You might be purchasing your very first home (congrats!) or buying a retirement villa. Either way, a mortgage calculator can be a big help.

Whether it’s a starter home or an additional income property, buying a house is likely going to be the biggest purchase you’ll ever make. You’ll no doubt be looking into the best mortgage options for your situation.

While you’re doing all this planning and research, using a mortgage calculator can help with the financial side of things. There are several mortgage calculators available, mostly through banking websites. And they all have different features and abilities.

Take a look at our mortgage calculator, plus some others available, and see how they can help.

Mortgage Information

- How to calculate your monthly mortgage payment

- How much of a mortgage can you afford?

- The basics of a mortgage

- How to lower your mortgage payments

- Can you get a no down payment mortgage?

- 5 big bank mortgage calculators compared

- FAQ

How to use a mortgage calculator

There are 4 main things you’ll need to know about your mortgage in order to use a mortgage calculator and figure out what each term will cost you.

- The principal amount of the mortgage: The initial cost of your home, less your down payment (i.e. $200,000)

- The length of the term: How long you have to stick with the current agreement (i.e. 5 years)

- The interest rate: The agreed-upon interest rate for the term (i.e. 5%)

- The amortization period: How long in total you’ll take to pay off your mortgage (i.e. 25 years)

When you press “calculate,” you’ll not only get your monthly payments, but also how much interest you’ll have paid over the course of your term.

Calculate your mortgage affordability before using the mortgage calculator

Figuring out how big of a mortgage you can afford is based on 3 factors:

- your household income,

- your monthly personal expenses, and

- other property-related expenses (property taxes, heating, etc).

In a general sense, it’s often recommended that your monthly housing costs don’t exceed 32% of your gross household monthly income. This includes everything that goes into paying for your home, from your mortgage payments to your property taxes and utilities.

The Canada Mortgage and Housing Corporation (CMHC) hosts a handy calculator that makes it easy to estimate how much you can afford. Simply input how much you make and your monthly expenses, and it’ll estimate the recommended total price of the home.

To use this calculator, you’ll need the following details:

- your average household income (before taxes),

- the down payment amount you plan to use,

- the mortgage interest rate,

- your province of residence, and

- the total amount you spend on household expenses.

The basics of a mortgage payment

Of course, with such a big financial decision, it’s important to make sure you have at least a basic grasp of all the terms involved in the transaction.

So let’s start at the beginning – what’s a mortgage?

In a basic sense, it’s a loan you take out to cover the cost of your home. It will often last a couple decades, but most mortgages are separated into smaller periods of time, called “terms.”

Let’s define a few key mortgage terms:

What is an amortization period?

Amortization is when you periodically pay off a loan over a certain amount of time. This is done through scheduled payments that include both the principal and the accumulated interest. You’ll be paying mostly towards the interest at the beginning of your mortgage, then mostly towards the principal at the end of your mortgage.

The amortization period is the length of time it’ll take you to pay off your full loan, based on the monthly payments you’ve agreed on. For CMHC insured homes, the maximum amount of time is 25 years. Otherwise it’s 35 years.

In general, longer amortization periods mean lower monthly payments but higher total interest payments.

Example amortization schedule

Here are the first and last 5 months of a 25 year mortgage of $250,000 with an interest rate of 6.5%:

| Month | Mortgage amount left | Capital paid that month | Interest paid that month | Total capital paid | Total interest paid |

|---|---|---|---|---|---|

| 1 | $250,000.00 | $ 338.37 | $ 338.37 | $ 1,336.19 | $ 1,336.19 |

| 2 | $249,661.63 | $340.18 | $1,334.38 | $678.56 | $2,670.56 |

| 3 | $249,321.44 | $342.00 | $1,332.56 | $1,020.56 | $4,003.12 |

| 4 | $248,979.44 | $343.83 | $1,330.73 | $1,364.39 | $5,333.85 |

| 5 | $248,635.61 | $345.67 | $1,328.89 | $1,710.05 | $6,662.74 |

| 296 | $8,240.20 | $1,630.52 | $44.04 | $243,390.32 | $252,279.29 |

| 297 | $6,609.68 | $1,639.23 | $35.33 | $245,029.55 | $252,314.61 |

| 298 | $4,970.45 | $1,647.99 | $26.57 | $246,677.54 | $252,341.18 |

| 299 | $3,322.46 | $1,656.80 | $17.76 | $248,334.34 | $252,358.94 |

| 300 | $1,665.66 | $1,665.66 | $8.90 | $250,000.00 | $252,367.84 |

The biggest thing to note is that you start out paying a lot more interest than you do capital. But as you can see in the last 5 months of your mortgage, that gets switched around – you’ll be paying way more towards your capital and much less towards interest.

What are mortgage terms?

Mortgage terms are segments of your full amortization period where you’re committed to a certain bank and an interest rate for a specified amount of time. These are usually in the area of 6 months to 10 years long, with 5 years being the most common term.

Once your term is up, you’ll have to renew your mortgage based on the new rates and terms available. If what your bank is offering no longer interests you, you can also renegotiate or change lenders.

Longer terms tend to have higher interest rates to make up for the convenience and safety of locking in a rate for longer periods of time. Shorter term lengths have lower initial rates, but you’re more vulnerable to rising interest rates in the future, plus will need to renegotiate more often.

What’s the difference between open and closed mortgages?

A couple terms you’ll see a lot when browsing mortgage rates are “closed” or “open” – so what do they mean?

A closed mortgage has more strict agreements that you’ll have to stick to throughout the entire term. You’ll have to keep paying the amount you agreed to at the beginning of the term for the whole time.

This means the lenders can depend on your payments to keep coming in for the term length – so closed term interest rates tend to be lower to entice you.

An open mortgage is more flexible. You’ll be able to pay as much as you want, as long as it reaches the minimum monthly payment specified. This means you could pay your principal off faster, lowering your overall amortization period as well as total interest payments.

What’s the difference between fixed vs. variable mortgage rates?

There are 2 more terms you’ll want to keep in mind while getting a hold on your mortgage – fixed vs. variable rates.

Variable-rate mortgages are almost always lower at the outset, but come with a bit more risk. This is because they’re based on Canada’s prime rate and can rise or fall at any time.

Fixed-rate mortgages, on the other hand, have an interest rate that is set in stone for the length of a term. No matter what happens in the economy or to your lender, you’ll have the reliability of the same interest rate for the whole term. Of course, this reliability comes with a bit of a premium, so fixed interest rates tend to be higher.

How to lower your mortgage payments

If your monthly payments are causing too much of a strain on your wallet, there are a few things you can do to get some relief:

- Extend your total mortgage length: The more time you have to pay off your loan, the smaller the monthly payments will be.

- Refinance your mortgage: This is especially helpful if your mortgage is relatively new and can get you lower interest rates.

- Make a larger down payment: If you can take a larger chunk off the principal of your mortgage right away, that will be less you’ll be needing to pay towards every month.

- Drop your PMI: If your down payment was less than 20% of your home, you’re likely paying Private Mortgage Insurance. Once you’ve paid off 20% equity in your mortgage, you may be able to contact your lender and ask about dropping this payment.

There’s just one thing to keep in mind – though extending your mortgage length is one of the easiest ways to lower your monthly payments, this will also increase the overall cost of your home. You’ll be paying it off longer and accumulating more interest.

If you’d rather save money on your whole mortgage, paying it off as quickly as possible is your best bet.

Can I get a no down payment mortgage?

Though a lot of the focus on buying a home goes towards the total cost and the monthly payments, the initial down payment is an important factor to consider as well.

The minimum down payment for mortgages in Canada is 5%.

But if you put down less than 20% of the total cost of your home as a down payment, you’ll need to have private mortgage insurance – which is an extra monthly cost. That’s why it’s best to aim for 20%.

What about a cash back mortgage?

Cash back mortgages can be very convenient, but they won’t work for everyone.

If you agree to a cash back mortgage, you’ll receive a lump sum cash payment once the mortgage closes. It’s often used as an incentive to carry and complete the mortgage with a specific lender. Terms and amounts will vary from bank to bank.

Keep in mind that the cash back amount isn’t usually quite enough to cover your down payment.

This type of mortgage can work for you if:

- you need fast cash to help with closing costs,

- there are minor repairs or renovations that need to be done to your new property,

- your new home needs new furniture, or

- you’re moving your mortgage to a new bank and want the transfer fees covered.

However, this type of mortgage often comes with a higher interest rate.

Mortgage calculators by bank

A lot of major banks have their own mortgage calculators, so let’s take a look and see what makes each one special.

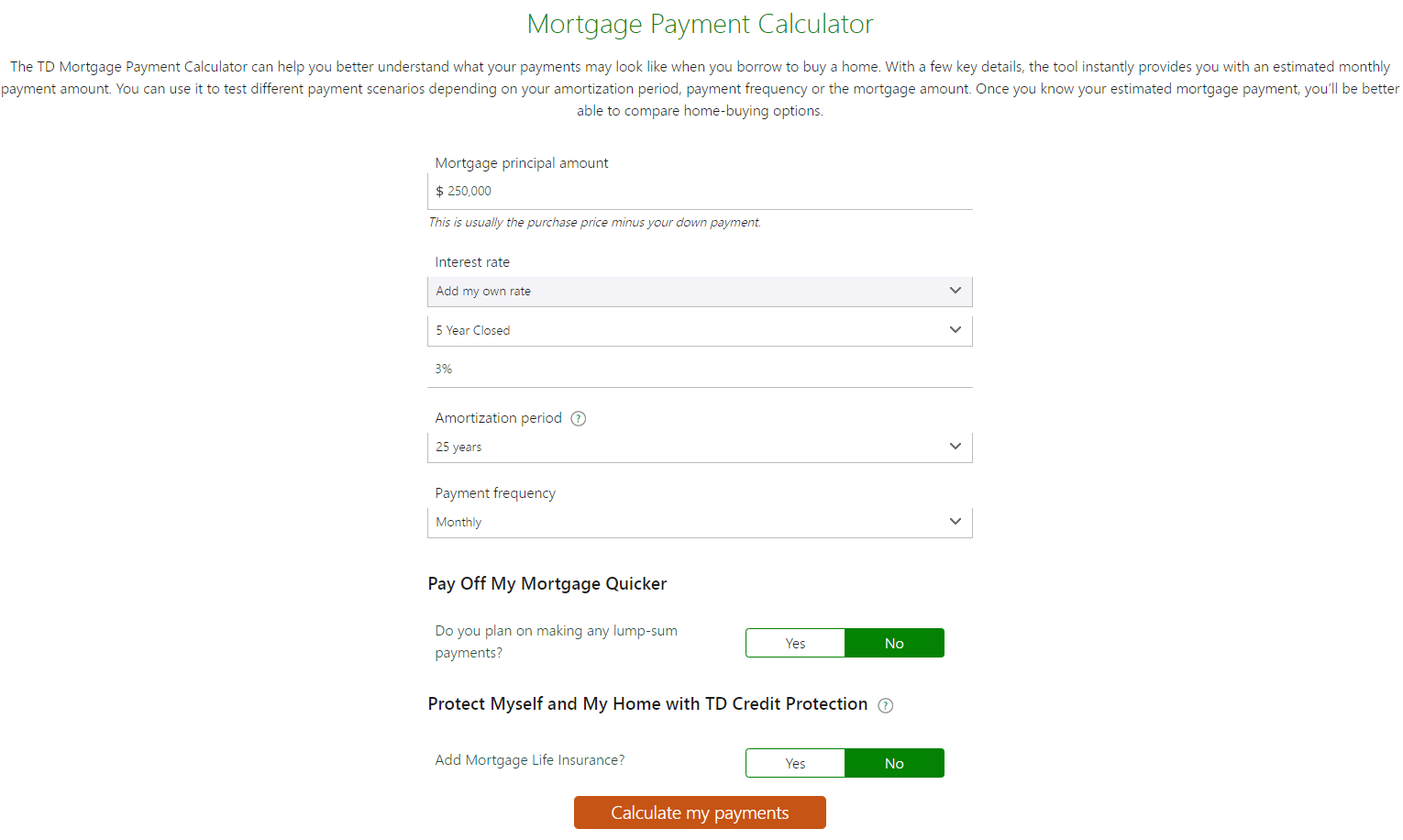

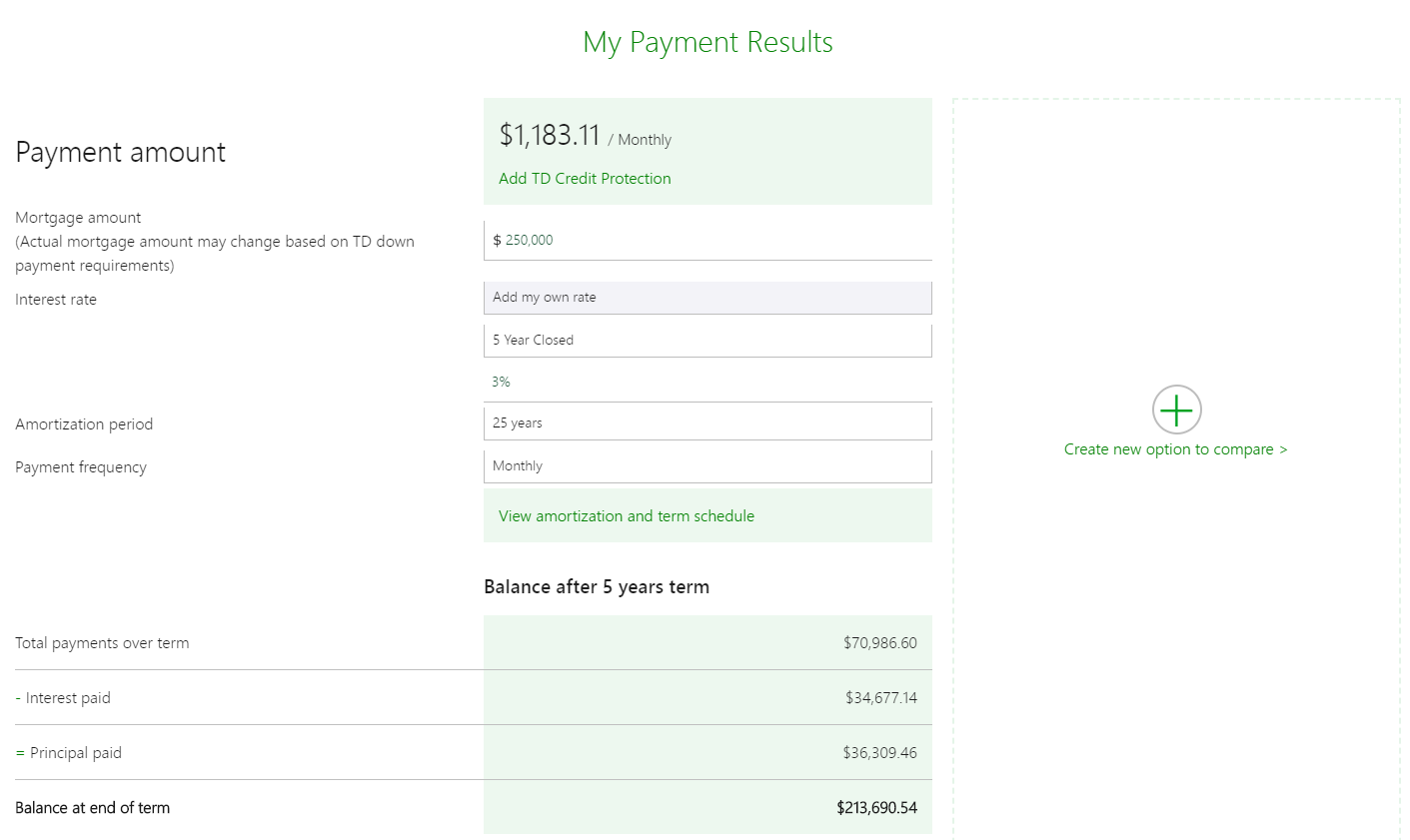

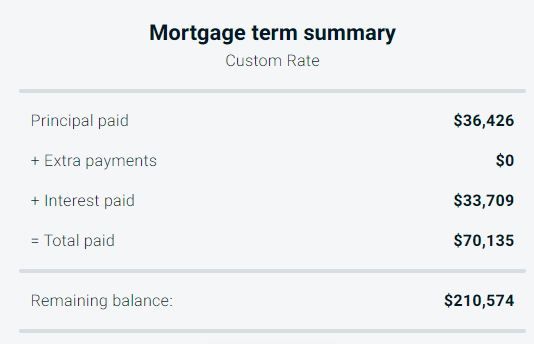

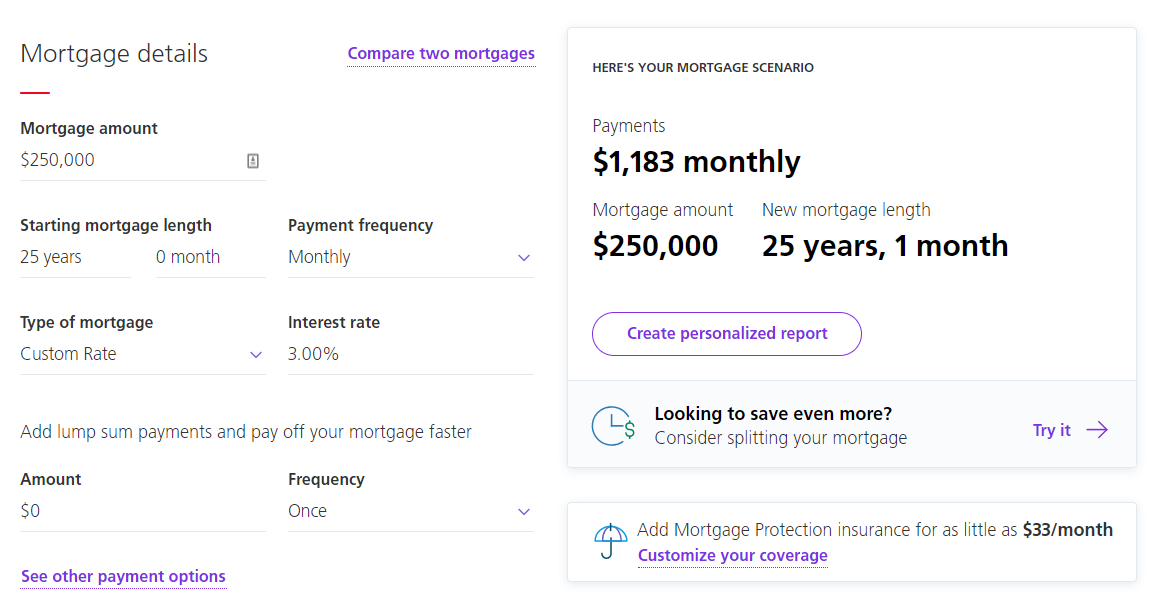

TD mortgage payment calculator

TD offers a simple calculator that lets your input your own mortgage rate and even gives you room to compare between different mortgage scenarios.

You can also choose to add lump-sum payments and TD insurance to see how they change your mortgage outlook.

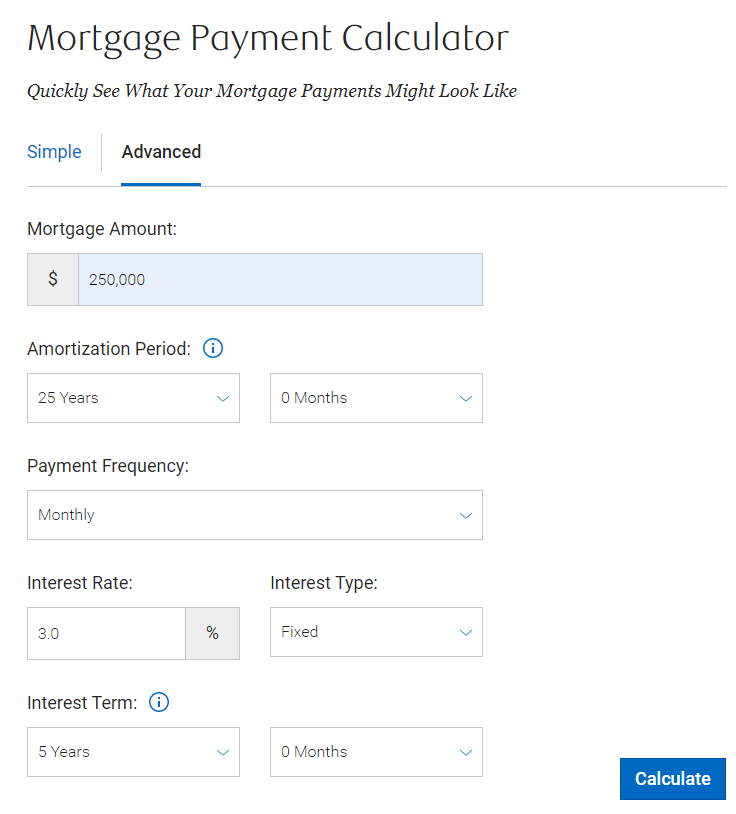

RBC mortgage payment calculator

RBC offers several different mortgage calculators, including:

- mortgage payment calculator,

- home value estimator,

- neighbourhood explorer,

- rent or buy,

- and more.

Focusing on the mortgage payment calculator, you’ll have the option between a “simple” or “advanced” calculation. The first one only asks for the mortgage amount and calculates based on the popular rates and term lengths (currently 5-year fixed rate of 3.04% over 25 years). This makes it simple if you’re just looking for a general idea.

For the “advanced” option, you’ll be able to enter all the normal details in yourself so you can get a more personalized picture.

In the results, you’ll be able to check out the difference between various payment frequencies, as well as your full amortization table.

CIBC mortgage payment calculator

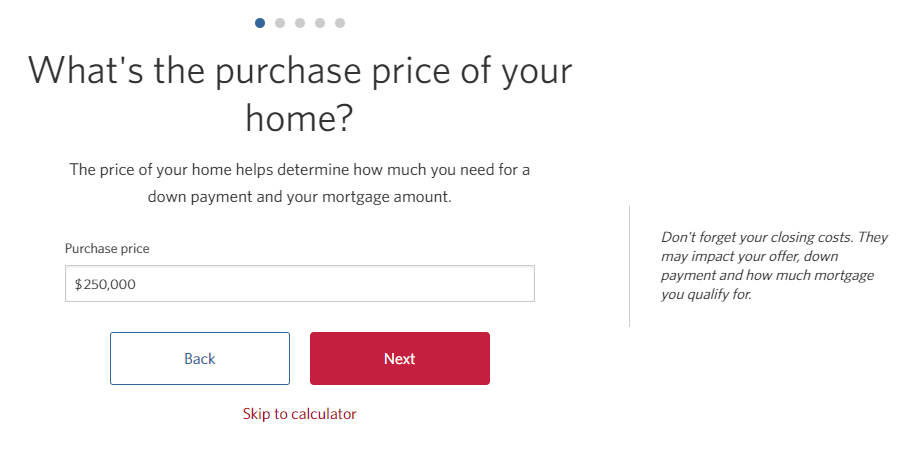

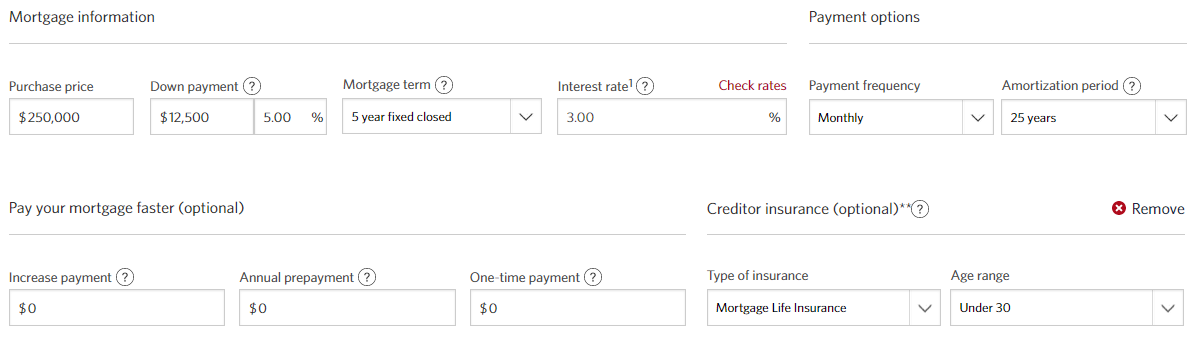

CIBC‘s calculator takes you through each question step-by-step, explaining each term and giving helpful tips on the side.

If you’re not interested in having your hand held, you can skip right to the full calculator:

Having the option to input your down payment is definitely a nice touch.

You’ll also get a payment frequency table here, but it’s less detailed than RBC’s – still, nice to have.

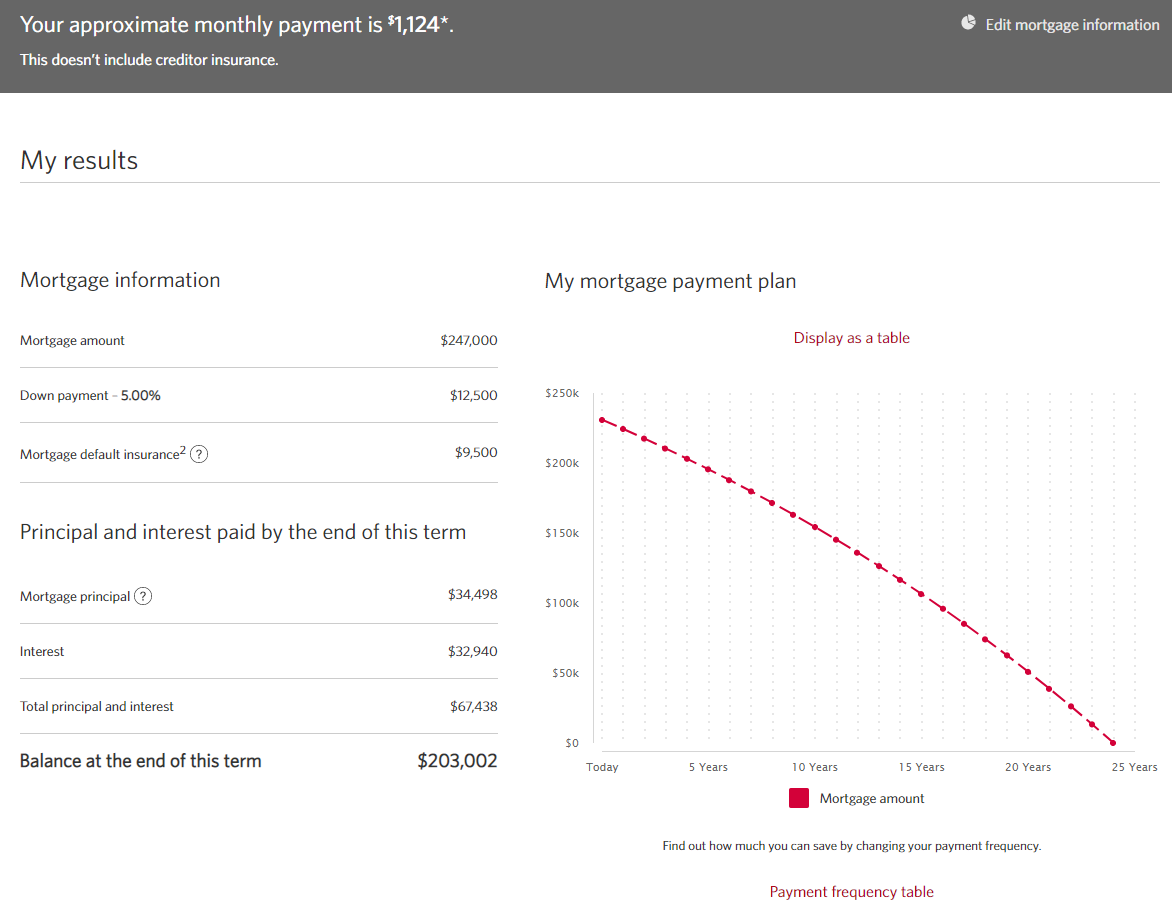

BMO mortgage payment calculator

BMO‘s calculator updates in real time so you know how each of your changes affects your monthly payments – a great feature. It also includes a down payment section, which calculates the mortgage default insurance you’ll need to buy if the down payment is less than 20%.

For results, you’ll get the following information, plus a handy amortization schedule graph and chart:

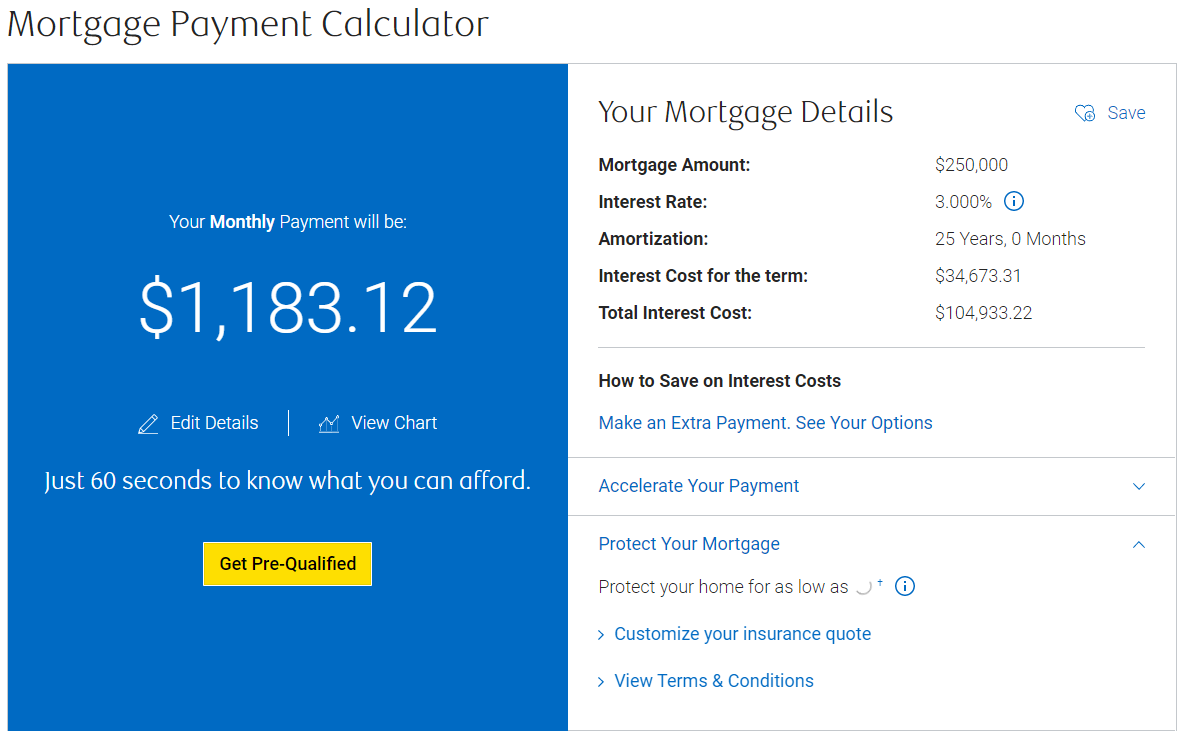

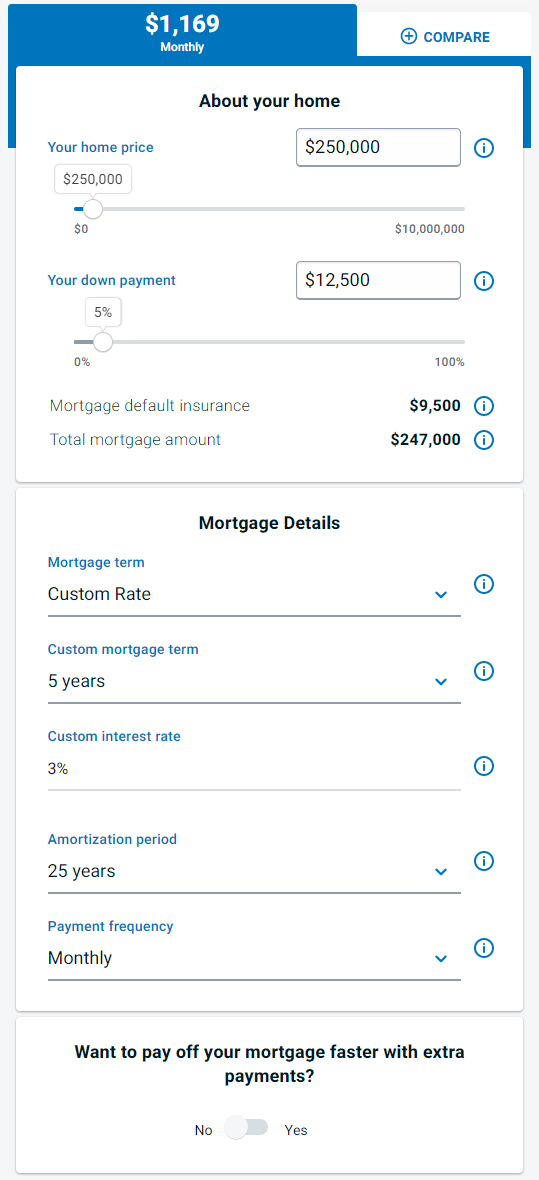

Scotiabank mortgage payment calculator

Finally, Scotiabank‘s calculator also updates in real time, with all the info in one area for easy reading:

It’s more bare-bones than some other options, but does allow you to easily download a PDF of your personalized report without even needing to enter your email.

How will you calculate your mortgage payment?

When dealing with the huge numbers involved in calculating your mortgage, it’s easy to lose track of how your payments will affect your month-to-month life. Calculating your mortgage payments is a great way to get a better handle on the short-term consequences.

Have you used any of these mortgage calculators during the home buying process?

Which calculator is your favourite?

Let us know in the comments below.

FAQ

How do I calculate my monthly mortgage payments?

There are several factors that go into determining your monthly mortgage payments, most notably: the total amount of your mortgage, the length of your term, length of your mortgage, and your interest rate. It can get complicated, but you can play with our easy-to-use calculator right here.

How much of a mortgage can I afford?

The general rule of thumb is that your total monthly housing payments (including things like your mortgage, property taxes, heating, etc.) don’t exceed 35% of your gross household monthly income. Get more information on figuring out how much you can afford here.

Do I need to pay a down payment on my mortgage?

The minimum down payment needed in Canada is 5% of your total mortgage cost. That being said, you’ll have to pay for private insurance if your down payment is less than 20% of the total cost – so that’s the area you’ll likely want to shoot for. Read more about mortgage down payments here.

What should I know before meeting a mortgage lender?

Really, the mortgage lender should be the one informing you about things you should know. But to prepare for meeting a mortgage lender, you should have already prepared the necessary documents for proving your income amounts and information about your current debt load. Write down some questions you’d like the lender to answer too.

How do I estimate my TD mortgage monthly payments?

TD Bank hosts its own mortgage calculator that will calculate your monthly payments plus how your mortgage will look by the end of your term. You’ll also have room to compare 2 mortgage options side by side. Check out their calculator here.

How do I estimate my RBC mortgage monthly payments?

If you’re thinking of getting a mortgage with RBC, you can use their mortgage calculator to create a detailed amortization schedule along with your estimated monthly payments. Read more about their calculator here.

How do I estimate my CIBC mortgage monthly payments?

CIBC offers a mortgage calculator with lots of tips to help you out. You’ll even be able to play with ways you can pay off your mortgage faster, plus add on creditor insurance. Check it out here.

How do I estimate my BMO mortgage monthly payments?

BMO’s mortgage calculator updates in real time so you can see how each choice affects your monthly payment – a cool feature. Get more info right here.

How do I estimate my Scotiabank mortgage monthly payments?

If you’re thinking of using Scotiabank for your mortgage lender, their mortgage calculator is an easy-to-use and quick way to get an estimate of your monthly payments. You can see more here.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments