Have you been asked to provide a letter of employment for your mortgage? If this is your first time hearing about it, you may be a bit confused…

But no worries, seeking your letter of employment in order to verify parts of your application is fairly standard practice.

Here’s everything you need to know to get you on your way with minimal delay.

What is a letter of employment?

A letter of employment is a document signed by your employer that verifies that you work for the company, your position, and your salary.

You may be asked to provide one of these letters before being approved for large credit products, such as a mortgage, line of credit, or other type of loan. Sometimes your prospective landlord may even request a letter of employment before extending an offer for leasing their unit.

Why do you need a letter of employment for a mortgage?

But don’t worry – asking for a letter of employment doesn’t mean you don’t seem trustworthy or they think you’re lying to them.

Most of the time, the reason lenders and landlords may request a letter of employment is simply to do their due diligence. They want to ensure that your job is secure and your income is valid and steady at the time you made your application.

There’s a lot of money exchanging hands in the case of a mortgage, so it only makes sense that the mortgage broker may want to double confirm everything in your application looks good. Having a letter of employment is just one of the many things they can do to confirm you’re a trustworthy candidate.

How to get a letter of employment for mortgage

The only way to get a legitimate letter of employment is by asking your employer (since it needs to be signed by them). You can do so by asking your boss directly, or sending a quick email to the HR department to see if they can point you in the right direction.

Since asking for a letter of employment is a common practice, your employer won’t be surprised or confused when you ask them to write you one. Big companies will likely even have a template on hand that they can quickly fill out and sign for you.

If you’re self-employed, your mortgage broker may instead ask for other means of verification, like your tax return for the past few years and any financial statements from your business. Speak with your broker to confirm exactly what they want to see in order to feel confident in your ability to pay back your mortgage.

What to include in your letter of employment for a mortgage

Once you receive your letter of employment, make sure it’s signed by the person issuing it (most likely your boss or manager). It also makes it look more official if it’s written on company letterhead.

Here’s a list of things to make sure is included in your letter of employment for mortgage:

- your position,

- how long you’ve been there,

- your salary or wage,

- any bonuses you receive,

- hours per week (if an hourly worker), and

- job title and contact info of the person signing the document.

With all the above information, your mortgage broker should be satisfied with your letter of employment.

It may also be useful to include brief explanations of unusual circumstances, like when your probation ends, any expected overtime income that’s included in your contract, whether you’re on maternity leave, or any other pay fluctuations.

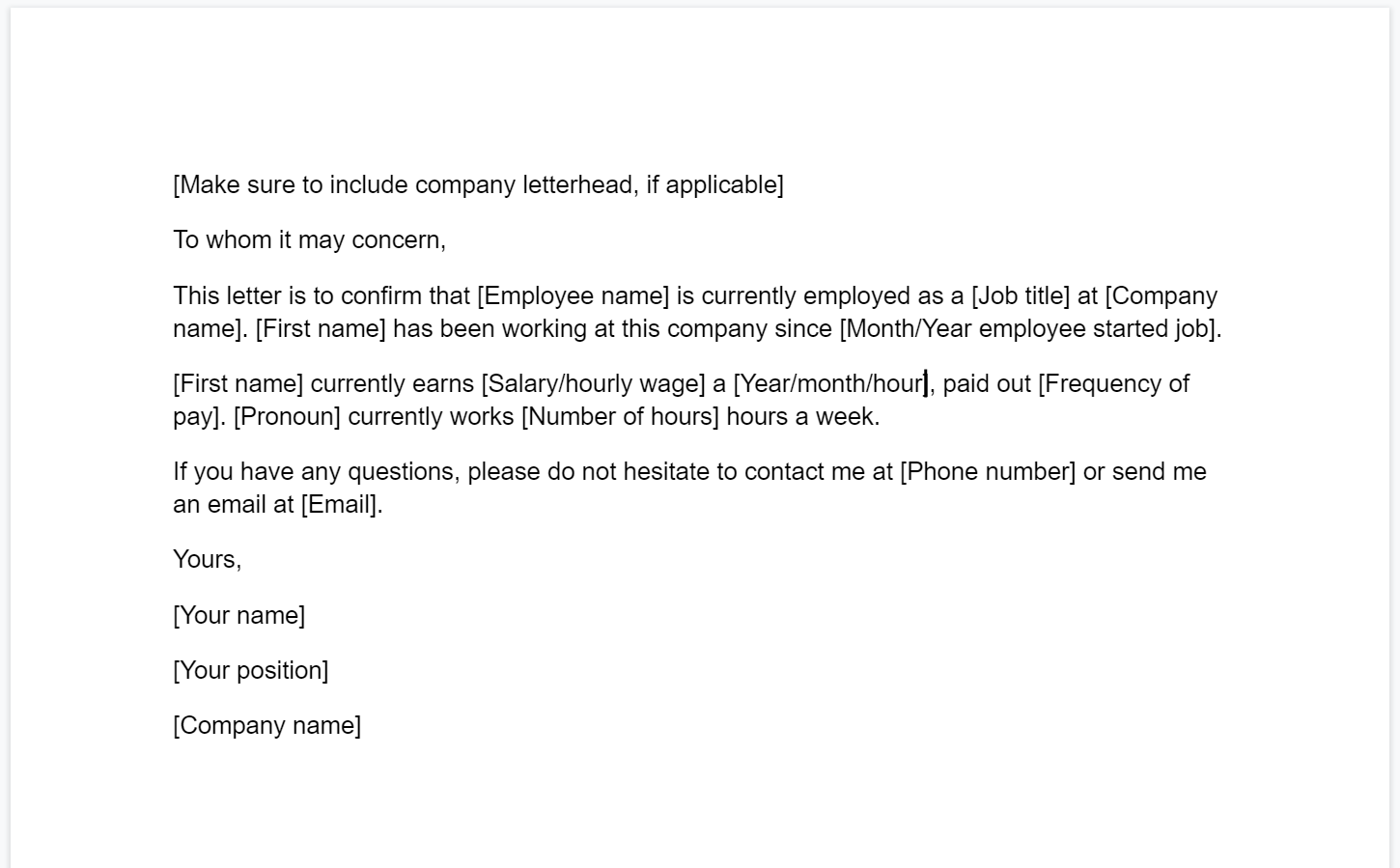

Letter of employment sample

Want an example of what a letter of employment for a mortgage might look like? Here’s a template you can feel free to send over to your boss (or use yourself):

If you’d like to download this letter of employment template for quick use, it’s available right here:

Get your own letter of employment for your mortgage now

Now that you know what a letter of employment is and why your broker may be asking you for it, it’s time to send off a quick email to your employer so you can get the process started.

In the end, this is likely one of many documents you’ll need to provide while finalizing your mortgage. Hopefully you’ll have it locked in soon!

If you have any more questions or tips, please let us know in the comments below.

FAQ

What is a letter of employment?

A letter of employment is a document provided and signed by your employer upon request which confirms that you work at the company. It also provides additional information, like your salary, pay frequency, and how long you’ve been working there.

Why do I need a letter of employment for a mortgage?

Your mortgage broker may ask you for a letter of employment in order to confirm that your employment details are accurate and your salary is stable. It’s usually one of many documents you’ll need to provide over the course of applying for a mortgage. Here’s how you can get your letter of employment.

Where can I find a letter of employment template?

We’ve created an easy, downloadable letter of employment template for you right here, just make sure to use company letterhead so it looks more official.

Why do I need a letter of employment for renting?

In rarer cases, your prospective landlord may ask you for a letter of employment before extending an offer to lease their unit. This is just another way for the landlord to confirm you have stable income, which will ensure you pay off your rent consistently and on time.

Leave a comment

Comments