The Smith Maneuver is a Canadian tax strategy that converts your mortgage interest into a tax-deductible expense.

Why does this work? Because in Canada, the interest paid on a mortgage (on a principal residence) is not deductible for tax purposes, but the interest paid on an investment loan is.

Not surprisingly, this strategy has become popular over the years as it has the potential to generate tax refunds, allow quicker mortgage paydown, and improve an individual’s net worth.

Keep reading to learn how to use the Smith Maneuver, pros and cons of the strategy, and when it’s worth it.

Key Takeaways

- The Smith Maneuver is a tax strategy in Canada that essentially converts the interest paid on your mortgage into a tax-deductible expense.

- The resulting tax refund is then used to pay off your mortgage faster.

- The strategy works by taking out a HELOC and using the funds to buy investments.

- The procedure was popularized by Fraser Smith's 2002 book The Smith Manoeuvre and is a legal practice in Canada.

The Smith Maneuver in 4 steps

The Smith Maneuver involves obtaining a readvanceable mortgage, which is similar to a regular mortgage, except it also has a home equity line of credit (HELOC) included. Use the HELOC portion of the mortgage to invest in income-producing assets, like dividend stocks.

The interest is then deducted on your tax return, leading to a tax refund that gets reinvested to pay down the mortgage principal.

That might seem complicated, but don’t worry – we’ll break down each step so it’s easier to understand.

1. Get a readvanceable mortgage

The first step in the Smith Maneuver is to obtain a readvanceable mortgage – a combination of a conventional mortgage and a HELOC. This allows you to continually re-borrow the principal portion that gets paid off. As more of the principal gets paid down, there's more available room to borrow.

In the Smith Maneuver, the net amount of your debt remains the same because as the mortgage principal gets paid down, you re-borrow that amount through the HELOC portion.

Generally, banks allow you to borrow up to 65% of your home’s value for a HELOC, but up to 80% of the total equity. Consequently, the difference of 15% will be a traditional mortgage with a monthly payment.

Readvanceable mortgage lenders in Canada include:

- RBC Homeline Plan

- TD Home Equity FlexLine

- Scotiabank Total Equity Plan (STEP)

- BMO Homeowner ReadiLine

- National Bank All-in-One

- Meridian Flex Line Mortgage

If you're looking to find the right mortgage for you, using an online mortgage broker like Homewise can make it much easier. They compare over 30 banks and lenders so you can find your best options fast. They'll also negotiate on your behalf.

2. Borrow money from your HELOC

Use your HELOC to re-borrow the money that you’ve paid on the principal of your loan. Then, use that money to invest in income-producing assets such as dividend stocks.

Be sure to invest the money in a non-registered account. If the money is invested in a TFSA, RRSP, or any other registered account, the interest on the loan won’t be tax-deductible.

3. Claim your HELOC interest on your tax return

Interest rates on a line of credit are tax-deductible, unlike the money you pay on a mortgage. So if you’re using the Smith Maneuver, you can take the interest paid on your HELOC and claim it at tax time.

For example, if you have an annual interest expense of $6,000 and your marginal tax rate is 30%, you should receive a tax refund of $1,800.

4. Reinvest your savings

Finally, use the tax refund you receive from deducting the HELOC interest paid to pay down the mortgage principal. This will then increase the amount in the HELOC that you have available to invest. Each year, your investments will grow, and you’ll pay off your mortgage faster.

Smith Maneuver examples

The Smith Maneuver can change drastically depending on your situation and whether you're using additional strategies (known as accelerators), but let's take a look at a simple example.

- A family has a house that's currently valued at $600,000 with a mortgage of $300,000.

- The family pays $2,500 per month for their mortgage payment, $1,000 of which is interest.

- They open up a HELOC with a value of $180,000.

- They then borrow $50,000 from their HELOC to invest in income-generating assets, like stocks or bonds.

- The interest they pay on the HELOC is now tax deductible, since it's being used for investment purposes.

- They continue to pay their mortgage payment and the interest on their HELOC, while reinvesting any of their capital gains into their mortgage as a prepayment or into more investments.

- As they pay off more of their mortgage, more value in their HELOC opens up, which means they can borrow even more to invest.

- Rinse and repeat.

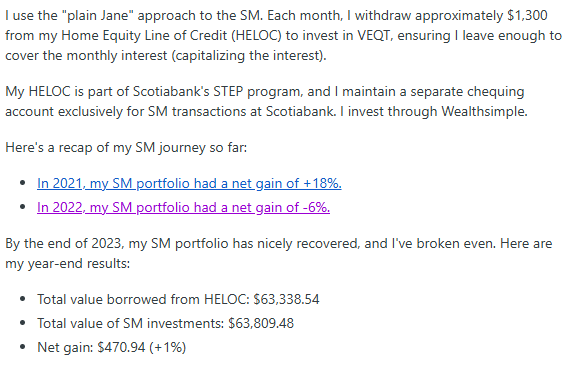

Here’s another example of the Smith Maneuver (SM) from a 2023 Reddit post:

Pros of the Smith Maneuver

There are a couple of key advantages of the Smith Maneuver – although before you try them, it’s important to consider how each of these would impact your own mortgage, taxes, and personal finances.

1. Pay down your mortgage faster

The Smith Maneuver could enable you to pay off your mortgage faster than you would with a traditional mortgage. It has the added advantage of allowing you to become debt-free faster, and potentially even retire earlier – now who wouldn't be interested in that?

For anyone looking to retire earlier but within a longer investing time frame, these are important details to consider.

2. Deduct the interest on your taxes

The interest on your investment loan is tax-deductible. And the higher your marginal tax rate is, the more valuable the tax deduction becomes because it can generate an even higher tax refund for you.

3. Invest without using additional cash flow

Normally you need to budget for investments. But with the Smith Maneuver, you’re investing the money you already pay on your mortgage, so you don’t need to free up any additional cash. This can help you build your portfolio while still leaving room for things like building up your savings or investing in registered accounts.

Cons of the Smith Maneuver

There are also a few key downsides to the Smith Maneuver – mostly involving increased risk. If you can’t afford to take on that risk, the Smith Maneuver may not be the best fit for you right now.

1. Increased tax filing requirements

Because the Smith Maneuver requires you to invest in non-registered accounts, all income earned on the investments needs to be tracked and reported on your tax return.

Depending on the type of investments you hold, this could include things like:

- Return of capital

- Foreign currency exchange

- eligible vs. non-eligible dividends

- Capital gains/ losses

Depending on the complexity of your investments, consider hiring an accountant to track and report your investments. This does mean an increase in costs, but in return, you’ll have peace of mind that your taxes are in order.

2. Increased market risk

There are significant financial risks to using the Smith Maneuver, especially in the short term. Leveraged investing, or investing with borrowed money, can make it tempting to sell for a loss if the value of your investments significantly decreases. This strategy works better if you have the risk tolerance to hold through losses and wait for your investments to recover.

3. Increased housing market risk

The Smith Maneuver also increases your risk in the housing market. If home values drop dramatically, you run the risk of carrying an underwater mortgage (which means you owe more on the loan than the market value of the home).

Is the Smith Maneuver worth it?

The Smith Maneuver can help you pay off your mortgage way faster, increase your tax refund, and help you grow your money. That said, it's complicated and does come with increased risk, especially since you're using your home equity for investments. It’s important to carefully consider the risks and rewards – and consider consulting a personal financial advisor before you decide whether to move forward.

Smith Maneuver calculator

If you’re trying to decide whether the Smith Maneuver is right for you, a Smith Maneuver calculator can be useful. Enter the value of your home and your total mortgage amount, interest rates for your mortgage and HELOC, total income, any accelerators, and more.

The calculator will then tell you how much you could expect to receive as an annual refund, and how much you could expect to improve your net worth over the life of your mortgage.

4 Smith Maneuver accelerators

Accelerators are ways you can use the Smith Maneuver to pay down your mortgage even further using money you already have. None of these options require additional cash flow, but they can increase your deductions, allowing you to pay down your mortgage more quickly.

Here are the 4 primary Smith Maneuver accelerators:

- The cash flow diversion: Prepay your mortgage using funds that you would typically use for investments, then use the extra room you created in your HELOC for investing.

- The cash flow dam: Use the revenue from your small business or rental property to prepay the mortgage on your primary residence, then re-borrow those funds to pay your usual business expenses.

- The debt swap: Use funds from your paid-up investments to prepay your mortgage, then re-borrow the same amount to invest in a new source or repurchase the same prior investment. You could even fully convert your mortgage this way.

- The DRiP: Use funds you have set for automatic reinvestment from dividends on your existing investments (DRiP stands for "dividend reinvestment plan") to prepay your mortgage, then re-borrow the same amount to use for your typical investments.

Each of these accelerators, and the Smith Maneuver itself, can be extremely complicated to do correctly, so reaching out to an experienced financial advisor is likely the best way to get started.

FAQ

What is the Smith Maneuver technique?

The Smith Maneuver is a (legal) tax strategy that converts your non-deductible mortgage interest into a tax-deductible expense. The strategy can potentially lead to higher tax refunds, faster mortgage pay-down, and an increase in net worth.

How do I do the Smith Maneuver?

The Smith Maneuver involves taking out a Home Equity Line of Credit, using the funds to invest in income-producing assets, then claiming the interest paid on your tax return. You can also reinvest the return from your investments into your mortgage or into more investments.

Is there a Smith Maneuver calculator?

Yes, a quick Google search will help you find some calculators and spreadsheets to guide you through the Smith Maneuver. Here’s an example scenario of the Smith Maneuver at work.

Is the Smith Maneuver legal in Canada?

Yes, the Smith Maneuver is a legal investment strategy in Canada. However, it’s still important to evaluate whether it’s a sound strategy based on your unique financial situation.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments