Plenty of Canadians wonder whether it's better to buy a cell phone outright or get financing. You'll save money (though not much) by buying, but financing still makes sense if you need a phone ASAP and/or don't have savings set aside.

Phone companies break the cost of a phone into small monthly payments and add it to the cost of your monthly service plan. Some providers also allow you to trade in your phone after a few years, which can lower your monthly payment.

In this article, we cover the pros and cons of each option, break down which is cheaper, and offer other tips for those in need of a new cell phone.

Key Takeaways

- The cost of buying and financing a phone are the same because most phone plans offer 0% financing.

- Most carriers offer options to trade in your old phone or return a device for extra savings.

- Buying a used phone from a trusted buyer is an affordable and reliable option.

Buying a phone outright vs. cell phone financing

Let's look at the pros and cons of buying a phone vs. financing it through a provider:

Pros of buying a phone

- No contract commitments

- Easier to switch carriers

- Lower monthly bills

- Better plans

Cons of buying a phone

- The total upfront cost hurts

- You might not be able to afford the phone you want all at once, so you settle for a cheaper one

Pros of financing a phone

- The new phone you want, right now

- Little or no upfront cost, not feeling the pinch

Cons of financing a phone

- Loosely locked into a contract

- Paying penalties and outstanding balances owing on devices if you do leave the contract

- Possibly worse plans

- Hidden fees mean you may be paying more for your device than you need to

The bottom line is: If you don’t have upwards of $1,500 hanging around, you can't afford the new iPhone or Samsung Galaxy. People buy into the two-year plan because the smaller payments make it feel affordable.

People feel like they can afford an extra $30 or $40 a month. So, when Bell offers an $80 monthly phone plan for 200GB of data and unlimited calling in Canada, suddenly adding $40 for the latest iPhone doesn't seem too bad.

In the end, it's just 0% financing. If you stay on top of your bill, you aren’t paying any more for the cell phone.

Is it cheaper to buy a phone outright or finance it?

Though this would be a major pro for buying a phone instead of financing, there actually isn't much of a price difference when you compare the costs of buying a phone or financing it.

These days, when you finance your phone, the payment is simply split across your monthly bills – there aren't any tricks involved here.

That said, you can definitely find some savings if you buy a used phone instead of a brand new one, or if you trade in your old phone for credit towards a new device.

But when you compare apples to apples – the cost of buying the phone outright and the extra tab that's on your bill – you'll mostly find that it's pretty much the same. There's no direct savings there.

Cell phone financing options in Canada

If you’re leaning toward financing your cell phone, here are some financing options and tips to help you find the best cell phone payment plan.

Financing through your existing provider

The most obvious path forward with financing is through your current cell phone carrier.

Before you sign a contract, make sure you know:

- The length of the term (i.e. 2 years)

- The amount added to your bill each month for the purchase of your cell phone

- When your cell phone will be paid off

The last point is the most important, since once you've finished paying off your cell phone, your monthly cost should go down. If it doesn't, you're paying extra for no reason.

Shopping around for a new provider

As you should do with most large purchases, if you can’t afford the full upfront cost, be sure to shop around and compare prices.

Here’s a quick comparison of some of the top providers and their prices for the iPhone 17 Pro with 256 GB of storage, paid over 24 months:

| Provider | Cost with device return | Cost without device return |

|---|---|---|

| Eastlink | $40 per month | $63.46 per month |

| Telus | $40.50 per month | $62.17 per month |

| Bell | $40.50 per month | N/A |

| Rogers | $40.50 per month | N/A |

| Fido | N/A | $68.50 per month |

| Koodo | N/A | $68.50 per month |

| Virgin | N/A | $68.54 per month |

Please note: The above prices were recorded on November 28, 2025, and are for illustrative purposes. Please visit the sites directly for the most up-to-date information.

As you can see, most of the providers offer similar pricing. If you’re thinking of switching, you may want to compare other benefits and features to see whether it’s worth switching.

Device return programs

Some of the top providers offer phone return programs – in fact, some providers only offer this option now. Essentially, these programs allow you to lease the phone from them in exchange for a lower monthly payment.

These programs require the cell phone to be returned in good working order. They also give you the option to keep the device at the end of the term, but you’ll have to pay the difference.

For example, Eastlink offers the lowest monthly payment plan for the iPhone 17 Pro at $40 per month for 24 months, but only if you return the phone at the end of the period.

Trade in your old phone

Most of the major providers give the option of trading in your old phone for credit towards a new one.

Continuing with the iPhone 17 Pro example above and using an iPhone 15 with 128 GB of storage as our trade-in, here’s a quick comparison of credits offered by the big phone carriers:

| Provider | Credit |

|---|---|

| Rogers | $390 |

| Telus | $350 |

| Virgin | Up to $410 |

| Bell | $410 |

Because this is a newer phone, the trade-in value is higher than, say, an Apple iPhone 12. However, if you’re planning to upgrade your phone anyway, it’s worth checking out the value of your existing phone to see if it’s eligible for a trade-in credit.

The case for buying your cell phone outright

Even though you may not save money on buying the phone upfront, there are still reasons to do it.

How marketing affects cell phone financing

But there's another important part of the cell phone buying game – consumer psychology.

It feels better to pay an extra $40 per month than it does to pay $1,000 upfront (it's also easier to fit into a strict budget). And when we're done paying off the cell phone, we're usually ready to get a new one and keep on paying that tab – and the phone companies know this.

But you'll be on the hook for 24 months.

If you're unhappy and want to switch carriers, you'll have to:

- Cancel your contract

- Pay your outstanding balance on your cell phone

- Pay any early cancellation penalties

And let’s face it. If you didn’t have the money to buy the cell phone outright, you probably don’t have the money to pay the remaining balance. You’re stuck.

Then at the end of it all, they get to send you another notification – "You're eligible for a free upgrade!" – and the cycle starts again.

Buying a used phone

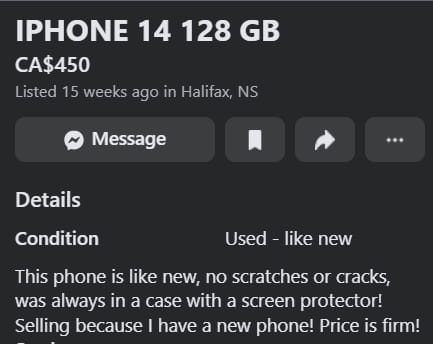

If you don’t mind a slightly older cell phone, buying a used one can be a great way to save money.

You can often get a one or two-year-old phone in excellent condition for about half the price.

Here's an example from Facebook Marketplace:

When buying a cell phone, make sure you:

- Insist on seeing it before you buy

- Check its condition and functionality

- See if you can set up the cell phone on a plan

- Check if it’s compatible with the provider’s network

One of the best situations would be to have the person meet you at a telecom provider’s brick-and-mortar location and have the cell phone set up there.

FAQ

What's the best cell phone to buy?

The best cell phone for you depends on which service provider you want to work with and which operating system you prefer. The best cell phone also largely depends on your personal budget.

What credit score do I need to finance a cell phone?

Most service providers don’t list a specific credit score requirement for clients hoping to finance a new cell phone. As in many circumstances, it's safe to assume that the better your score, the more likely you are to be approved.

Is it a good idea to finance a new phone?

Yes, it’s a good idea if you can’t pay for a new phone outright and you need one. Financing plans don’t charge exorbitant fees, so you typically break even, especially if you’re also trading in an old phone.

What are things to consider when buying a phone?

In addition to choosing a brand and service provider, pay attention to details like camera quality, storage space, and battery life. If it's a used phone, check its functionality and ensure it works with your chosen network.

Can you tell me how to choose a good cell phone?

A good cell phone should be within your budget, have the storage space you need, and use an operating system you’re comfortable with. A good used phone should be in peak condition and work with your chosen network.

Leave a comment

Comments