out your risk tolerance, it’s time to act on it by setting investment accounts and buying the holdings to match your risk tolerance. However, opening an investment account is only half of the battle.

You’ll need to make sure your portfolio doesn’t drift off target from your risk tolerance over time, otherwise you could expose yourself to more risk than wanted or anticipated, or conversely decrease your potential returns by ending up with a more conservative portfolio.

For example, say you set your portfolio according to your risk tolerance as 70% stocks and 30% bonds. If the stock market goes up, your stock allocation would mechanically go up as well and increase your risk level.

If you manage your investments yourself, you need to keep track of the market to make sure your portfolio allocation stays on target and doesn’t expose you to a level of risk you’re not comfortable with.

If you do need to make adjustments, you’ll need to calculate how many of each security you need to buy and/or sell, and finally manually place the trades one by one.

How Passiv can help

With Passiv, you can automate your portfolio strategy and easily stick to your target allocation.

Passiv will notify you when your portfolio drifts from its target and automatically calculate the trades that will bring your portfolio back on track. You can even place the trades directly in Passiv with the one-click trade feature.

Passiv makes it easy to contribute regularly while keeping your target allocation. You’ll also be able to tweak your target if your risk tolerance changes over time.

Whether you’re a new or experienced investor, Passiv makes it fast and easy to rebalance your portfolio.

What’s your own level of risk tolerance?

Everyone’s level of risk tolerance is different and will affect their investment decisions in a variety of ways. But understanding your risk tolerance and working within your comfort zone will set you on the path to maximize your investment potential.

What do you think your risk tolerance is? Does your investment portfolio match up?

We love hearing from readers, so let us know your thoughts in the comments below.

FAQ

What is risk tolerance in investing?

Risk tolerance refers to how comfortable you are with the risks associated with investing. The 3 main classifications of risk tolerance are aggressive, moderate, and conservative. Looking at the details for each of these categories can help you to understand your own risk tolerance.

Is there a difference between risk appetite and risk tolerance?

Yes, there is a slight difference between risk appetite and risk tolerance. Risk appetite refers to the amount and type of risk that you’re willing to pursue, related to your broader, overall investment objectives. Risk tolerance is the level of risk that you’re willing to take on a per-investment basis. Typically, the term “risk appetite” is most often used in relation to a financial organization rather than individual investors.

What are some risk tolerance factors to consider?

The 4 main factors that affect risk tolerance include your age, your income and financial goals, your personality, and your investment horizon. Each of these is important on its own but also works in tandem with the other factors to affect your tolerance level.

Can you tell me how to determine risk tolerance?

To really determine your personal level of risk tolerance, you’ll need to understand the definitions of each of the 3 classifications of tolerance, study the factors that affect risk tolerance, and realize the relationship between risk and reward.

This is a guest post from Passiv, a software company that helps DIY investors grow and manage their wealth at online brokerages.

Leave a comment

Comments