An exchange-traded fund – commonly known as an ETF – is an investment fund that can be bought and sold on an exchange, similar to a stock. They allow Canadian investors to buy a collection of individual stocks and/or bonds at once, similar to mutual funds.

Most ETFs follow the performance of an index, a specific economic sector (such as healthcare, industrial, or energy), or even global markets. They can save you significant time and money by allowing you to spread your money across a range of companies without having to hand pick each one.

Below, we discuss how ETFs work, why you should consider them for your portfolio, the ways you can invest, and more.

Key Takeaways

- ETFs are investment funds that trade on stock exchanges and hold a diversified mix of assets.

- They provide a well-diversified mix of securities that would be tricky to assemble by yourself.

- When choosing ETFs, look for diversification, asset class, fees, and management details.

- Canadians can choose to invest in ETFs through robo advisors, online brokers, or financial advisors.

How do ETFs work?

ETF providers bundle various investments, give the bundle a theme or name the sector it's tracking, and sell shares to the public. They offer investors a diversified mix of securities that would otherwise be costly and time-consuming for someone to assemble on their own.

It's important to note that ETFs come with transaction and rebalancing costs, as well as management fees and operating expenses. These expenses combined annually and presented as a percentage of the fund’s total value.

Just like many other investment types, ETFs are quoted and traded on various stock exchanges and prices can fluctuate throughout each day. Since ETFs can add or remove shares as needed, the number of available shares can change daily, too.

Types of ETFs in Canada

There are many types of ETFs, from stock-based ETFs that track specific industries or regions to bond ETFs for those looking for some income.

This table illustrates some of the most common types:

| Type of ETF | Description |

|---|---|

| Commodity | Focused on a single commodity that's held in physical storage (precious metals, oil, etc.), or on investments in commodities futures contracts |

| Currency | Can include individual currencies or a basket of currencies |

| Equity/Stock | Allows you to purchase proportionate ownership of the underlying businesses |

| Fixed-income/Bond | Includes broad markets or sectors of the bond market, but are often lower risk than equity ETFs |

| Index | Tracks an index of equities |

| International | Include investments that go beyond the borders of North America |

| Real estate | Composed of multiple real estate investment trusts (REITs) |

| Sector or industry | Investments in a specific, well-established sector/industry (health care, finance, etc.) |

| Specialty | Usually contains either leveraged or inverse types of funds |

| Sustainable | Includes securities with environmental and/or social significance |

What to look for when choosing ETFs

With so many ETFs on the Canadian market, some are meant to track market indexes across the world in a balanced way, while others are meant to be a collection that has specific assets.

The top Canadian ETFs will suit your needs and appreciate in value over time.

Here are four factors you can consider when choosing your next ETF in Canada:

1. A low MER

A Management Expense Ratio, or MER for short, is the total fee charged by companies that offer ETFs or mutual funds. It includes expenses, like taxes and operating expenses.

It's usually shown on an ETF top sheet or sales sheet and is expressed as a percentage of the fund’s average net assets for the year. For example, if a fund has assets of $100,000 and incurs a cost of $260 per year, then the MER would equal 0.26%.

The best ETFs in Canada will have low management fees. The lower the management fees, the more of your own money you get to keep and invest.

2. An overall asset class that helps diversify your portfolio

The best ETFs in Canada will help your portfolio become properly diversified.

ETFs help target an asset class – these are the main types:

- Equities (stocks)

- Bonds (fixed income)

- Commodities

- Currencies

- Real estate

- Preferred stocks

Overall, most ETFs hold the first three classes (equities, bonds, commodities). A well-diversified portfolio will also include real estate exposure and preferred stocks.

3. The underlying holdings

The premise behind many ETFs is to hold a large variety of bonds or stocks. By doing so, wild market fluctuations only have a minor impact on the share price.

So if you examine what an ETF in Canada is composed of, you'll see that it owns shares in 10s or 100s of companies.

For example, if you were to buy Vanguard’s VFV, which tracks the S&P 500 Index (those being the 500 largest publicly traded companies in the USA), you're buying an ETF that holds shares in companies like Apple, Amazon, and Tesla:

The big question is...how is this fund balanced?

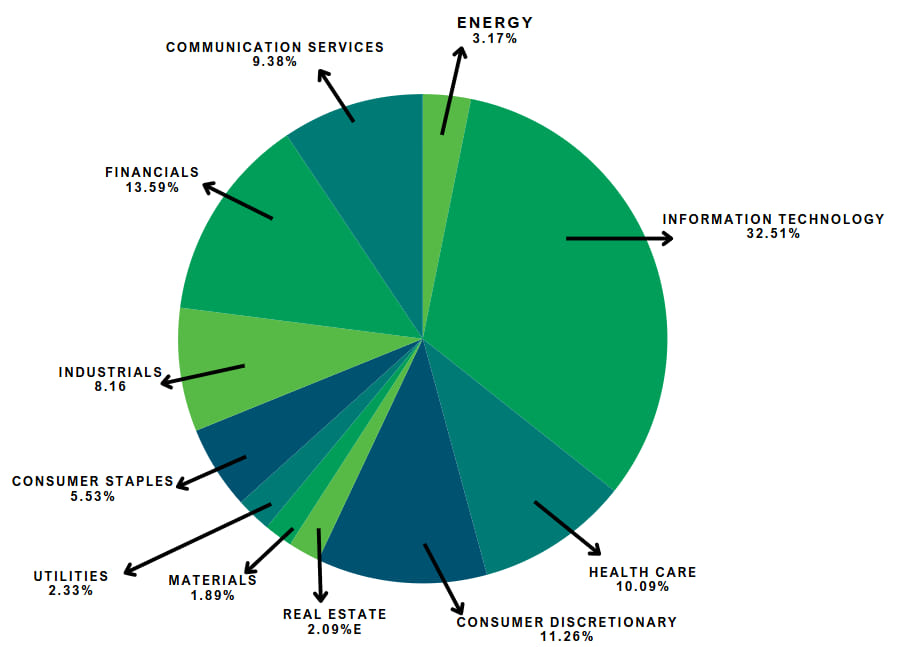

Using the weighted exposure of VFV as an example, here's what a well-diversified ETF looks like:

4. Average annual return

It's helpful to look at how the ETF performs on an average year. This determines the kind of income an ETF can earn.

Naturally, the longer the ETF has been in existence, the better the data set for this average return. But newer ETFs can still have high average annual returns, so the inception date isn't always as important as it may seem.

Pros and cons of ETF investments

Pros:

- Low fees: Compared to mutual funds, ETFs usually have lower management fees

- Flexibility: You can buy or sell ETFs easily if the stock market changes (or your investment goals change)

- Diversification: ETFs include a selection of assets, so you’re spreading out your risk

- Tax benefits: ETFs have fewer taxable events than mutual funds, so this could help reduce your tax burden as an investor

- Efficiency: Save you time and effort searching for quality, well-diversified individual investments

Cons:

- Market volatility: ETFs are just as subject to market changes as other investments, and some will perform worse than others

- Easy liquidation: The inherent flexibility makes it easy to cash out during market swings, etc., and you may miss out on gains

- Lower yields: Some ETFs pay dividends, but payouts may be lower than owning high-dividend stocks directly

How to invest in ETFs

There are three main ways to invest in ETFs in Canada:

- Opening and funding a robo advisor account, which will automatically invest your money in an ETF-based portfolio

- Opening and funding an online broker account, then buying ETFs directly

- Speaking with a financial advisor and buying ETFs they recommend

1. Investing in ETFs with a robo advisor

Robo advisors offer a laid-back way to invest in Canada. And thanks to the fact that they're based on a trusted algorithm instead of being actively managed, they usually have low fees.

Most of them deal with ETF portfolios, making it easy to invest right away. That means you don't need to deal with the nitty-gritty details of which ETFs to invest in – your money will be spread out across multiple options.

If you're looking to get started with a robo advisor, RBC InvestEase is an excellent choice. With the valuable help provide NOMI Insights and the low investment threshold, this RBC product is both valuable and reliable.

The RBC InvestEase platform is one of the most reliable robo advisors in Canada, provided by one of Canada’s biggest banks. Upon funding your account, the RBC InvestEase algorithm (and experts) maintain your investments for you. This makes the entire process simple, especially for new investors.

- Trusted industry name

- Big portion of transfer fee can be waived

- Low minimum to start investing

- Responsible investing portfolios

- NOMI Insights helps with goals

- The fees could be better

- Transferring to another institution incurs a hefty fee

- No mobile app

- Resident of Canada

- Age of majority

- A SIN starting with a number from 1 to 7

- Low minimum balance requirement

- Non-registered

- TFSA

- RRSP

- FHSA

2. Investing in ETFs with online brokerages

But if you prefer the DIY approach to investing, you can buy ETFs through an online brokerage. That way you can pick and choose the exact ETFs you want to buy.

Most of the big banks in Canada offer brokerage services. While these tend to be a bit pricier than non-bank alternatives, they have plenty of other benefits – especially the security and reputation of the institution supporting it.

The TD Direct Investing is a particularly good choice. There's no minimum amount required to get started, you'll have access to a variety of trading platforms, and there are plenty of free tools and market research available at your fingertips.

Like all of the Big 5 Banks, TD offers convenient online investing tools that regular people (not just professional traders) can use to manage their own investments. The TD Direct Investing Platform has high per trade fees, but does offer some pretty interesting educational materials and opportunities to help new and advanced investors.

- No minimum investment needed to open an account

- Some transfer fees may be reimbursed

- Active trader discount

- Variety of trading and investing platforms

- Wide array of free tools and market research

- Cash back offer

- High fees per trade can add up fast

- $25 per quarter inactivity fees

- No practice accounts

- No way to automate certain account activities

- Video series to learn about investing

- Daily live, interactive Master Class workshops

- Free investment research and tools

- TFSA

- RRSP

- RESP

- RRIF

- LIRA

- LIF

- RDSP

- Cash account

- Margin account

- FHSA

- Stocks

- Mutual Funds

- ETFs

- Options

- Fixed Income

- GICs

- Cryptocurrency ETFs

3. Investing in ETFs with a financial advisor

While this can be a costly option, many people feel more comfortable discussing their wants and needs with a professional who can offer a hands-on approach.

Independent advisors are best, but you can also ask your bank if they have any in-house financial advisors. Feel free to meet with several individuals so you can find one that feels right and understands your goals.

We recommend working with an advisor who charges a flat fee upfront, rather than a percentage of your earnings. This way, the true cost of investing with them isn't hidden.

FAQ

Are ETFs a good investment in Canada?

Yes, ETFs can be an excellent choice, especially for new Canadian investors looking for passive-style investing with significant diversification. The main downside of ETFs is that they may have lower yields than other investment types.

What is the best ETF in Canada?

Especially since their value is constantly fluctuating, it's tough to name one top ETF. However, a few top ETF options include XEQT, VEQT, and XCG. Scotiabank is the best provider of an ETF, with low management fees and consistently valuable performance.

Are ETFs good for beginners?

Yes, ETFs are an excellent choice for those just starting out on their investment journey. Most are passive investments (minimum cost/effort for maximum returns) with low fees, offering wide diversification in a single product.

Is an ETF better than a mutual fund?

These are similar products and their true value depends on what the investor is looking for. ETFs offer flexibility and are tax efficient, while mutual funds often have a longer history, which helps determine its overall performance and value.

How much do ETFs cost?

Typical MERs for ETFs range from 0.05% to 2%, and we've determined that the average MER of the top ETFs is 0.25%. You'll also need to consider management fees, operating expenses, and brokerage commissions.

How do you invest in ETFs?

Canadians can invest in ETFs through online brokers, robo advisors, or financial advisors. Robo advisors offer an automated investment method, while online brokerages require a bit more attention. Financial advisors can be pricey but add an often-needed personal touch.

Leave a comment

Comments