Inflation refers to the overall increase in prices across the economy over time. If you consider how much a movie ticket cost when you were younger and compare it to today’s prices, you’ll notice it’s a lot more expensive. That’s inflation at work. While inflation can seem like a negative force, it’s not always harmful – as long as it's kept in check. In Canada, the target inflation rate is around 1.9%, which aims to ensure that the rise in prices aligns with the growth of money in circulation.

Here's everything you should know.

What is inflation?

At the basic level, inflation means currency is worth slightly less than before. In other words, you need more money to purchase the same thing (often called a decrease in "purchasing power").

A more thorough definition of inflation would include the fact that it actually measures this change in value – and that the change is happening all the time.

In fact, the Bank of Canada targets a specific annual inflation rate in order to keep the economy as healthy as possible. This is 1.9% – the middleground of a 1% - 3% range that they're comfortable with.

Another important part of inflation to keep in mind is that it measures the change in price in general. The fact is that prices for specific products change all the time based on supply and demand.

Gas prices in Canada provide a good example of how inflation works. When gas prices spike overnight, it's typically not due to inflation but rather a mix of factors such as global oil prices, supply and demand, and market conditions. However, if you compare the cost of filling up your tank in the 1970s to what you pay today, the difference reflects the broader impact of inflation. Inflation tends to rise more gradually over time, thanks to the measures put in place by the government and central banks to maintain economic stability.

What causes inflation?

Inflation occurs when there is an increase in the money supply, usually because the authorities responsible for a country’s finances inject more money into the economy. This can happen through measures like printing more money, which reduces the value of the currency, or by issuing loans through the banking system.

But why would they do this? The goal is to promote steady, predictable inflation. When you know how much things will cost in the future, it’s easier to plan your budget and resources. Without inflation control, the rate could fluctuate wildly, and the price of goods could rise sharply from one year to the next.

To prevent this, the Government of Canada and the Bank of Canada aim for an inflation rate of around 1.9%, which has provided stability since 1991.

What's the inflation rate in Canada?

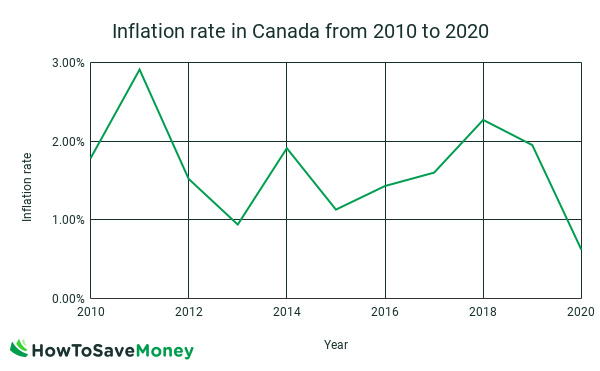

The inflation rate in Canada is 1.27% for 2021, according to Statista. The below table shows how inflation fluctuated between 2010 and 2020.

| Year | Inflation rate |

|---|---|

| 2010 | 1.78% |

| 2011 | 2.91% |

| 2012 | 1.52% |

| 2013 | 0.94% |

| 2014 | 1.91% |

| 2015 | 1.13% |

| 2016 | 1.43% |

| 2017 | 1.6% |

| 2018 | 2.27% |

| 2019 | 1.95% |

| 2020 | 0.62% |

And here’s the same data plotted on a chart, for the visual learners out there:

As you can see, there was quite the drop in 2020 – but that’s not surprising because of the pandemic.

Inflation vs. recession

Though both terms refer to economic conditions, they describe different phenomena and aren’t necessarily opposites.

A recession occurs when an economy experiences 2 consecutive quarters of negative growth in its Gross Domestic Product (GDP). This is a sign of reduced economic activity and lower production levels.

Inflation, on the other hand, happens when the purchasing power of money decreases due to an increase in the money supply. Interestingly, the opposite of inflation is deflation, not recession.

Deflation, like a recession, signals a negative trend in the economy. It’s marked by a general decline in prices and can contribute to a recession.

How global crises impact inflation

World events, such as the COVID-19 pandemic, can significantly influence inflation rates, though the effects may not always be as straightforward as they appear. The pandemic led to global economic disruptions, including government relief packages, business closures, and changes in consumer behavior. These factors contributed to economic stimulation and increased government spending, which could impact inflation.

During the pandemic, countries worldwide, including Canada, released various relief packages to support citizens and businesses. While these measures injected money into the economy, they didn't immediately result in runaway inflation. As the economist in a Bloomberg article points out, the inflation caused by such stimulus spending is often balanced by corresponding deflationary pressures, creating a more stable economic environment in the long run.

In the case of COVID-19, the inflationary effects were somewhat offset by changes in demand and supply chains and ongoing adjustments in the global economy. While inflation did rise during and after the pandemic, it’s unlikely that it will continue unchecked in the long term, especially with measures to manage economic recovery and balance inflation.

Is inflation good or bad?

Though a whole lot of inflation at once can be disastrous for an economy, moderate and controlled inflation can be beneficial.

The pros of inflation

Inflation – specifically moderate inflation – can actually be beneficial for the economy.

Enables wage and relative price adjustments

Being able to measure, predict, and control inflation allows the government to keep the rest of the economy on the same page.

One major example is your wages. With the rise of the cost of goods in check, minimum wage can be adjusted accordingly.

It’s better than its opposite – deflation

If you don’t have inflation, you’re more likely to have deflation rather than just stagnant money. And deflation is a bad sign of the economy and can lead to recession.

In general, inflation is a good thing because it indicates a healthy and growing economy.

The cons of inflation

But inflation is under strict control by the government and central banks for a reason.

Your savings are worth less

If you kept your savings under the mattress or in a jar for 20 years, it’ll be worth much less when you go to use it again than it was when you first put it away.

Of course, a $20 bill will be worth $20 – but the amount of goods you can buy with that $20 bill will be less.

If you compare something that cost $20 in 1970, in 1990 that same item would cost about $76.44 – thanks to the years of unchecked inflation that occurred between those 2 dates.

But now that Canada has a target inflation rate of around 2%, the effects are rarely that drastic. If you compare something that cost $20 in 2000, it would cost about $29 in 2020.

This is why you should aim to get a return of 2% or more on your investments, whether they're GIC investments, ETFs, real estate, or whatever the case may be. This way, you can aim to keep up with inflation, at the very least.

High levels of inflation are unsustainable

If the economy has high levels of inflation, it can cause huge problems for the economy. Imagine if something cost $10 one year and $100 the next – how could you keep up with the prices unless your wages were significantly increased?

This is why it’s so important to keep inflation in check.

How do you measure inflation?

Inflation is often measured by comparing the value of a certain collection of goods which are chosen to represent the wider economy.

This is done through various price indexes, with the Consumer Price Index and the Wholesale Price Index being the 2 most common.

The Consumer Price Index (CPI)

CPI is likely the most popular price index. The CPI is calculated by getting the weighted average cost of a fixed basket of goods over time. These goods include things that are thought to be central to the average Canadian – such as food, transportation, recreation, clothing, and shelter.

The prices used to calculate CPI are the retail price of the item, which is the main difference between it and WPI. That means the CPI is a closer measure of the cost of living for the average Canadian.

The Wholesale Price Index (WPI)

The WPI, on the other hand, measures the change in price of a selection of goods before they hit the retail market.

That means it doesn’t take into account profit margin or the different ways a product can be sold. For example, you’ll be looking at cotton prices instead of cotton clothing prices.

Inflation calculator

If you’re interested in seeing how inflation has changed the cost of goods in Canada, the Bank Of Canada has an easy-to-use inflation calculator available on their website here.

You can use it to measure the change in value anywhere between 1914 and now. This calculator uses the Consumer Price Index to calculate inflation.

Inflation formula

Want to know a bit more about the formula behind the calculator? Thankfully, Investopedia outlined it clearly in their article, but I’ll distill the process here as well.

It starts with getting the inflation rate for the time period you’re looking at. You’ll need to know the initial and final CPI value for this. Here’s what the formula looks like:

Inflation rate = (Final CPI value / Initial CPI value) * 100

So say you were looking at February 2001 vs. February 2021. The CPI for 2001 was 96.8 and it was 138.9 in 2021. Here’s what your formula looks like with the numbers plotted in:

Inflation rate = (138.9 / 96.8) * 100

Inflation rate = (1.4349) * 100

Inflation rate = 143.49%

Now that you know the rate of inflation, you’ll need to apply that to the amount of money you’re looking to compare. To keep things simple, let’s say you wanted to know how much $1,000 from 2001 is worth in 2021.

Here’s what that formula looks like:

Change in dollar value = Inflation rate * initial dollar value

And let’s plug our numbers in:

Change in dollar value = 1.4349 * $1,000

Change in dollar value = $1,434.90

So if you put $1,000 under your bed in 2001, that would’ve been equivalent to $1,434.90 today. You lost a bit over $400 in purchasing power.

How do you save enough money to outpace inflation?

So how do you make sure your investments are outgrowing inflation?

Well, things are a bit easier now that the Bank Of Canada has a target inflation rate of 2%, which they have managed to keep more or less steady for the past few decades. That means you should aim to get about a 2% return on your investments to break even – and more than that to earn real profit.

For example, if the inflation rate is 2% and you had your money in a HISA with 0.05% interest – you’re not really growing at all. The value of your money is decreasing due to inflation.

Here are some options for keeping your investments above the inflation rate.

High interest savings accounts with rates higher than inflation

If you want to keep things simple, you can put your money in a high interest savings account that offers more than 2% interest.

Before the pandemic, there were several online bank accounts that could offer this in Canada. Unfortunately, the rates were all cut – but that may turn around as the economy recovers.

Investing your money on the stock market

But high interest savings accounts are fairly low risk, so they don’t get you the best return on your investments.

If you want to do more than just break even with inflation, you’ll have to start playing around with more serious forms of investments – either by buying investments yourself with an online broker or letting a robo advisor handle the legwork.

Let’s take a quick look at your options.

Robo advisors

Robo advisors are portfolio-based investment products that work based mostly on algorithms. This allows for much of the emotional element of investing to be reduced, helping you avoid some mistakes.

And because much of the work is done by the algorithm, you can cut management costs significantly (when compared to a traditional financial advisor).

Here are some examples for Canadians.

| Robo advisor | Fees | Interested? |

|---|---|---|

| Wealthsimple | * $100k or less: 0.5% * More than $100k: 0.4% | Learn more |

| Questwealth | * Under $100k: 0.25% * Over $100k: 0.2% | Learn more |

Online brokers

If you’d rather take a more hands-on approach to investing, you can instead opt for an online broker. This way, you can buy investments yourself – whether you go for stocks, ETFs, mutual funds, or more. Everything is in your hands.

Here are a couple examples for Canadians.

| Online broker | Fees | Interested? |

|---|---|---|

| Wealthsimple Trade | * No commission fees * Can only trade ETFs and stocks | Learn more |

| Questrade | * Stocks: 1 cent per share (min: $4.95, max: $9.95) * ETFs: Free to buy, 1 cent to sell (min: $4.95, max $9.95) * Options: $9.95 + $1 per contract * Mutual funds: $9.95 per trade * Bonds: Free with minimum $5,000 purchase * GICs: Free with minimum $5,000 purchase | Learn more |

FAQ

What is inflation?

Inflation is a general rise in the cost of products over a period of time. With persistent inflation, the money you hold today will be worth less in the future – meaning you can get fewer products for the same amount of money. Learn more here.

Is inflation good or bad?

Like most things, inflation is both good and bad. As long as it’s kept in check, inflation can be indicative of a healthy economy and help adjust wages and costs. On the other hand, too much inflation can mean your savings are worth less and can be unsustainable for the longer term.

How do you measure inflation?

Inflation is usually measured using the Consumer Price Index, or CPI, which is the weighted average of a collection of goods that are seen as essential for the average Canadian. The change in price of these goods (including things like groceries and transportation) indicates the inflation rate that’s happening in the economy at large.

Where can I find an inflation calculator?

The Bank Of Canada has an inflation calculator on their website that’s easy to use. We also go over the formula behind the calculator here, so you can better understand the math involved.

How can you make sure you’re saving enough to outpace inflation?

Since the Bank Of Canada targets an inflation rate of about 2% every year, you should aim for at least that much return on your investments. You can get this from the best high interest savings accounts in Canada, and from other more profitable investments – whether you choose to go with a robo advisor, an online broker, or a more traditional financial advisor.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments