Comparing KOHO vs. Tangerine begins with looking at the products and features these online banks offer. Tangerine wins for having solid, more traditional banking products and options, but KOHO has some very appealing modern options.

Owned by Scotiabank, Tangerine has a variety of account types, including chequing, saving, credit card, and investment accounts. KOHO has only one hybrid account available, with three unique tiers and an accompanying prepaid Mastercard.

We studied all the features, benefits, and drawbacks of these two financial institutions for the following review.

Key Takeaways

- KOHO and Tangerine are both online-only institutions that offer a free chequing account.

- KOHO’s prepaid Mastercard provides cash back rewards and interest on your balance.

- Tangerine has multiple savings account options, including U.S. Dollar and registered accounts.

- Only Tangerine offers investment options.

KOHO vs. Tangerine: Overview

KOHO and Tangerine are two digital banking options in Canada. Both have fee-free accounts, high interest rates, and convenient mobile apps.

However, they differ in features, services, and overall product offerings. Neither bank has physical branches and neither offers mortgages, but both offer valuable banking solutions to different types of clients.

KOHO is a fintech company, not a true financial institution like Tangerine. Its primary product is a prepaid cash back Mastercard that functions like a hybrid chequing/savings account with a very high interest rate.

As this Reddit user points out, you can earn quite a bit of cash back with this account:

Tangerine, on the other hand, is a full-fledged online bank. It offers chequing accounts, savings accounts, credit cards, and investment options that include registered savings accounts.

Thanks to its relationship with Scotiabank, Tangerine clients have free access to Scotiabank's network of ATMs.

However, as this user points out, having a relationship with a big bank doesn't mean that Tangerine feels like a big bank:

Chequing accounts

KOHO doesn't offer a traditional chequing account, but Tangerine does.

With a KOHO Earn Interest, you load money into your account and use the accompanying prepaid card like a debit card, enjoying added perks like cash back and savings features.

KOHO offers three tiers for this hybrid account, each with increasing levels of cash back and interest:

- Essential: $0 per month (with direct deposits), 1% cash back, 2.5% interest on your balance

- Extra: $18 per month, 1.5% cash back, 3% interest on your balance

- Everything: $22 per month, 2% cash back, 4% interest on your balance

This KOHO account can be an excellent option for younger users or for sharing with the younger users in your household, as pointed out by these clients:

KOHO accounts have no NSF fees, no monthly account fees, and free Interac e-Transfers. However, since it's a prepaid card and not a true chequing account, you can’t write cheques.

In contrast, the Tangerine Chequing Account is more of a typical chequing account. It comes with these features:

- No monthly fees

- Unlimited transactions and Interac e-Transfers

- 0.1% interest

- Free first book of cheques

- Free access to Scotiabank ATMs for cash withdrawals

You can use the Tangerine Chequing Account for shopping online or in person, making bill payments, writing cheques, and more.

The winner: Tangerine

Tangerine offers a true chequing account with no fees and even the opportunity to earn a (tiny) bit of interest.

It's hard to compare them since KOHO’s account is so different in nature. Still, it's an intriguing option and potentially valuable product, and we do like the prepaid and cash back combo.

High-interest savings accounts

KOHO does not offer a traditional savings account, but its KOHO Earn Interest does earn interest on the balance you keep in your prepaid account. On the other hand, the Tangerine Savings Account is a typical savings account.

Here are the interest rates available to you at both KOHO and Tangerine:

- KOHO Essential: 2%

- KOHO Extra: 3%

- KOHO Everything: 3.5%

- Tangerine (promo): 4.5% for 5 months

- Tangerine base: 0.3%

As mentioned here on Reddit, the Tangerine Savings Account is quite well-known for its high promotional rates:

Tangerine doesn't charge a monthly fee and doesn't require a minimum balance requirement for this savings account.

KOHO's account has a unique RoundUp feature that automatically rounds your purchases up to the nearest $1, $2, $5, or $10 (your choice) and deposits the extra funds into your account. It's a very convenient way to add tiny boosts to your savings.

The winner: Tangerine

Tangerine offers a dedicated savings account with more flexibility and more traditional features, even though the base interest rate isn't particularly noteworthy.

While KOHO offers a much higher base rate, you have to pay for a plan to unlock it.

Credit cards

Tangerine provides a true cash back credit card.

KOHO offers three tiers of its prepaid Mastercard. In addition to earning interest on your balance, KOHO cards also offer cash back on grocery, transportation, and food and drink purchases.

Here are the cash back and interest rates:

- Koho Essential Mastercard: 1% cash back, 2.5% interest

- Koho Extra Mastercard: 1.5% cash back, 3% interest

- Koho Everything Mastercard: 2% cash back, 4% interest

Other features of the KOHO prepaid cards include:

- No interest charges on spending

- No NSF fees

- Access to budgeting tools

- Free credit score checks

- Payments via Interac e-Transfer

- No FX fees (for Extra and Everything cards)

It's important to note that the KOHO card is not connected to your credit score. It won't help you build credit and it won't lower your credit score if you don't make payments.

Instead, KOHO has a product called KOHO Credit Building that essentially reports your payments to a credit bureau and helps beef up your score. You also have access to financial coaching and the ability to track your progress with Equifax – all for $10 per month.

As this Reddit and KOHO user points out, the interest, cash back, and lack of FX fees add up for some sweet savings:

Tangerine offers two types of cash back credit cards: the Tangerine Money-Back Credit Card and the Tangerine World Mastercard.

First up, the Tangerine Money-Back Credit Card comes with these features and benefits:

- No annual fee

- 2% cash back on two spending categories of your choice

- 0.5% cash back on everything else

- Welcome bonus of 10% cash back (up to $100)

- Unlock a third cash back category when your rewards are deposited into a Tangerine Savings Account

The Tangerine World Mastercard has similar features and even more perks, but does require a higher income:

- No annual fee

- 2% cash back structure in 2 spending categories of your choice

- 0.5% cash back on everything else

- Welcome bonus of 10% cash back (up to $100)

- Unlock a third cash back category when your rewards are deposited into a Tangerine Savings Account

- Access to Mastercard Travel Rewards

- Mastercard Travel Pass from DragonPass

Like most traditional credit cards, you’ll pay interest charges if you carry a balance on either of these Tangerine cards.

The winner: Tangerine

Tangerine has two excellent credit card options with basic perks, credit-building, and solid cash back rewards. The World Mastercard has even more perks for travellers.

However, if you want a no-risk prepaid card with cash back, KOHO could work very well for you.

Investments

If you’re looking for a bank you can invest with, Tangerine has multiple investment options. KOHO has no true investment options.

Mutual funds

Tangerine Investment Funds include low-fee, index-based mutual funds. These are passively managed and designed for long-term investing.

While Tangerine's Core Portfolios don't contain mutual funds, their Global ETF Portfolios and Socially Responsible Global Portfolios do. Each of these is built with a selection of ETFs in a mutual fund.

The Global ETF Portfolios feature a 0.76% MER, while the Socially Responsible Global Portfolios have a 0.82% MER.

Tangerine investments offer an excellent opportunity to take advantage of the Canadian couch potato investment strategy, as this client did:

KOHO doesn’t offer any investment products, which isn't really surprising as it doesn't claim to be a traditional bank or investment provider.

The winner: Tangerine

Tangerine is the only option that gives you actual stock market exposure. Its investment options are a little simplistic, but we like low MERs – they're considerably lower than the mutual fund average of 1.47%.

GICs

If you want to set aside cash to grow for a specific amount of time, only Tangerine offers Guaranteed Investment Certificates (GICs).

There are several types of Tangerine GICs:

- Regular GICs

- Tax-free GICs

- RSP GICs

- RIF GICs

- USD GICs

There's also quite a range of term lengths to choose from:

- 90 days

- 180 days

- 270 days

- 1 year

- 1.5 years

- 2 years

- 3 years

- 4 years

- 5 years

As of February 21, 2025, here are the GIC terms and rates available for typical GICs with some of the most common terms:

| Bank | 1-year term | 2-year term | 3-year term | 4-year term | 5-year term |

|---|---|---|---|---|---|

| Tangerine | 3.5% | 3.5% | 3.5% | 3.5% | 3.55% |

The winner: Tangerine

With CDIC insurance and a decent range of term lengths, Tangerine GICs are worth considering. The earn rates may not be the best on the market, but they’re competitive.

Registered and foreign currency savings accounts

As a fintech company rather than a bank, KOHO doesn't offer any registered savings accounts.

Tangerine offers three tax-advantaged savings accounts:

- Tangerine TFSA: 0.3% interest

- Tangerine RSP Savings Account: 0.3% interest

- RIF Savings Account: 0.35% interest

You can hold cash, investments, and GICs within these registered accounts. But it's not an open marketplace, which means you'll have to choose from among Tangerine’s portfolios.

The winner: Tangerine

Tangerine’s registered accounts are excellent choices for the casual investor. They're not the best TFSAs available in Canada, but they're solid, safe choices.

Mobile apps

KOHO and Tangerine both offer mobile apps.

Since KOHO itself focuses on its prepaid credit card, its app is designed for prepaid card management. Users can also access their KOHO Credit Building information, and the app has excellent budgeting features and offers valuable spending insights.

Tangerine’s app is more comprehensive, as are its product offerings. This app includes features for:

- Paying bills

- Depositing cheques

- Sending and receiving Interac e-Transfers

- Managing your chequing and/ or savings accounts

| KOHO | Tangerine | |

|---|---|---|

| App Store | * 4.8 stars * 80,500+ ratings | * 4.8 stars * 70,900+ ratings |

| Google Play | * 4.4 stars * 69,100+ ratings | * 4.6 stars * 43,000+ ratings |

Reddit reviews are quite mixed for the KOHO app:

The winner: Tangerine

Tangerine’s app provides a full-service banking experience, with a straightforward user interface that can handle pretty much any task you need to accomplish.

KOHO’s app is an excellent tool for managing prepaid KOHO cards and/or your KOHO Credit Building information, but as the products are limited, so are the app's features.

Other bank features

When choosing a bank, consider the features that matter most to you. Whether it’s access to investment choices or inexpensive international money transfers, the right options can make a big difference in your banking experience.

This table lists other banking products offered by KOHO and Tangerine:

| KOHO | Tangerine | |

|---|---|---|

| Personal loans | No | Yes |

| Line of credit | No | Yes |

| HELOC | No | Yes |

| RSP loan | No | Yes |

| Global money transfer | No | No |

| Business GICs | No | Yes |

| Business bank accounts | No | Yes |

| Kids bank accounts | No | Yes |

| U.S. bank accounts | No | No |

Customer service is another critical feature to consider, especially with online-only banks.

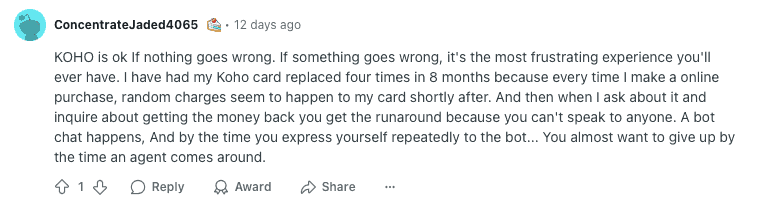

The KOHO customer service reviews are rather scathing:

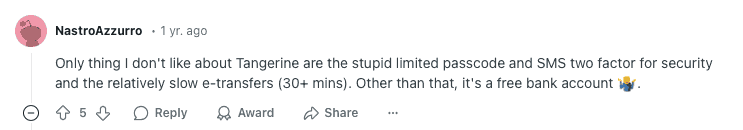

But there are more than a few unhappy Tangerine clients out there too:

The winner: Tangerine

Tangerine offers more additional features than KOHO. Plus, KOHO’s online reviews leave a lot to be desired.

Again, it's difficult to compare the products these two institutions offer when one is a more traditional online bank and the other a fintech company.

Final winner

Tangerine is our overall winner, but there’s a lot to love about both KOHO and Tangerine.

KOHO’s prepaid card service with cash back and interest is a unique and valuable product. Many Canadians use KOHO to keep their everyday spending under control – while also earning valuable rewards and interest.

Tangerine is a more comprehensive banking solution, with multiple account, investment, and credit card products. While it’s still an online-only bank with no branches and sometimes laggy customer service, most Canadians are happy with Tangerine’s wraparound banking services.

FAQ

Is KOHO or Tangerine better?

Tangerine is better for people who need full banking services like loans, lines of credit, and business accounts. KOHO is ideal for budgeting-focused folks who prefer a simple, fee-free prepaid Visa card and savings tools.

What bank runs KOHO?

KOHO is a financial tech company, not a bank. It’s independently operated, but partners with Mastercard and People's Trust Company to offer products and maintain security. It's also backed by investors like Drive Capital, Portag3, and BDC.

What are the disadvantages of Tangerine banks?

Tangerine lacks physical branches, which limits certain customer service options. While Tangerine does have a decent product menu, its total number of products is considerably less than what's typically offered by traditional banks – especially Canada's big banks.

Can Americans use KOHO?

KOHO is available only to Canadian residents at this time. We're unsure of any specific plans, but KOHO continues to grow, so it's possible that it could expand to serve the U.S. in the future.

What makes Tangerine different from other banks?

Tangerine stands out for its no-fee, fully digital banking platform. It provides solid banking and investment products, offers very valuable welcome bonuses, and has a highly-rated mobile app. Plus, its clients have free access to Scotiabank's extensive ATM network.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments