You may have heard about Mogo through their free credit score service, or maybe it was those controversial high-interest loans that caught your eye…

Whatever it was, Mogo has certainly made a name for itself in Canada. And with 5 different financial products to choose from, there are a lot of reasons to check them out.

In this Mogo review, we’ll go through everything they offer so you can see if there’s something for you.

First things first, 5 things you should know about Mogo

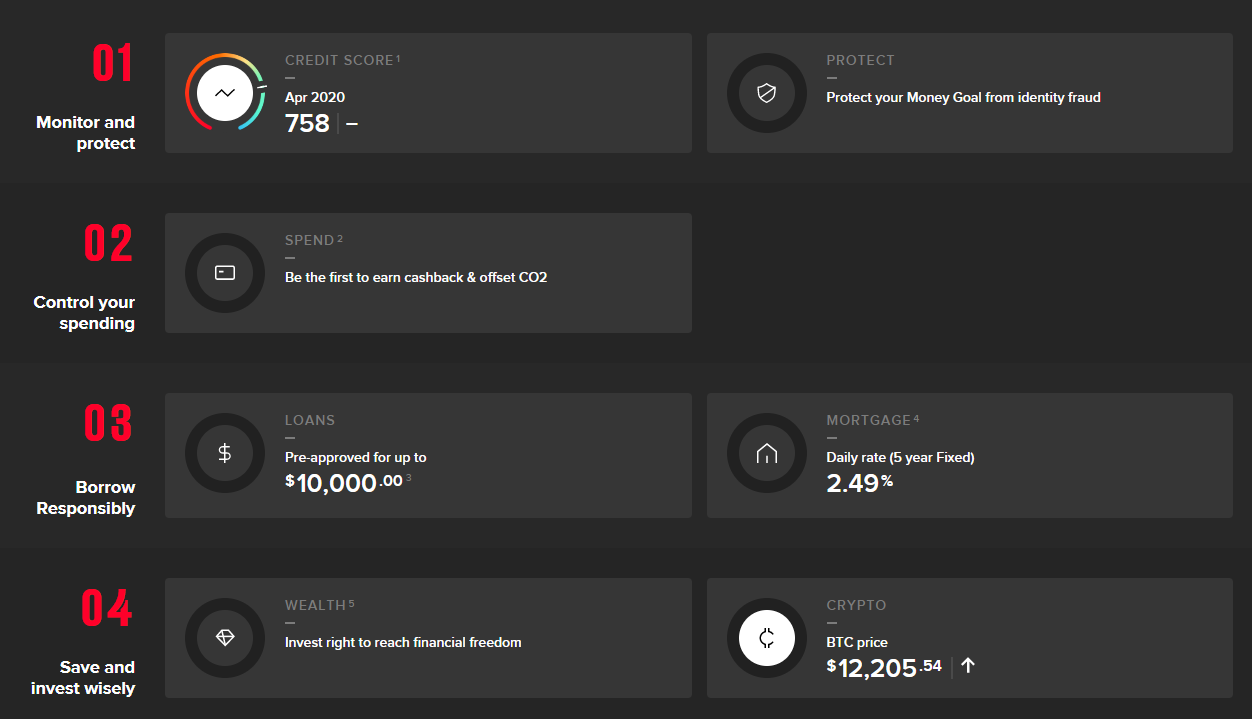

Mogo currently offers and advertises 5 different products – each with their own set of features.

| Product | Brief description |

|---|---|

| Credit score | * Free access to your credit score * From Equifax * Updated monthly |

| MogoProtect | * Daily Equifax account monitoring * Help with suspicious activity * Costs $8.99/month or $89.99/year |

| MogoMoney | * Personal loans powered by EasyFinancial * Loans up to $35,000 available * Get pre-approved without affecting your score |

| MogoMortgage | * Low rate, online mortgage broker * Fixed and variable options available |

| MogoWealth | * Investment tool |

Should you stay away from Mogo?

If you frequent personal finance forums, chances are you’ve seen some negative reviews of Mogo.

Most of them center around their loans, which (depending on what you’re offered) can give you absurd interest rates you’ll be paying off for years. Some are dismissing it as just another payday loan.

But now with 6 other financial products under their belt, can the other things Mogo has to offer make up for their high rate loans?

The pros of Mogo

- Modern app that consolidates all their products in one easy-to-access dashboard.

- Free credit score from Equifax that’s updated monthly – 1 of 3 Canadian companies to provide this service.

- Offers free money tips through their MoneyClass course.

- Currently offering MogoProtect for free for 6 months with code STAYSAFE.

- Mortgage rates are actually pretty competitive.

- Get $5 for free to try out investing in bitcoin.

What to watch out for with Mogo

- High-interest rate loans will likely leave you in a bigger mess than you started out with.

- Effective marketing combined with payday-like loans makes it hard to trust them.

- A difficult, controversial past that’s hard to move on from.

Mogo loans

Let’s start with the most controversial of their products – their loans.

Currently, they offer 2 types of loans:

| Mogo Loan | Personal Loan Amount | Term | Interest Rate |

|---|---|---|---|

| MogoLiquid personal loan | $500 – $35,000 | 9 months – 5 years | 5.9% – 46.96% |

| MogoMini line of credit | $300 – $5000 | Open line of credit | 34.37% AIR |

They also used to offer MogoZip, but it has since been removed from their site. No word on why, but one could assume it was in response to some of the controversy against them.

Even if you’re able to get the lowest rate offered with the MogoLiquid loan, there have been reports of negative customer service experience even as recently as August 2019. One Reddit user claims once you’re a customer, your only service is through chat bots.

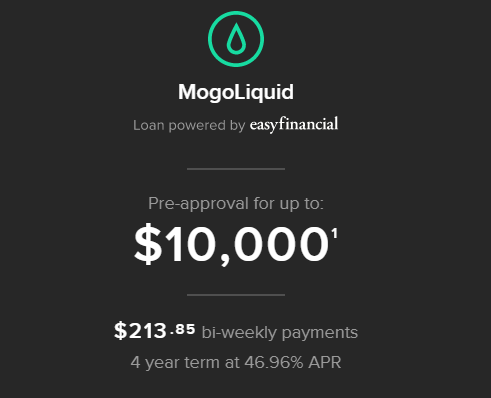

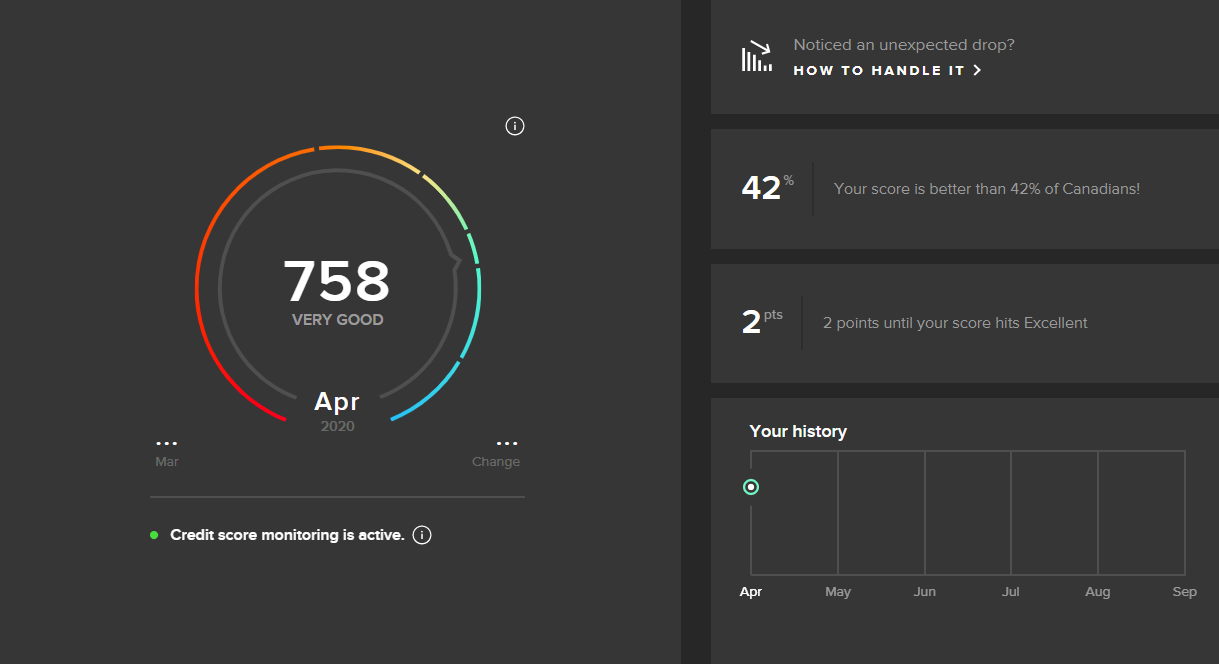

And despite the attractive marketing, it’s clear the rates lean towards the higher end. According to Mogo, my credit score is 758 (“Excellent” is 760), yet this is what they offered me for a loan:

In case it wasn’t clear that 46.96% APR is not an acceptable rate, by the time you finish paying off the above loan, you would’ve paid $12,319.12 in interest alone. Plus the APR is more than double the standard credit card rate – which is already insane.

It’s likely best to stay away from their loan service altogether, but you can check it out for yourself here.

Mogo loan alternatives

If you’re looking for a loan, Mogo is probably one of the last places you’ll want to go to.

One option is to go to your bank and ask what kind of loan options they have. It might not be best to go with the first thing they offer you, but this will be a good way to see what kind of rates you’re dealing with.

You can then check out a search engine, like LoanConnect, to compare multiple loans from several different companies.

Mogo credit score

| Product | Free credit score |

|---|---|

| Credit bureau | Equifax |

| Update frequency | Monthly |

| Affects your score? | No |

That being said, some of their other products might be worth a try. Consider, for example their free credit score reports.

Mogo gets your credit score directly from Equifax which is updated every month. You’ll get a notification from the app when it’s updated so you can keep on top of your score without even thinking about it.

And don’t worry – your score won’t be affected by signing up with Mogo.

Overall I was impressed with how quickly my credit score appeared in my MogoAccount. All I had to do was give them basic information, like my name and address, then answer a few questions about some of the credit info on my file, and I was done.

A couple things to keep in mind:

- Equifax is only 1 of 2 major credit bureaus in Canada (the other is TransUnion). Since you don’t know which bureau a potential lender will check, it’s best to keep on track with both bureaus. Credit Karma is the only 3rd party option in Canada for checking TransUnion.

- Each credit bureau has several different formulas for calculating your scores, which means what you see on Mogo may not be what a bank sees when they do a hard check on your file. This is normal and true for Credit Karma and Borrowell as well.

Find out more here.

MogoProtect fraud protection

| Product | MogoProtect |

|---|---|

| Service | Daily monitoring of Equifax credit report |

| Price | $8.99/month or $89.99.year |

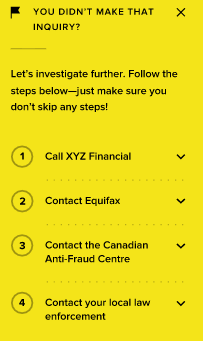

If you hate thinking about the potential for identity theft and fraud in our increasingly online world, MogoProtect offers some peace of mind – for a price.

For $8.99 a month or $89.99 a year, Mogo will monitor your Equifax report daily and alert you when anything suspicious happens.

If something does come up, they’ll guide you through some steps you can take to ensure the threat doesn’t turn into a full-out fraud.

Though an interesting idea, you can also get your credit report for free every month from Credit Karma. This way you can check everything yourself without paying a dime. That being said, if you’re drawn to the daily monitoring that’s done automatically, MogoProtect is an option for you.

Find out more here.

MogoMortgage

If you’re in the market for a house, Mogo offers mortgages through their online-only broker.

And the offered rates are pretty competitive, assuming there’s no additional markup behind the scenes. We’ll compare against Tangerine’s rates, since they’re some of the best big bank mortgage rates in Canada right now:

| Mortgage type | MogoMortgage | Tangerine |

|---|---|---|

| 3 year fixed | 2.54% | 2.69% |

| 5 year fixed | 2.49% | 2.69% |

| 5 year variable | 2.20% | 2.45% |

I have to admit, these are pretty attractive – but the fact that their other credit products (i.e. their loans) have such high interest rates makes me wary about what kind of terms you’ll need to meet and agree to in order to qualify.

If you’re still interested, you can find out more here.

MogoWealth and stock

If you’re interested in what Mogo is doing and see it as a good investment opportunity, they’re a publicly traded company on both the TSX and NASDAQ.

Here’s some basic information:

| Product | Mogo stock |

|---|---|

| Ticker | MOGO |

| Traded on | * Toronto Stock Exchange * Nasdaq |

| Average volume | 55,090 |

| 52-week range | 0.790 – 5.200 |

Want an easy way to invest? One may be in the works…

MogoWealth, which you can check out here, looks set up to be an online investment tool.

This is all Mogo says about it so far, with links to their investment course through MoneyClass:

This will be helpful for Mogo users who are also investors – putting most of your financial needs in one place.

Is Mogo legit and safe?

Yes, Mogo is a legitimate, publicly-traded company, founded in 2003 in Vancouver, Canada.

It has been under heavy fire for years now because of its high-interest loans, which is warranted, but if you just want an easy way to check your credit score or maybe a new prepaid credit card – you avoid the source of the majority of criticism.

One thing you should be aware of is they’ll use your provided information to target you with ads for product offers. If you like to avoid companies using your information for marketing purposes, then you may want to skip on making an account altogether.

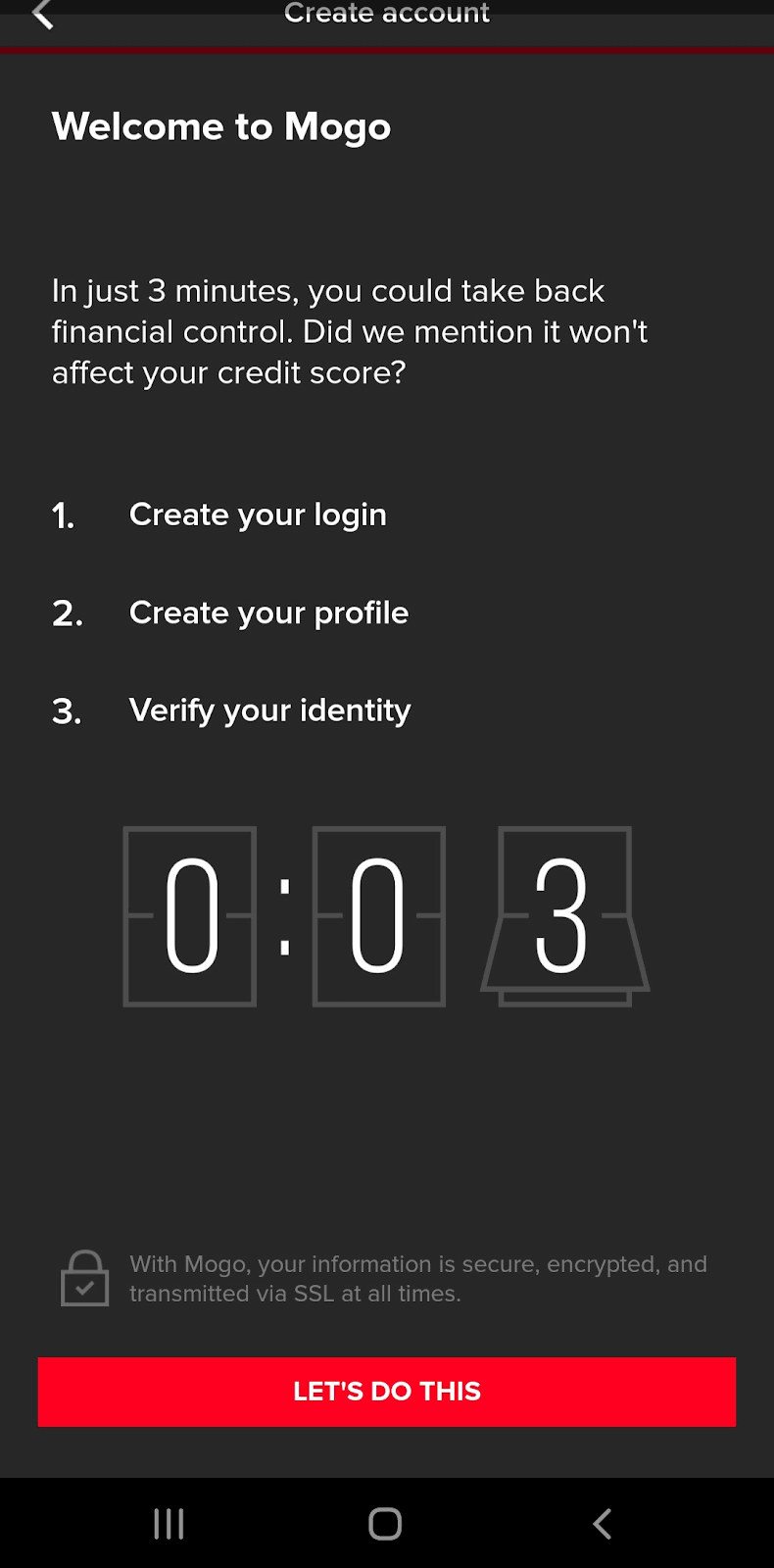

How do you set up an account?

Setting up a Mogo account is easy and only takes a couple of minutes.

All you have to do is give basic information like:

- your full name,

- your address,

- your living situation, and

- how much you make.

Then they ask 3 verification questions about things that are on your credit report in order to confirm your identity. This can be stuff like who your car payment and cell phone bill is with.

Once that’s done, you get immediate access to your dashboard – and your credit score.

Conclusion

What do you think about Mogo?

Do you trust them for their non-loan products? Or have you written them off completely?

FAQ

What is Mogo?

Mogo is a Canadian fintech company that was founded in Vancouver in 2003. They’ve faced much criticism for their high interest loans, but have since expanded to a portfolio of 7 financial products. These products include your free credit score, a prepaid credit card (coming soon), and more. Learn more about what Mogo offers here.

Is Mogo legit?

Yes, Mogo is a legitimate, privately-traded Canadian company with real, secure financial products. The main things you need to look out for is the interest rates on their loans and the fact that they may use your information to sell you products. You can read more about the safety of Mogo here.

Are Mogo loans safe?

Mogo loans mostly come with absurdly high interest rates. Though they aren’t payday-loan level rates, they can still leave you paying thousands of dollars in interest by the time the term is up. Read more about their loans here.

Is Mogo actually a payday loan?

Most payday loans have annual interest rates upwards of 400%. The highest MogoLiquid personal loans go is 46.96%, and the MogoMini line of credit goes up to 47.71%. That said, these are still absurdly high rates, more than double that of your credit card. You can read more about Mogo’s loans here.

Does checking my credit score with Mogo affect my score?

No, checking your credit score with Mogo does not affect your score. You can read more about getting your monthly credit score updates with Mogo right here.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments