Canadian Deposit Insurance Corporation (CDIC) coverage is free, automatic insurance you receive on up to $100,000 of your deposits with each member account. Most of the major banks in Canada are covered by CDIC insurance, including all the biggest ones and a lot of the online banks too.

In the event that a bank you have money with enters bankruptcy, the money you have in savings, chequing, and some investments will be covered and returned to you. If your bank doesn't have this coverage, your money would be lost (unless covered by alternative insurance).

Here's what you need to know about CDIC coverage and how to make sure your money is covered.

Key Takeaways

- Any money you deposit into an eligible CDIC member account is automatically covered in the case of bankruptcy (up to $100k per member bank account).

- This coverage extends to only certain types of deposits, such as chequing accounts, savings accounts, and GICs.

- Most big banks and major online banks have this coverage.

- A lot of credit unions have this coverage as well, or they may be covered by provincial insurance as an alternative.

How CDIC coverage works

CDIC coverage is automatically applied to your deposit with a member financial institution, up to a maximum of $100,000 per eligible account. This insurance will take effect if the bank goes under, which means it declares bankruptcy and isn't able to return your money. The return would be sent to you in the form of a cheque and you wouldn't need to file a claim.

The failure of a bank may sound like an unlikely scenario, but the CDIC has handled 43 failures since 1967 which affected over 2 million depositors. In each of those cases, the CDIC was able to recover everyone's money.

Just keep in mind that the $100,000 CDIC limit is separate for each bank and for each category of eligible account you hold with that bank. So let's say you have $110,000 and it's split between TD and BMO in the following way:

- TD chequing: $80,000

- BMO chequing: $30,000

If both banks went under, you'd be reimbursed the full $110,000, since you're under the maximum with each bank.

And let's say you had that same $110,000 but it was split between two different categories of TD accounts, like this:

- TD chequing: $80,000

- TD TFSA: $30,000

You'd still get the full amount reimbursed in this example since you're under the maximum with each account type.

But if you had the full $110,000 stored entirely in your TD chequing account and/or savings account, you'd only be reimbursed $100,000 – the maximum per member category.

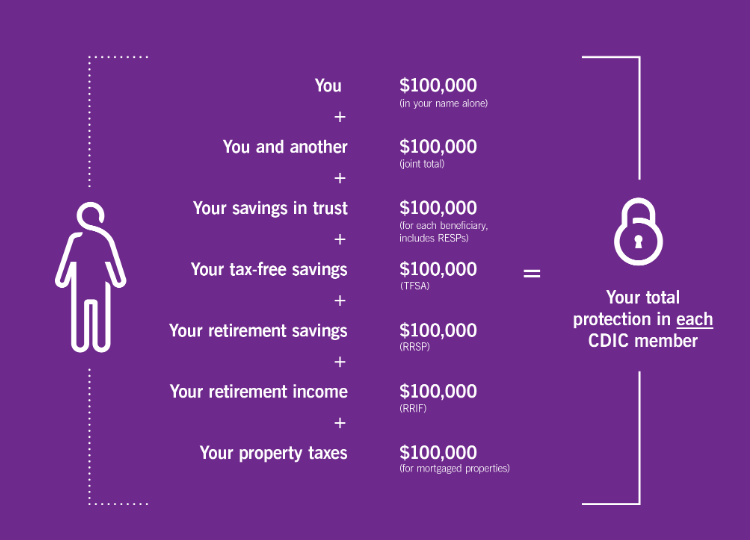

To further clarify, here's a handy graphic the CDIC uses to describe their limits:

What's covered by CDIC insurance?

CDIC coverage applies to Canadian or foreign currency deposits in the following account types:

- chequing accounts,

- savings accounts,

- GICs, and

- term deposits.

You get up to $100,000 worth of coverage for deposits in the above account types in each of the 9 following categories:

- deposits held in your name,

- jointly with 2 or more people,

- in a Registered Retirement Savings Plan (RRSP),

- in a Registered Retirement Income Fund (RRIF),

- in a Tax-Free Savings Account (TFSA),

- in a First Home Savings Account (FHSA),

- in a Registered Education Savings Plan (RESP),

- in a Registered Disability Savings Plan (RDSP), and

- in a trust.

So that means all your non-registered accounts and term deposits are covered for up to $100,000 per CDIC member. If you have joint or registered accounts, those are also covered in a separate category.

You don't need to be a Canadian citizen to get access to CDIC coverage. You just need to have money deposited in an eligible account with a member institution.

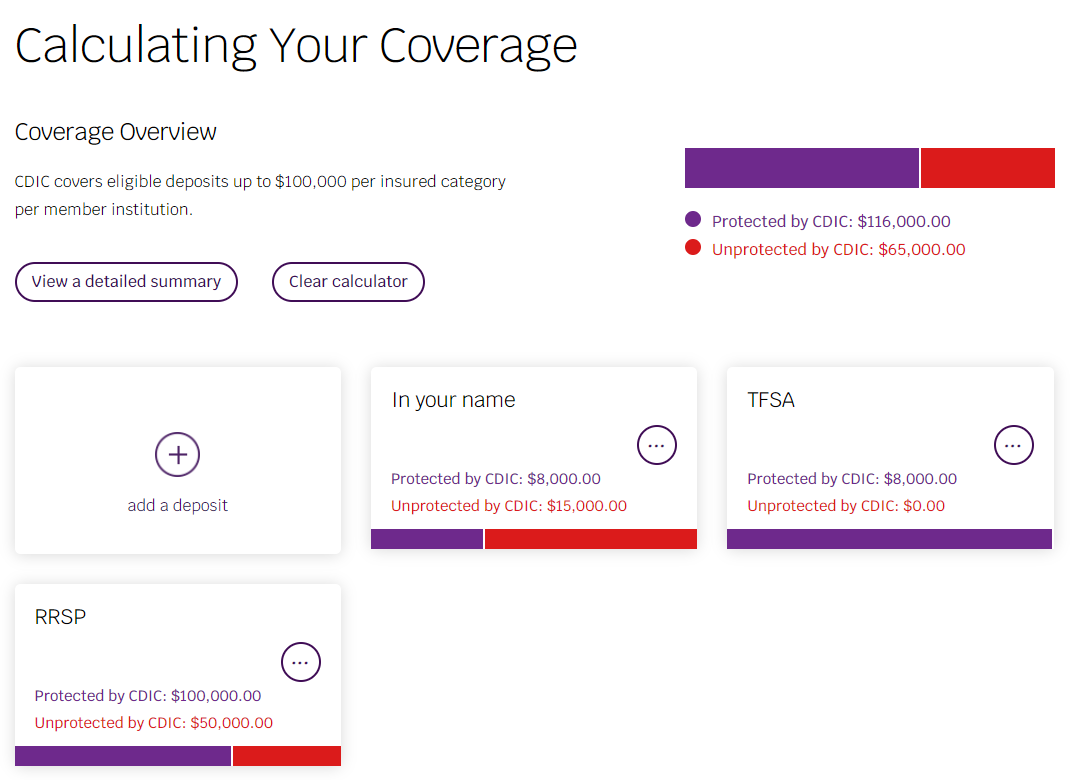

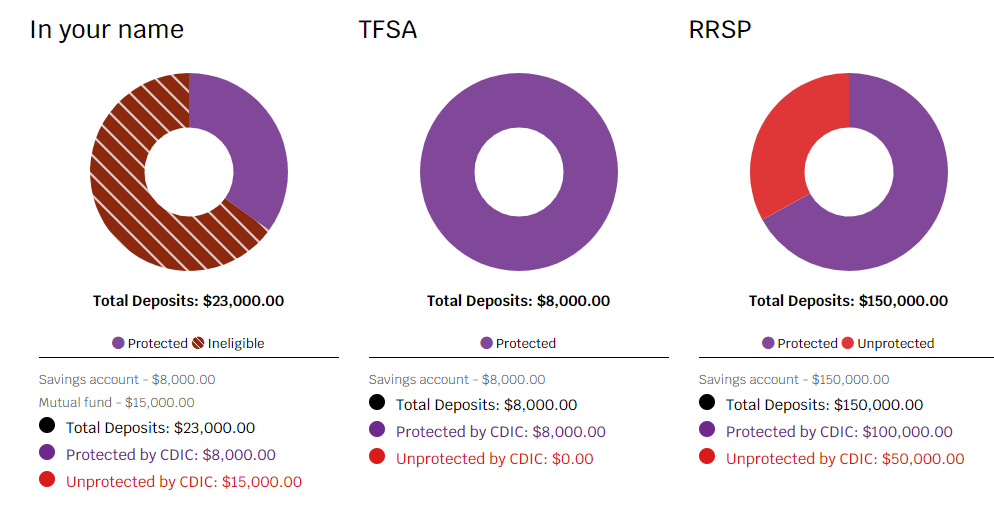

If you want to see for yourself what's covered in your specific situation, the CDIC Deposit Insurance Calculator is extremely handy. All you have to do is enter all your deposits, indicating what types of accounts and what institutions they're with. Once you're done, you'll have something like this:

What's not covered by CDIC insurance?

CDIC insurance doesn't cover market-linked investments, which include:

- mutual funds,

- stocks,

- bonds,

- exchange-traded funds (ETFs), and

- cryptocurrency.

You also aren't covered if you experience loss due to fraud or theft. The only time you'll receive reimbursement from the CDIC is if the bank you have deposits with goes under.

Who are the CDIC members?

At the time of writing, CDIC has 87 member banks and financial institutions. You can see the full list of CDIC member institutions here, but we’ll list some of the major players:

- BMO,

- Scotiabank,

- CIBC,

- Canadian Tire Bank,

- Alterna Bank,

- Desjardins,

- Equitable Bank,

- Home Trust Bank,

- Laurentian Bank,

- Manulife,

- National Bank,

- RBC,

- Simplii,

- Tangerine, and

- TD.

All 5 of the big Canadian banks are covered, plus most of the popular online banks you've likely heard of. The only institutions that may not be covered are more niche credit unions or online banks.

Are you thankful for CDIC coverage?

Did you know about your CDIC coverage?

Do you think you’d prefer maximizing your coverage even if it means a hit to your interest earnings?

Let us know in the comments below.

FAQ

What’s the CDIC?

The Canada Deposit Insurance Corporation (CDIC) is a government corporation created to protect your eligible deposits in Canadian banks and savings institutions. If a member bank defaults, your deposits will be insured up to $100,000 per bank and per account type. This insurance is automatic and requires no opt-ins or sign-ups.

What happens to my money when a bank fails?

If your money is deposited in an eligible account with a CDIC member, the CDIC will contact you and repay what you lost up to certain limits. Deposits that aren’t covered are more volatile investments, like stocks, bonds, and mutual funds. You can read more about what types of deposits are covered here.

How do I maximize my CDIC coverage?

You can maximize your CDIC coverage by spreading your money across different account categories and members. Each category (which includes non-registered, joint accounts, and registered accounts) is insured for up to $100,000 separately, which is also separate per bank.

Leave a comment

Comments