Pay stubs are receipts from your employer that show the time worked and income earned during a specific period.

Pay stubs include both the amount you've earned and what you've paid in taxes, aka, the "net" amount that goes into your bank account and that hard-to-stomach pre-tax, or “gross,” amount.

Pay stubs are important to receive, important to understand, and important to keep. So let's take a look at what pay stubs are in Canada and why we need them.

Key Takeaways

- Pay stubs are receipts that show an employee's time worked and income earned during a certain timeframe.

- Some details included on your pay stub are the pay period dates, gross and net income amounts, and your year-to-date earnings.

- Deductions such as income tax, EI, and CPP are also noted on you pay stub.

- Employers and employees should both keep track of pay stubs as they are required during certain situations, like resolving pay discrepancies.

What is a pay stub for?

A pay stub is a receipt an employer gives their employees that breaks down earnings during a certain pay period.

Your pay stub also contains important information about your employment and income, including:

- Pay periods

- Net and gross wages

- Various types of deductions

- General employment info

Don’t forget to save your pay stubs! It’s important to save your pay stubs because they’re records of your earnings for tax purposes. Likewise, employers should keep careful records of payment history in case remuneration is ever called into question.

For tax purposes and other reasons, it's recommended that you keep your pay stubs for at least a year, but preferably 6 or 7 years.

What's on a pay stub?

Every time you receive a pay stub, it will contain the same information, including how much money you've earned during the most recent pay period as well as year-to-date.

Pay stubs can also be referred to as pay slips, paycheque stubs, or wage statements.

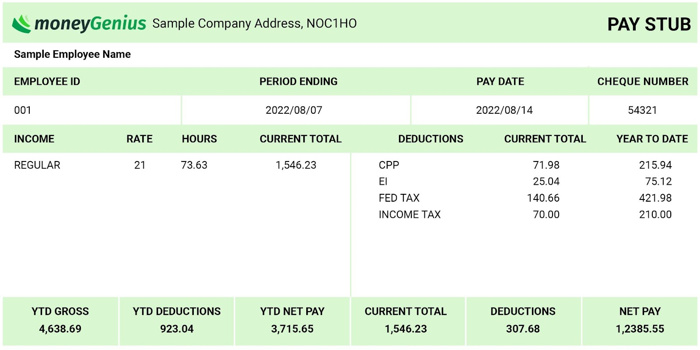

Here's an example of what a pay stub might look like and what's included:

Let's take a closer look at the most important information contained on your pay stub.

How much money you've earned

Not all pay stubs look the same, but the total amount you've earned during the pay period (your favourite part) is often highlighted. Near this amount, you should also see your hourly rate (if applicable) and any overtime hours worked.

This amount you’ve earned is usually broken into 2 subcategories:

- Gross pay: The amount of money you earned before taxes and other deductions. For example, if you earn minimum wage at a pizza shop in Manitoba ($11.95 per hour) and you've worked 22 hours in the specified time period, your gross pay will be $262.90.

- Net pay: Is the amount after taxes and deductions – the amount that will be deposited into your bank account.

Deductions from your paycheque

Deductions are amounts taken out of your cheque. Some are federally mandated deductions, like income tax and employment insurance, and others are personal preferences, like RRSP savings.

Here are some things you might see listed on the pay stub as deductions:

- income tax,

- employment insurance (EI),

- Canada Pension Plan (CPP) or Quebec Pension Plan (QPP),

- vacation pay,

- group pension plan,

- group insurance plan,

- union dues, and

- RRSP savings.

The amount you've earned year-to-date

Each one of your pay stubs will indicate the amount you've earned thus far in the calendar year.

The earnings-to-date is often located near your net and gross pay amounts, but this isn't always the case. You'll likely find a column to indicate dollar amounts from this particular paycheque alongside another column with the year-to-date amounts.

Details for employees

We know, it can be tempting to look at the net amount on your pay stub and then throw it in the recycling – but dollar amounts aren’t the only important things on your pay stub. Let's take a look at these details.

Pay stubs are a record of your wages earned

As mentioned, your pay stub is a legal statement of the money you've earned for doing a job. They show proof of income as well as proof of employment. Pay stubs will come in handy (and may even be required) in the following situations:

- Budgeting

- Filing taxes

- Applying for loans

- Renting a home

- Enrolling for government benefit programs

They can help you understand the taxes you pay

Understanding taxes and deductions can be complicated, particularly for those new to the workforce and newcomers to Canada. A pay stub lays it all out in an organised way, making it easy for you to identify which taxes you pay and how much.

Once you've identified these details, you can always ask your boss, a bank representative, or even a family member for further information. You might want to learn what each tax is for, whether your tax deductions are on par with others in your field, etc.

You'll likely need to provide pay stubs when applying for loans, mortgages, etc.

As mentioned, there are many situations where you'll need to show a pay stub as proof of income. Here are a few example documents and situations where this kind of proof will be required:

- Mortgage applications

- Loan applications

- Apartment leases

- New car financing

- Requesting interest relief for Canada Student Loans.

Details for employers

It's just as important for employers to keep track of the pay stubs they supply as it is for the employees who receive them. Employers need to understand all the information we mentioned above, just like their employees, but here are a few details specific to them:

- You're legally required to provide pay stubs to your employees, and they can request copies of pay stubs at any time, even if it's for payment received in the past.

- Pay stubs are essential for resolving any pay discrepancies, whether it's the employer or the employee making the complaint.

- According to Canadian regulations, you should keep pay stubs on file for at least 6 years.

How pay stubs are created

Employers use payroll systems and software to create pay stubs for their employees. The employer needs to collect all of the essential payment information, like rates and deductions, and feed it into the system.

Here's a look at the information an employer needs to input when generating pay stubs:

- Number of hours worked during the pay period

- Any overtime hours worked

- Hourly wages or salary

- Paid time off (when applicable)

- Bonuses given

- Applicable provincial and federal taxes

- Applicable deductions

If your workers are paid via direct deposit, you'll need other information too, such as their contact information and bank account details.

Do you have a better grasp on your pay stubs now?

So there you have it, everything you'll need to know about pay stubs.

Was there anything we missed? Do you have any other questions regarding pay stubs? Let us know in the comment section below!

FAQ

What is a pay stub?

A pay stub is a legal document that acts as your proof of earnings and employment. It contains vital information about how you're paid, how much work you've done, and how much you've paid in taxes and other deductions.

How do I get my pay stubs?

Employers are required to provide their workers with either an electronic pay stub or a paper slip for every pay period. Employees always have the right to request copies of any prior pay stubs.

What is on a pay stub?

There's quite a bit of information included on a pay stub, including the dates of the pay period, the employee's net pay, gross pay, deductions, and more. These details are important for tax records.

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

$25 GeniusCash + Total of $60 off your first four orders + free delivery (Eligible for New Customers in ON and QC only)

Leave a comment

Comments