If you’re looking for a convenient, flexible online bank, Tangerine and Simplii Financial are both solid options. Based on our comparison of products and services, Tangerine comes out on top – but you really can’t go wrong with either one.

Tangerine is owned by Scotiabank and Simplii is owned by CIBC, so you get all of the security of banking backed by the Big Five, including their ATM networks.. However, since these subsidiaries are online-only, you won’t have access to actual bank branches.

To determine whether Tangerine or Simplii is the better online bank, we compared each one across categories like chequing accounts, credit cards, investment options, and more.

Key Takeaways

- Simplii Financial and Tangerine are both full-featured online banks owned by bigger national bank chains.

- Simplii's no fee chequing account is slightly better than Tangerine's, mostly thanks to the free cheques included and valuable referral bonus.

- Both banks have excellent HISAs.

- Tangerine offers two Mastercards, while Simplii offers just one Visa.

- Both banks have multiple investment options, but Tangerine's are a bit easier to understand and access.

Simplii Financial

| Pros | Cons |

|---|---|

|

|

Tangerine

| Pros | Cons |

|---|---|

|

|

Chequing accounts

Simplii and Tangerine both offer convenient no fee chequing accounts with plenty of features. In fact, their chequing accounts have so much in common that it’s hard to choose a winner.

The Simplii No Fee Chequing Account and Tangerine Chequing Account both offer:

- Unlimited monthly transactions and bill payments

- No monthly or annual fees

- No fees for withdrawals

- Direct deposit

- Free Interac e-Transfers

- Mobile cheque deposit

- Mobile wallet

- Up to $5,000 optional overdraft protection, with a 19% interest charge while your account is overdrawn.

There are a few differences, although many of them are minor:

| Simplii No Fee Chequing Account | Tangerine Chequing Account | |

|---|---|---|

| Overdraft fees | * $4.97 per month * 19% interest | * $5 per use (up to once per month) * 19% interest |

| ATMs | * CIBC network * 3,000+ machines nationwide | * Scotiabank network * 3,600 machines nationwide |

| Debit card | Debit Mastercard | Debit Visa |

| International money transfers | Simplii Financial™ Global Money Transfer | N/A |

| Referral bonus | * $125 per referral * Capped at 50 referrals per year, 250 lifetime | * $50 bonus per referral * Capped at 3 referrals per year |

| Interest | * 0.1% | * Up to $49,999.99: 0.01% * $50,000 - $99,999.99: 0.05% * $100,000 - $499,999.99: 0.1% * $500,000+: 0.01% |

| Cheques | * Free | * First book free * Additional books $50/each |

| Sign-up promotions | $300 | $250 |

| Genius Rating | 2.7 | 3.3 |

The winner: Simplii

This one was close, but ultimately, we had to hand it to Simplii for the Simplii Financial Global Money Transfer, free cheques, and generous referral bonus.

That said, Tangerine has access to a bigger network of ATMs, and you can earn more interest if you plan to keep a large balance in your chequing account.

High-interest savings accounts

Tangerine and Simplii’s high-interest savings accounts (HISAs) are quite competitive. When you’re comparing Simplii High Interest Savings Account and Tangerine Savings Account, they look pretty similar.

Here’s a breakdown of their features:

| Simplii High Interest Savings Account | Tangerine Savings Account | |

|---|---|---|

| Standard interest rate | * Up to $50,000: 0.3% * $50,000.01 – $100,000: 0.5% * $100,000.01 – $500,000: 0.6% * $500,000.01 – $1 million: 0.8% * $1 million+: 1.5% | * 0.3% |

| Promotional rate | 4.5% for 5 months | 4.5% for 5 months |

| Monthly fee | $0 | $0 |

| Automatic deposits | Yes - Autodeposit | Yes - Automatic Savings Program |

| Minimum balance | N/A | N/A |

| Genius Rating | 2.4 | 4.1 |

The winner: Tie

This one’s too close to call – it really depends on your savings goal.

Tangerine’s higher introductory offer makes it easy to get your savings off to a good start, but you’ll earn more interest with Simplii if you maintain at least a $50,000 balance.

Credit cards

There are credit card options from Tangerine and Simplii that include features like no annual fee, purchase protection, and cash back.

Tangerine offers two cards:

Simplii offers one card:

The cash-back features are where these credit cards shine"

Simplii Cash Back Visa Card

- Earn 4% cash back on purchases made at restaurants, bars, and coffee shops

- Earn 1.5% cash back when you buy gas or groceries, make purchases at a drugstore, or make a pre-authorized payment

- Earn 0.5% cash back on all other purchases

- Total cash back across all categories is capped at $5,000 per year

Tangerine Money-Back Credit Card

- Earn 2% cash back in two categories of your choice (from a list of 10 options)

- Choose a third cash back category if your cash-back rewards go into a Tangerine Savings Account

- Earn 0.5% cash back on all other categories, with no annual cap

Take a look at this side-by-side comparison of the credit cards offered by Simplii and Tangerine:

| Simplii Financial Cash Back Visa Card | Tangerine Money-Back Credit Card | Tangerine World Mastercard | |

|---|---|---|---|

| Welcome offer | 10% cash back for first 3 months | 10% cash back (up to $100 earned) for first 2 months | 10% cash back (up to $100 earned) for first 2 months |

| Maximum cash back | $5,000 per year | Unlimited | Unlimited |

| Annual fee | $0 | $0 | $0 |

| Extra features | * No fees to send money abroad via Simplii Financial Global Money Transfer * Low income requirements ($15,000) | * Change cashback categories whenever you like * Special balance transfer offer during the first 30 days * Student version available | * Mastercard Travel Rewards and Mastercard Travel Pass * Change cashback categories whenever you like * Special balance transfer offer during the first 30 days |

| Insurance coverage | * Extended warranty (1 year) * Purchase protection (90 days) | * Extended warranty (1 year) * Purchase protection (90 days) | * Extended warranty (1 year) * Purchase protection (90 days) * Mobile device ($1,000) * Rental car theft and damage |

| Purchase interest rate | 20.99% | 20.95% | 20.95% |

The winner: Tangerine

For well-qualified borrowers, Tangerine’s World Mastercard offers extra perks like mobile device insurance, rental car collision, and access to lounges while you’re travelling.

Borrowers who don’t meet the requirements for the World Mastercard can choose between the Simplii Financial Cash Back Visa Card and the Tangerine Money-Back Credit Card. Both are solid options, but we gave Tangerine the edge because of its unlimited cash-back and the ability to choose your cash-back categories.

Still, you might prefer Simplii’s card if you spend more at restaurants and coffee shops, or if you're not worried about the annual cash-back cap. Compare both options to see which one’s best for you.

Investments

If you’re looking for a bank you can invest with, Simplii and Tangerine both have valuable options.

Mutual funds

Simplii offers a selection of mutual funds that you can choose from based on your preferred level of risk – Conservative, Balanced, and Growth. These are managed by investment experts, but Simpli clients receive a 10% management fee discount.

Tangerine offers several portfolios, including its Core Portfolios, Global ETF Portfolios, and Socially Responsible Global Portfolios – each with variants you can choose based on your preferred risk.

Here's a look at how these bank mutual fund offerings measure up:

| Simplii | Tangerine | |

|---|---|---|

| Automatic rebalancing? | Yes | Yes |

| Minimum to invest | $25 | $25 |

| Global diversification? | Yes | Yes |

| Management fees | Not listed | * 0.80% for Core Portfolios * 0.50% for Global ETF Portfolios * 0.55% for Socially Global Portfolios |

| Management Expense Ratio (MER) | * 0.42% – 1.44% for index funds * ETF portfolios: 1.11% | * 1.06% for Core Portfolios * 0.76% for Global ETF Portfolios * 0.82% of Socially Global Portfolios |

Simplii and Tangerine both offer money market funds, as well.

Simplii gives you access to CIBC's money market funds. The Class A fund has an MER of 0.5% and requires an initial minimum investment of $500, while the Premium Class fund's MER is 0.35 and has an initial minimum investment of $100,000.

Tangerine’s Money Market Fund has an annual management fee of 0.5% of the fund’s value, plus an annual fixed admin fee of 0.15% of the fund’s value. You can invest with as little as $25.

The winner: Tangerine

We’re crowning Tangerine here thanks to its lower MERs, low investment minimums, and detailed, easy-to-understand online info.

We also love Tangerine’s Socially Responsible Global Portfolios, which don’t exclude investments from companies known to engage in shady business practices, deal in controversial weapons, or have relatively high carbon footprints.

GICs

If you want to set aside cash to grow for a specific amount of time, Simplii and Tangerine both offer Guaranteed Investment Certificates (GICs). Choose how long you want your GIC term to be, and compare interest rates to decide which one is right for you.

As of January 2025, here are the GIC terms and rates available from each bank:

| Bank | 1 year rate | 2 year rate | 3 year | 4 year rate | 5 year rate |

|---|---|---|---|---|---|

| Tangerine | 3% | 3.05% | 3.45% | 3.25% | 3.35% |

| Simplii | 3.5% | 3.4% | 3.4% | 3.5% | 3.6% |

The winner: Tangerine

Tangerine offers more choices when it comes to GIC terms, and for most GIC terms, Tangerine GICs are a little higher.

That said, if you’re planning to purchase a 5-year GIC, Simplii’s rates are a little better.

Registered and foreign currency savings accounts

If you’re interested in other savings options, like a registered savings account, both Simplii and Tangerine can help.

Here’s more about the alternative savings accounts offered by both banks:

| Simplii | Tangerine |

|---|---|

| Simplii TFSA * 0.4% interest | Tangerine TFSA * 0.3% interest |

| Simplii RRSP * 0.4% interest | Tangerine RSP Savings Account * 0.3% interest |

| Simplii USD Savings Account * 2.8% interest | Tangerine US Dollar Savings Account * 0.1% interest * No fees/balance requirements * Ability to automate transactions |

| Simplii Foreign Currency Savings Accounts: * EUR * GBP * CNH * INR * PHP | Tangerine Children’s Savings Account * 0.4% interest |

The winner: Simplii

Simplii’s TFSA and RRSP interest rates are a little higher than Tangerine’s, giving them a slight edge.

And Simplii really shines if you want to save in other currencies. Its USD Savings Account offers 2.8% interest, compared to Tangerine’s 0.1%. And while you won't earn interest, Simplii has an impressive variety of foreign currency accounts with competitive exchange rates.

It’s also worth noting that Simplii is the only Canadian bank that offers personal deposit accounts in Indian rupees (INR) and Philippine pesos (PHP).

Mobile apps

Simplii and Tangerine both offer free mobile apps and quite well rated:

| Simplii | Tangerine | |

|---|---|---|

| App Store | * 4.2 stars * 12,000+ ratings | * 4.7 stars * 69,000+ ratings |

| Google Play | * 3.9 stars * 16,000+ ratings | * 4.5 stars * 41,000+ ratings |

The winner: Tangerine

While they’re both rated pretty highly on the App Store and Google Play, Tangerine is a clear favourite.

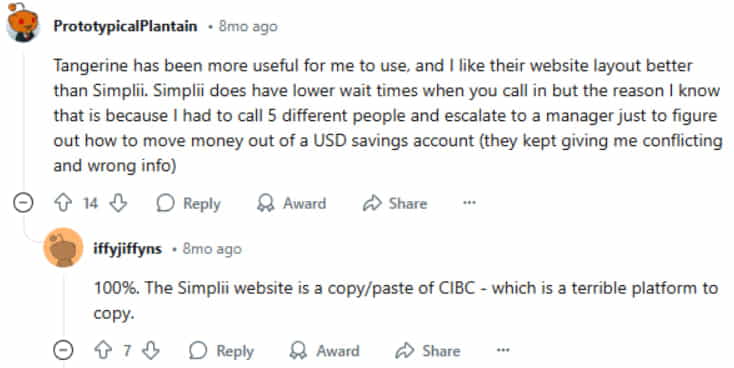

Reddit users agree, saying:

Other bank features

When you’re choosing a bank, it’s important to look at the features that are important to you. If you’re looking for a bank that offers HELOCs or you regularly need to transfer money internationally, these features might make a difference in your decision.

This table lists various products offered by Tangerine and Simplii Financial:

| Simplii | Tangerine | |

|---|---|---|

| Personal loan | Yes | No |

| Line of credit | Yes | Yes |

| HELOC | Yes | Yes |

| RSP loan | No | Yes |

| Global money transfer | Yes | No |

| Business GICs | No | Yes |

| Business bank accounts | No | Yes |

| Kids bank accounts | No | Yes |

| U.S. bank accounts | Yes | Yes |

The winner: Tangerine

In short, Tangerine offers more of these extra products than Simplii. It's a tough call, though, as all products from both institutions are high quality choices.

Final winner

Tangerine won in most of the categories listed above. Its winning mobile app, versatile credit cards and variety of investment options will make it very attractive for many customers.

Still, the Simplii No Fee Chequing Account won for best chequing account, and since the HISA comparison was a tie, that may leave Simplii in the top spot for your day-to-day banking.

When you’re trying to decide whether Simplii or Tangerine is better, it ultimately comes down to what you need from a bank. Hopefully, the above comparisons will help you narrow things down.

FAQ

Tangerine vs. Simplii – which is better?

It’s hard to choose between Tangerine and Simplii. Both are solid online banking options, with chequing accounts, HISAs, investment options, credit cards, and more. Tangerine may be better for investing, while Simplii may offer a better daily banking experience.

Are Tangerine and Simplii better than a big bank?

If you enjoy visiting a branch and interacting with a bank teller, a traditional big bank is probably a better option. But if you prefer the flexibility and inexpensive nature of online banking, online banks are clear winners.

Who owns Tangerine?

Tangerine is a wholly-owned subsidiary of Scotiabank, one of Canada's largest and most popular banks. Scotiabank bought Tangerine (then known as ING Direct) in 2012. Thanks to this relationship, Tangerine clients have access to Scotiabank's nationwide network of ATMs.

Who owns Simplii?

Simplii Financial is owned by CIBC, one of Canada's largest banks. What was once a relationship with PC Financial ended with CIBC purchasing and rebranding PC financial as Simplii Financial. Simplii clients have access to CIBC's ATM network.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments