A RESP (Registered Education Savings Plan) is a government-supported savings account designed to help families save for a child's post-secondary education. Contributions to an RESP grow tax-free, and the government may provide additional grants to boost savings.

Withdrawals typically take place when your child enrolls in a college, university, or some type of post-secondary education.

Here's a look at the top RESP options for Canadians and how to determine which is the best fit for your family.

Key Takeaways

- The best RESP in Canada for keeping costs low is the Questrade RESP.

- The best RESP in Canada from a big bank is the RBC RESP.

- The best investments for an RESP are those that add diversification, offer strong returns, and meet your horizon goals.

- The best RESP providers offer government grant maximization, a wide variety of investment options, and charge low fees with a clear fee structure.

Best RESPs in Canada

Investing is a very personal activity, which means choosing one "best" RESP is tricky – however, we can say that the top choice from a big bank is the RBC RESP, and the best option for keeping costs down is the Questrade RESP.

Some RESP providers have specialty investment options for more experienced traders, such as options. Others offer new account bonus offers, low fees, and other benefits.

Considering all of these factors, this table shows the best RESP options from the top providers in Canada:

| RESP provider | Best for… | Self-management option? | Professional management option? | Investment options | Fees |

|---|---|---|---|---|---|

| BMO | Valuable welcome bonus – up to $3,500 for investing in mutual funds | Yes | Yes | * GICs * Bonds * Mutual funds * ETFs * Stocks | Varies |

| CIBC | Big bank online brokerage – CIBC Investor's Edge | Yes | Yes | * GICs * Mutual funds * Index funds * ETFs * Bonds * Options | Varies |

| Questrade | Low management fees – fees as low as 0.2% | Yes | Yes | * ETFs * Stocks * Bonds * GICs * Mutual funds * Options * Precious Metals | * 0.25% for investment accounts with between $250 and $100,000 in asset value * 0.2% for investment accounts with over $100,000 in asset value * Additional fees for EFTs |

| RBC | Big bank reliability – RBC is the largest bank in Canada | Yes | Yes | * GICs * Mutual funds * Stocks * Bonds * ETFs * Options | Varies |

| Scotiabank | 1.5% cash bonus on transfers up to $3,750 | Yes | Yes | * GICs * Mutual funds * ETFs * Equities * Bonds | Varies |

| Wealthsimple | Socially responsible investors – Offers Socially Responsible Investing (SRI) portfolios | No | Yes | * ETFs * Stocks * Bonds | * 0.5% for investment accounts with under $100,000 in asset value * 0.4% for investment accounts with over $100,000 - $499,999 in asset value * 0.2% - 0.4% for investment accounts with $500,000+ in asset value |

Best investments for an RESP

It's tricky to pinpoint the best investment choices for an RESP since there are multiple factors to consider, such as your personal risk tolerance and potential management fees.

You'll want to consider these details before choosing an investment type to add to your RESP:

- Does it add diversification to your portfolio?

- Are the management fees reasonable?

- How strong are the returns?

- How liquid is it?

- What's the term length to maturity?

Your child's age also plays a factor – the younger your child is, the longer your investment horizon. A longer horizon means taking risks a bit more comfortably and possibly focusing on a growth-oriented profile.

As your child ages, you can revisit your strategy and perhaps focus more on fixed-income and cash-based investments.

Working with an RESP provider that offers learning tools can make a huge difference when it comes time to choose investments. CIBC Investor's Edge, for example, is well-known for its educational resources.

This online investment brokerage is owned and run by CIBC, and is targeted towards people who are interested in managing their own investments, learning about how to manage their own investments, and people who do investment management for a living. With relatively low fees for trades, and discounts for students and active traders, this is a service worth looking into.

- Get 100 free online equity trades with code EDGE2526

- No minimum investment required

- Lower than average fees per trade

- Discount on trade fees for students and young adults

- Discount on trade fees for active traders

- Seems to be designed for regular people, not just the ultra rich

- Per transaction fees can add up quickly

- Ages 18 - 24 trade for free

- Free investment research tools

- Extended trading hours

- TFSA

- RRSP

- RESP

- RRIF

- LRSP

- PRIF

- LIRA

- LRIF

- Cash

- Margin

- Corporate

- Partnership

- Formal trust

- Investment club

- Estate

- FHSA

- Stocks

- ETFs

- Options

- Mutual Funds

- GICs

- Fixed Income

- Precious Metals

- Structured Notes

- IPOs

- CDRs

Pros and cons of RESPs

| Pros | Cons |

|---|---|

|

|

How to choose an RESP provider

Choosing the right RESP provider requires looking at the institution's reputation, the fees involved, and any extras the provider can offer. Perhaps most importantly, make sure they include the Canada Learning Bond, Canada Education Savings Grant, and other provincial education savings incentives in their plan.

Here's a list of the details to consider with prospective RESP providers:

- Grant maximization

- Fee structure

- Fee amounts

- Investments options

- Minimum deposit requirements

- Deposits, withdrawals, and transfers flexibility

- Reputation and customer service reviews

- Types of RESPs

- Educational resources

You can find a bit more information on this topic on the federal page titled "Choosing the right RESP brochure."

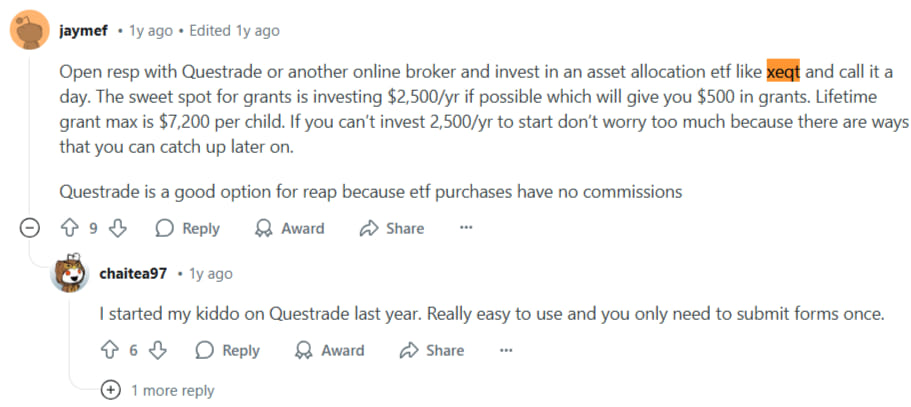

The best RESP in Canada according to Reddit

Redditors agree that a low-fee RESP is good for newer investors who just want to contribute without too much thought. Investing in diverse ETFs is a simple way to achieve good gains.

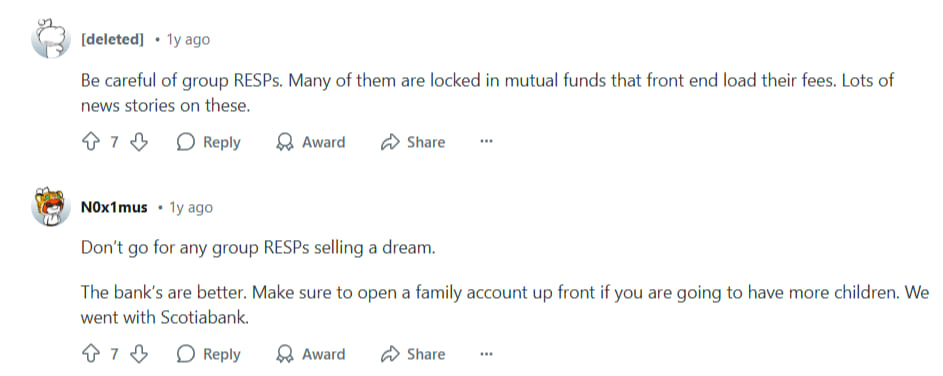

They also caution against using group RESPs, preferring the consistency and safety of large institutions.

FAQ

What is the best investment for an RESP?

The best investment for an RESP is one that adds diversification to your portfolio, has low management fees, and provides strong returns. This will be different for every person, depending on your child's age and other factors.

What's the RESP contribution limit?

There's no annual limit for RESPs, but there is a maximum lifetime contribution limit of $50,000 per beneficiary. Contributing up to $2,500 per beneficiary each year is recommended in order to maximize your potential CESG grant amounts.

Which RESP provider is the best?

There are several top options, but the best RESP provider from a big bank is RBC. It's the largest bank in Canada and includes options as an investment type. Other banks don't include options for RESP investments.

What are the best ETFs for RESP?

It's hard to pinpoint "the best," but two top ETFs choices for RESP investments include the iShares Cdn Core S&P/TSX Capped Composite Index (ticker symbol XIC) and the Vanguard FTSE Canada All Cap ETF (ticker symbol VCN).

Is there a better option than RESP?

An RESP is the best choice for education savings as it allows you to receive government grants to help build your fund. These include the Canada Learning Bond, Canada Education Savings Grant, and various provincial programs.

Is an RESP better than a TFSA?

RESPs are a better choice for education savings. While a TFSA is a flexible savings account that can be used for education savings, it doesn't allow you to take advantage of government grants. However, RESP contributions aren't tax-deductible.

Leave a comment

Comments