EQ Bank and Wealthsimple are online-only financial institutions in Canada, but EQ Bank specializes in everyday banking and Wealthsimple specializes in investing.

Still, the products they do offer are quite valuable and very, very convenient. EQ Bank is a fan-favourite for everyday high interest rates and Wealthsimple is hands-down the best platform for online investing in Canada right now.

Key Takeaways

- Both EQ Bank and Wealthsimple offer hybrid chequing accounts that come with prepaid debit cards.

- EQ Bank offers fewer registered accounts, and they can only hold GICs and cash.

- Wealthsimple offers a wide variety of investment products, including ETFs and crypto.

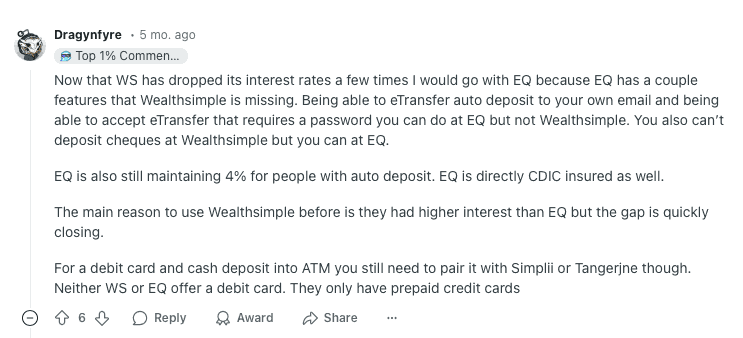

- Many Canadians use one or both institutions as a secondary finance account to complement their main big 5 bank account.

EQ Bank vs. Wealthsimple: Overview

EQ Bank and Wealthsimple are two of Canada’s top digital financial platforms, but they serve different needs.

EQ Bank is known for high-interest savings accounts, no-fee banking, and a short list of investment options.

Wealthsimple has a high-interest chequing account as well as automated investing, stock trading, and crypto options.

EQ Bank leans more toward banking and savings, while Wealthsimple is primarily an investment platform.

For everyday banking and high interest rates on your savings, try EQ Bank.

For more investment options and a great app experience, try Wealthsimple.

Chequing accounts

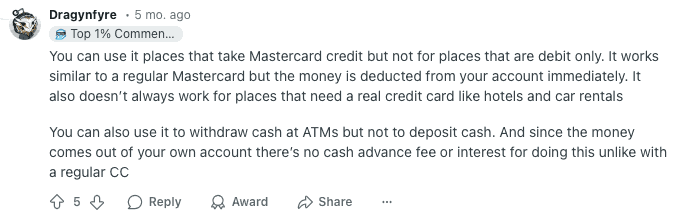

Neither EQ Bank nor Wealthsimple offers a traditional chequing account. Instead, they each provide a prepaid spending or hybrid account, one that acts as both a chequing and savings account.

EQ's hybrid account is the EQ Bank Personal Account, which offers these features:

- Max 2.75% interest

- Free ATM use, including reimbursement for independent fees

- Quick, inexpensive global money transfers via Wise

- A prepaid EQ Bank Mastercard (earns 0.5% cash back)

Wealthsimple Chequing is a similar prepaid spending account:

- Max 2.25% interest

- Free peer-to-peer transfers within Wealthsimple

- Early paycheque direct deposits

- A prepaid Wealthsimple Cash Mastercard

The winner: EQ Bank

We’re giving this one to EQ Bank for its free ATM withdrawals and higher interest rate.

High-interest savings accounts

Both EQ Bank and Wealthsimple offer high-interest savings options, but they’re very different.

EQ Bank has two account options that earn interest:

- EQ Bank Personal Account: 2.75% interest with $2,000 monthly recurring direct deposits

- EQ Bank Notice Savings Account: 2.75% for 30-day notice withdrawals, 2.35% for 10-day notice withdrawals

Wealthsimple has one savings option in CAD and one for USD:

- Wealthsimple Chequing: 1.25%, 2.5%, or 2.25% depending on your balance

- USD Savings Account: 2.25% for core clients, 2.75% for premium clients, and 3.25% for generation clients.

The winner: EQ Bank

It simply comes down to the fact that EQ Bank’s 2.75% rate is better. And a high rate is exactly what you want for a savings account.

That being said, if you know that your balance will consistently be under $100,000, either financial institution is a good choice with similar rates.

Credit cards

EQ Bank doesn't offer a traditional credit card. However, each has a spending card with cash back rewards.

EQ Bank Card offers a prepaid Mastercard with cash back and interest.

It's a bit difficult to comprehend, but the EQ Bank MasterCard isn't actually a debit card or a credit card:

The Wealthsimple Cash Mastercard is a prepaid card that accompanies its the Wealthsimple Chequing account. Wealthsimple also offers a traditional credit card, in the form of the Wealthsimple Visa Infinite.

The winner: Wealthsimple

Since Wealthsimple offers a true credit card, it's clearly their win.

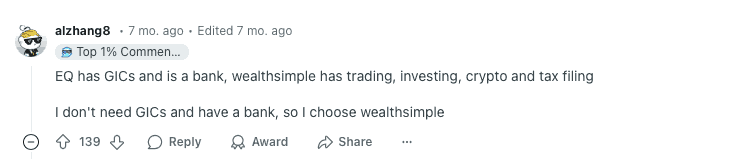

Investments

Both EQ Bank and Wealthsimple have valuable options, but Wealthsimple is the clear winner with a full suite of investment products.

Wealthsimple's other valuable features include extremely low fees, the ability to buy fractional shares, and a straightforward platform for making your investments.

Plus, Wealthsimple offers crypto buying and selling whereas EQ Bank does not.

Investment platforms

EQ Bank doesn't offer its own investment platform, but Wealthsimple does.

You have two options when investing with through Wealthsimple – a robo advisor or a self-directed platform:

- Wealthsimple managed investing: After an initial risk tolerance assessment, this robo advisor automatically handles your money and investments for you.

- Wealthsimple Self-Directed Investing: This is a self-directed platform where you manually buy and sell mutual funds and other investment products. It can be automatically funded, which is quite a valuable feature.

The winner: Wealthsimple

There's literally no contest here since EQ Bank doesn't have its own platform at all, but both Wealthsimple managed investing and Wealthsimple Self-Directed Investing are highly rated products in their own right.

GICs

If you want to set aside cash to grow for a specific amount of time, EQ Bank offers GICs. Unfortunately, Wealthsimple doesn't offer its own GICs.

You have a choice of term lengths with EQ Bank's GICs, and each has a set interest rate. Take a look:

| Term | Rate |

|---|---|

| 1 year | 3.4% |

| 15 months | 3.4% |

| 2 years | 3.45% |

| 27 months | 3.45% |

| 3 years | 3.45% |

| 4 years | 3.4% |

| 5 years | 3.6% |

These are the rates as of February 19, 2024.

The winner: EQ Bank

EQ Bank is the only one of the two institutions to offer GICs, and its rates are quite competitive.

Registered and foreign currency savings accounts

Both EQ Bank and Wealthsimple offer registered savings accounts.

EQ Bank offers these:

However, both of these account types can only hold GICS – no stocks or ETFs.

Wealthsimple offers these accounts:

These accounts can hold stocks, ETFs, and cryptocurrencies.

As for foreign currency accounts, EQ Bank has a U.S. savings account, but that's it.

The EQ Bank US Dollar Account provides 2.5% interest and charges no monthly fees.

Clients seem to appreciate the EQ Bank US Dollar Account too:

Wealthsimple also offers a full-featured USD Savings account.

The winner: Wealthsimple

Ultimately, Wealthsimple has more registered account options as well as its own investment platforms.

At EQ Bank, you can only hold GICs in your RRSP and TFSA – and that’s probably not enough for your primary retirement strategy.

Mobile apps

EQ Bank and Wealthsimple both offer mobile apps that are similarly well-rated.There are far more Apple users who choose Wealthsimple over EQ Bank, but EQ's rating is slightly higher in the App Store.

| EQ Bank | Wealthsimple | |

|---|---|---|

| App Store | * 4.8 stars * 42,500+ ratings | * 4.6 stars * 125,400+ ratings |

| Google Play | * 4.4 stars * 9,500+ ratings | * 4.4 stars * 79,200+ ratings |

The ratings on both platforms are very, very close – but if the number of reviews also indicates the number of users, it seems Wealthsimple is the more popular choice.

This person recently switched to Wealthsimple, but they say they prefer EQ Bank’s app:

Still, some Redditors swear by the Wealthsimple app:

The winner: Wealthsimple

Both apps do the job, but Wealthsimple’s intuitive interface and the many features give it a slight edge.

Other financial features

When considering financial features aside from those mentioned above, Both EQ Bank and Wealthsimple have very similar offerings.

Both institutions offer international money transfers through Wise, for instance, but Wealthsimple offers a broader overall product menu, including a free tax-filing service:

This table lists various products offered by EQ Bank and Wealthsimple:

| EQ Bank | Wealthsimple | |

|---|---|---|

| Mortgage* | Yes | Yes |

| HELOCs | No | No |

| Personal loans | No | No |

| International money transfers | Yes | Yes |

| Business accounts | Yes | Yes |

| Business GICs | Yes | No |

| Kids bank accounts | No | No |

Technically, EQ and Wealthsimple both offer mortgages. EQ Bank works with nesto and has a unique Mortgage Marketplace where clients can view the best rates from all across the market.

Wealthsimple offers mortgage products through its partner organization, Pine. The mortgage itself isn't funded by Wealthsimple, but you'll get cash back and/or other perks by applying through the Wealthsimple site.

The winner: EQ Bank

Since EQ Bank offers more of the products listed, it wins the category. And since many people prefer to keep all or most of their financial products and services under one roof, this gives EQ Bank a leg up.

However, it's difficult to compare these types of extra products since Wealthsimple isn't, and doesn't claim to be a bank.

Final winner

We're calling it a tie.

Technically, EQ Bank won in most of the categories we reviewed, it feels a bit like comparing apples and oranges. Simply put, both institutions specialize in different things and this makes it difficult to compare like with like.

EQ Bank is the better choice for everyday spending and saving. It offers a unique hybrid account with a prepaid card that gives you cash back and interest on your balance. You can hold GICs with EQ, but no stocks or ETFs.

Wealthsimple is the better choice for investing. It won in more investment categories, and we like its mobile app is slightly better rated.

Ultimately, it comes down to what you need. And it certainly can't hurt to work with both EQ Bank and Wealthsimple.

FAQ

Is EQ Bank or Wealthsimple better?

For a full banking experience, EQ Bank is the stronger choice. But for investing, Wealthsimple wins. EQ Bank is better for high interest savings, GICs, and free international transfers, while Wealthsimple excels at investing and stock trading.

Is EQ Bank a reputable bank?

EQ Bank is a reputable, secure, and popular digital bank. It’s owned by Equitable Bank, a federally regulated Canadian financial institution. It’s also a member of CDIC, meaning eligible deposits are protected, and it consistently offers competitive savings rates.

Is there a catch to EQ Bank?

EQ Bank is a digital bank, so there are no branches. Plus, their unique hybrid chequing/saving account with a prepaid card may not work for everyone. Account offerings may be more limited with an online-only bank like EQ.

How do I get money out of EQ Bank?

You can use an ATM to withdraw your funds using the EQ Bank Card. You can also send funds to yourself or someone else via Interac eTransfer, or use an EFT to send money to a linked bank account.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments