When comparing BMO vs. RBC, both banks are similarly reliable and well-established – but BMO wins out for better user experience, lower fees, and higher interest rates.

Each of these institutions provides a safe place to keep your money, and each has a long list of banking products to suit your needs. While BMO leads in more categories, RBC stands out for its reward-heavy travel credit cards and its proliferation of ATMs and branches across Canada.

To determine whether BMO or RBC is the better choice for banking in Canada, we compared each one across categories like chequing accounts, credit cards, investment options, and more.

Key Takeaways

- RBC is the biggest bank in Canada and BMO is the third.

- RBC has the best air travel credit card, while BMO has the best grocery credit card.

- BMO and RBC both offer ways to waive the monthly fee for chequing accounts.

- BMO and RBC both offer U.S. savings accounts.

- BMO has more investment options and better rates than RBC.

BMO vs. RBC: Overview

Many Canadians are comparing BMO vs. RBC, and the truth is that both banks are pretty similar.

Both are major Canadian institutions with strong reputations. They have equally long lists of banking products, from credit cards and chequing accounts to mortgages and investment options.

The two biggest differences between BMO and RBC seem to be user experience and rates.

Here’s what BMO’s biggest fans had to say on Reddit:

Of course, Reddit is full of equally passionate RBC fans:

Let’s compare the nitty-gritty details of BMO vs. RBC.

Chequing accounts

Both BMO and RBC offer everyday and specialized chequing accounts, such as student and premium accounts (although neither takes the prize for best chequing account in Canada).

BMO Performance Chequing Account and RBC Signature No Limit Banking Account offer:

- Unlimited transfers: Enjoy unlimited Interac e-Transfers and free debit transactions.

- Senior discounts: Both offer a $4 discount on the monthly fee for seniors.

However, there are a few differences between BMO and RBC chequing accounts:

- Monthly fees: Both offer free student and senior accounts.

- Discounts for minimum balance: BMO will waive monthly fees if you maintain a certain minimum balance. RBC does the same.

- Bundling: BMO offers account bundles where you pay just one fee for multiple accounts.

The winner: BMO

BMO's fee waivers with minimum balances are usually more valuable and convenient than RBC's method of requiring multiple products. Plus, BMO's account bundles provide valuable savings.

However, choose RBC if you prefer perks like Petro-Canada discounts and free bank drafts.

For senior bank accounts, we’d actually recommend CIBC.

High-interest savings accounts

Let’s compare the BMO Savings Amplifier Account account and the RBC High Interest eSavings account accounts.

- BMO’s interest rate: 0.7%

- RBC’s interest rate: 0.55%

BMO has a slight lead on interest rates, but let’s compare their other features:

- Access: Both BMO and RBC give you free transfers between in-bank accounts.

- External transfers: Both charge fees for moving money to other banks, but RBC gives you one free RBC ATM withdrawal per month.

- Other: The BMO Savings Goal feature lets you set specific goals.

The winner: BMO

While the features of both accounts are pretty similar, BMO’s base interest rate is higher. Both have excellent, nearly identical promotional rates, however.

Note that while RBC does feature in our review of the best high-interest savings accounts, its usefulness is mostly limited to current RBC clients.

Credit cards

There are credit card options from BMO and RBC that include features like no annual fee and cash back, plus special perks like purchase protection and extended warranty.

BMO offers more than 12 credit cards (including three no annual fee cards), but these are the best:

- BMO CashBack World Elite Mastercard

- BMO eclipse Visa Infinite Card

- BMO Ascend World Elite Mastercard

- BMO AIR MILES World Elite Mastercard

- BMO AIR MILES World Elite Business Mastercard

- BMO CashBack Mastercard for students

- BMO Preferred Rate Mastercard

RBC offers 19 credit cards (including five no annual fee cards), but these are the top options:

- RBC Avion Visa Infinite

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Business

- RBC Cash Back Preferred World Elite Mastercard

- RBC ION Visa

- RBC Visa Classic Low Rate Option

- moi RBC Visa

The winner: Tie

Though both offer travel rewards, RBC has the best program with Avion Rewards. RBC also has better welcome bonuses, along with Mastercard and Visa options. However, to access the best of RBC’s premium cards you need a very high income – and you’ll pay a high annual fee.

BMO shines with its cash back cards. It’s also the better option if you spend more on groceries than air travel. Plus, BMO’s student credit card also ranks well on the list of best student credit cards.

Investment platforms

If you’re looking for a bank you can invest with, BMO and RBC both have valuable options.

Overall, both banks offer similar investing features:

- Self-directed (BMO InvestorLine, RBC Direct Investing) and managed portfolios

- Robo advisors: BMO SmartFolio, RBC InvestEase

- Learning tools: RBC has practice accounts, BMO has online demos and tutorials

- Investment types: Both offer mutual funds, bonds, stocks, ETFs, options, GICs

- Discounts: RBC and BMO offer discounts to active traders

- Minimum investment: $500

- Fees: Both self-directed platforms charge $25 quarterly maintenance fees

There are a few differences:

- Account types: Both have standard types like TFSAs and RRSPs, but BMO offers more.

- Cost per trade: BMO offers commission-free trades on popular ETFs, but RBC charges for every ETF purchase.

You cannot currently invest in cryptocurrency directly with either BMO or RBC.

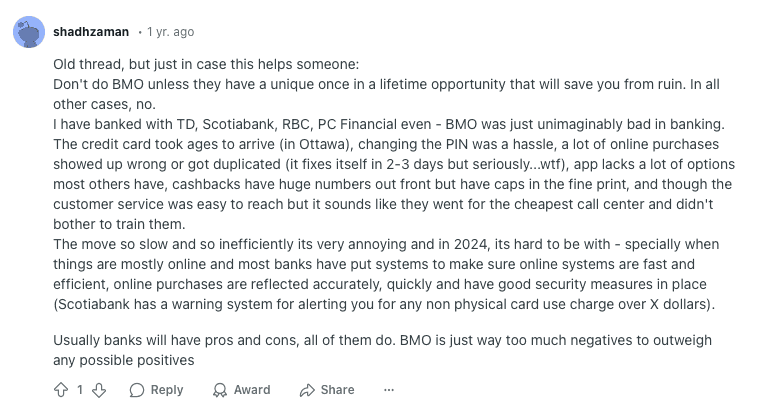

Reddit, alas (sort of), is full of both RBC and BMO clients who have personal experience (and strong opinions):

The winner: BMO

BMO has more account types and better pricing than RBC.

However, both banks offer comparable investment platforms and valuable features like automatic rebalancing on some accounts.

GICs

If you want to set aside cash to grow for a specific amount of time, both BMO and RBC offer Guaranteed Investment Certificates (GICs). Choose how long you want your GIC term to be, and compare interest rates to decide which one is right for you.

As of February 12, 2025, here are the GIC terms and rates available from each bank:

The winner: BMO

BMO’s GIC rates are higher across the board.

Foreign currency savings accounts

BMO has a USD savings account and a USD chequing account, as does RBC. However, RBC also offers a few other global currency accounts.

Here's a look at the USD accounts available from these banks:

| Bank | Account name | Details |

|---|---|---|

| BMO | BMO US Dollar Premium Rate Savings Account | * Requires having another eligible BMO chequing account * Shares transaction limits with your BMO chequing account * 0.05% interest |

| BMO | U.S. Dollar Primary Chequing Account | * Requires having another eligible BMO account * Monthly fee is tied to your other BMO account, can be waived with minimum balance * Cheques available |

| RBC | U.S. High Interest eSavings Account | * $0 monthly fee

* 1 debit transaction included per month * 0.03% interest |

| RBC | RBC U.S. Personal Account | * $3 monthly fee * 6 debit transactions included per month * Cheques available |

RBC's other global currency accounts include these:

- RBC Hong Kong Dollar eSavings

- RBC Euro eSavings

- RBC British Pound eSavings

RBC’s cross-border bank account is valuable, but one person struggled to find ATMs:

For another Canadian, BMO was the best choice simply because of the family bundling option.

The winner: RBC

RBC has more global currency options overall, and its U.S. Personal Account is much less confusing than BMO's U.S. Dollar Primary Chequing Account.

However, the BMO US Dollar Premium Rate Savings Account has a slightly better interest rate than the RBC U.S. High Interest eSavings Account, so if you want to save your money, BMO is the better choice.

Mobile app experience

BMO and RBC offer free mobile apps, and they’re similarly well-rated:

| BMO | RBC | |

|---|---|---|

| App Store | * 4.6 stars * 111,721 ratings | * 4.8 * 209,332 ratings |

| Google Play | * 4.1 stars * 84,596 ratings | * 2.2 stars * 44,466 ratings |

Android users gave extremely poor ratings to the RBC app.

Here’s what BMO fans on Reddit had to say about the mobile app:

And here’s some positive praise for the RBC mobile app on Reddit:

The winner: BMO

This one is close, but we have to give it to BMO simply because its app earned a much higher rating in the Google Play store.

Other bank features

There are plenty of other features that may be important to you, like HELOCs or international money transfers.

When it comes to other banking services, aside from what's been mentioned here so far, RBC and BMO have nearly identical offerings:

| BMO | RBC | |

|---|---|---|

| Personal loan | Yes | Yes |

| Line of credit | Yes | Yes |

| Mortgages | Yes | Yes |

| HELOC | Yes | Yes |

| RRSP loan | Yes | Yes |

| Global money transfer | Yes | Yes |

| Kids bank accounts | Yes | Yes |

| Business GICs | No | Yes |

| Business bank accounts | Yes | Yes |

RBC wins on sheer domination for its high number of ATMs and branches. Plus, its market cap is about $100B higher than BMO’s.

The winner: Tie

For personal banking purposes, BMO and RBC offer very similar banking products and all are high-quality choices.

Final winner: BMO

BMO won the most categories listed above. It has a strong mobile app, a large selection of credit cards, and a diverse list of investment and account options that will suit a wide variety of Canadians.

Still, RBC is the biggest bank in Canada for a reason. It offers excellent credit cards that deliver valuable rewards, especially for travel. Most Canadians are within reach of an RBC branch or ATM.

If you’re deciding between BMO and RBC, it comes down to what you need from a bank. Check current rates and then make your decision – or open accounts with both banks and get some firsthand experience.

FAQ

Is RBC bigger than BMO?

Yes, RBC is the biggest bank in Canada and BMO is the third largest bank. RBC has many more ATMs and branch locations than BMO, but both banks offer similar banking products and account types.

Who is RBC's biggest competitor?

TD Bank is RBC’s biggest competitor, but all of the other big banks compete with RBC to win business from Canadian clients. While other banks are still fierce competitors, TD closely trails RBC in revenue and other areas.

What is the biggest bank in Canada?

RBC is the biggest bank in Canada, with over $2 trillion in assets. RBC has 1,100+ branches in Canada and serves over 17 million clients across the globe. It's also one of the oldest banks, founded in 1864.

What are the disadvantages of BMO?

BMO charges monthly fees for many of their accounts, although these can be waived with a minimum balance (unlike RBC). BMO may have comparably low interest rates, and some customers also report poor customer service.

Does RBC have banks in the USA?

While RBC doesn't have its own branches in the USA, it partners with PNC Bank to provide services to its clients visiting the U.S. Plus, clients can access more than 50,0000 no-fee ATMs, located across all 50 states.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments