There are more and more robo advisors popping up in the Canadian market, making it hard to decide which low-cost investment option will work the best for your money.

When in doubt, it can help to fall back on the OG of your desired product. In the case of Canadian robo advisors, that privilege belongs to CI Direct Investing (formerly WealthBar).

Today, this robo investment option has fallen a bit short of offering the cheapest rates, but its hybrid model – which couples algorithmic investments with real human support – helps it stand out from the crowd.

Everything considered, CI Direct Investing is best for seasoned investors with a lot of money to move around – letting them take advantage of the lower annual fees and reimbursement options.

Promo: Use this link to get your first $10,000 managed FREE for the first year.

- What is CI Direct Investing?

- The pros and cons

- How do CI Direct Investing fees work?

- CI Direct Investing portfolios – ETFs and Private Investments

- Extra CI Direct Investing benefits

- Is CI Direct Investing safe?

- How it compares to Wealthsimple and Questrade

- How to set up an account

- The verdict

What is CI Direct Investing?

CI Direct Investing is a hybrid robo advisor that combines the reliability of investment algorithms with the comforting touch of human advisors.

It offers many of the standard robo advising features plus some unique benefits you won’t find elsewhere.

Summary of features

| Types of accounts | RRSP, TFSA, Individual (non-registered), RESP, Joint, Corporate, LIRA, RRIF, LIF, RDSP |

|---|---|

| Minimum investment | $1,000 |

| Tax loss harvesting | Yes |

| Socially responsible investing options | Cleantech add-on to any portfolio |

| Automatic rebalancing | Yes |

| Live advice? | Unlimited through messaging or phone calls |

| Fees | First $150,000: 0.60% annually Next $350,000: 0.40% annually Above $500,000: 0.35% annually |

| Transfer fees | Refunded for transfers over $25,000 (up to $150 refund) |

| Withdraw fees | None |

| Special feature | Access to Private Investment Portfolios previously reserved to the uber-wealthy |

| Promo | Get $10,000 managed free for the first year |

| Interested? | Open an account |

The pros and cons

Before we get into the details of CI Direct Investing, let’s summarize what there is to love about it – and what you should look out for.

The pros

- Get the human touch through their team of licensed financial advisors, none of whom work for commission.

- 8 portfolios to match your risk, return, and diversification needs.

- Access to Private portfolios to maximize return through more diversification and less volatility.

The cons

- Higher fees than other robo advisors, including Wealthsimple.

- Account minimum of $1,000.

Are there any fees involved?

CI Direct Investing has a 3-tier fee system, with some ETF fees stacked on top. But even when added together, you can still save hundreds a year compared to the average mutual fund fees in Canada.

| Investment amount | Fees |

|---|---|

| First $150,000 | 0.60% annually + MER fees |

| Next $350,000 | 0.40% + MER fees |

| Above $500,000 | 0.35% + MER fees |

The way these fees are charged are similar to Canada’s tax brackets. Your first $150,000 in investments will be charged at the 0.60% point, and everything above that is charged at the lower rate.

So if you have $200,000 in investments, you’ll be paying 0.60% on $150,000, then 0.40% on $50,000 – for a total of $1,100 per year, which is an overall fee of 0.55%.

($150,000 * 0.006) + ($50,000 * 0.004) = $1,100

Want a more complicated example?

Okay, if you were to have $550,000 in investments, this is what your fee structure would look like:

($150,000 * 0.006) + ($350,000 * 0.004) + ($50,000 * 0.0035) = $2,475

Which is a total of 0.45% per year.

How does it compare?

Let’s quickly compare some numbers to see how much you’d pay in comparison to both Wealthsimple and the average Canadian mutual fund fees.

We’ll use the 1.94% pre-tax number that CI Direct Investing uses on their own site, which was taken from the 2019 study by Strategic Insights called “Monitoring Trends in Mutual Fund Cost of Ownership and Expense Ratios.”

| Investment | CI Direct Investing fees | Wealthsimple fees | Average fees |

|---|---|---|---|

| $5,000 | $30 | $25 | $97 |

| $15,000 | $90 | $75 | $291 |

| $150,000 | $900 | $600 | $2,910 |

| $550,000 | $2,475 | $2,200 | $10,670 |

Wealthsimple is cheaper in any scenario, so if your sole worry is fees – then Wealthsimple wins this one.

Related: Best Robo Advisors In Canada: A Comparison Of WealthSimple, Nest Wealth, Justwealth, and Questrade

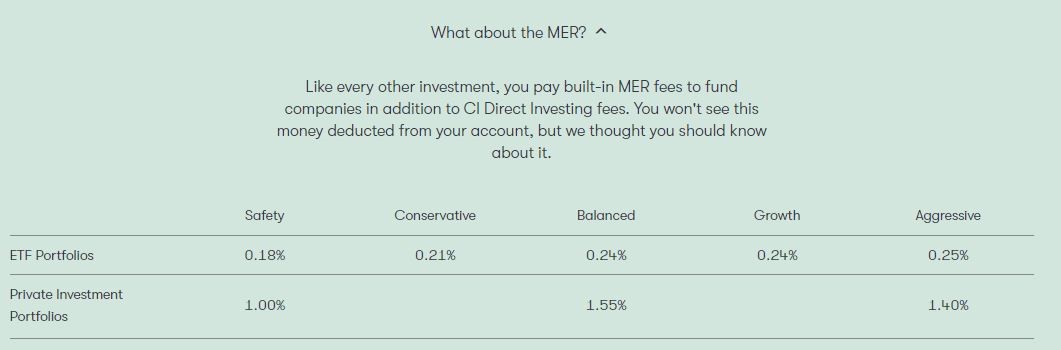

Don’t forget the MER fees

None of these numbers include the MER fees, which you’ll need to pay for most investments.

Here’s the breakdown as CI Direct Investing outlines it:

This means the real range of your fees is 0.53% to 2.15%.

In comparison, Wealthsimple states the MER fees are expected to be about 0.2% annually for them.

CI Direct Investing portfolios

With the fees out of the way, let’s take a closer look at what exactly CI Direct Investing can do for you. After all, this will be the deciding factor if it’s worth paying the premium for CI Direct Investing over Wealthsimple (or other robo advisors)…

Here’s an overview of all 8 portfolios you can get through CI Direct Investing:

| Portfolio | 5-year return | 5-year volatility | MER |

|---|---|---|---|

| Safety | 3.05% | 3.25% | 0.19% |

| Conservative | 4.48% | 4.69% | 0.23% |

| Balanced | 6.06% | 5.97% | 0.25% |

| Growth | 6.93% | 6.78% | 0.26% |

| Aggressive | 8.00% | 7.52% | 0.25% |

| Safety Private | 5.05% | 2.00% | 1.00% |

| Balanced Private | 7.14% | 3.51% | 1.56% |

| Aggressive Private | 7.96% | 4.71% | 1.37% |

For the most up-to-date rates and returns, visit CI Direct Investing directly.

In general, Private portfolios offer higher returns at lower volatility, but incur a higher MER fee – which is on top of the 0.35% – 0.60% you’re already paying as an annual fee. In theory, this should be covered by the extra returns you’re getting, but that may not always be the case.

Related: BMO InvestorLine Review: Powerful Tools, But Not Very Newbie Friendly

ETF Portfolios

These portfolios are likely what you’ll be investing in if you choose to go with CI Direct Investing. They give you 5 different risk levels, giving lots of options for both the risk-takers and money-protectors – and everyone in between.

Safety

For people who hate risks, the Safety portfolio ensures your investments have the least risk possible. In the past 5 years, this portfolio has given a 3.05% return at a 3.25% volatility rate.

Here’s how the portfolio is spread out:

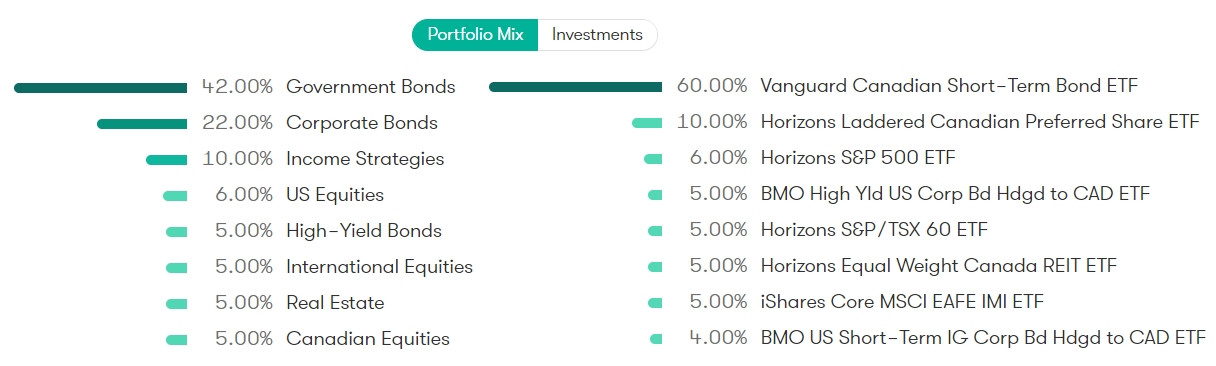

Conservative

If lowering risk is important to you, but you’d like to see a bit more return – the conservative portfolio may be more up your alley. The past 5 years have seen a 4.48% return with a 4.69% volatility rate.

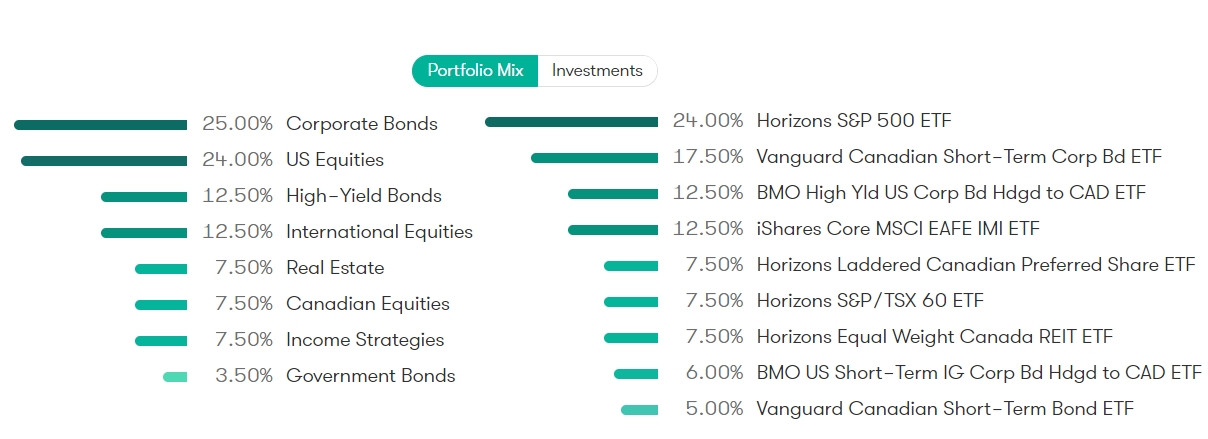

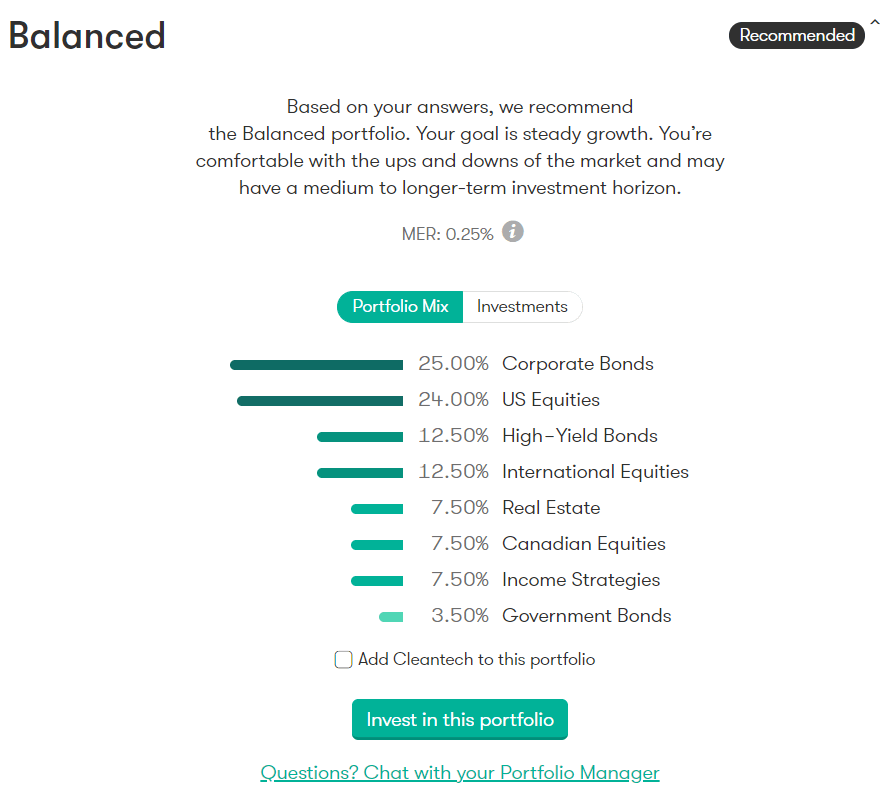

Balanced

But sometimes the middle ground is the best place to be. The Balanced portfolio will give you more ups-and-downs, but an overall better return – ideal for longer-term investments. The past 5 years have seen a 6.06% return with a 5.97% volatility rate.

Growth

Now we’re starting to get into some more volatile investments, but still keeping a handle on our risk. This is best for people who will be investing over many years – so that some loss will be fine, since you can wait it out for the market to recover.

The Growth portfolio has had a 5-year return of 6.93%, with a 6.78% volatility rate.

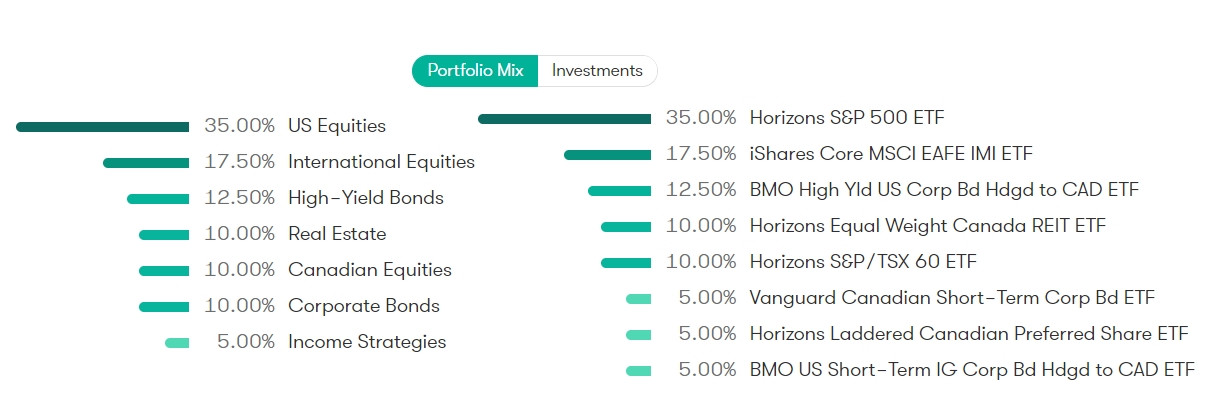

Aggressive

And last, but certainly not least in terms of return, is the ultimate risk-taking portfolio. This will maximize your return, but put you at more risk in the short-term.

This portfolio has seen an 8.00% return over the last 5 years, with a 7.52% volatility rate to go along with it.

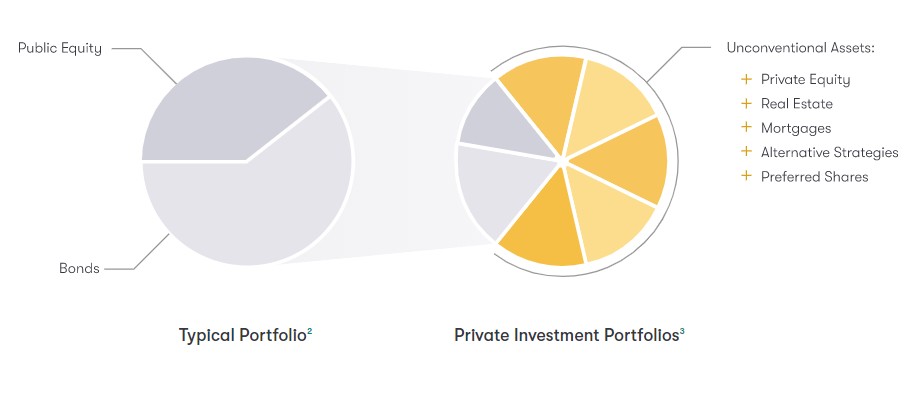

Private Investment Portfolios

But what really sets CI Direct Investing apart is its Private Investment Portfolios (PIPs). These help add more diversification in your portfolio, as well as weather any market storm that may come Canada’s way – since a lot of it is private investments.

This will give you a choice between 3 different Private portfolios:

Safety Private

For those who want to be extra secure, the Safety Private portfolio has the lowest volatility rate by far, while still keeping a decent return. Over the last 5 years, it has earned a 5.05% return rate and only 2.00% volatility.

Balanced Private

For those who love the more balanced approach, the Private option will give you a great return at an even better volatility rate. Right now, its 5-year numbers are 7.14% return and 3.51% volatility.

Aggressive Private

And finally, the Aggressive Private portfolio will give you almost the same growth rate as the Aggressive portfolio, but at almost half the volatility. It currently has rates of 7.96% return and 4.71% volatility.

More CI Direct Investing features

On top of the portfolios, there are several other features offered by CI Direct Investing that make them a good robo advisor to consider.

Socially Responsible Investing

In a world that’s putting more of an emphasis on social responsibility than ever before, Socially Responsible Investing (or SRI) has almost become a staple among robo advisors.

CI Direct Investing has not missed the opportunity to offer an eco-conscious option through the Cleantech add-on. No matter what portfolio you go with, choosing to add Cleantech will ensure 5.00% of your investments are helping the switch to hydro, solar, and wind energy.

Definitely a cool feature, but not as good as other robo advisors. The oft-compared Wealthsimple, for example, lets you choose portfolios that are up to 90% socially responsible, including up to 15% in Cleantech investments.

Free financial advice

Included with the slightly higher fees is unlimited financial advice from trained financial advisors. They don’t work for commissions, so you know they have your best interests in mind.

You can contact them through an easy chat app, through email, or even by scheduling a phone call.

Some of the advice will be automated, as is the case for most online customer service nowadays, but CI Direct Investing does give you the opportunity to talk to real people – putting the human back in robo advisors.

Related: Wealthsimple Review: Put Your Investing On Auto-Pilot

Automatic rebalancing

The fee also covers automatic rebalancing of your portfolio. This will happen at a minimum of every quarter, but will also be triggered by the following events:

- the asset allocation deviates from the original target by more than 5%,

- distributions are made, and

- contributions are made.

Refund transfer fees

Most financial institutions will charge you a fee for transferring your investments, but if you’re moving more than $25,000 to CI Direct Investing – they’ll refund the fees, up to a maximum of $150.

Is CI Direct Investing safe?

When you invest with CI Direct Investing, your money is protected by the Canadian Investors Protection Fund. This means you’re automatically insured for up to $1 million per account category in case anything happens.

You can also rest assured that CI Direct Investing is a registered portfolio manager, meaning they’re considered a fiduciary. This is a commitment to putting their clients’ needs first above their own.

Your account is also protected by various encryptions and security measures, as well as CI Direct Investing’s promise to never share or sell your information, in accordance with the Personal Information and Electronic Documents Act.

How does it compare to alternatives?

There are a lot of great robo advisors in Canada now, making the question of “who should I go with” a lot more difficult to answer.

Let’s look at some of CI Direct Investing’s biggest competitors.

CI Direct Investing vs. Wealthsimple

Wealthsimple will give you a similar easy-to-do investment experience with cheaper fees and more options.

| Robo advisor | CI Direct Investing | Wealthsimple |

|---|---|---|

| Fee structure | First $150,000: 0.60% annually Next $350,000: 0.40% annually Above $500,000: 0.35% annually |

Under $100,000: 0.50% Over $100,000: 0.40% |

| MER fees | 0.18% – 0.25% (up to 1.55% with Private portfolios) | Around 0.20% |

| Minimum investment | $1,000 | $1 |

| Special features | * Private Investment Portfolios * Cleantech add on * Halal option available upon request |

* Socially Responsible Investing portfolio * Halal option * Roundup and Overflow features |

| Interested? | Learn more | Learn more |

Instead of a tiered option, Wealthsimple simply charges you 0.5% if you have less than $100,000 invested, then 0.4% if you have more than that. As you can see in our fee comparison above, Wealthsimple will come up on top virtually all of the time.

You also get more options for Socially Responsible Investing through Wealthsimple.

Wealthsimple also has a $1 minimum investment rule, plus a slew of other features like Roundup and Overflow.

And Wealthsimple also pays transfer fees from your current investments, provided you transfer at least $5,000.

CI Direct Investing vs. Questrade

Like CI Direct Investing, Questrade also requires a minimum balance of $1,000 to start investing. It also has a multitude of portfolios to match your investment needs and risk comfort levels.

| Robo advisor | CI Direct Investing | Questrade |

|---|---|---|

| Fee structure | First $150,000: 0.60% annually Next $350,000: 0.40% annually Above $500,000: 0.35% annually |

Under $100,000: 0.25% Over $100,000: 0.20% |

| MER fees | 0.18% – 0.25% (up to 1.55% with Private portfolios) | 0.17% – 0.22% (up to 0.35% with Socially Responsible portfolios) |

| Minimum investment | $1,000 | $1,000 |

| Special features | * Private Investment Portfolios * Cleantech add on |

* Actively managed * Socially Responsible Investing portfolios |

| Interested? | Learn more | Learn more |

But Questrade is one of the cheapest robo advisors on the market, which is in stark contrast to CI Direct Investing being one of the most expensive.

One of the biggest differences is Questrade is still actively managed behind the scenes. This means on top of the algorithm that shaped your portfolio, there are financial advisors monitoring and reallocating your portfolio when necessary.

If you’re interested, you can sign up for Questrade right here.

How do you set up an account?

Setting up an account takes 4 steps, which we’ll outline briefly here. Overall it’s a fast and easy process, as has become standard for most online financial tools these days.

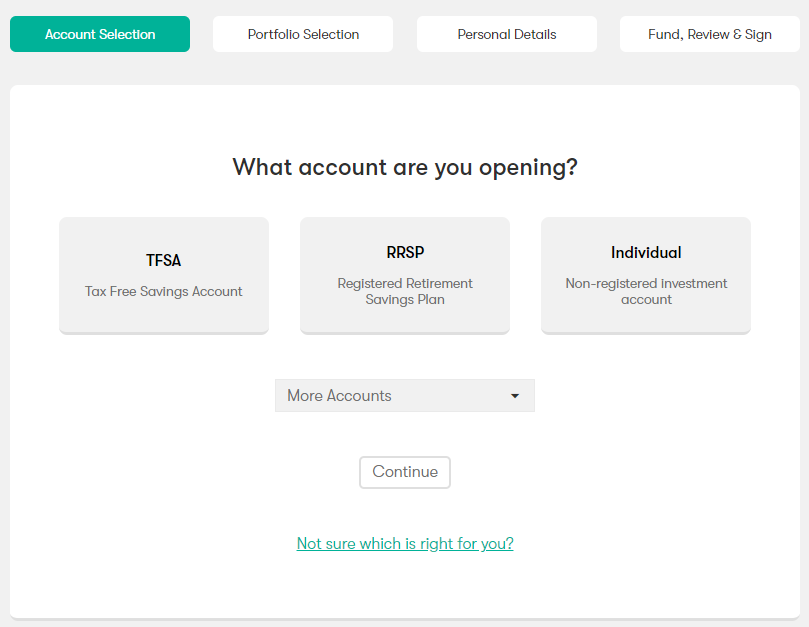

Step 1: Account selection

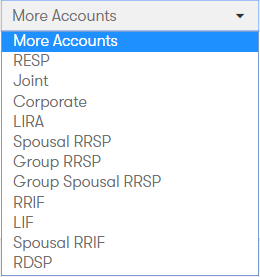

After entering your email address and creating a password, the first thing you’ll need to do is decide what kind of account you’d like to set up.

You’ll have the main 3 options (TFSA, RRSP, and Individual), but can find the following accounts under the “More Accounts” dropdown:

Step 2: Portfolio selection

This step is more involved. You’ll have to answer a series of questions relating to your investment goals to help them recommend an investment plan that’s best for you.

These questions include:

- How long do you plan to invest for?

- Do you care most about minimizing losses, maximizing gains, or both equally?

- What is your annual income?

- How much is your total debt?

- How much are your current investment accounts worth?

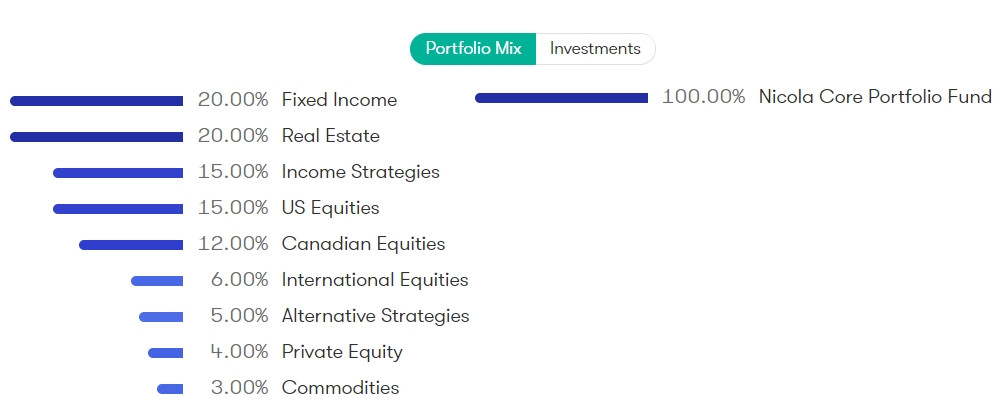

After you answer, CI Direct Investing will recommend one of their portfolios, but you’re free to choose from the other options if you think they’d suit you better. You can also look at Private portfolios by clicking the bottom link.

You’ll be able to see a brief description of each account, plus what the mix and investments are. See above for more information on your options. This is also the step where you’ll be able to add Cleantech investments to your portfolio.

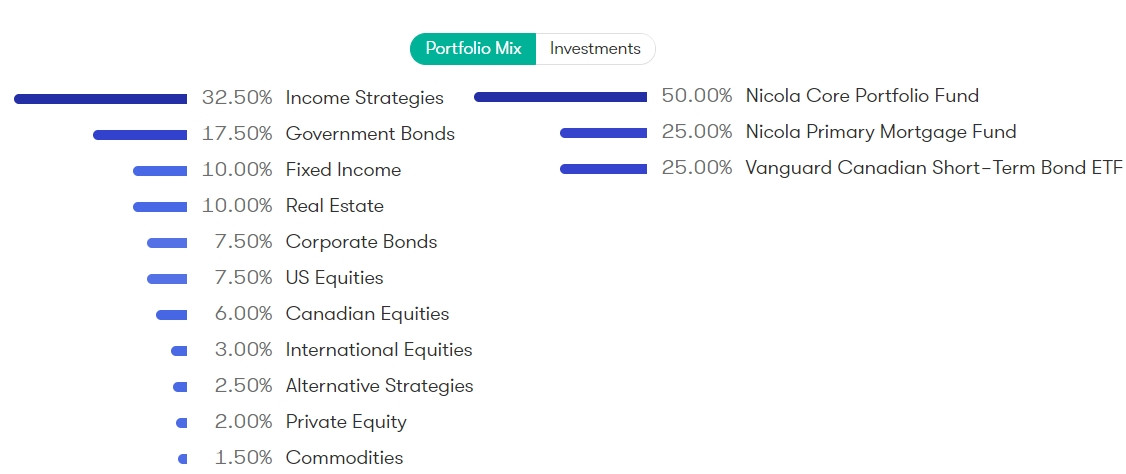

Here’s what I was recommended and all the info they gave me:

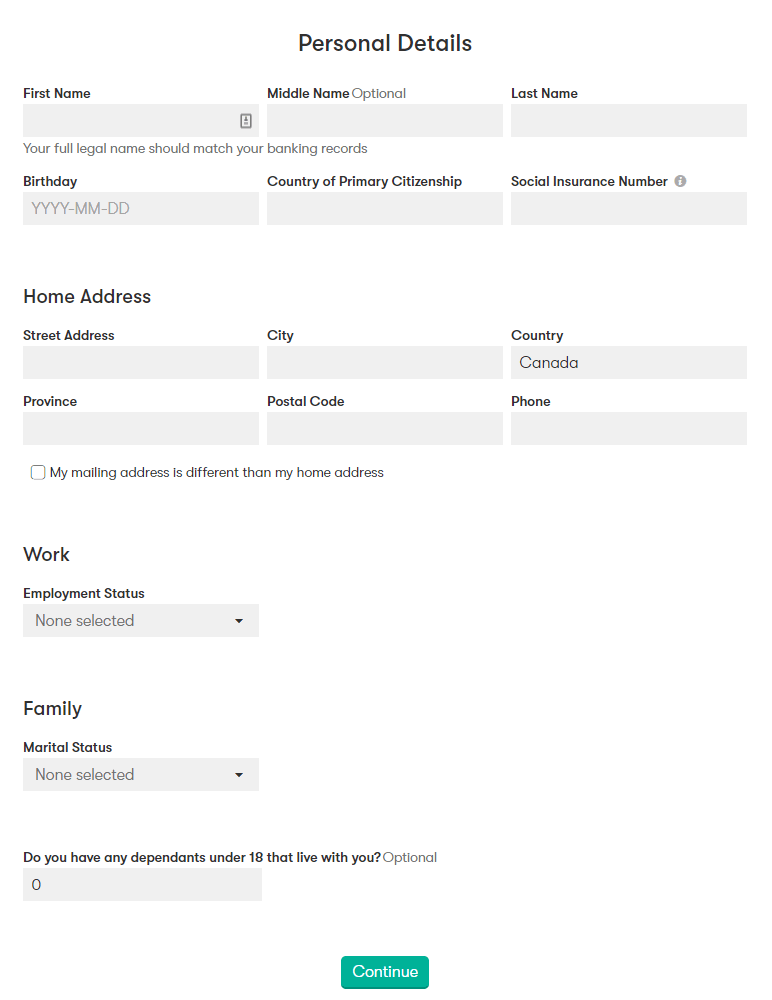

Step 3: Personal details

After you’ve chosen your portfolio, you’ll have to enter some standard personal details:

You’ll also be asked some regulatory questions, but most of us will likely just answer “No” to them. These seem to be mostly to protect conflict of interests.

Step 4: Fund, review, and sign

All that’s left now is to connect your bank account, review everything you’ve entered, then give your digital signature.

That’s it!

The verdict

CI Direct Investing is great for seasoned investors who already have a lot of money tied up in investments. That way they can take advantage of the free transfer to CI Direct Investing and the lower overall annual fee offered on the upper end of investments.

But for new investors, it can be hard to meet the minimum balance of $1,000, and even harder to justify paying more than your alternatives like Wealthsimple and Questrade. Then again, paying a premium could be worth it if you appreciate great customer service and financial advice.

As always, the decision is up to you and what you prioritize in your investments.

What about you?

Do you think you’ll try out CI Direct Investing?

Are you using any other robo advisors, or have you in the past?

Let us know in the comments below.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments