A void cheque is a typical cheque with the word "VOID" written across the front, making it invalid for regular use. Void cheques are safe to use and are often required for setting up direct deposits or other pre-approved deposits.

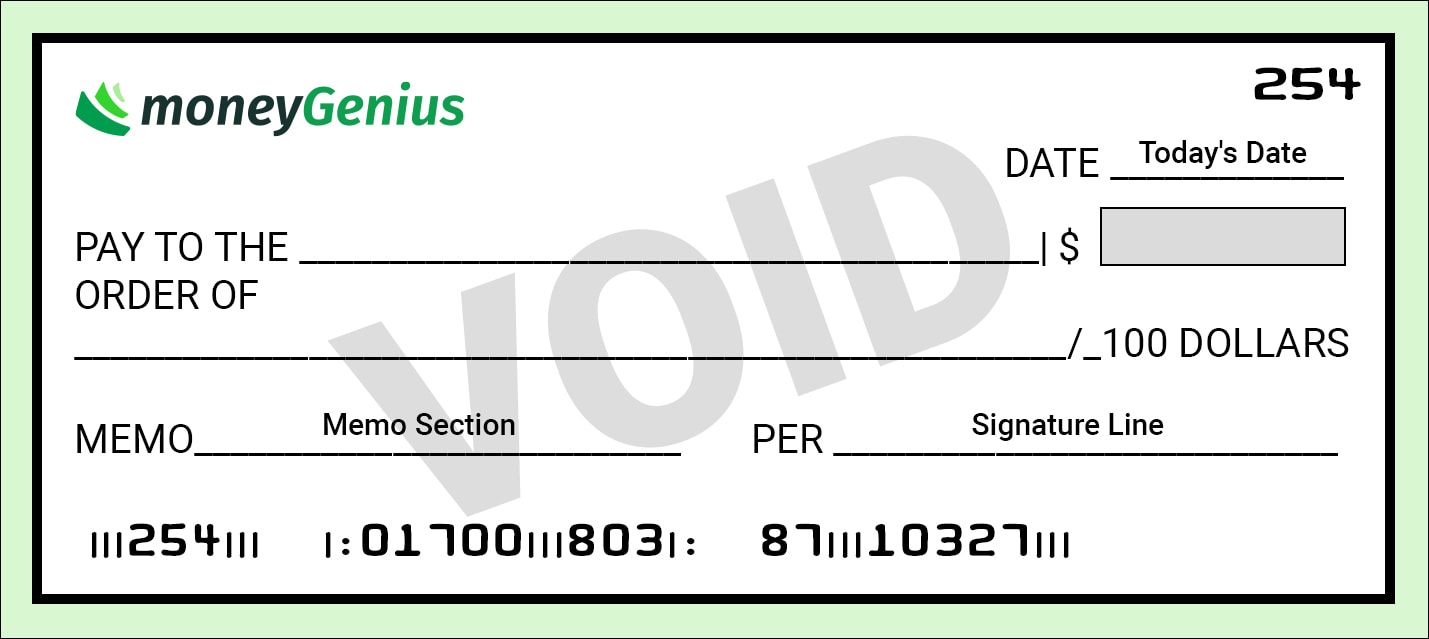

To read a void cheque, look for the series of numbers on the bottom. The leftmost set is the cheque number, while the remaining numbers contain information about your financial institution and chequing account.

Here, we'll look at how to read a void cheque yourself, how you can get one, when they're useful for banking in Canada, and more.

Key Takeaways

- A void cheque is a typical cheque with the word VOID written across it in large letters.

- Some important info should still be visible on a void cheque, like the account number and bank transit number.

- These are commonly needed when setting up a new direct deposit or pre-authorized payment plan.

- If you don't have a chequebook handy for making your own void cheque, you can get bank forms that serve the same purpose.

What is a void cheque?

A void cheque is a regular cheque that has the word "VOID" written across the front. It’s a convenient tool for establishing automatic payments to and from your bank account. The main uses for void cheques are to set up direct deposits and pre-authorized deposits.

Void cheques are helpful because they contain the following information:

- The name of your bank

- The bank's institution number

- The bank's transit (or branch) number

- Your account number

- Your name and address

However, because they’ve been voided, these cheques can’t be used by anyone else to draw money from your chequing account.

A voided cheque isn’t the same as a cancelled cheque. Voiding a cheque means that it can’t be used at all. Cancelling a cheque means that you’ve already written it, but you contact your bank to stop payment, like if you made a mistake when writing the cheque.

How to read a void cheque

To read a void cheque, look at the 4 sets of numbers across the bottom of the cheque. Each set of numbers contains unique information:

- Cheque number: All of the cheques in your chequebook are numbered in order, which makes it easier to track them. The cheque number is listed on the bottom left of the cheque. It may also appear in the top right corner of the cheque.

- Transit number: After the cheque number, you’ll see a 5-digit set of numbers – this is your bank's transit number, also called the branch number or routing number. This number identifies your home branch or the bank branch where you opened your account.

- Bank institution number: The third set of numbers on the bottom of a cheque is the 3-digit institution number. This is a unique number assigned to your financial institution – it indicates whether you bank at RBC, TD, BMO, etc.

- Account number: The rightmost set of numbers on the bottom of a cheque is your account number. This number is between 7 and 12 digits long and is unique to you.

How to void a cheque

To void a cheque, write "VOID" on it in big, obvious letters, taking care not to cover up the banking information on the bottom. This will indicate to anyone who sees it that this cannot be cashed the usual way, but the relevant info is still visible for anyone using it to set up direct deposits.

To break it down even further, you can follow these steps when writing a void cheque:

- Write the word "VOID" in large letters so it covers the entire paper. Alternatively, you can write it in somewhat small letters but draw a slash or an X across the rest of the paper.

- While you want to cover the paper with the word VOID or with your X, be sure not to cross out the account number or any of the numbers printed on the cheque. If you're using this to set up a direct deposit or pre-authorized payment, these numbers are important.

- Be sure to use a pen or a permanent marker when voiding a cheque. Don’t use a pencil – someone might erase it and attempt to cash the cheque.

- Do NOT sign the cheque. Signing a cheque essentially means it's authorized, so if someone else gets ahold of it, they may be able to use it and commit fraud.

How do you get a void cheque?

There are 3 ways to get a void cheque:

- Write one yourself from your chequebook

- Request one from your bank

- Find the relevant information through your online banking portal

If you don’t carry cheques, visit a bank branch and request either a void cheque or an official form containing the information you need.

How to get your direct deposit information online

If you don't have a chequebook and don't have time to visit the bank, log in to your online banking portal to get your banking information.

Once you've downloaded the proper forms, you can send a PDF to your employer, print out the form, or simply provide them with the specific numbers or details requested.

Direct deposit form vs. void cheque

A direct deposit form is a document that you fill out with your transit number, financial institution number, and account number. You then give the form to your employer so they can set up direct deposits on your behalf.

A void cheque already contains that information – you just need to write VOID across it.

Void cheque alternatives

While the direct deposit form is the most common void cheque alternative, you have several other options. Here's an overview of these choices:

| Alternative | Details |

|---|---|

| Direct deposit form | * Printable forms available via your online banking portal * Can also be requested at a bank branch * Most of the information is pre-filled, but there may be a few blanks * Requires your signature for authorization |

| Pre-authorized debit form | * Printable forms available via your online banking portal * Most of the information is pre-filled, but there may be a few blanks * Requires your signature for authorization |

| Bank letters | * Includes your account details and your bank's address * Must be requested from the bank (online or in person) |

| Online banking/banking app | * Most required info can be found through your online banking portal or via your banking app * Useful for employment forms that need to be filled out manually |

| Bank statements | * Can be either physical or digital copies * Accessible online or can be requested from the bank (online, phone, or in person) |

Void cheques by bank

Here’s how to read a void cheque issued by the big 5 banks in Canada:

| Financial institution | Institution number | Account number | Additional info |

|---|---|---|---|

| RBC | 003 | 7 digits | You can get cheques for free if you have one of these accounts:

* RBC VIP Banking * RBC Signature No Limit Banking Account * RBC Advantage Chequing Account (first 50 free) |

| BMO | 001 | 7 digits | Free cheques with the BMO Premium Chequing Account |

| CIBC | 010 | 7 digits | N/A |

| Simplii | 010 | 10 digits | Free personalized cheques with Simplii No Fee Chequing Account |

| Tangerine | 614 | 10 digits | First 50 cheques free with a Tangerine Chequing Account |

Reasons to get a void cheque

The most common reason to have a void cheque is to set up direct deposit with an employer. The cheque will contain all of the information needed to ensure your payment is sent to the right account.

You also need this information to set up pre-authorized payments with a merchant, which is why a void cheque is typically required.

You can also use a void cheque as a precaution if you make a mistake when writing a personal cheque – voiding it makes it unusable and you're free to throw it out.

FAQ

What is a void cheque?

A voided cheque is a cheque that has been rendered unusable, usually by writing or printing the word "VOID" across it in large letters. Most often, these are used to set up transactions like direct deposits or pre-authorized payments.

How do I void a cheque?

To void a cheque, you simply write the word "VOID" across the front of a personal cheque in large letters. However, it's important to ensure that the account number and other important details are still visible.

How do I read a void cheque?

The only things you'll need to read on a void cheque are the transit number, institution number, account number, the bank branch's address, and the account owner's home address. The numbers are usually found at the bottom of the paper.

How do I get a void cheque if I don't have any cheques?

The most popular alternative to a void cheque is to use a form provided by your bank. Sign into your online banking portal, navigate to your chequing account's documents, and then download the direct deposit or void cheque form.

What info is on a void cheque?

A void cheque should include the account owner's home address and their bank branch's address, as well as the account number, institution number, and the bank's transit or branch number. This information should be clearly visible on the paper.

Who is it safe to give a void cheque to?

Void cheques are generally safe to give out. You don't have to worry about the information being used to set up false pre-authorized debits, since the bank needs to approve those, and the "VOID" makes the cheque unusable otherwise.

Do you have to sign a void cheque?

No, you should not sign a void cheque. The only thing you should write on a void cheque is the word "VOID" in permanent ink (pen or marker). This is to prevent fraud and is extremely important.

Is a void cheque the same as a direct deposit form?

Void cheques and direct deposit forms are different, separate documents, but they both contain the information required to set up a direct deposit or pre-authorized debit. In fact, they can be used interchangeably in most situations.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments