Sales tax in Canada varies slightly from province to province – not only in terms of the actual rate, but also between GST, PST, and HST.

Though some countries bake tax into the displayed price, in Canada you have to keep in mind that you could be looking at an extra 15% tagged onto the price before you whip out that credit card. With some high sales tax rates across the country, you may be wondering why you have to pay so much just to buy something, and also curious about sales tax by province.

Here’s everything you need to know about sales tax in Canada, including what you can expect to pay it on, what’s exempt, and how it varies between provinces and territories.

What is sales tax in Canada?

Sales tax is an extra fee placed on nearly all purchases of goods and services, with some exemptions (most notably groceries). For most purchases, the tax is applied at checkout, so it’s important to note that the prices you see displayed in stores are most often before tax.

In Canada, the whole country is subject to 5% GST (Goods and Services Tax).

Some provinces impose their own individual taxes as well, usually called PST (Provincial Sales Tax) or QST (Quebec Sales Tax). Other provinces combine the 2 to create one higher rate that covers federal and provincial guidelines, known as HST (Harmonized Sales Tax).

If you’re wondering why you have to dish out up to 15% on every shopping spree, the government collects tax to fund public programs like health care, roads, education, police, and more.

When it comes to things you don’t need to pay tax on, there are 2 types of products: those that are completely exempt, and those that are known as a zero-rated good. Let’s take a look at the differences.

What’s exempt from sales tax?

Most of the things that are completely exempt from sales tax are services, rather than things you can buy at a store.

Here’s a few of the main examples:

- Most health services: including medical and dental

- Child care services: for children under 14

- Many educational services: courses, tutoring services

- Services provided by financial institutions: lending money, operating accounts

- Issuing insurance policies

If you want some more examples, check out this page: Type of supply.

What does zero-rated goods mean?

Another category of goods have a different tax status, referred to as “zero-rated supplies.” This means they’re charged tax, but that tax is at 0%.

Here’s a list of some examples:

- Basic groceries: milk, bread, vegetables, etc.

- Agricultural products: grain, raw wool, etc.

- Most farm livestock

- Most fisheries products: fish for human consumption

- Prescription drugs

- Certain medical devices: hearing aids, walkers, etc.

- Feminine hygiene products: tampons, pads, etc.

So what’s the difference between a zero-rated good and an exempt good? Well, there isn’t any for the consumer. In both cases, you don’t have to pay tax.

The only difference comes when you’re selling the goods. For tax exempt goods, you can’t claim ITCs (Input Tax Credits). But for zero-rated goods, you can. See How does the GST/HST work? for more information.

Different types of sales tax in Canada

While every province and territory within Canada uses some form of sales tax, the amount and types vary from place to place.

Some provinces/territories simply use the nationwide practice of charging GST, some use a PST, and others combine the two to create HST.

Here’s a look at the differences between those 3 terms.

Goods and services tax (GST)

GST stands for Goods and Services Tax. It’s a nation-wide tax implemented by the federal government that’s added to nearly all retail purchases, and it’s set at 5% in Canada.

Most countries around the globe use a form of GST and it’s usually the same rate across the entire nation.

Provincial sales tax (PST)

Some provinces issue a Provincial Sales Tax and collect it separately from GST.

British Columbia and Saskatchewan use a PST, while Manitoba uses a Retail Sales Tax (RST) and Quebec uses the Quebec Sales Tax (QST).

Most other provinces have their own PST but it’s bundled with GST to create the HST.

Harmonized sales tax (HST)

HST, or Harmonized Sales Tax, is used by certain provinces as a way to bundle 2 or more different tax types into one.

A province’s PST is combined with the GST to create the new HST.

Did you know there’s a GST tax credit in Canada? Click here for your guide to GST payments.

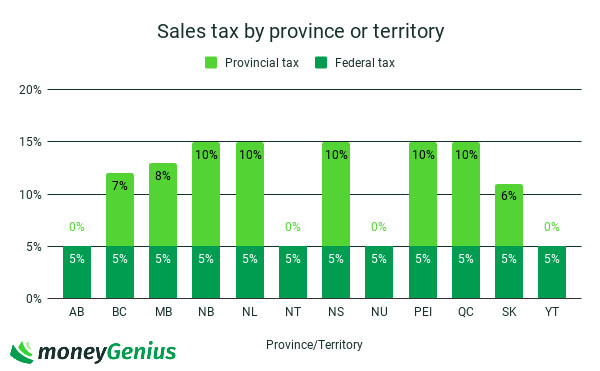

Sales tax by province and territory

So how much is sales tax by province? What about when you head up to the territories?

Here’s what you can expect in each region of Canada.

| Province/Territory | Tax breakdown | Total tax charged |

|---|---|---|

| Alberta | * GST: 5% * PST: 0% | 5% |

| British Columbia | * GST: 5% * PST: 7% | 12% |

| Manitoba | * GST: 5% * RST: 8% | 13% |

| New Brunswick | * GST: 5% * PST: 10% * Charged as HST | 15% |

| Newfoundland | * GST: 5% * PST: 10% * Charged as HST | 15% |

| Northwest Territories | * GST: 5% * PST: 0% | 5% |

| Nova Scotia | * GST: 5% * PST: 10% * Charged as HST | 15% |

| Nunavut | * GST: 5% * PST: 0% | 5% |

| Ontario | * GST: 5% * PST: 8% * Charged as HST | 13% |

| Prince Edward Island | * GST: 5% * PST: 10% * Charged as HST | 15% |

| Quebec | * GST: 5% * QST: 9.975% | 14.975% |

| Saskatchewan | * GST: 5% * PST: 6% | 11% |

| Yukon | * GST: 5% * PST: 0% | 5% |

As you can see, the rates vary greatly between regions. While Alberta and the territories only charge the standard 5% GST, the Atlantic provinces all charge 15% HST and Saskatchewan charges 11% GST + PST.

Be sure to keep this information in mind when making purchases outside of your home province or territory.

Sales tax calculator

To help Canadians understand their province or territory’s sales tax rates and to assist with financial planning, the government has created a convenient GST/HST calculator.

Once you’ve selected your home province or territory, you then type in the amount of the item or service you’re planning to purchase, and the calculator will tell you the final price.

It also breaks down the final price so you can see how much is charged for HST, GST, and PST, depending on where you live.

How to calculate sales tax yourself

But if you’re trying to calculate sales tax on the fly, it’s way easier to take out your phone’s calculator real quick than it is to navigate to a website.

Luckily the formula is super simple:

Total cost = Item cost * (Sales tax + 1)

So for example say you’re in the Maritimes, where your sales tax is 15%. This is what your calculation would look like if you’re buying a $20 item.

Total cost = $20 * (0.15 + 1)

Total cost = $23

Super simple, right? Once you get good at it, you can just skip a few steps and multiply the cost by 1.15 to get the result in one step.

Want to learn more about saving money on your income taxes? Check out our ultimate guide to taxes here.

What do you think of sales tax in Canada?

We’ve all paid sales tax throughout our lives, and some of us have been lured into certain areas of the USA where they don’t have any sales tax at all.

Knowing how our tax system works and remembering that rates are different in each province and territory can help us be better financial planners. Knowledge is key.

Now that you understand how sales tax works in Canada, what purchases will you make? Do you think Canadian sales tax is too high?

Have you ever been shocked at the sales tax while travelling?

Let us know in the comments below.

FAQ

What is sales tax in Canada?

Sales tax is something we pay on top of the original cost for most goods and services. In Canada, the rates are set by the government and vary from province to province. Learn more about sales tax in Canada here.

What’s the difference between GST, PST, and HST?

GST is a tax set by the federal government that every province and territory adheres to. PST is a provincial tax that only certain provinces use, some in conjunction with GST and some separate. HST is a combination of GST and PST that is used by several provinces. Learn more here.

How can I calculate sales tax in Canada?

All you have to do to calculate sales tax is times the price of your item by the sales tax + 1. So if your province’s sales tax is 15%, it would be the item price times 1.15. Alternatively, you can use the sales tax calculator here.

What’s the sales tax in my province or territory?

Since each province and territory adheres to different taxation rates, check this chart to see what the rates are where you live.

What’s exempt from sales tax in Canada?

Certain items are exempt from sales tax. These items include (but are not limited to) basic groceries, most fish products, farm and livestock, farm equipment, prescription drugs, medical devices, and feminine hygiene products. You can learn more here.

Leave a comment

Comments