Applying for a mortgage is one of those life-changing decisions that can keep you up at night, but a mortgage stress test can ease your mind.

The government of Canada now makes banks, mortgage brokers, and lenders perform something called a mortgage stress test on their clients. It may sound daunting, but it simply checks your financial health.

Reading up on mortgage stress tests can help you be prepared when your broker or lender broaches the subject. Plus it’ll hopefully mitigate some of your anxiety around mortgages and what’s involved in the home buying process.

What is a mortgage stress test?

Back in 2018, the government of Canada implemented the mortgage stress test. Overseen by the Office of the Superintendent of Financial Institutions (OSFI), the mortgage stress test is a calculation or financial health check done when someone applies for a mortgage.

The calculation is meant to uncover whether the borrower can continue to make payments in the face of higher interest rates in the future, not just the current rate.

Although no one has a crystal ball and can see the future, the assumption is that interest rates fluctuate over the long term and will rise at some point.

Why Canadian home buyers need to do it

So why do we need a stress test – and is it even necessary?

With interest rates near all-time lows, a stress test is a natural calculation in the borrowing process for Canadians. The idea is that today’s rates are some of the lowest in history, so they really have nowhere to go but up.

A combination of:

- these low rates,

- the low supply of properties for sale, and

- the effects of the COVID-19 pandemic…

…are what many professionals believe has led to higher home prices. Low mortgage rates and high prices may or may not be a recipe for people getting into unmanageable debt.

Given the complicated market, it’s not unusual to wonder if a mortgage stress test is meant to help home buyers or hinder them. Ultimately, though, making these calculations and considering the volatility of interest rates can help you prepare for a worst-case scenario – so it’s worth it.

As of 2018, everyone borrowing money for a mortgage must go through the mortgage stress test process.

It’s also important to note that the mortgage stress test applies to you if you refinance your home, switch lenders, or take out a home equity line of credit.

How the test works

In all cases, the interest rate you’re tested at is 5.25% or your proposed mortgage rate plus 2%, whichever is higher.

For example:

- If your lender offers you a rate of 2.59%, you’d have to run the stress test at a 5.25% interest rate because it’s the higher option.

- If your lender offers a rate of 3.55% and you add 2% (5.5%), this rate is higher so you’d use it instead.

The stress test uses these rates along with 2 basic criteria. These criteria are the Gross Debt Service Ratio and the Total Debt Service Ratio.

But what are these ratios and how are they measured?

Gross debt service ratio (GDS)

A gross debt service ratio (or GDS) is a pure measurement of how your ability to cover a mortgage payment and to pay for the necessities of owning a home – including:

- utilities,

- property tax,

- condo fees, etc.

All of this is based on your household income.

The idea is that these costs need to be calculated as they’re direct responsibilities of owning a home. These costs should not exceed 32% of your annual gross income.

Total debt service ratio (TDS)

The second ratio is the total debt service ratio (or TDS) and it factors in all of your other debts as well. This can be anything from car loans to credit card bills – any liabilities added to the cost of your mortgage and projected housing costs.

This number should not exceed 40% of your income.

In simple terms, the question answered by a mortgage stress test is whether you can maintain and carry a mortgage with a higher interest rate and not exceed 32% on the GDS and 44% on the TDS.

What happens if you fail your stress test

A stress test really shows the top end of borrowers’ limits, and failure certainly can happen.

If it’s determined that what you can borrow isn’t in line with prices in the current housing market, you might want to rethink where you want to purchase, or if you should buy property at all.

Keep in mind that housing prices fluctuate both ways, just like interest rates do. However, we just haven’t seen prices take a dive for quite a while.

Mortgage stress test example

Luckily, there are online calculators to help uncover whether you’ll likely pass or fail the mortgage stress test – they’re easily available on this government site. The calculator uncovers the TDS and the GDS for you by simply plugging in your numbers.

However, this calculator is only meant to be a guide. It’s ultimately up to your lender to decide whether or not they’ll allow you a mortgage.

Let’s run through a few examples of stress tests to help you understand the process.

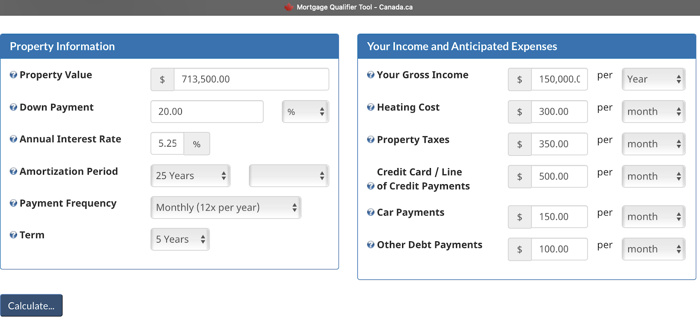

Scenario 1: Mortgage stress test on an average home

First, we’ll use the average price of a home in Canada for December 2021 of $713,500.

In this scenario, Average Buyer has:

- a 20% downpayment,

- a loan at 2.8% from their local mortgage broker, with

- a fixed rate for the next 5 years on a 25-year mortgage.

Therefore, Average Buyer has to test at the standardized higher rate of 5.25%, which results in an amount of $570,800.

Average Buyer also has these factors to consider:

- an above-average annual salary of $150,000,

- a credit card payment of $500 per month,

- a $150 monthly car payment,

- $100 added to other debts each month,

- monthly heating costs on the new property are around $300, and

- property taxes are $350 per month.

All of these amounts can be added into the calculator.

Once these have been entered, hit the “Calculate” button for the results.

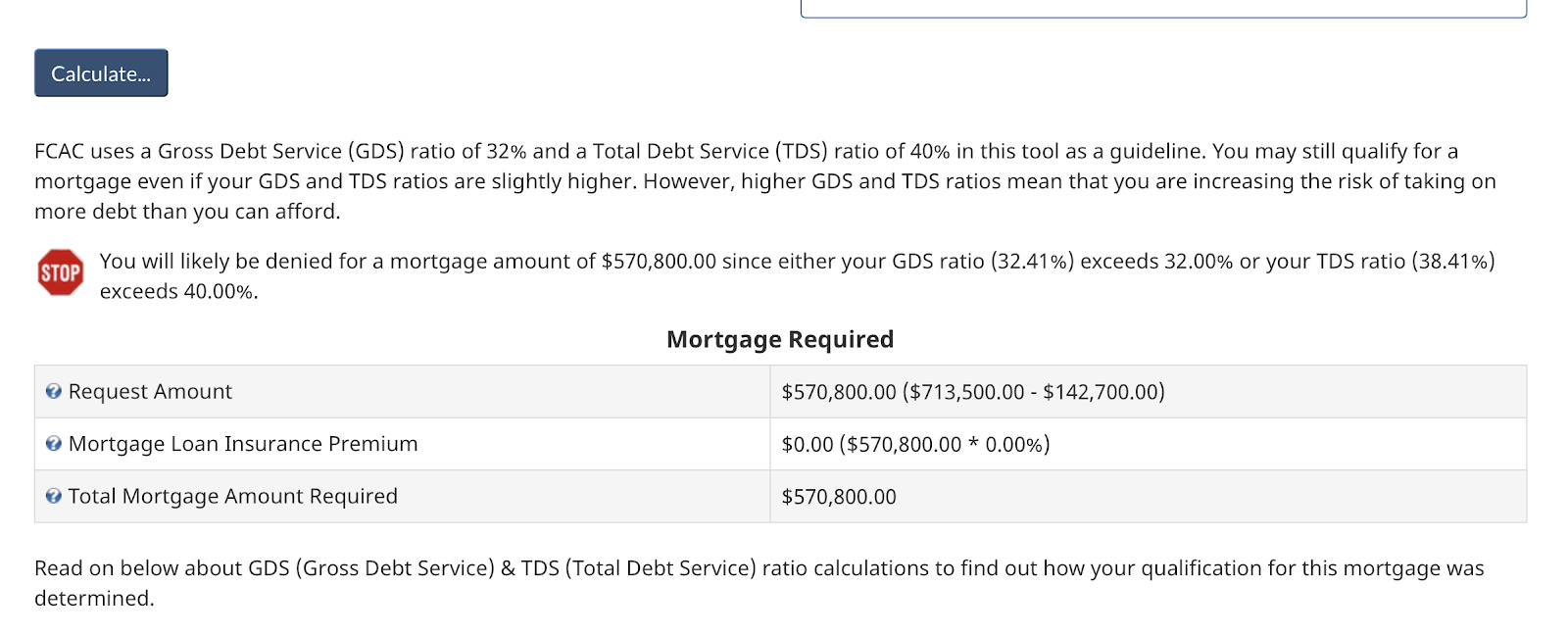

First of all, you’ll notice a STOP sign has appeared before the number breakdown. Their GDS is just slightly above the requirement, coming in at 32.41%, but the TDS is below the required 40%.

Will Average Buyer be denied a loan? Not necessarily, but they are at the top end of the stress test requirements.

To improve these results and lower the GDs to under 32%, Average Buyer should:

- find a way to lower the heating costs,

- pay off personal debts to free up that $100 each month, and

- supply a larger downpayment.

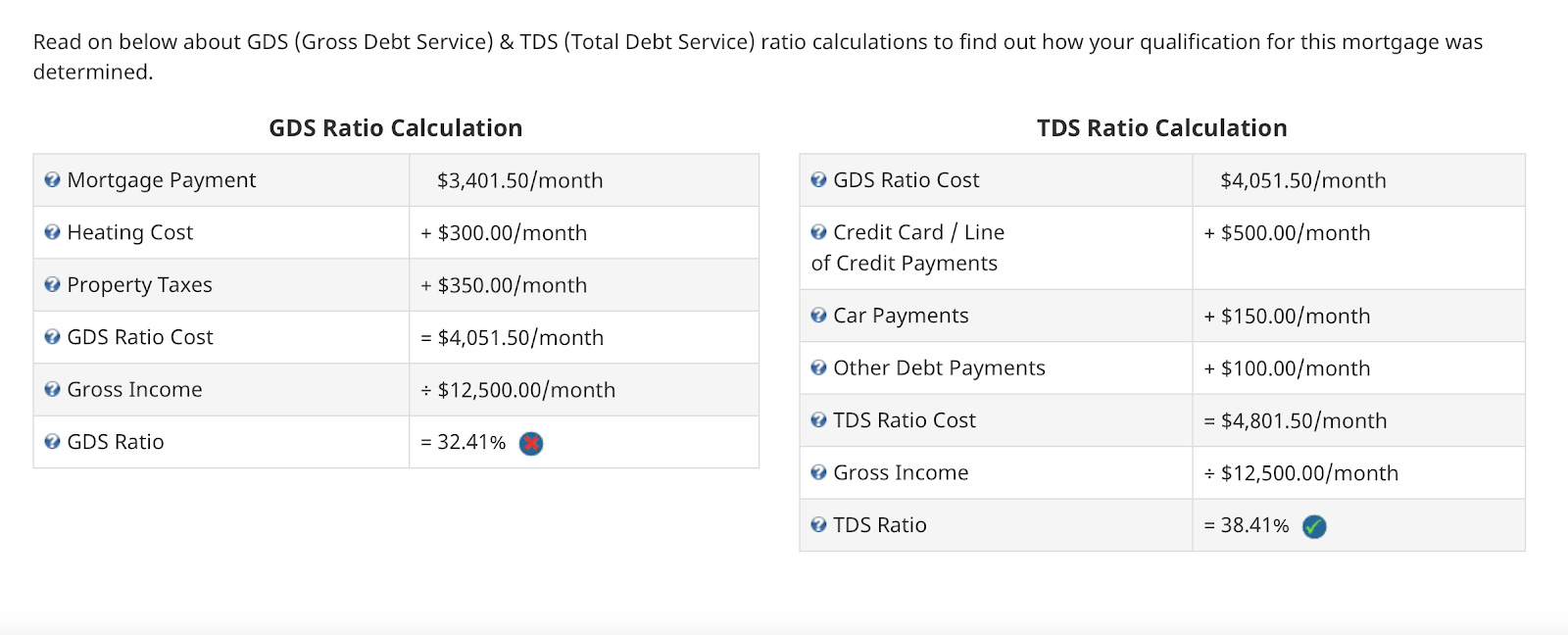

Scenario 2: Mortgage stress test on a cheaper home

Let’s take a look at a below average priced home in another Canadian market.

Here, Mr. and Mrs. Frugal have these details to work with:

- a 15% downpayment (on a home less than $713,500),

- they’re applying for a mortgage for $300,000,

- the mortgage will have a fixed rate of 3.35% for 5 years, based on an amortization period of 25 years.

In this case, the stress test interest rate used will be 5.35%.

Here are other financial information the Frugals have to consider:

- their combined annual income is $75,000 per year,

- no credit card or other types of debt,

- no car payments (they choose to cycle, walk, or use public transit),

- anticipated heating costs are $150 per month, and

- monthly property taxes are $250.

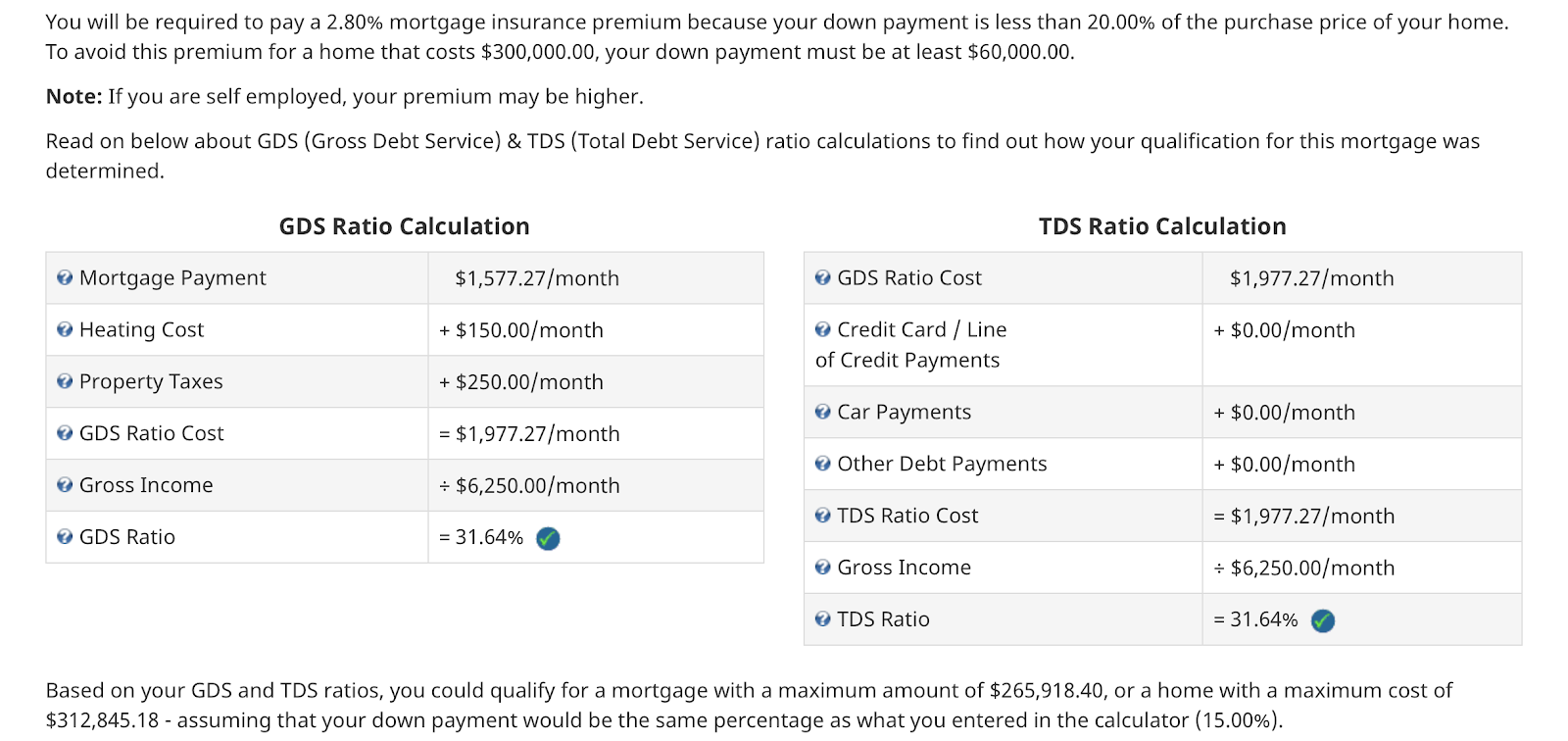

For the Frugals, the ratios check out and they’ll likely qualify for the mortgage – as long as their credit rating and financial histories are okay.

Their GDS and TDS are both under the stress test mark. The calculator also lets them know that they’ll need to have a CMHC (insured) mortgage, which is an extra 2.8%.

Assuming their downpayment is 15%, their borrowing limit is $312,845.18.

Scenario 3: Mortgage stress test on an expensive home

The Renters have lived in a large Canadian city their entire lives and want to continue to do so. They’ve witnessed home prices climb to unprecedented levels and are kicking themselves for not buying a place sooner.

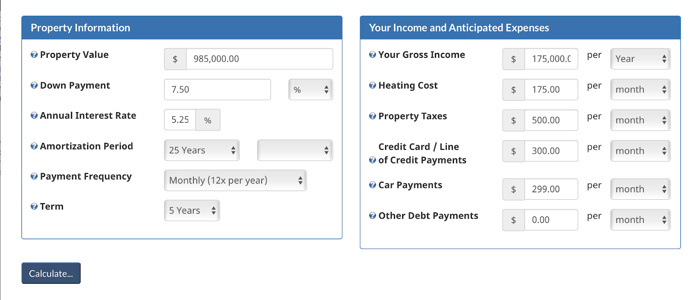

Looking at a $985,000 home, this is what they have to work with:

- a downpayment of $73,875 (5% of the purchase price), and

- a 5 year fixed interest rate of 2.59% from their credit union.

This means they’ll have to at the minimum 5.25% for the stress test, and here’s what the calculations look like.

As for the other monetary considerations, the Renters’ numbers look like this:

- a combined income of $175,000,

- credit card payments of $300 each month,

- a $299 monthly car payment,

- monthly heating costs expected to be $175, and

- $500 in monthly property taxes.

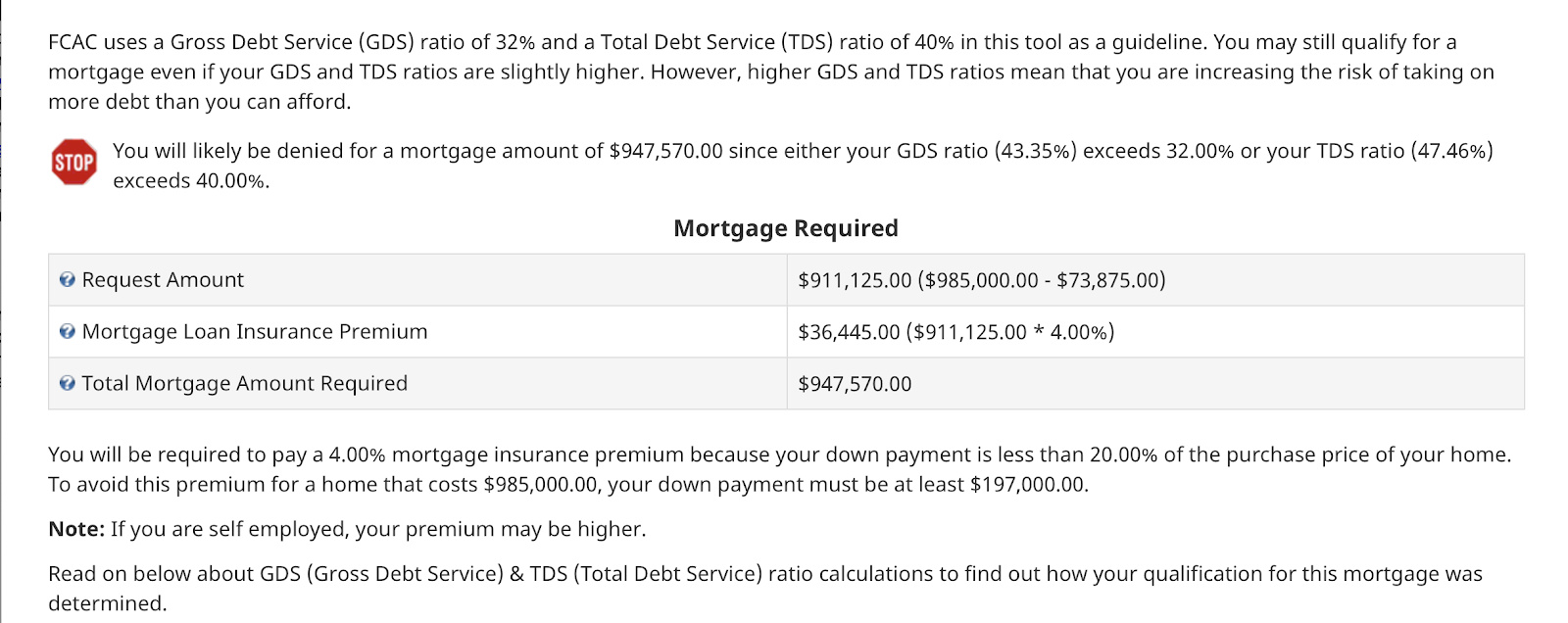

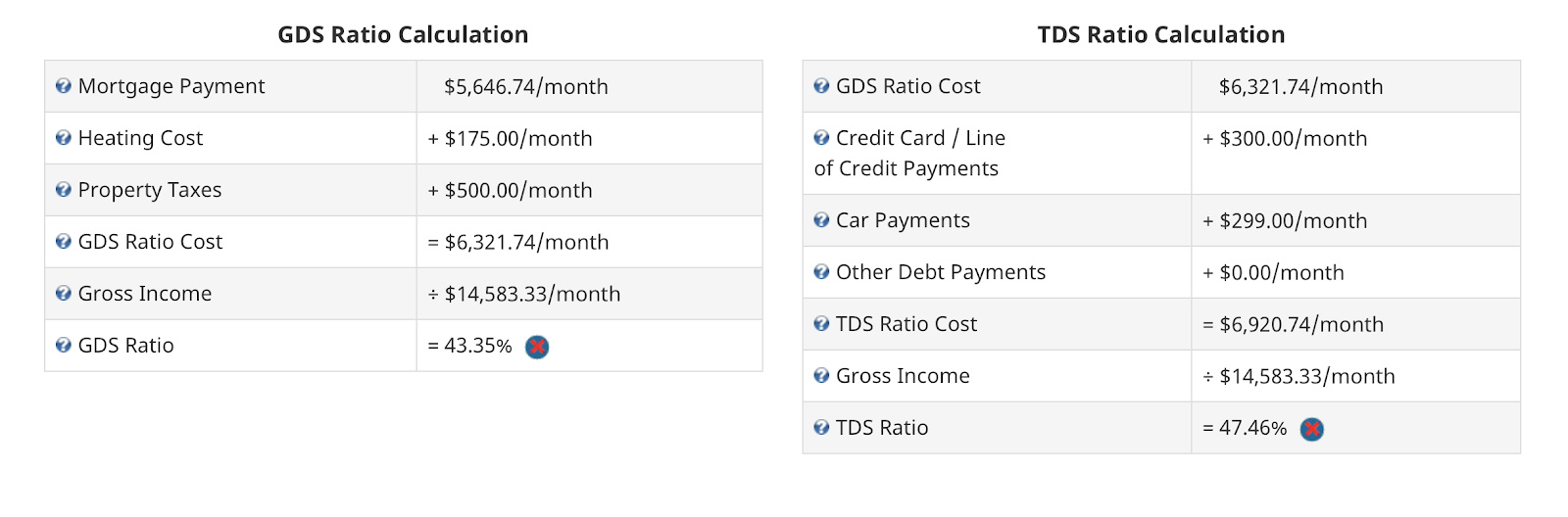

Things don’t look good for The Renters as both their TDS and GDS ratios far exceed the recommended amount they need to borrow at the elevated interest rate.

Their options include:

- moving to a place where the homes aren’t as expensive, or

- saving for more of a down payment.

For now, they decide to keep saving for a home and continue renting in order to not uproot their family.

Mortgage stress test calculators

Mortgage stress test calculators help take the guesswork out of the math. The results can help pinpoint areas you may need to improve upon before meeting with your lender or mortgage broker.

What are mortgage stress test calculators and how can they help?

These calculators are handy additions to your financial toolbox.

Taking this test can benefit you in several ways as you head into your meeting with a mortgage broker or lender.

- It shows you’ve done your homework and are ready for serious discussion, which makes you look good to the broker or lender.

- You’ll be prepared and armed with these calculations and results, so they won’t be able to mislead you.

- There will be fewer surprises for you during this meeting regarding interest rates, the likelihood of approval, etc.

Just remember that doing these calculations doesn’t mean you shouldn’t still meet with a mortgage broker or lender. Together you may be able to find ways to improve your financial health and ultimately pass a mortgage stress test when the time comes.

Which are the best ones to use?

Of all the online stress test calculators available, the best is likely the one created by the government of Canada that we mentioned above.

It’s incredibly simple to use – just plug in the necessary numbers and click “Calculate.”

Tips for performing well

The best way to perform well on a mortgage stress test calculator is to have a decent-sized down payment and few other debts.

Obviously, a higher salary helps as well, so seeing the results on the calculator may even prompt you to have a conversation with your boss or HR department about increasing your wages.

Still renting, but dreaming of owning your own home? Find answers to your renting vs. buying questions here.

What to do with the info from your mortgage stress test

Running your information through an online mortgage stress test calculator is a good way to get a sense of where you stand before officially applying for a mortgage.

Does it affect the mortgage amount you qualify for?

While the calculator definitely helps paint a picture of what it may cost you to borrow for a home, it will also show the maximum amount you can borrow.

Try running the calculations a few times with a higher downpayment, higher salary, or a combination. This could result in a more desirable mortgage amount and determine what steps you need to take.

Your ability to buy a home isn’t affected either

Running your numbers through the mortgage stress test – whether you do it with a mortgage professional or at home with an online calculator – is just another tool for understanding the cost of home ownership. It doesn’t make changes or affect your finances in any way.

It may, however, motivate you to create a monthly budget for better saving potential. And your understanding of how fluctuating interest rates can make you house-poor will improve, which can mean making better financial choices for yourself.

How to find the right mortgage

Really, it’s never a bad idea to speak with a mortgage broker or lender in order to find the right mortgage rates for your home.

Most banks typically post their rates online, through various advertising methods, and even on posters inside their branch locations.

Mortgage brokers work on your behalf to get the lowest rate possible. They’re there to help, working with each client individually instead of giving the same rates and services to everyone who walks through the door.

To do this, they shop around to find the lender who best matches your needs, much like an insurance broker looks around to find you a provider with the best plan for your needs.

A sweet alternative

A reliable, convenient alternative to traditional mortgage brokers is Homewise – an entirely online brokerage that’s changing theexperience of applying for a mortgage.

Looking at a list of the benefits of an online broker, they suddenly become even more attractive:

- no need to sit uncomfortably in a stuffy office,

- you’re not relying on someone else to input your private information,

- response times are quick and easy,

- a pool of over 30 different lenders is available, and

- the process is completely transparent for the user.

A resource like this can be the alternative that many people in today’s online world have been looking for.

You want the best mortgage in Canada – and Homewise makes it easy to find. Easily compare over 30 lenders with a simple 5 minute application (and no credit check required).

- Get $250 GeniusCash when you fund your mortgage

- Easy online application process

- Faster responses than traditional banks and lenders

- Get the best mortgage for you from over 30 different lenders

- Works for new mortgages, refinancing, or switching lenders

- Top of the line support with a human touch

- Application process requires a LOT of personal information

- No face to face support available

- A credit check is required when you apply for a mortgage

- Canadian citizen or resident of Canada

$250 GeniusCash + Get the best mortgage rate with your personal advisor + Easily close online.

$250 GeniusCash + Get the best mortgage rate with your personal advisor + Easily close online.- Personal advisor will help you get approved

- Can help people who are self-employed or have bad credit find mortgages

- Works with the Habitat for Humanity charitable organization

Your turn

Have you endured the mortgage stress test recently? We’d love to hear about your experience and have you tell us what you thought of it!

Did it hinder or deter you from purchasing a home?

Did you use the handy government of Canada online calculator prior to visiting a lender?

Feel free to share your thoughts with us in the comments section below.

FAQ

What is a mortgage stress test?

A mortgage stress test is a calculation used by lenders to determine the financial health of clients applying for a mortgage. In 2018, the government of Canada made it mandatory for every mortgage applicant to take a stress test before being given a loan.

What are the mortgage stress test rules in Canada?

The stress test has 2 basic criteria. In both cases, the interest rate you’re tested at is the greater of these 2 – either 5.25% or the mortgage rate offered by a lender + 2%. There are also 2 main ratios used to calculate the stress test. These are the gross debt service ratio (GDS) and the total debt service ratio (TDS).

Do mortgage brokers use the stress test?

The simple answer is yes. Lenders use the mortgage stress test on all clients, no matter their financial status or what type of mortgage they’re hoping to apply for. This is because the government’s rules regarding the stress test apply to everyone.

How do you beat a mortgage stress test?

To “beat” the test, your gross debt service must not exceed 32% and your total debt service ratio should not exceed 40%. There are several online calculators available to help you determine your mortgage stress test score before you go see a lender. This can help you prepare for the actual test and qualify for the mortgage you want.

Leave a comment

Comments